The direction of the wind cannot be changed, but we can change the direction of our sails.

-Mansi Shah

With recent cooling in economic growth, an uptick in unemployment, inflation moderating back to the Federal Reserve’s (Fed) 2% target, and expectations for rate cuts, we believe the winds are shifting in the U.S. fixed income market.

In our view, investors may need to adjust their sails to harness the shift in a way that could benefit their portfolios. As they chart a course in this new environment of lower economic growth and declining interest rates, we believe investors should consider an allocation to agency mortgage-backed securities (MBS).

Following are five reasons why we believe MBS are poised for relative outperformance.

1. Catching the interest rate downwind

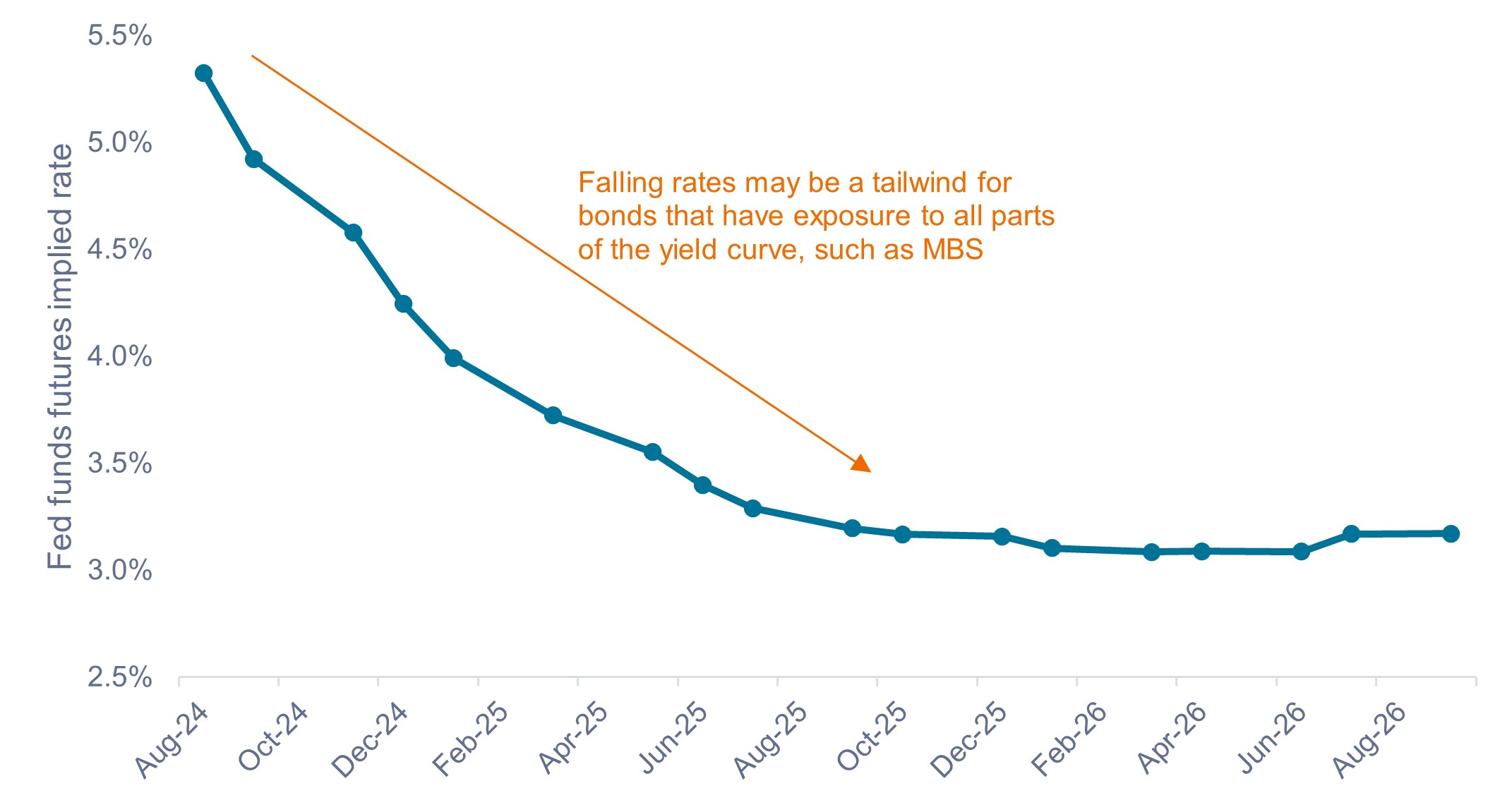

As shown in Exhibit 1, the Fed’s benchmark interest rate is expected to be cut by more than 2% over the next 12 months.

If short-term rates do decline as expected and the yield curve steepens (i.e., yields on short-duration bonds fall more than yields on long-duration bonds), we believe securities such as agency MBS that have exposure to all parts of the yield curve (short, medium, and long) have a high probability of capturing the positive effects of interest rate cuts.

Additionally, we believe MBS can complement the shorter-duration and floating-rate exposures many investors have allocated to in recent years. Floating-rate bonds continue to offer attractive yields on the back of interest rates that are still at multi-decade highs. We believe investors should continue to lean into short-duration yields, while adding exposure to MBS to potentially catch the downwind of declining rates.

Exhibit 1: Fed funds futures implied rate

The market expects over 2% of rate cuts in the next 12 months.

Source: Bloomberg, as of 13 August 2024.

Source: Bloomberg, as of 13 August 2024.

