Portfolio manager Laura Foll discusses the strong earnings recovery this year, the risks of cost inflation and the outlook for UK income investors in 2022.

Key Takeaways

- A faster-than-expected recovery in earnings has led to a forecasted 45% recovery in dividend payments for UK companies in 2021.

- While the demand backdrop for 2022 is encouraging, modest UK dividend growth is expected with cost inflation a key risk to earnings.

- UK stocks are currently trading at a significantly higher average valuation discount, while dividend yields appear relatively attractive.

After the UK economy’s sharp contraction in 2020, this year has been a period of strong recovery, with UK growth in aggregate returning close to pre-pandemic levels. This has been evident in company results, with many companies reporting a faster-than-expected recovery to 2019 earnings levels outside of the most affected areas (for example airlines and hospitality). As earnings have recovered, dividends have followed and after a 43% fall in UK dividend payments in 2020, dividend payments are forecast to recover by 45% year-on-year in 2021*, with particularly strong dividend growth from the banking and commodities sectors.

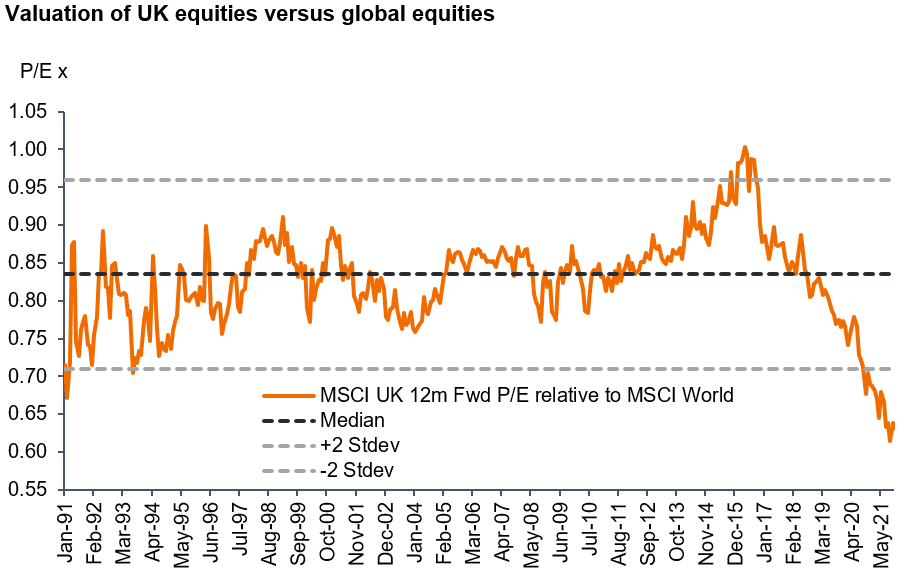

UK equities remain significantly undervalued relative to global equities

Thinking about the outlook for UK equities in 2022, considering valuations is key. The UK equity market is trading at a significantly higher than historical average valuation discount to global equities (see chart below). The timing of this UK valuation divergence coincides with the European Union referendum in 2016, but despite recent political stabilisation and a trade deal reached with the EU, it is showing no signs of returning to ‘normal’ levels. This valuation discount leaves the UK companies vulnerable to takeovers from international peers and private equity, a trend that we expect to continue in 2022 based on several high-profile deals seen this year.

Source: JP Morgan, Janus Henderson Investors as at 8 November 2021.12-month forward P/E is calculated by dividing the price per share by forecasted earnings per share of the company over the period of the next 12 months and is a popular ratio used to value shares. Stdev=standard deviation measures the variation or dispersion of a set of values/data and provides a gauge of the historical volatility of an investment. A low standard deviation shows the values tend to be close to the mean while a high standard deviation indicates the values are more spread out. There is no guarantee that past trends will continue, or forecasts will be realised.

Consumer strength tailwind and margins benefiting from cost discipline

The average UK consumer is starting 2022 with a stronger household financial position, having built up surplus savings over the pandemic. This higher savings level will need to be balanced against ongoing cost pressures that could mean real [inflation-adjusted] wages could be under pressure if wage growth fails to keep up with inflation. Recent trading updates from UK retailers (such as Marks & Spencer, Halfords and Vertu Motors), suggest that the backdrop for consumer spending remains positive and households seem willing to gently draw down on their surplus savings despite far-reaching inflationary pressures.

