Hybrids have been a much-loved sector of the Australian income market, having served investors well over the past few decades. They have often been a comfortable place to invest with household names providing an opportunity to generate regular distribution income and a unique feature of franking credits for local debt investors.

There have been periods of significant drawdowns as liquidity and banking system stress was tested during the Global Financial Crisis (GFC) and for a brief period during 2020. However, for the most part investors have enjoyed a smooth ride, without the heartaches of Additional Tier 1 (AT1) wipeout that has faced offshore banks, and European regulators that requested banks not to distribute to equity capital providers during 2020.1

APRA’s proposed amendments

The Australian Prudential Regulation Authority (APRA) has determined that the hybrid market may now be entering its final stanza. More recently it has sought to isolate the sale of these complex structured investments to professional investors, and in a world first have announced it is formally planning to completely phase out AT1 capital from Australian banking structures. This will put the Australian banking system in a globally unique position without this layer of AT1 capital, with APRA arguing it will provide more simplicity and clarity in a time of crisis.

Since the implementation of Basel III, APRA has favoured a simplified capital structure for the banks. In this latest plan it cited these key reasons for the change:

- Ensure that regulatory capital can more effectively absorb losses in a crisis, and efficiently support a resolution (bank recapitalisation or wind-up scenario).

- Simpler and lower capital requirements for smaller domestic banks.

- Reduced compliance costs of design, marketing, and issuance of AT1.

What happens next?

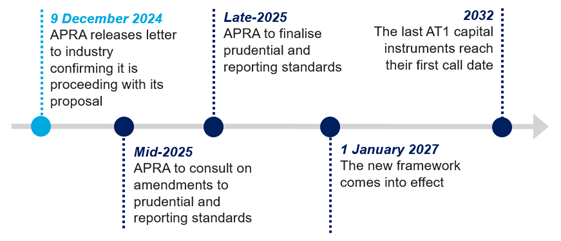

The key considerations for investors based on APRA’s announcements2 include the following:

- Bank hybrids are to be phased out by 2032. This aligns with the longest current call date on bank hybrids, with NAB Capital Notes 8 (which trade under the ASX code of NABPK) due to be called in March 2032.

- Amendments to the capital framework will be finalised by APRA in 2025, and come into effect from 1 January 2027.

- In preparation, existing hybrids are likely to be called at their next call date by banks and replaced with Tier 2 capital.

- If a severe market event occurs in the interim, existing hybrids features will remain and corresponding risks of distribution stops and conversion can occur.

- There is a concerted lobbying effort from market participants for a reversal in the decision taken by APRA. As an active manager we will keep a close eye on this area as a potential risk for market pricing.

