It’s been a challenging year for global equity markets, with the MSCI World Index down 5.0% year-to-date.1 Investors have faced – and continue to face – a laundry list of concerns, including the war in Ukraine, surging inflation, the threat of central bank tightening in the face of slowing global growth, and the impact of Covid-19 lockdowns in China on global supply chains. Meanwhile, consumers are grappling with a cost-of-living crisis.

Underneath the surface, however, regions, sectors, and businesses have all been impacted differently, with some more resilient than others. The FTSE 100 (+2.7%), in particular, has been relatively resilient – outperforming indices such as the S&P (-3.9%) and Eurostoxx 50 (-11.7%).2 Most of this outperformance can be attributed to the markets sector make up – it consists of sectors and large businesses that have benefitted from higher commodity prices, general risk-off sentiment, and the prospect of higher interest rates.

While such a turnaround in performance is a welcome relief to many investors; the focus has primarily been on larger businesses. We believe the UK market potentially has more to offer.

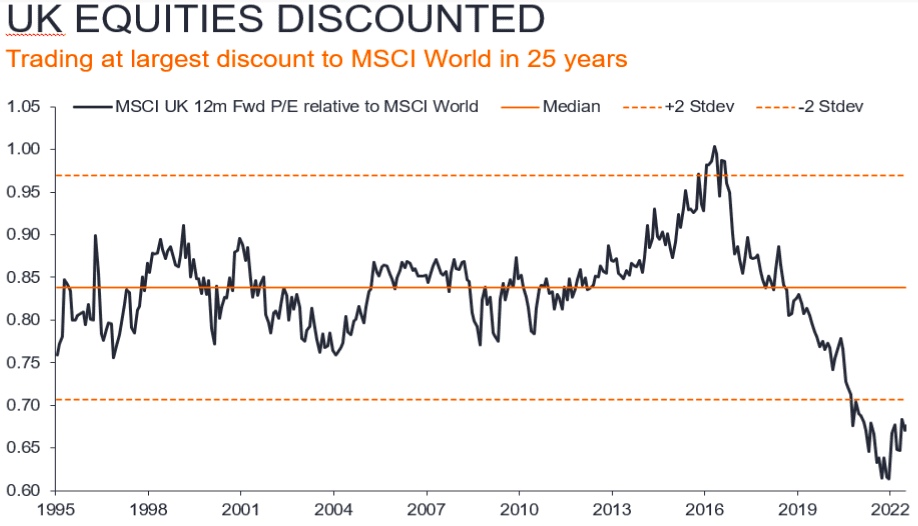

UK equities remain cheap

UK equities are trading at the largest discount to the MSCI World in more than 25 years (see chart below). The combination of Brexit and the Covid-19 pandemic resulted in investors looking elsewhere for opportunities, leaving the UK market significantly de-rated. For us, this created a fertile environment for skilled stock pickers to find high-quality companies at attractive valuations.

Source: JPMorgan, Janus Henderson Investors Analysis, as at 1 July 2022.

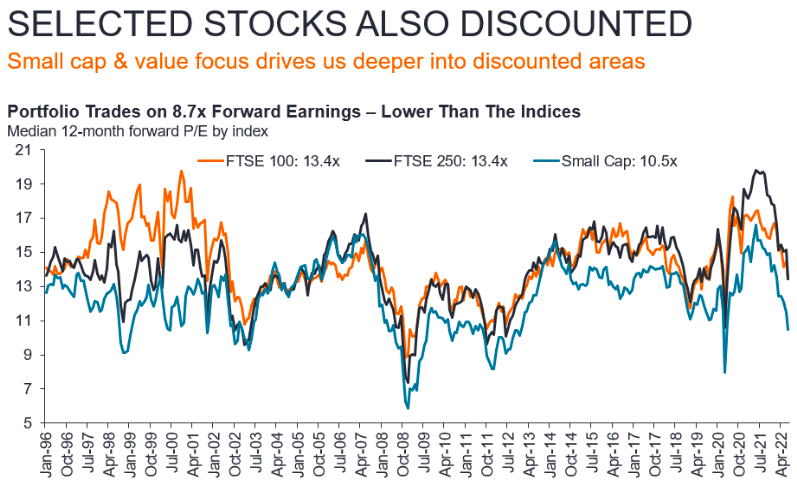

While large UK companies are cheap relative to global peers, smaller businesses are cheaper still (See chart below – Selected stocks also discounted). We have been finding opportunities within the smid-cap space, which is often overlooked for dividends. However, we believe that there are many market-leading, well-managed businesses within this area that can provide a differentiated source of income. Though some of these businesses might not be household names, their products and services are widely used throughout the country.

One such example is Finsbury Foods, which makes supermarkets cakes/treats and speciality breads. It is one of the UK’s market leaders in its area and its valuation is low versus both the market and peers. We believe that it’s a well-invested, well managed businesses that is providing essential products in a cost-effective manner. The structural story also remains solid – we’ll all still eat cake in ten years’ time.

