October 2020

The highly rational – and sometimes slightly less rational – world of tech investing

Denny Fish

Denny Fish

Portfolio Manager | Research Analyst

Key takeaways

- While many investors have pointed at recent volatility to call for sector rotation or a shift to value stocks, we believe some of the most promising growth opportunities remain in tech and Internet-focused communications stocks.

- We sit on the cusp of the Fourth Industrial Revolution where a greater share of economic profits may shift toward digital rents as artificial intelligence, the cloud and increased connectivity improve efficiencies across the entire economy.

- Volatility is inherent in equity markets, but we believe in seeking to identify resilient companies with consistent cash flow generation and those which are levered to the themes defining the Fourth Industrial Revolution.

Tech stocks just can’t keep out of the spotlight: first, by outpacing broader equities over much of the past couple of years, then with a swift early September sell-off. The relentless upward march in technology prices and valuations we have witnessed has brought many a prognostication on why we need to see a “sector rotation” or witness a “regime change from growth to value.”

To be clear, that may very well happen, and we respect the potential. We are not numb to the power of shorter-term market movements, particularly given what can be perceived as near-term extremes. But we believe we are on the cusp of the Fourth Industrial Revolution as economic profits get redistributed to digital rents and away from many legacy industries. Importantly, while many technology stocks have seen significant price appreciation, several market-leading tech and internet-focused communications companies are considered to offer some of the soundest fundamentals and long-term opportunities across all equity sectors, which has led to strong financial performance. We continue to believe this development could continue on a multi-year basis.

Rooted in fundamentals

Our view has been that tech’s solid fundamentals have been in place for several years and that only lately have investors truly begun to grasp the magnitude of this opportunity. Growth stocks are among the longest-duration assets (companies with a revenue stream that occurs over a long period of time). This is especially true for the tech companies leveraged to the secular themes of artificial intelligence (AI), cloud computing and the Internet of Things (IoT). These complementary forces are the underpinnings of a digital global economy that has been years in the making.

The luster of tech’s growth profile increased during the 2019 economic slowdown and again this year as many tech offerings helped businesses and households navigate the disruptions caused by the COVID-19 pandemic. Also helping large tech and internet companies weather the early-year sell-off were perceived defensive characteristics given their resilient business models and strong balance sheets.

This context is necessary to put current valuations in perspective. Inherent within growth stocks is the expectation that promising companies’ earnings will ultimately grow into today’s share price. This phenomenon is magnified by the current pall hanging over the global economy as stocks that have demonstrably delivered growth are in demand.

As tech and internet stocks prices rose over much of this year, they commanded a higher portion of the growth equities universe. While growth indices’ tilt toward tech raised some eyebrows, mega-cap companies’ contribution to index earnings and cash flow growth has even exceeded the pace at which their share of several benchmarks has risen.

GROWTH TECH EARNING ITS KEEP

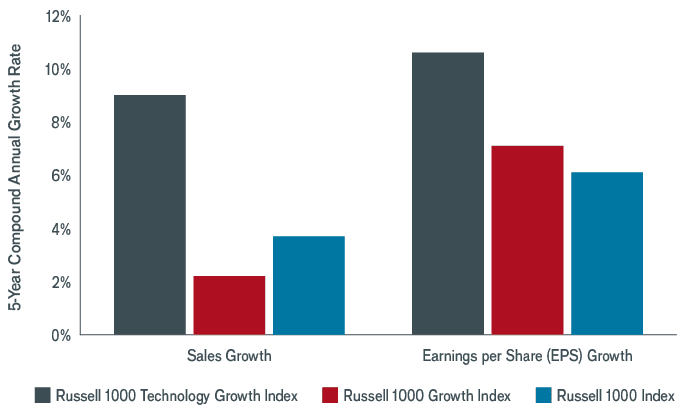

The larger share commanded by higher-growth tech names in both the large-cap growth and broader large-cap indices has increased materially; these commanding positions are being fueled by unrivaled sales and earnings growth.