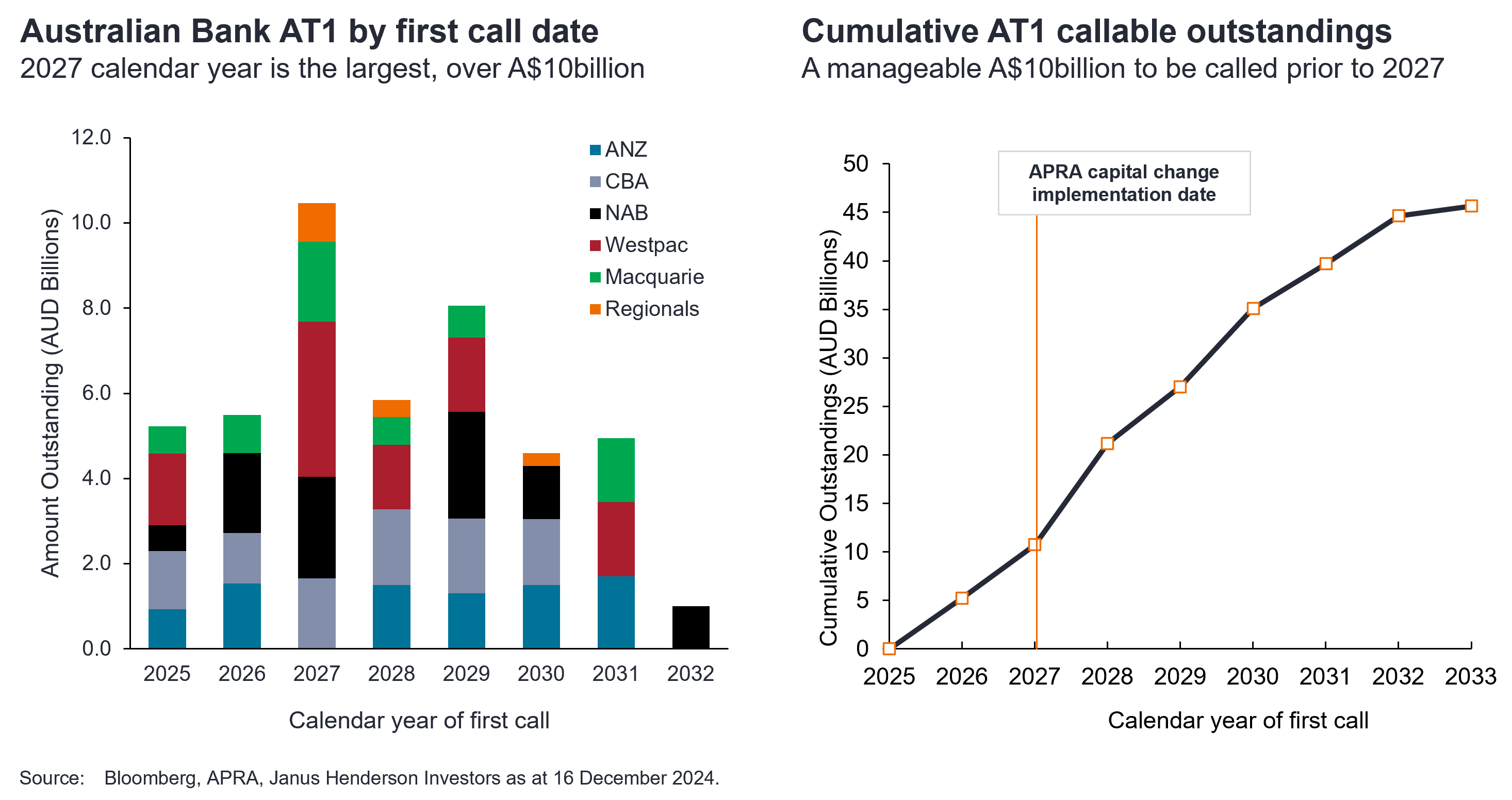

AT1 replacement profile

While APRA has provided an avenue for banks to roll over their existing hybrids under certain conditions, we anticipate most banks will begin immediately replacing hybrids at their call dates with Tier 2 where they have capacity to do so. Most of the banks have sufficient buffers in their Tier 1 capital to handle the reduction in hybrids through to 2027. The insurance sector meanwhile will still be able to issue AT1 instruments, including the likes of Challenger, IAG, QBE and Suncorp Group.

We expect the main consequence of the regulatory changes will be increased levels of Tier 2 to replace hybrids, while four major Australian banks, along with Macquarie, will be required to have a small additional amount of common equity capital.

Key timeline dates:

Source: APRA 9 December 2024, “A more effective capital framework for a crisis: Update” https://www.apra.gov.au/a-more-effective-capital-framework-for-a-crisis-update

This provides a full year in 2026 after the finalisation of the new framework for banks to adjust ahead of the 1 January 2027 implementation date.

Impacts on bank credit quality and market dynamics

Our team’s conversations with bank treasurers and rating agencies around the country have considered the following:

- Bank treasurers have indicated they are unlikely to refinance or issue any new hybrids. It is far quicker, easier and cheaper for them to issue Tier 2, as opposed to the documentation and month-long book build process to issue a listed hybrid. Also, most of them have sufficient Tier 1 capital buffers above the regulatory requirements to make the switch leading into the 2027 implementation date.