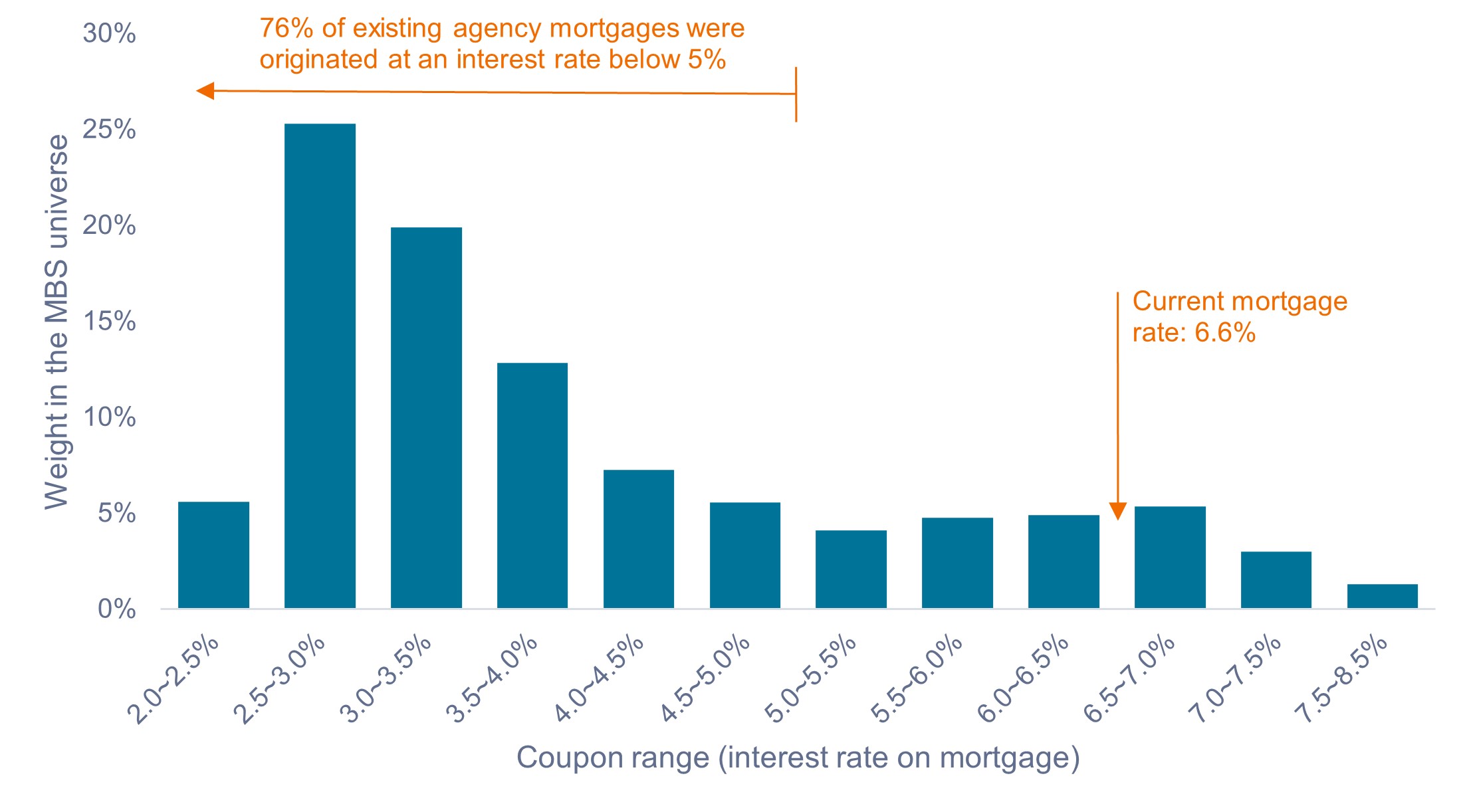

2. Prepayment risk at historically low levels

Agency MBS are backed by the U.S. government and therefore carry a negligible amount of credit risk. Prepayment risk is the primary fundamental risk for agency MBS, however. Homeowners may pay off or refinance their mortgage at any point, which would negate the future income on that mortgage for an investor.

Generally, refinancing increases when interest rates fall, as homeowners attempt to switch to lower-rate mortgages. These prepayments result in the duration of MBS falling when interest rates decline, a concept known as negative convexity. As a result, MBS may not fully realize the price appreciation from declining interest rates compared to a bond whose duration rises (positive convexity) when rates fall. To compensate investors for this risk, MBS pay an additional yield, or spread, above the yield on a comparable U.S. Treasury. (The Bloomberg U.S. MBS Index has on average in 2024 paid a 0.47% spread over U.S. Treasuries.)

While prepayments are an ever-present risk, the MBS market presently finds itself in a unique situation where prepayment risk is at historically low levels. As shown in Exhibit 2, due to an extremely low rate environment in 2020 and 2021, 76% of existing mortgages were originated at an interest rate below 5%, while the current mortgage rate hovers above 6.5%. To create a financial incentive for most homeowners to refinance, the mortgage rate would need to drop well below 5%, the likelihood of which we think is slim within the next 12 months.

In addition to the current environment offering no financial incentive to refinance, it actually disincentivizes many homeowners from moving (also leading to lower prepayments), as they would be giving up their “cheap” mortgage for a more expensive one.

In a nutshell, we do not expect prepayments to materially increase as rates come down, resulting in the duration of MBS remaining more stable and allowing the sector to better harness the positive effects of falling rates.

Exhibit 2: U.S. MBS distribution by borrower coupon

The current mortgage rate would have to fall well below 5% to initiate a material wave of refinancing.

Source: RiskSpan, as of 31 July 2024.

Source: RiskSpan, as of 31 July 2024.

