The Fed’s new policy, inflation and its implications for U.S. bonds

-

Greg Wilensky, CFA

Greg Wilensky, CFA

Head of U.S. Fixed Income | Portfolio Manager -

Michael Keough

Michael Keough

Portfolio Manager

Key takeaways

- The U.S. Federal Reserve (Fed) announced a new average inflation targeting regime where it aims to push inflation above 2%, but we do not foresee a significant rise in inflation in the near term.

- While the yield curve may steepen modestly, we believe the low interest rate environment will persist as the Fed continues to provide significant accommodation to the markets and economy via near-zero policy rates and large-scale asset purchases.

- We continue to see value in diversified bond portfolios and favor exposure toward high-quality credit that will likely benefit from central bank actions, progress on a vaccine and persistent need for yield across the globe.

Chairman Jerome Powell recently introduced the Fed’s new monetary policy strategy with a renewed commitment to achieving an average inflation target. The policy will require allowing inflation to run above 2% to make up for persistently missing that goal in the prior economic cycle. For the current recovery, this means the Fed is committing to a more dovish path forward where it will not preemptively hike rates based on low unemployment or the first signs of inflation, but rather wait to confirm sustained inflation has taken hold. This is an important policy shift, but it is one thing to set a goal and another to deliver on it. Given the Fed’s actions and statements have been the primary factor in the performance of financial markets since the outbreak of COVID-19, a change in its approach to managing inflation warrants a fresh look at the implications for bond portfolios.

Will inflation rise?

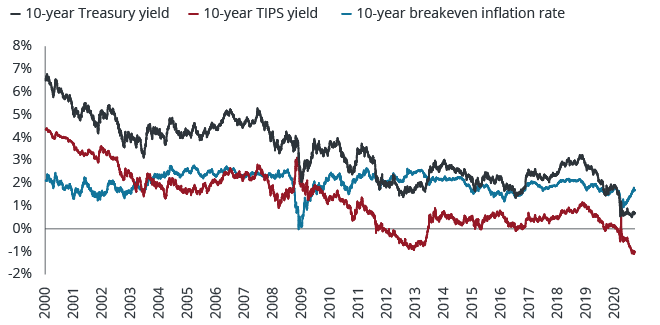

With the large amounts of monetary and fiscal policy unleashed into the economy to combat the COVID-19 pandemic and market-based levels of inflation expectations on the rise (see chart below), many investors are starting to wonder if rising inflation and higher yields will become a headwind for returns across the fixed income markets. True money supply is at historic highs as the Fed’s balance sheet has exploded due to its asset purchase programs at the same time massive fiscal stimulus programs were enacted. But for all the money that has been pumped into the U.S. economy by the Fed and Congress, the stimulus does not look likely to turn into sustained inflation anytime soon. Unemployment remains high, spending is constrained, and while growth is turning positive there is still a significant amount of repair and healing that needs to occur in many parts of the economy. The persistent and continued spread of COVID-19 has also delayed the reopening of the economy on a larger scale.

IMPLIED INFLATION EXPECTATIONSInflation expectations are rising, as demonstrated by the difference between the U.S. 10-year Treasury (nominal) yield and the 10-year TIPS (real) yield.

[caption id=”attachment_323595″ align=”alignnone” width=”660″]

Source: Bloomberg, as of 11 September 2020. Treasury Inflation-Protected Security (TIPS) are a type of Treasury security issued by the U.S. government that is indexed to inflation in order to protect investors from a decline in the purchasing power of their money. As inflation rises, TIPS adjust in price to maintain its real value. Nominal yield is the yield of a bond before considering the effects of inflation. Real yield is the nominal yield of a bond minus the rate of expected inflation.[/caption]