We are not the only ones recognising value within the UK market. Within recent years we have seen heightened takeover activity in the market and our portfolio. For example, RSA Insurance Group was bought by Canadian insurer Intact Financial Group and Danish insurer Tryg. Meanwhile, St Modwen Properties was acquired by Blackstone. We’ve also seen attempted takeover from Euromoney Institutional Investor and Elementis.

Value within the portfolio

While our focus on smid-caps and value has driven us into deeper discounted areas of the market, we believe that this provides our investors with exposure to a selection of well-managed, resilient businesses with solid balance sheets in an unloved and under-appreciated corner of the market. Currently, our portfolios forward Price to Earnings (P/E) ratio is around 9x, which is low by historical standards and lower than all of the main UK indices (see chart below).

Source: Liberum, Datastream, Janus Henderson Investors Analysis, as at 1 July 2022

Source: Liberum, Datastream, Janus Henderson Investors Analysis, as at 1 July 2022

Note: Portfolio P/E data sourced from Janus Henderson, as at 1 July 2022

Year-to-date, it should be no surprise why smaller and medium sized businesses have struggled. During periods of uncertainty, smaller companies (on average) are always hit the hardest because they are more cyclical and domestic in their exposure. This year has been no different. However, we believe that over the longer-term these smaller companies have greater potential for sales and earnings growth, as they are at an earlier stage of their life cycle with a longer pathway of growth ahead of them. In the meantime, we will happily collect the dividends these companies are paying whilst we wait for them to rebound.

At a time when smid-cap stocks have struggled, our larger holdings (circa 48% of the portfolio)3 have been a ballast to the portfolio. To retain balance, we have the flexibility to invest across the market spectrum to identify where some of the best value opportunities are. Holdings such as Shell (+38.3%), BP (28.2%) and HSBC (+24.2%)4 have performed strongly and have helped dampen volatility within the portfolio. They have also provided higher than average dividend yields, which are crucial to investors in the current inflationary environment.

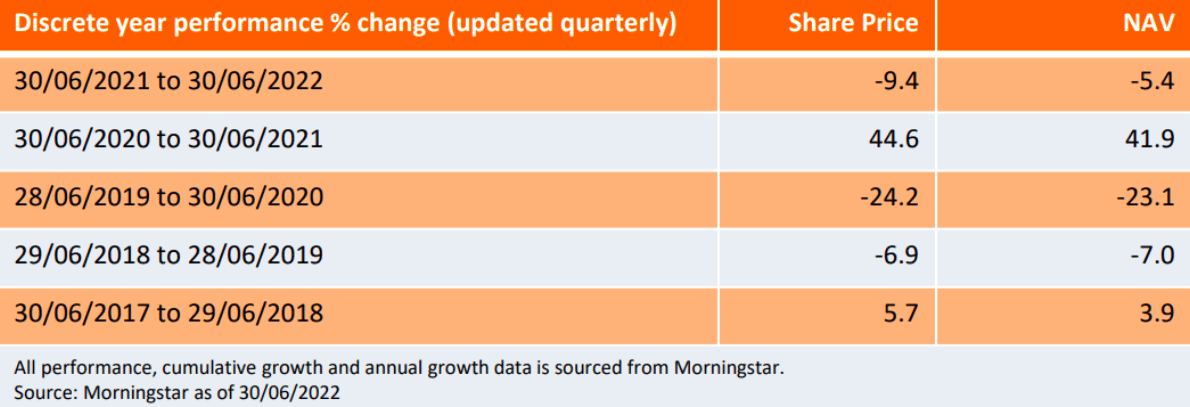

Though it has been a challenging year, Lowland’s long-term record remains solid. The Trust has outperformed its benchmark over the last 10 years and the annual dividend has never been cut since it was founded in 1963.5 In addition, the Trust’s current yield is 5.3% vs 4.0% on the FTSE All Share – reflecting the underlying value within the portfolio. For those investors seeking a higher-than-average return with growth of both capital and income over the medium to long term, these facts are hard to ignore.

Global growth will likely slow in the second half of the year as higher food, energy and other input prices weigh on consumers and businesses. In this backdrop, it’s more important than ever to identify companies with defendable barriers to entry, strong cash flows, solid balance sheets and talented company management that can navigate this challenging landscape. We believe our portfolio consists of such companies and is well placed to navigate this tricky market environment.

1Source: Bloomberg as at 02/08/2022

2Source: Bloomberg as at 02/08/2022 (returns are in GBP)

3Source: Lowland Investment Company as at 31/07/22

4Source: Bloomberg as at 03/08/2022

5Source: Lowland Investment Company as at 31/07/22

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Cyclical stock – Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

De-rating – Investors wanting to pay less for a stock/ or, in the case of a bond, lowering the credit rating.

Dividend yield – A financial ratio that tells you the percentage of a company’s share price that it pays out in dividends each year.

Forward price-to-earnings (forward P/E) – A version of the ratio of price-to-earnings that uses forecasted earnings for the P/E calculation.

Standard deviation – A statistic that measures the variation or dispersion of a set of values/data. A low standard deviation shows the values tend to be close to the mean while a high standard deviation indicates the values are more spread out. In terms of valuing investments, standard deviation can provide a gauge of the historical volatility of an investment.

Volatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.