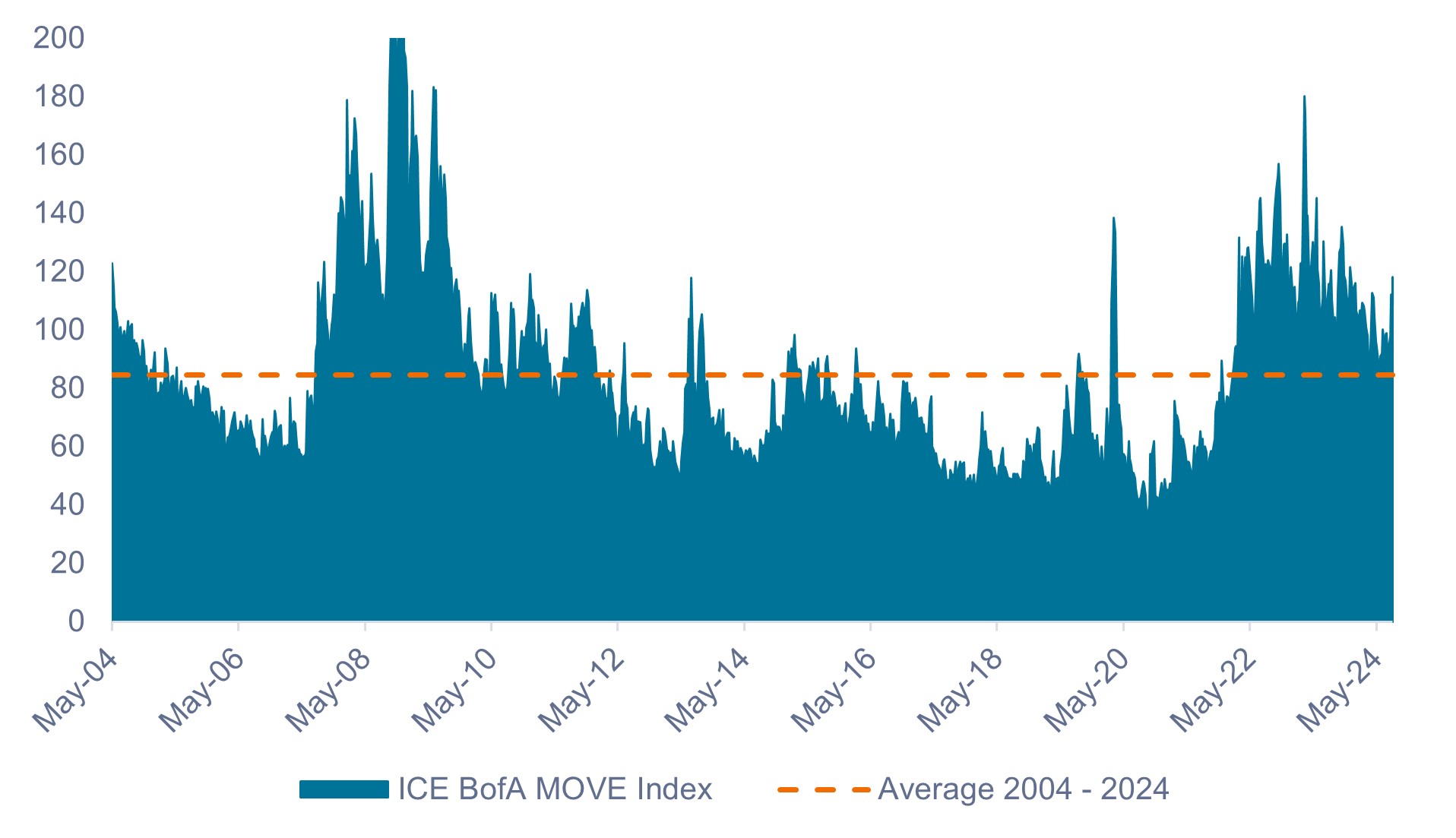

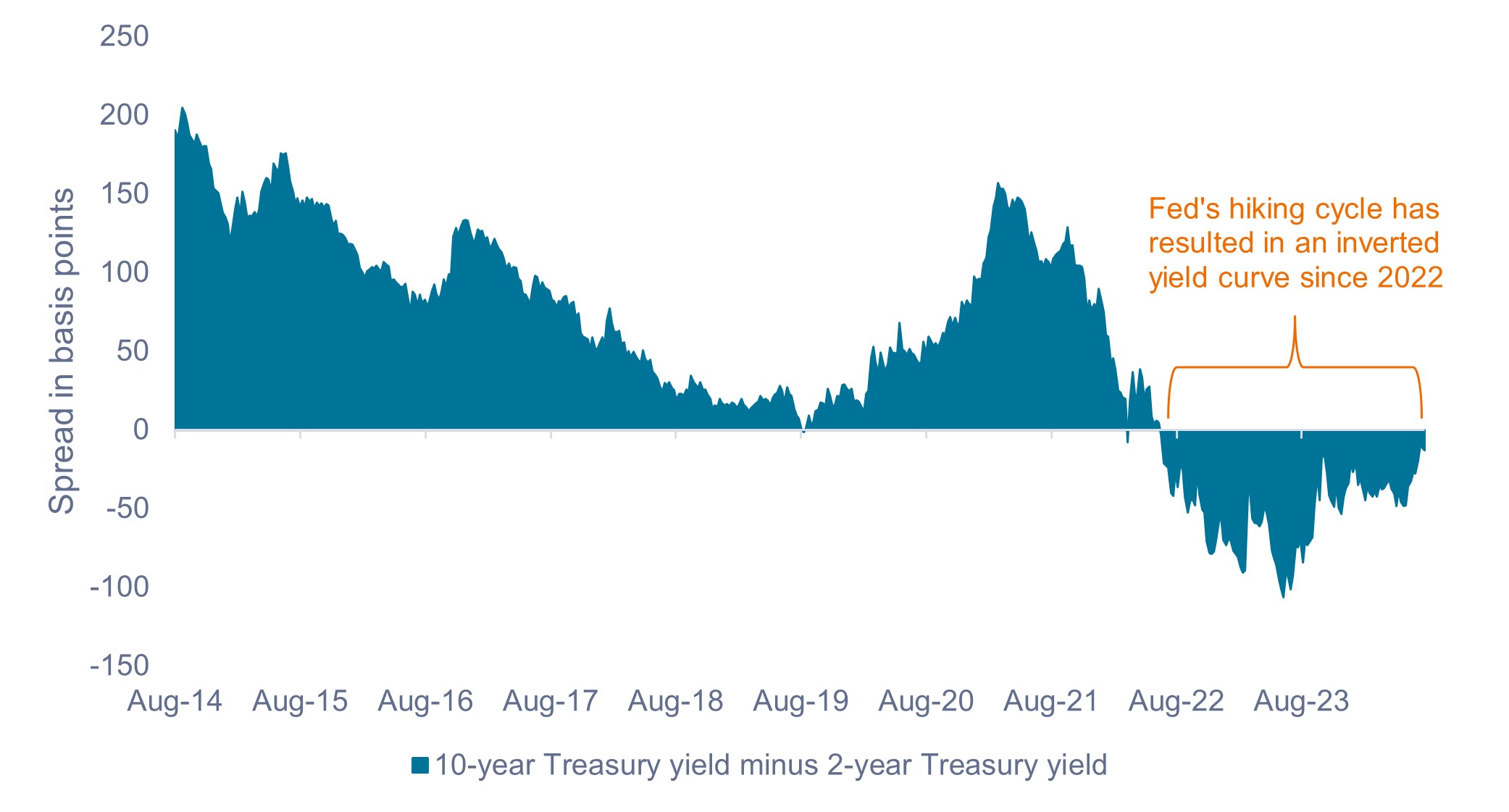

3. Declining interest rate volatility and a normalizing yield curve

Since early 2022, when the Fed began raising rates to combat inflation, two market dynamics have proved to be ongoing headwinds for MBS returns – high interest rate volatility and an inverted yield curve.

High short-term interest rates and uncertainty surrounding the Fed’s expected path of future interest rates have resulted in these two dynamics being present, which typically affect MBS to a greater degree than other fixed income sectors.

