Underneath the surface, the dividend culture is maturing at a rapid rate, with dividends growing 58% faster than profits on account of booming cashflows.2 For investors seeking income, this fact is hard to ignore. Though the dividend trends in the region look positive, we must be cognisant of the challenging economic climate we currently face.

The risks in Asian markets

Unfortunately for many emerging economies including those in Asia, tighter monetary policy in the US on account of high inflation strengthens the dollar and exports inflation. This weighs on global trade and may impact the interest paid on any government debt held in dollars. Given that many Asian countries are heavily dependent on trade, this isn’t great for the health of their economies.

However, fiscal management has much improved on account of the lessons learned during the Asian Financial Crisis of 1997, and these days far more debt tends to be priced in domestic currencies. In addition, unlike Western central banks, Asia have more room to raise interest rates. As they are starting from a lower base, rates should stay below real GDP growth, keeping the debt dynamics manageable.

As one of the largest economies in the region, China’s faltering growth on account of the government’s zero-Covid policy hasn’t helped either. This policy is unlikely to change until after the communist party’s major political conference, the 20th National Congress, later in the year. US-China tensions surrounding Taiwan have resurfaced – further worsening sentiment towards China.

Yet, it serves us well to remember that ignoring short-term market noise tends to serve the long-term investor well, and if we expand our time horizons, Asia remains one of the most exciting investment cases in the world.

Three reasons to invest

Although market conditions are challenging for investors presently, it is at these times, when markets tend to be excessively pessimistic, that attractive investment opportunities arise. Here we examine three compelling reasons to invest in Asian markets and why Henderson Far East income offers an attractive investment proposition.

Over the past decade, in an era of cheap money and low inflation, exciting and expensive growth stocks with lots of profits promised in the future have been pretty much the only game in town. Yet, as inflation and interest rates have risen and as recessions loom, investors have moved to de-risk their portfolios and are investing in companies on more reasonable valuations that pay strong levels of cash today.

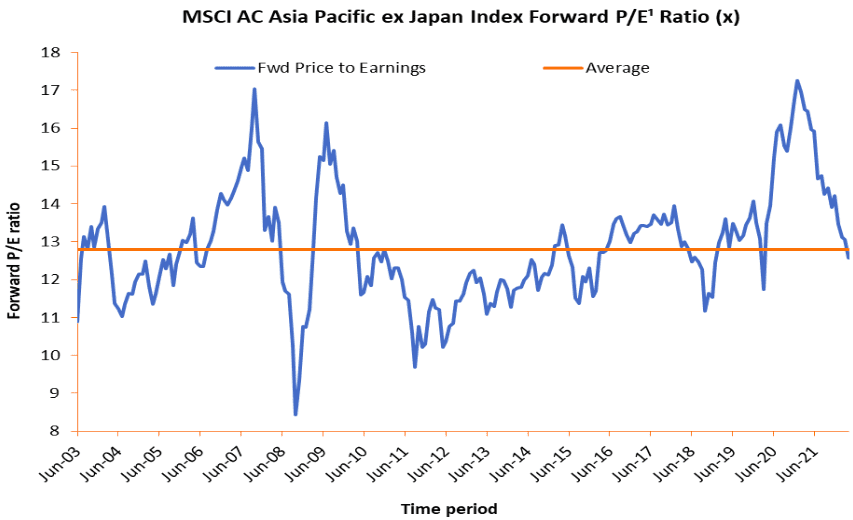

This rotation suits the investing style of the fund managers and Trust’s approach. They seek to invest in businesses with high levels of consistent cashflow, trading at attractive valuations. Currently, valuations in Asia are at their lowest level since March 2020, as regional markets have come under pressure on concerns over a global recession and aggressive rate hikes by major central banks (see below).

Source: FactSet. MSCI AC Asia Pacific ex Japan Index, Janus Henderson Investors Analysis, as at 30 April 2022.