[caption id=”attachment_321816″ align=”alignnone” width=”688″]

Source: Bloomberg, annual data as of 31 December 2019. The Russell 1000 Index comprises more than 90% of the total market capitalization of all listed stocks in the U.S. equity market. The Russell 1000 Growth Index measures the growth segment of the index, including firms whose share prices have higher price‐to‐book ratios and higher forecast earnings growth rates. The Russell 1000 Technology Growth Index is made up of Technology companies that fall into the Growth segment. Compound annual growth rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each year of the investment’s lifespan. Past performance is not a guide to future performance.[/caption]

The power of the Fourth Industrial Revolution

This year’s powerful run by tech stocks has drawn unflattering comparisons to the dot-com bubble of 20 years ago. However, in our opinion, there is a major difference: in contrast to that era, tech companies today seem to be delivering important efficiencies to companies and value to consumers.

Many of these benefits are being powered by the technologies that we consider the building blocks of the Fourth Industrial Revolution. Similar to the role played by steam and semiconductors during previous waves of innovation, data is the catalyst for this period. Information collected through IoT-enabled devices or user information on the internet is processed in the cloud – often through AI-driven algorithms – and used to make more informed business decisions. While these elements have been in place for a while, they were acutely called into action during this year’s economic slowdown as companies scrambled to maintain access to customers and ensure back-office operations functioned optimally. In this respect, the digitization of the enterprise has been pushed forward – by years in some cases.

Tech stocks have also risen on the recognition that the total addressable market of many of their offerings has likely increased. Entire cohorts of consumers who had heretofore been hesitant to interact with the digital economy had little choice but to increase their engagement during extended lockdowns. This is most evident in rising e-commerce activity, remote learning and work as well as online entertainment.

As data is the currency of the Fourth Industrial Revolution, this increased activity has likely reinforced the competitive positions of the large internet platforms that have already invested in the technologies necessary to synthesize information gleaned from rising usage into actionable business intelligence. And while this year marked an acceleration, it is our view that we are still in the early innings of this digital shift. We expect the deployment of 5G infrastructure over the coming years to help keep the momentum going.

Unforced errors

Just as many investors were late to recognize the opportunity presented by the large tech platforms driving these long term themes, they also committed the oft-repeated mistake of approaching the sector as a homogenous entity. It’s not. The later stages of the recent tech rally have shown evidence of indiscriminate buying, with little differentiation made between stocks leveraged to long-term drivers and those of legacy tech companies likely destined to see once-lucrative end markets wither. One-size-fits-all investment strategies only exacerbate the matter.

Despite the leading role played by tech in transforming the global economy, appropriate due diligence remains an essential part of the investment process. In our view, several swaths of the sector should be avoided, either due to negative transformation headwinds in the case of legacy companies or – for more speculative names – little visible path to profitability. Instead, an investor’s focus should remain on identifying capable management teams, understanding unit economics and – with an eye toward future growth – exploring business adjacencies complementary to a company’s core offering.

A place for optionality

Given the dynamic nature of technology and innovation, many of today’s smaller enterprises could meaningfully contribute to the sector’s future growth. Yet, given their wider range of potential outcomes, their investment risk is high. There is potentially a place for such companies in a tech portfolio, but they must be sized appropriately. We categorize companies capable of delivering high rates of earnings growth as displaying optionality.

Not only should risk be dispersed among stocks exhibiting optionality, but we believe that as evidenced by September’s market volatility, it’s prudent for investors to counterbalance “optional” stocks with a robust allocation toward more established companies with resilient business models. Tech investors find themselves in a unique position today given that many resilient, mega-cap stocks exhibit their own optionality thanks to the strength of the data collection and analysis, which may give them a leg-up in identifying and delivering new digital solutions.

Glossary of terms:

Price to book ratio: A financial ratio that is calculated by dividing a company’s market value (share price) by the book value of its equity (value of the company’s assets on its balance sheet). A P/B value of less than 1 can indicate a potentially undervalued company or a declining business. The higher the P/B ratio, the higher the premium the market is willing to pay.

EQUITY

PERSPECTIVES Back to main

Related products

Global Technology and Innovation Fund (JATIX)

Global Technology and Innovation Fund (JNGTX)

More Equity Perspectives

PREVIOUS ARTICLE

Looking past election volatility

Director of Research Matt Peron says that while the 2020 U.S. presidential race could create volatility for stocks, such pullbacks are often based on fear, not long-term fundamentals.

NEXT ARTICLE

Global real estate – coming to the end of the abnormal?

Global real estate Portfolio Managers Guy Barnard, Tim Gibson and Greg Kuhl address misperceptions investors may have about real estate post-COVID-19 and explain why the team believes it remains an attractive and relevant asset class.