While these factors have pressured MBS returns until now, we believe interest rate volatility and the yield curve should normalize once the Fed starts cutting, turning these headwinds into tailwinds for the MBS sector.

Exhibit 3: ICE BofA MOVE Index (2004 – 2024)

Interest rate volatility is likely to fall to normalized levels once the Fed starts cutting.

Source: Bloomberg, as of 13 August 2024.

Source: Bloomberg, as of 13 August 2024.

Exhibit 4: U.S. Treasury yield spread: 10-year minus 2-year (2014 – 2024)

We believe the anticipated dis-inversion of the Treasury yield curve should benefit MBS returns.

Source: Bloomberg, as of 14 August 2024.

Source: Bloomberg, as of 14 August 2024.

4. Having some defense is the best form of defense

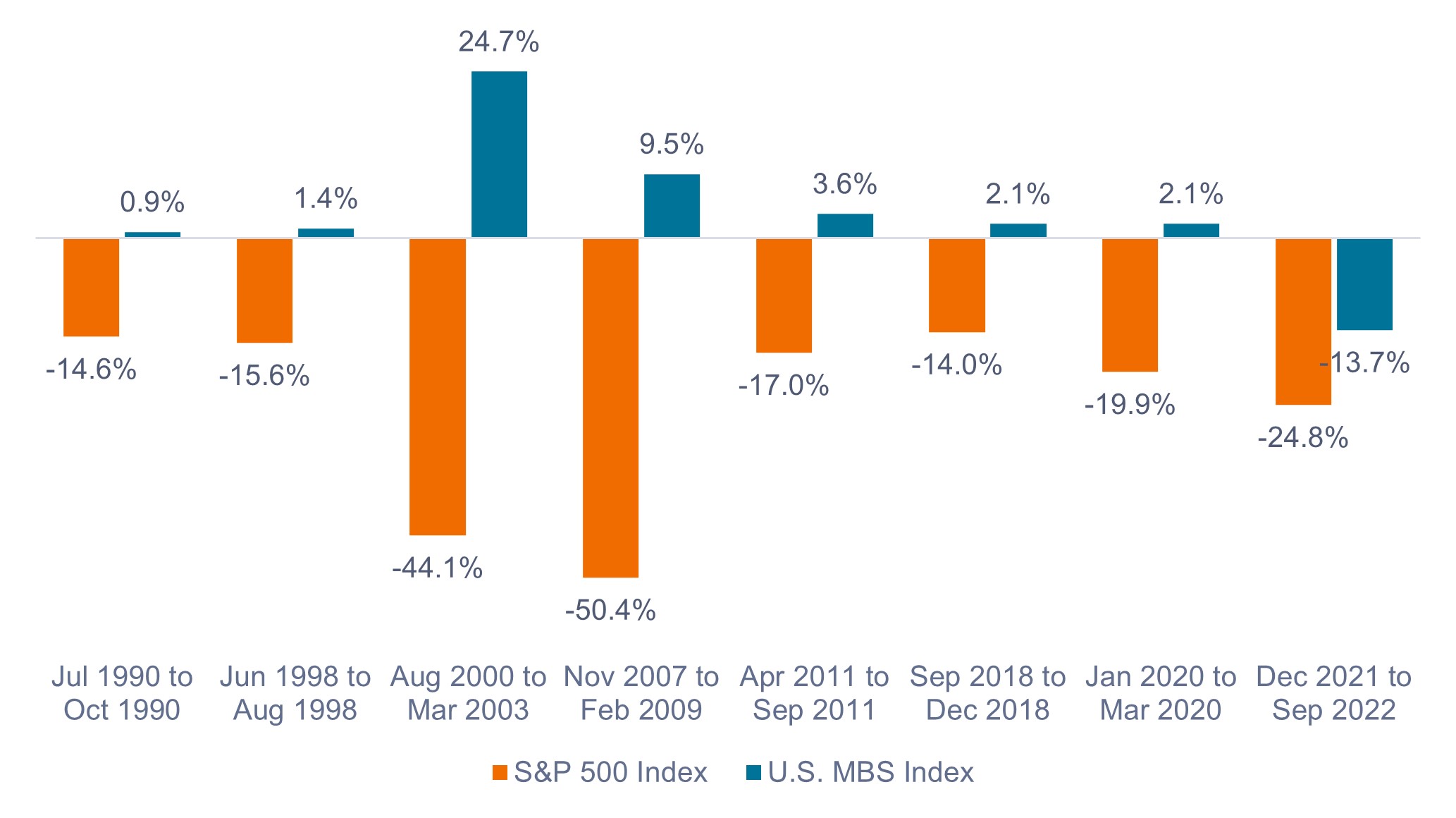

The U.S. economy has thus far remained resilient in the face of higher interest rates, but it is beginning to show some signs of cooling. Equity selloffs due to growth scares – like what we experienced in early August – are not uncommon during this part of the cycle, and we recommend investors ensure they have sufficient defensive assets in their portfolios to dampen equity market volatility.

Historically, MBS has acted as a ballast when equity markets have sold off, making it a suitable defensive diversifier in multi-asset portfolios, in our view.

Exhibit 5: S&P 500® Index peak-to-trough drawdowns greater than 10% (1990 – 2024)

Agency MBS has historically played defense when equities sell off.

Source: Bloomberg, as of 31 July 2024. Peak-to-trough drawdowns based on month-end data. Past performance does not predict future results.

Source: Bloomberg, as of 31 July 2024. Peak-to-trough drawdowns based on month-end data. Past performance does not predict future results.

5. The importance of active positioning

While we believe the MBS asset class is broadly poised for outperformance, there is significant dispersion among various pools of MBS.

Previously, we noted that prepayment risk is at historical low levels. But importantly, it is not uniformly low across all MBS subsectors. Some pools exhibit very high prepayment risk, such as recently issued to-be-announced (TBA) mortgages with coupons in the 6%-8% range.1

