Judging by relative spread levels, corporate and securitized markets are not in agreement on either the state of the U.S. economy or the risk inherent in credit markets.

As shown in Exhibit 1, while securitized spreads are trading around their 10-year average levels or wider, corporates are trading near their all-time tightest levels. Quite simply, securitized assets are being sold to investors at a significant discount to corporates.

JHI

Thankfully, in our view, investors need not make a pinpoint prediction about the future of the U.S. economy to gain from this situation but can rather seek to take advantage through a simple relative value trade.

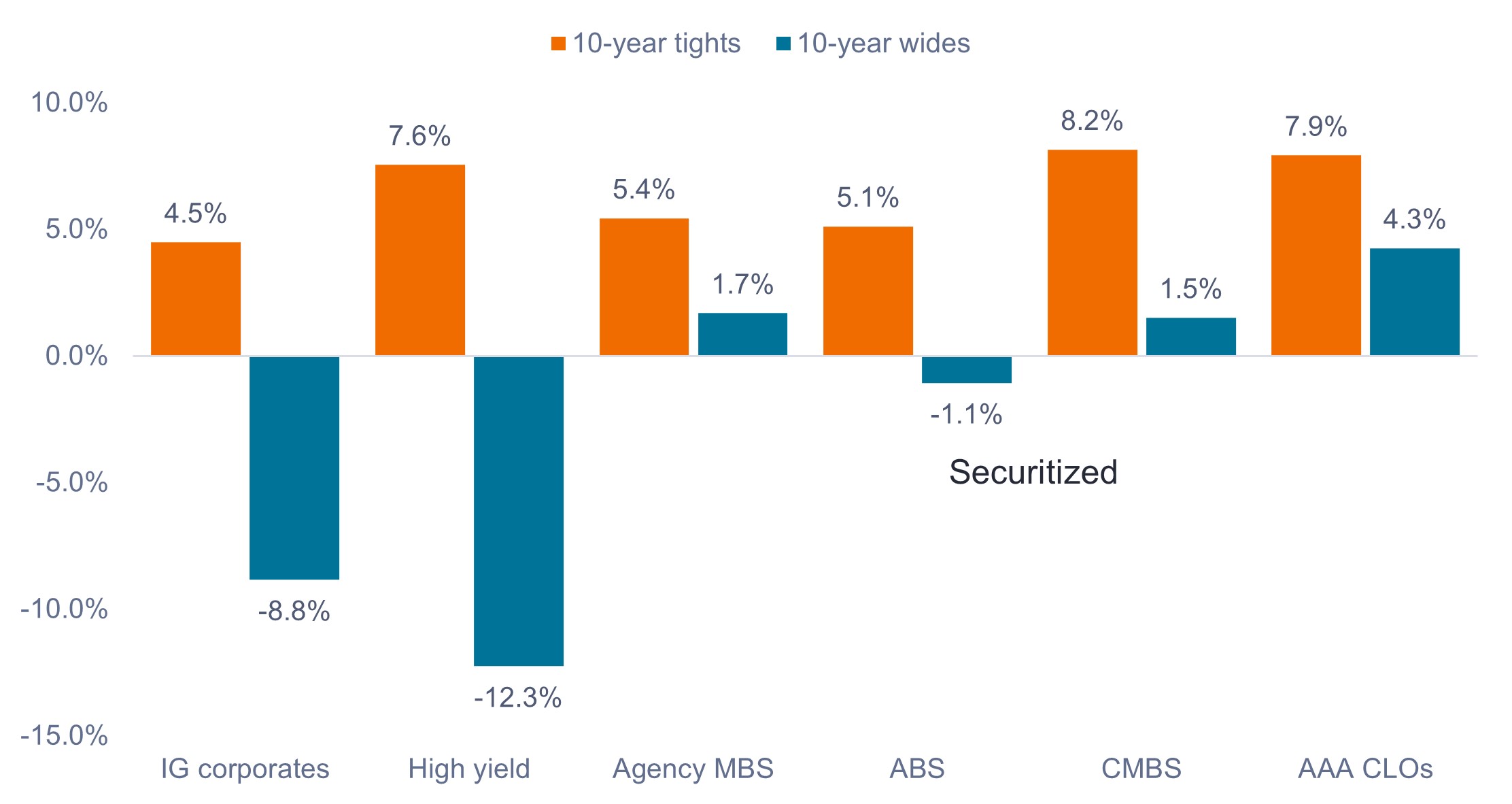

Exhibit 1: Securitized sectors are trading at attractive valuations versus corporates