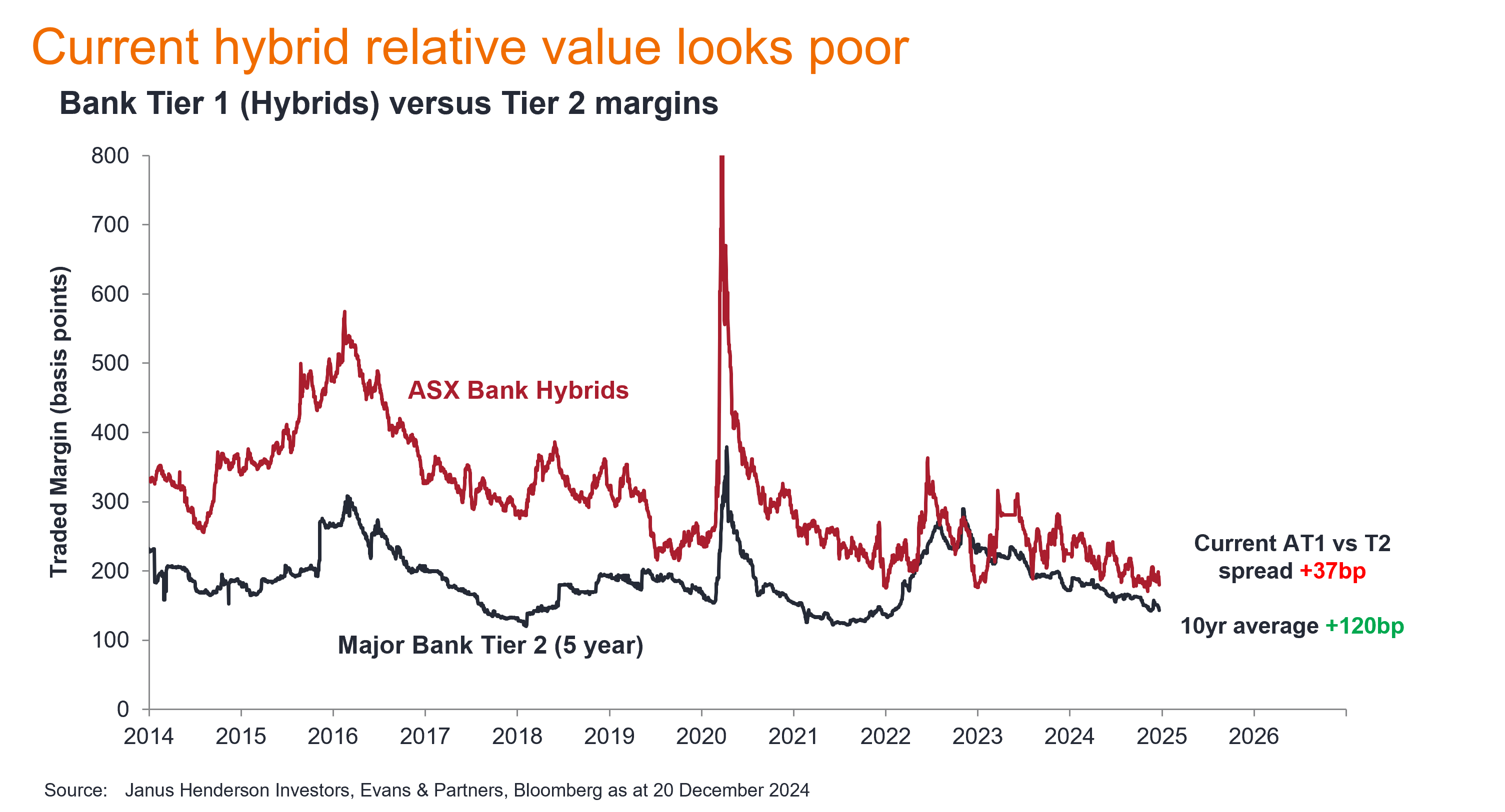

- This has implicitly built in a scarcity premium into listed hybrid market pricing in recent months and has effectively eliminated extension risk post their first call dates.

- The total Tier 1 capital that banks will carry under the new proposal will be lower. This has implications for credit rating agencies and may lower the credit profiles of some Australian Banks when viewed in a global context. In the absence of any mitigating action taken by management teams, we expect at least one major bank may have their stand-alone credit profile downgraded, which will impact ratings on their Tier 2 and AT1 securities while their senior credit rating should remain the same.

- Leverage ratios will rise. Whilst this may weaken investor perception of the very high quality of Australian regulated banks quality versus other global banks, the current view is that the market still recognises the “unquestionably strong” level of capital, and the high underwriting quality of household and corporate lending of Australian banks.

So what choices remain for higher income investors?

Alongside the increased availability of Tier 2 bank debt, a number of issuers have been considering the void left behind of a A$47 billion market fading away, and recently we have seen some issuance and had conversations with issuers regarding other types of income investment opportunities that may arise.