These TBA mortgage pools have enticed investors with their juicy yields. But due to their high coupons borrowers are incentivized to refinance as soon as possible, while interest rates need only decline marginally for refinancing to make financial sense. These bonds might be attractive in a rising rate environment, but the opposite is true when rates are set to decline: Investors are likely to have chunks of their bonds prepaid, thereby losing the future coupon income they were anticipating from that bond.

In contrast to the TBA market, investing in specified mortgage pools may allow an active manager to home in on mortgages that offer attractive yields without elevated prepayment risk. As an example, New York mortgages under $110,000 might be attractive to an active manager for two reasons.

First, residents of the state of New York are subject to approximately a 2% tax on mortgage refinancing. As a result, interest rates need to fall much more than in other states to create a financial incentive for New York homeowners to refinance. Second, refinancing a mortgage under $110,000 equates to a smaller monthly saving in dollar terms than a high-value mortgage. For many homeowners, a hypothetical saving of $20-$50 per month is not worth the cost and trouble of refinancing.

In our view, evaluating and managing prepayment risk is critical when investing in MBS. Weighing the risk versus expected return for each security is an important and ongoing process. Therefore, Janus Henderson’s securitized team dedicates significant time, technology, and resources to modeling prepayments on various mortgage pools, and it is also why we believe active management is essential when selecting MBS to add to portfolios.

1 A TBA serves as a contract to buy an MBS on a specific date, but the identity of the securities to be delivered is not specified at the time of the trade. This is because the TBA market assumes that MBS pools are largely interchangeable, as long as buyers and sellers agree on key parameters such as issuer, maturity, coupon, price, par amount, and settlement date. The TBA process helps to increase the overall liquidity of the MBS market as it allows mortgage lenders to hedge their origination pipelines.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Bloomberg U.S. Mortgage Backed Securities (MBS) Index measures the performance of U.S. fixed-rate agency mortgage backed pass-through securities.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.