Macro backdrop

The FTSE All-Share Index produced a negative total return of 1.7% as high inflation stoked fears of a recession. July’s Consumer Price Index (CPI) rose to 10% for the first time in over 40 years. In response, the Bank of England (BoE) hiked interest rates to 1.75% -the highest level since 2008. Concerns over UK economic growth, combined with a hawkish update from the US Federal Reserve (Fed), caused sterling to fall over 4.5% compared with the US dollar during the month.¹

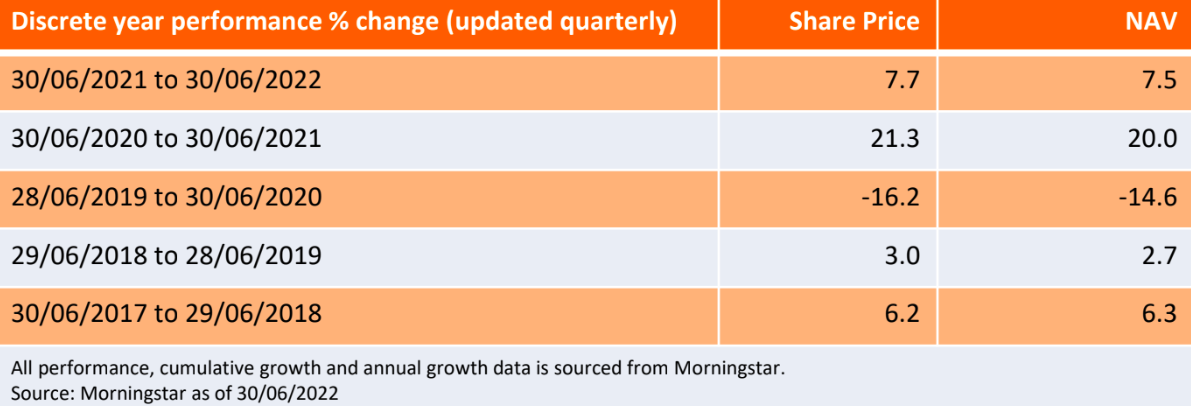

Trust performance and activity

The Trust’s net asset value fell 1.7% in August, while the FTSE All-Share Index also fell 1.7%.¹

Persimmon, the house building company, was a notable detractor over the month as its share price reacted adversely to higher interest rates. The position has been maintained given Persimmon’s large land bank which is available for the construction of family homes around the UK. The defensive attributes of tobacco companies, where profits have tended to be resilient in recessions, found favour during the month as Imperial Brands and British American Tobacco were among the best contributors. Conversely, banks have been benefiting from the positive effect of rising interest rates on their net interest margins and so the fund’s underweight position in HSBC was a detractor.

In terms of activity, we added to the Trust’s position in NatWest. We also added to the position in Rathbones, the private client wealth manager, as a replacement for Brewin Dolphin, which is in the process of being taken over by Royal Bank of Canada.

Outlook/strategy

The macroeconomic outlook is difficult with central banks needing to raise interest rates in the UK and overseas to counter inflation. In addition, the effect of inflation on consumer spending and on cost pressures for companies adds to the uncertainty. Markets will probably need some visibility that inflation and interest rates are peaking before a sustained rally can be achieved. Our portfolio is diversified with some two-thirds of investee company sales coming from overseas, while the dividend yield from UK equities remains attractive relative to the main alternatives.

¹Bloomberg as at 31 August 2022  Glossary Expand

Glossary Expand

Dividend yield – The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Net Asset Value (NAV) – The total value of a fund’s assets less its liabilities.

Recession – A recession is a significant, widespread, and prolonged downturn in economic activity. A popular rule of thumb is that two consecutive quarters of decline in gross domestic product (GDP) constitute a recession. Recessions typically produce declines in economic output, consumer demand, and employment.