This underperformance may be noteworthy, but it’s not a departure from recent experience. The UK has fallen behind other world markets by a huge margin: the FTSE 100 has grown by under 20% over the last 10 years whilst the S&P 500 has grown by over 200%2, a sobering disparity. Hope springs eternal, however. After years of inferior performance, the most compelling argument in favour of the UK is current valuations. Brexit-related perils imposed large discounts on UK stocks, such that no developed world market was cheaper; the pandemic then drove value stocks globally to near-record lows relative to growth stocks.

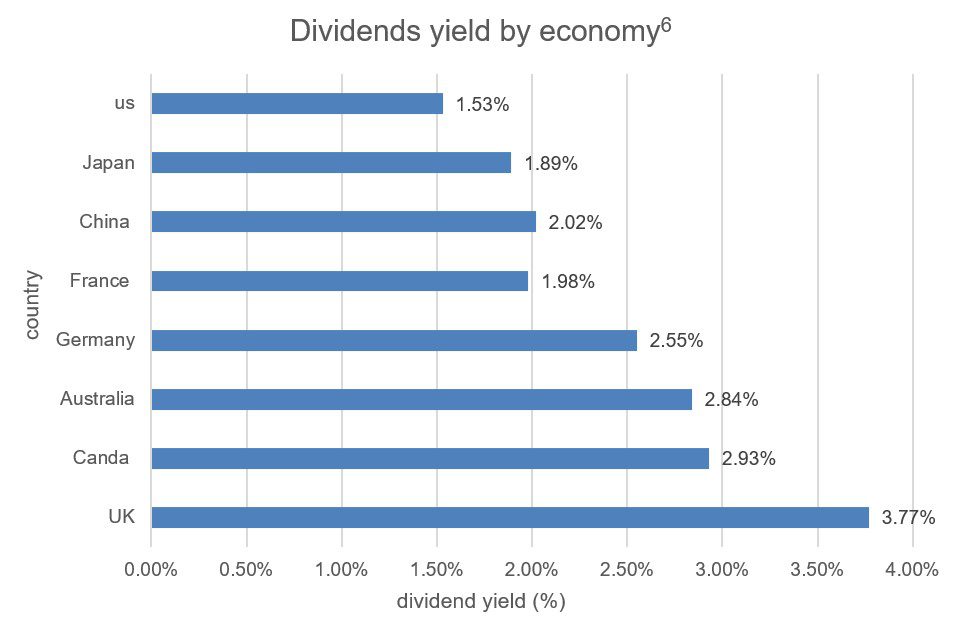

It’s an acutely relevant facet, given that the UK market has traditionally been a happy hunting-ground for those in search of yield. At over 3.5% at the end of 2020, it tops the pile of the major world equity markets as illustrated by the chart below. The yield is particularly attractive relative to cash, which is virtually zero (until recently, UK monetary policy makers were openly discussing negative interest rates), and bond yields which in some cases – particularly sovereign debt – have fallen into negative territory.