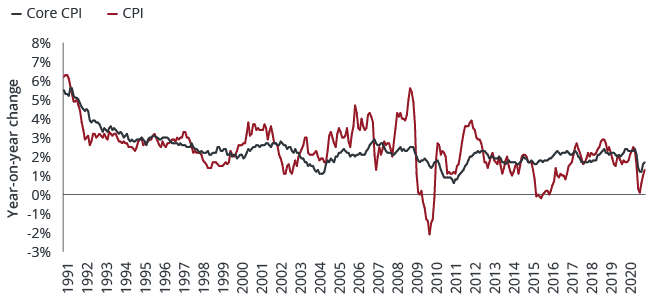

We believe the Fed would like to see higher inflation in the U.S. because it has drifted lower across the recent business cycles and has not averaged 2% in some time. To the extent there is fear of a Japan-like stagnation occurring in the U.S., rising inflation would not only confirm the economy has recovered but would also reduce concerns about the Japanification of the U.S. and any doubts about the Fed’s ability to achieve its policy goals. In the current environment, we believe the Fed is more focused on raising the expectation of eventual inflation and so far Fed policy has been effective in keeping nominal U.S. Treasury yields anchored at low levels while inflation expectations have risen. Currently low nominal yields and negative real yields are supportive of economic growth and investment while also providing firm support for asset prices, as we have seen coming out of the crisis.

U.S. CONSUMER PRICE INDICES OVER THE PAST 30 YEARSInflation has generally remained below the Fed’s 2% target since the Global Financial Crisis.

[caption id=”attachment_322418″ align=”alignnone” width=”660″]

Source: Bloomberg, as of 31 August 2020. The Consumer price index (CPI) is a measure that examines the price change of a basket of consumer goods and services over time. Used to estimate inflation, headline CPI is a calculation of total inflation in an economy, and includes items such as food and energy, in which prices tend to be more prone to change. Core CPI is a measure of long-run inflation and excludes transitory/volatile items such as food and energy.[/caption]

What will happen to the yield curve?

We believe that interest rates at the front end of the U.S. Treasury yield curve will remain low for the foreseeable future. The Fed’s new stance on inflation only increases the probability that its policy rate remains lower for longer than we have been accustomed to. Typically, the Fed raises rates when they think inflation is at risk of rising. This time, it has stated it will wait to see sustained higher inflation before raising rates. As progress is made on a vaccine and it is administered across the world, we would expect to see an uptick in economic activity and cyclical inflation from depressed levels, but we would not mistake that with a more significant shift of inflation requiring the Fed to withdraw accommodation and raise rates.

In terms of the back end of the yield curve and 30-year interest rates, it is imperative to remember the Fed was early and aggressive in its policy support. After lowering policy rates to zero, the Fed also began large-scale asset purchases with quantitative easing (QE) to support the stabilization of the financial markets and facilitate many borrowers’ access to much-needed liquidity. In a recent speech, Fed Governor Lael Brainard repeated that “in coming months, it will be important for monetary policy to pivot from stabilization to accommodation.” As a result, we will be listening for any additional details related to forward guidance and changes to the asset purchase program where it may increase purchases at the long end of the curve to help keep long-end rates in check. Meanwhile, we expect additional demand for longer-dated bonds to come from investors as they look to access the yield available in U.S. markets amid a large swatch of negative-yielding global debt. As long as the yield curve remains positively sloped, the historically low level of yields incentivizes investors to take longer-dated risk to achieve their objectives. This incentive will only increase when and if longer-term yields rise. Between investor demand and the Fed’s desire to stimulate the economy through low long rates (both real and nominal), we expect any rise in longer-dated yields to be modest.

The outlook for a diversified bond portfolio

The benefit of a fixed income strategy that can invest across multiple sectors is the flexibility and tools to position for dynamic markets such as the one we find ourselves in today. For investors who can allocate between Treasuries and credit markets, low Treasury yields are not compelling compared to the opportunities across credit sectors that offer attractive yields and potential upside as the economy recovers. This is not to say that U.S. Treasuries don’t have value in a diversified portfolio. Even at current yields, the long end of the curve should still be a diversifier of risk – and a source of potential capital appreciation should the economy weaken and risk assets, such as equities, sell off. But low yields in government bonds are creating an incentive to take credit risk. Indeed, we think the Fed wants to create conditions where investors allocate to these sectors and keep borrowing costs low for consumers and corporations, reversing the flight-to-quality that occurred in the first half of the year to help fund the private sector.

While the Fed has a new stance on inflation, we continue to believe it will take time for the economy to recover and prices to move sustainably higher, so, in our view, diversified bond portfolios offer value to investors. There are always risks that investors must navigate, such as election risk or a resurgence of COVID-19 as we enter the winter months, but we believe that investors will be best served by remaining flexible and continuing to align with Fed policy. As central banks continue to proactively support the recovery and reduce tail risks, we expect credit should remain well supported.