Corporate Subordinated Debt – We have seen a recent resurgence of Corporate subdebt that has been issued by entities such as Scentre Group, Ampol and Pacific National. We also have expectations that with the national build out of renewable energy infrastructure and transmission networks, utility companies will also look at this form of capital for ratings support during their decade long development phase. These securities come in different call/maturity structures and may or may not include equity conversion. Each note should be assessed on its own merits which complicates matters for investors.

Foreign Bank AT1 – A number of global institutions issue AT1/Contingent Convertible notes (CoCos) and we are able to access such instruments across various currencies and markets. Several, like UBS and BNP have also issued AT1 bonds in Australian dollars. During our meetings with top tier global institutions, we continue to encourage them to consider expanding their bank capital issuance programmes to include Australian dollar denominated securities.

There are also emerging types of global capital structures which exhibit some characteristics of hybrids including Limited Recourse Capital Notes (LRCNs), and we are monitoring the development of these innovative structures for suitability for domestic income investors.

Listed structures – Those investors who prefer investing via listed instruments may find an increase in the number of Listed Investment Trust (LITs) or Exchange Traded Funds (ETFs) available in future, in order to cater to former hybrid investors.

Institutionalisation of the market

The consistent theme between the regulator and the forward-looking income options is that the individual securities are generally offered or issued into the wholesale institutional market. Professional investors have been served well, having had a wider credit opportunity set from which to select, which have historically delivered strong risk adjusted returns, often commensurate with those of hybrids, including the benefits of franking. Whilst there are some terrific options in the market for those looking for the outcomes of historical hybrid returns, some may be quite specific, while others may be actively managed and have a broader global approach.

Global credit markets have been around for over a century, and today are deeper, more diverse and generally more liquid than ever before. Plenty of investment choices exist across public markets like corporate investment grade, high yield, asset backed, emerging market debt, and Collateralised Loan Obligations (CLOs), as well as the semi-private syndicated loan markets, and finally private credit markets including direct lending and securitisation warehousing. Each investment type has its own nuances and risks associated with the pursuit of higher levels of income. And while they have delivered well for professional investors over the decades, some have been difficult to access by end investors.

There are a number of funds with solid longer-term track records available to fill investors income needs in a post hybrid world. Some are specialised single credit capabilities which target one area of the broader credit market. Our experience suggests to us that over the market journey, a broader and more diverse set of credit exposures will often serve investors best, by having the ability to allocate across different sectors to enhance returns while at the same time reducing risks such as drawdown and sequencing risk.

How are we actively navigating the environment?

In the most recent months since APRA first announced their plan to remove hybrids in September 2024, the hybrid market has underperformed other higher ranking floating rate credit (Senior Bank and Tier 2 debt) and at some points falling behind cash returns.

Floating rate sub-sector returns 1 October – 16 December 2024.

We have favoured a more diversified approach to credit income investing, and over the past decade our funds have reduced their reliance on the local hybrid market, having now fully divested from ASX listed hybrids due to their now poor relative value. Instead, we have favoured a rotation into exposures in bank Tier 2 debt, global secured loans and the senior debt of Australian investment grade companies, which are offering better risk adjusted value for investors.

Investors have benefited from this approach, with our strategies having delivered attractive returns over cash rates on a consistent basis, while maintaining low levels of drawdown risk. Increasingly, we have seen this approach resonate with investors – and pleasingly one of our strategies, Janus Henderson Diversified Credit, was recently named Best Credit Fund – High Yield in Money Magazine’s 2025 Best of the Best Awards. As an independent award, please refer to their assessment criteria for how winners are selected.

A clean break or long kiss goodnight for hybrids?

For income investors in Australia, 2024 will likely be remembered as the year in which APRA announced it would give Australian hybrids the long kiss goodnight. Since that announcement, enthusiastic market pricing has brought forward the risk of underperformance for those remaining hybrid holders. As such, as we begin 2025, we believe investors may wish to assess other income-generating credit opportunities outside of the hybrid space to complement their investment portfolios.

1ECB, 27 March 2020, “ECB asks banks not to pay dividends until at least October 2020.” https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr200327~d4d8f81a53.en.html

2APRA 10 September 2024, “A more effective capital framework for a crisis” https://www.apra.gov.au/a-more-effective-capital-framework-for-a-crisis