Source: Siblis Research, as at 31.12.20

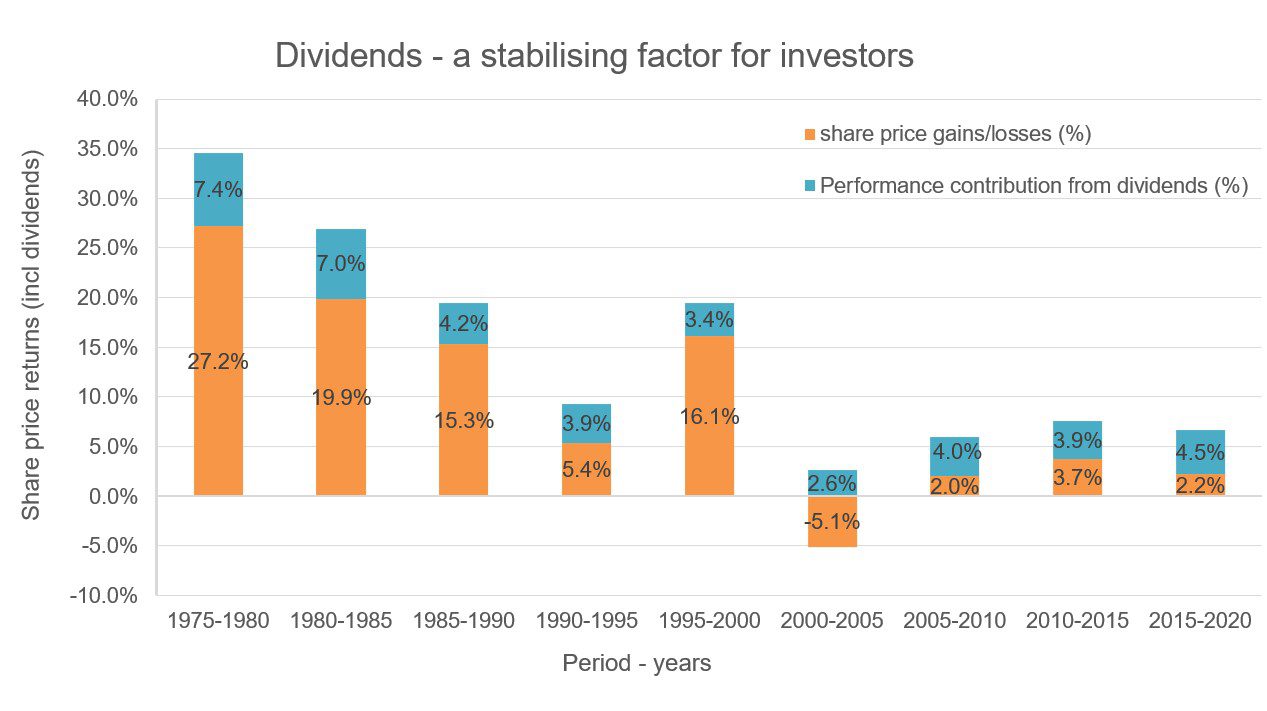

Source: DataStream, Allianz GI Global Capital Markets & Thematic Research

Link Group’s latest UK Dividend Monitor (Q1 2021) expects UK underlying dividends to rise by 5.6% in the best-case scenario, whilst headline dividends are expected to increase by 11.1% in a worst-case scenario and 17.2% in the best-case scenario.8 In the previous quarter, it was anticipating a worst-case decline of 0.6% on an underlying basis but, as businesses have increasingly been declaring dividends in line with best-case predictions over the first quarter as the economy re-opens, the gap between the low and high forecasts has narrowed markedly. After significant dividend cuts last year, the payout ratio of the average UK company is now below where it has been for some time – even taking into account a depressed earnings base – which leaves significant headroom for dividends to grow at a healthy rate as cashflows and profitability recover.

The trajectory of the UK’s dividend is very much front of mind for Laura Foll, co-Portfolio Manager of Lowland Investment Company, part of the Janus Henderson stable of investment trusts, although Laura is keen to stress that she treats income as an ‘output’ of the investment decision-making process. If used as a starting point, one can very rapidly end up chasing one’s tail, with higher yielding shares often acting as ‘value traps’ where challenged fundamentals merit low valuations.

Outside of the banking sector, Laura has been encouraged by the speed at which companies have returned to paying dividends. The majority of companies held in Lowland’s portfolio that suspended dividends during the pandemic have since returned to paying. Companies held that continue not to pay a dividend are either in the areas most affected by the pandemic (such as Johnson Service Group, which launders textiles for the hospitality industry) or did not pay a dividend prior to the pandemic. This could be due to their stage in the company lifecycle (for example solid state battery company Ilika, which is still at a stage of heavy investment in research and development and scaling up production). However, while dividends have in most cases resumed where they were previously suspended, company boards remain understandably cautious on dividend payout ratios at this stage in the economic recovery. This conservatism on payout ratios, combined with earnings that are still recovering from their lows during the pandemic, means that in Laura’s view there is a further ‘leg’ of dividend recovery to come. This further progress could come as earnings continue to climb and company boards become increasingly confident in the durability of the turnaround.

Patient income investors have been rewarded as UK companies begin the restoration of payouts to pre-pandemic levels. After a long, hard winter for dividends, the green shoots of late spring are sprouting. 2021 FTSE 100 dividends (excluding special dividends) are set to increase by 18% to £73.4 billion.11 It’s a far cry from the levels of 2018 and 2019, but heartening nonetheless, and puts the 2021 forecast dividend yield for the index as a whole at 3.8% which is still at a significant premium to the yield on most other global equity indices. By way of comparison, the current yield on the US S&P 500 Index is 1.37% 12 – only just over a third of that anticipated for the UK.

1 Source: Bloomberg, as at 30.06.212 Source: Bloomberg, 17.05.11 to 17.05.21

3Source: OECD Economic Outlook, Interim Report March 2021

4 Bank of England, Monetary Policy Report May 2021

5Source: Link Group, UK Dividend Monitor Q4 2020

6 Source: Siblis Research, as at 31.12.20

7Source: DataStream, Allianz GI Global Capital Markets & Thematic Research

8Source: Link Group, UK Dividend Monitor Q1 2021

9Source: Lowland Investment Company PLC factsheet, 31.06.21

10Source: The Association of Investment Companies, as at 21.06.21

11 Source: AJ Bell, Q1 2021 Dividend Dashboard

12 Source: Ycharts, 30.04.21 Discount Expand

When the market price of a security is thought to be less than its underlying value, it is said to be ‘trading at a discount’. Within investment trusts, this is the amount by which the price per share of an investment trust is lower than the value of its underlying net asset value. The opposite of trading at a premium.

Dividend ExpandA payment made by a company to its shareholders. The amount is variable and is paid as a portion of the company’s profits.

Net asset value (NAV) ExpandThe total value of a fund’s assets less its liabilities.

Monetary stimulus/policy ExpandThe policies of a central bank aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Valuation metrics ExpandMetrics used to gauge a company’s performance, financial health and expectations for future earnings e.g., price to earnings (P/E) ratio and return on equity (ROE).

Value stock ExpandA value stock refers to shares of a company that appears to trade at a lower price relative to its fundamentals, such as dividends, earnings, or sales, making it appealing to value investors.

Value trap ExpandAn equity that appears to be cheap due to an attractive valuation metric (such as a low P/E ratio) may attract investors who are looking for a bargain. However, this may turn out to be a ‘trap’ if the share price does not improve or falls, which may happen if the company or its sector is in trouble, or if there is strong competition, lack of earnings growth or ineffective management.

| Discrete year performance % change (updated quarterly) | Share price | NAV |

|---|---|---|

| 31/03/2020 to 31/03/2021 | 45.9 | 47.2 |

| 29/03/2019 to 31/03/2020 | -29.8 | -29.6 |

| 30/03/2018 to 29/03/2019 | -6.3 | -4.8 |

| 31/03/2017 to 30/03/2018 | 6.2 | 2.5 |

| 31/03/2016 to 31/03/2017 | 16.0 | 20.5 |

All performance, cumulative growth and annual growth data is sourced from Morningstar

© Copyright 2021 Morningstar. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.