Note: ¹ Fwd P/E = A popular ratio used to value a company’s shares. It is calculated by dividing the current share price by its predicted earnings per share. In general, a high Fwd P/E ratio indicates that investors expect strong earnings growth in the future, although a (temporary) collapse in earnings can also lead to a high P/E ratio.

In addition, the income focus means the Trust is delivering an exceptionally strong yield – the highest in its sector at 8.5%.3 As dividend income makes up a large part of the Trust’s total return, this should benefit investors given that elevated inflation and higher interest rates are constraining capital returns.

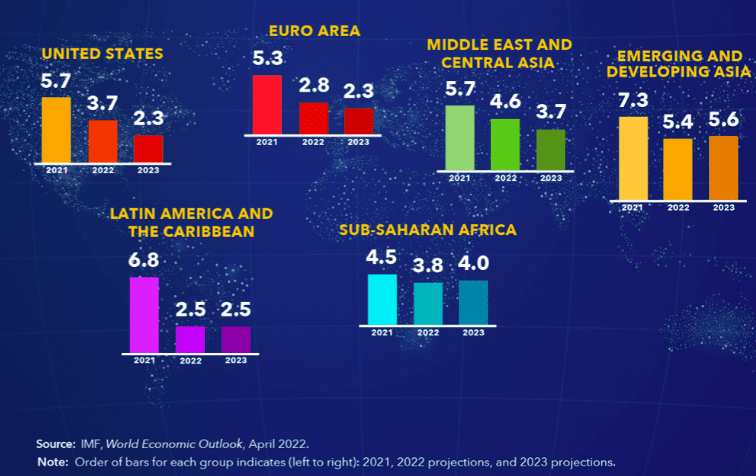

Company profits and growth are bound to the economic performance of the countries they operate within, and nowhere in the world offers such strong growth prospects as the Asia Pacific Region. Below, we can see GDP projections over the next few years, as forecast by the International Monetary Fund (IMF).

Note: There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns

In Asia, we see a different picture – in comparison to the US, dividend cover rose last year to 2.4x. This is important. In the US, it seems the rate of dividend growth cannot be sustained and indeed companies are turning to debt to support pay-outs, whereas in Asia we see that dividend programs are being much more conservatively managed.

This view is supported by balance sheet health, important in supporting dividends. A report released by Janus Henderson in 2020 – the JHI Corporate Debt Index – showed that Asian companies (excluding financials) owed 6% of the world’s debt yet provided 18% of the world’s dividends.

All said, it points at room to manoeuvre and potential increases in dividends. As such, the managers expect pay-outs to grow 6-8% over the year to a total of £33 billion, a new record.

Exciting prospects

We must concede that although the medium to long prospects for the region are very positive, in the near-term and for equity markets in general, the outlook is challenging. Earnings may struggle to keep up with inflationary pressures given the scale of rising input costs, and with monetary policy tightening, this may drag markets lower. Yet, given the strength of the Trust’s dividend, the income may offer investors some ballast as capital values remain volatile.

The Asia-Pacific region is hugely diverse. There are hundreds of companies to choose from, in a wide range of sectors, in countries at varying stages of development – all powered by strong secular drivers of growth. In addition to the wide choice on offer, companies in the region tend to be under researched, meaning there is scope to find opportunities that are mispriced relative to their prospects and fundamentals. Given current market valuations, this sets the Trust up strongly to potentially deliver strong returns to its investors, long into the future.

1Source: Henderson Far East Income – Asia Dividend Index 2022: Gobal Profit & Income Barometer: How Asia measures up against the wider world

2Source: Henderson Far East Income – Asia Dividend Index 2022: Gobal Profit & Income Barometer: How Asia measures up against the wider world

4Source: Henderson Far East Income – Asia Dividend Index 2022: Gobal Profit & Income Barometer: How Asia measures up against the wider world

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Growth stock – A company stock that tends to increase in capital value rather than yield high income.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Monetary policy – The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Valuation metrics – Metrics used to gauge a company’s performance, financial health, and expectations for future earnings e.g. price to earnings (P/E) ratio and return on equity (ROE).

Yield – The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.