From a corporate perspective, many companies significantly reduced costs during the pandemic in the face of such a severe demand shock. This led to, for example, some industrial companies permanently reducing their manufacturing footprint while keeping their most efficient plants open. Now that we are in a phase of demand recovery, we have seen a number of industrial companies (such as IMI and Morgan Advanced Materials) increasing guidance or reporting results at the top-end of guidance for organic growth [generated by the company’s own resources]. This is evidence that the pandemic-necessitated cost discipline is becoming ingrained. Margins in some areas are showing demonstrable evidence of being re-set higher post-pandemic. This margin expansion could apply more broadly to other sectors, as many companies have discovered new, and in some cases more efficient, ways of working following the pandemic that is enabling greater productivity and lower costs.

But cost inflation warrants caution

While the demand backdrop for 2022 is in our view encouraging, cost inflation remains a key risk to corporate earnings, with companies in many cases facing exceptionally high and uncertain input costs, creating a challenging backdrop. This is a trend that has already been evident in the second half of 2021, as several companies (for example in the consumer staples sector) have struggled to pass on significantly higher freight and commodity costs to consumers. At times of material cost inflation, the key advantage that a company may have to rely on is a uniqueness or differentiated product or service. If a company is the market leader, or among them, the ability to pass on these cost pressures is much greater than in a commoditised market with many competing suppliers. Even a specialist producer, however, will not necessarily be able to pass on cost pressures immediately (there is often a lag of a few months). Therefore, we could see short-term margin compression [reduction] in some areas next year, but over the longer term the lean cost bases put in place during the pandemic could (in our view) enable higher margins to be generated.

Energy and banks are likely key drivers of dividend growth

When looking ahead for UK dividends there are a few factors to bear in mind. Mining company dividends, having been exceptionally strong this year due to soaring commodity prices, may be lower in 2022, as suggested by the recent fall in the iron ore price and other metals; furthermore, many companies are adhering to strict dividend payout ratios. In contrast, within energy, in an earnings update, Royal Dutch Shell rebased its quarterly dividend higher to 38% in Q2 2021, and announced it will rebase dividend payouts by a similar percentage in subsequent quarters, to maintain its target to grow dividend per share by 4% annually. This increase, along with further (modest) dividend growth expected, could indicate that the energy sector may experience strong dividend growth in 2022. There could also be further dividend growth from banks as a result of holding capital in excess of company management targets. This excess capital might be returned to shareholders via a mixture of dividends and share buybacks in 2022.

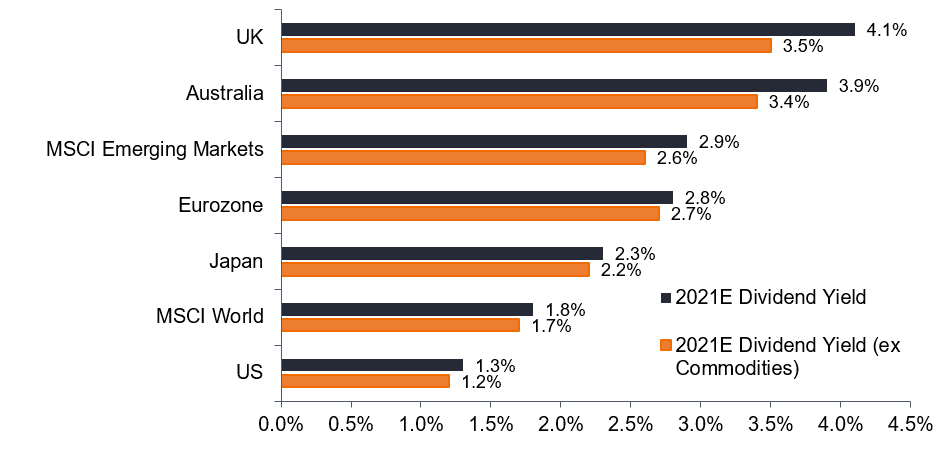

UK dividend yields appear to remain relatively attractive

Source: JP Morgan, Janus Henderson Investors as at 8 November 2021. E= expected/forecast. There is no guarantee that past trends will continue, or forecasts will be realised.

Pulling these factors together, we are expecting modest UK dividend growth in 2022, albeit the uncertainty and scale of mining dividends makes the aggregate difficult to forecast. We believe that despite the UK dividend cuts seen in 2020, even when commodity company dividends are excluded, UK dividend yields appear attractive relative to other global equity markets.

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase, and neither should be assumed profitable.

Footnotes:

*Source: Link Group UK Dividend Monitor Q3 2021 report : https://www.linkgroup.eu/media/1644/link-group-q3-dividend-monitor.pdf.

Dividend payout ratio: the percentage of earnings distributed to shareholders in the form of dividends in a year.

Dividend yield: the income received on an investment relative to its price, expressed as a percentage.

GC-1221-116925-123022 TL