Option-adjusted spread (OAS) percentile ranking (10-year)

Source: Bloomberg, Morningstar, and Janus Henderson Investors, as of 31 May 2024. Indices used to represent asset classes: IG corporates = Bloomberg US Corporate Bond Index, High yield = Bloomberg US Corporate High Yield Bond Index, Agency MBS = Bloomberg US Mortgage-Backed Securities Index, ABS = Bloomberg Aggregate Asset-Backed Securities Index, CMBS = Bloomberg Investment Grade Commercial Mortgage Backed Securities Index, AAA CLOs = JP Morgan CLO AAA Index. There is no guarantee that past trends will continue, or forecasts will be realized. Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to consider an embedded option. AAA CLOs OAS changed from Discount Margin-to-Worst to Discount Margin-to-Maturity on 5/31/2024 because it is a more accurate representation.

Source: Bloomberg, Morningstar, and Janus Henderson Investors, as of 31 May 2024. Indices used to represent asset classes: IG corporates = Bloomberg US Corporate Bond Index, High yield = Bloomberg US Corporate High Yield Bond Index, Agency MBS = Bloomberg US Mortgage-Backed Securities Index, ABS = Bloomberg Aggregate Asset-Backed Securities Index, CMBS = Bloomberg Investment Grade Commercial Mortgage Backed Securities Index, AAA CLOs = JP Morgan CLO AAA Index. There is no guarantee that past trends will continue, or forecasts will be realized. Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to consider an embedded option. AAA CLOs OAS changed from Discount Margin-to-Worst to Discount Margin-to-Maturity on 5/31/2024 because it is a more accurate representation.

In our view, the pricing disparity between corporates and securitized may potentially give investors the opportunity to increase returns through higher yields, while also mitigating risk.

Should the U.S. economy cool more than expected, we think securitized sectors are likely to outperform, as corporate spreads may experience a starker repricing. On the other hand, if the soft landing continues to unfold, we believe securitized could outperform as their spreads have more room to tighten, potentially providing an additional tailwind to returns.

As shown in Exhibit 2, buying securitized assets at today’s valuations offers investors the potential for higher returns, with lower dispersion, versus their pricier corporate counterparts. Notably, the potential total return in most securitized sectors would remain positive if spreads widened to their 10-year extremes. This is due to a combination of higher coupon income, which helps to cushion the effects of price movements, and the fact that securitized sectors are trading nearer their 10-year wide levels.

Exhibit 2: Potential return should spreads widen or tighten from current levels to 10-year extremes

Source: Bloomberg, Janus Henderson Investors, as of 31 May 2024. Indices used to represent asset classes as per Exhibit 1. Hypothetical examples are for illustrative purposes only and do not represent the returns of any particular investment. Actual results may vary, and the information should not be considered or relied upon as a performance guarantee.

By focusing on finding value in spreads, we believe investors may optimize the efficiency of their portfolios and earn higher yields without necessarily taking on greater credit risk.

Investors who are sitting in cash could potentially lock in higher yields with only incrementally higher risk by incorporating securitized assets in their fixed income portfolios. Similarly, investors with corporate-heavy bond allocations may benefit from diversifying into securitized to earn potentially attractive yields, while also standing to gain on a relative basis should the pricing mismatch between corporates and securitized normalize.

Bloomberg U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

Bloomberg U.S. Mortgage Backed Securities (MBS) Index measures the performance of U.S. fixed-rate agency mortgage backed pass-through securities.

Bloomberg U.S. Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

ICE BofA U.S. ABS & CMBS Index tracks the performance of U.S. dollar denominated investment grade fixed and floating rate asset backed securities and fixed rate commercial mortgage backed securities publicly issued in the U.S. domestic market.

J.P. Morgan CLO AAA Index is designed to track the AAA-rated components of the USD-denominated, broadly syndicated CLO market.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.