In this article, Laura Foll, Portfolio Manager of Henderson Opportunities Trust explores whether now is the time to dial down exposure to stocks.

Of course, these broad numbers hide a much more nuanced story – and perhaps some investment opportunities. too.

We believe that over the long-term strong growth tends to come from small and medium-size companies. But their performance can be volatile, and large-cap and natural resources companies can act as stabilisers within a portfolio.

That philosophy has made a big difference to our performance this year, and I cannot remember a time when, as multi-cap managers, we held such a large exposure to these “stabiliser” companies. But in recent weeks we have been asking if it is time to rotate back towards the small and mid-cap stocks that have had such a difficult time.

Too gloomy?

The Alternative Investment Market is down nearly 27% in the past year; the FTSE 250 is down 13%.3 Experience tells us that smaller companies go through these periods of darkness but have a tendency to spike up sharply when they reach the other side – usually triggered by a change of sentiment.

The current market narrative is dominated by doom. Central banks are raising their inflation expectations as well as interest rates; economists point to inverted yield curves, while the International Monetary Fund has just declared that the outlook for the global economy has “darkened significantly”.4 Global recession appears imminent.

We cannot rule out more share tumbles, but markets seem to have largely priced in these expectations. I cannot imagine a more dismal scenario than we beheld at the beginning of the Covid crisis. Markets crashed. This year many stocks have experienced similar corrections.

There is a perception in the market more broadly that the price/earnings compression has happened and next there may be substantial earnings downgrades.

But this does not tally with the messages we hear when attending company meetings and calls. Reflecting on share price performance, managements seem quite bemused – and sometimes frustrated. Demand so far seems resilient, and we are impressed by how many companies have price escalation clauses within their contracts.

De-rated stocks

One area that has de-rated materially is building materials companies. Even if house prices were to fall, housebuilders would have to carry on building homes – otherwise their earnings dry up. So they will still need bricks and other materials.

Vertu motors has seen its share price fall 21% so far this year.9 But it is still trading satisfactorily, and the shift to electric vehicles is encouraging more people to buy new cars.

Vertu is paying a good dividend – over 3%. Brickmaker Ibstock, another company we like and whose share price is down around 13% in the past year, is paying nearer 4.5% in dividends. Epwin Group, a UPVC window manufacturer, is delivering over 5%.

We are told to sell cyclical stocks as we enter recession. But markets appear to have priced in a significant amount of bad news, with the median FTSE 350 share down almost 20% this year.10 And maybe – just maybe – this time round a recession may not be as painful for many of these companies as in times past.

We are not calling the bottom, but for us it has made sense to pocket some of the gains we made from energy shares and begin moving gently back into some of these cyclical areas in readiness for their recovery. In the meantime, we will happily take those dividends – we call it being paid to wait for the rebound.

Laura Foll is co-manager of the Henderson Opportunities Trust and the Lowland Investment Trust.

Sources Expand1 https://www.google.com/finance/quote/UKX:INDEXFTSE?sa=X&ved=2ahUKEwiDrtqn7Jv5AhWLSkEAHa0KDsIQ3ecFegQIKRAY to 25 July 2022

https://www.google.com/finance/quote/.INX:INDEXSP?sa=X&ved=2ahUKEwjj18bP7Zv5AhVVQEEAHQlIDsQQ3ecFegQIFBAY to 15 July 2022

2 https://www.google.com/finance/quote/BP:LON?sa=X&ved=2ahUKEwjs0YSj75v5AhWQOcAKHc4SBUAQ3ecFegQILRAa To 25 July 2022

https://www.google.com/finance/quote/SHEL:LON?sa=X&ved=2ahUKEwjv44Hc75v5AhWyQ0EAHarlBtIQ3ecFegQILhAa to 25 July 2022

https://www.google.com/finance/quote/GLEN:LON?sa=X&ved=2ahUKEwiRtM3875v5AhUDR8AKHWErB-UQ3ecFegQIKRAY to 25 July 2022

3 https://www.google.com/finance/quote/AXX:INDEXFTSE?sa=X&ved=2ahUKEwjIsZi67pv5AhWTbsAKHUbPCQEQ3ecFegQIJBAY to 25 July 2022

https://www.google.com/finance/quote/MCX:INDEXFTSE to 25 July 2022

5 Source: Bloomberg as 03 August 2022

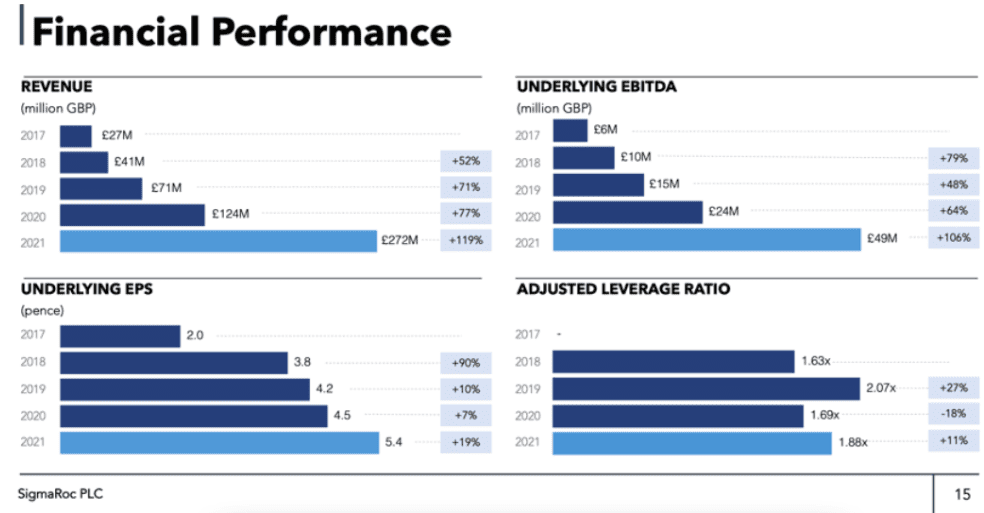

6 https://sigmaroc.com/wp-content/uploads/Mello-Presentation.pdf

7 https://sigmaroc.com/wp-content/uploads/FY21-Annual-Report.pdf

9 https://www.google.com/finance/quote/VTU:LON?sa=X&ved=2ahUKEwikwMew8Jv5AhUYi1wKHXPiBYUQ3ecFegQIKxAY&window=YTD To 25 July 2022

10 Data from Laura

Glossary ExpandCyclical stock – A cyclical stock is a stock that’s price is affected by macroeconomic or systematic changes in the overall economy. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

De-rating or re-rating – When the market changes its view of a company sufficiently to make calculation ratios such as PE substantially higher or lower, this a re-rating.

Yield curve – A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher tha