January 2022 Global Bonds

TEST2 Migration: Opportunities and risks in a multi-speed recovery

January 2022 Global Bonds

TEST2 Migration: Opportunities and risks in a multi-speed recovery

Global Bonds Portfolio Managers Dan Siluk and Jason England explain how an asynchronous global recovery should lead to dislocations and opportunities in fixed income markets.

Key Takeaways

- Global central banks will likely be hesitant to precede the Federal Reserve in tightening policy.

- The early-year rates sell-off has increased the term premium in many markets and with it the opportunity to capture “roll down” gains.

- Economic recovery will be asynchronous with different regions and sectors travelling at varying speeds.

Headlines have not been kind to bonds in 2021. With the worst of the economic calamity hopefully behind us and rock-bottom interest rates in many regions having only one way to go (higher), many believe it’s an easy call to increase exposure to riskier assets. The year’s steady din about the potential for accelerating inflation has only exacerbated matters. While some of these concerns merit consideration, we believe that diversified portfolios should maintain a sufficient bond allocation for two crucial reasons: its lack of correlation to equities and typically lower volatility, especially among higher-quality, shorter-dated issuance.

With several global stock benchmarks reaching record highs this spring and the spread between the yield on high-yield bonds and Treasuries roughly 40% below their 20-year average, one has to wonder how much of the global reopening is already priced in. While earnings improvements and, in some – but not all – cases, repaired balance sheets have lent support to the rally in riskier assets, so too has the reach for yield as central bank purchases compelled investors to venture further out along the risk spectrum. Should the economic recovery underwhelm, or central banks reduce implicit support for markets, investors may get a harsh reminder of the benefits inherent in assets capable of preserving capital and dampening volatility.

Creating the template

Rates are low and central bank balance sheets are bulging. We’ve been here before. This was the playbook adopted foremost by the Federal Reserve (Fed) during the depths of the Global Financial Crisis (GFC). The recession triggered by the COVID-19 pandemic has some advantages over the GFC era. Entering 2020, the world’s economy was on relatively sound footing and the crisis itself was not the result of credit transgressions. Slowdowns caused by natural events tend to be shorter-lived than those with economic origins as past excesses don’t have to be absorbed.

But while the world entered the crisis together, its emergence is shaping up to be asynchronous, with particular regions and business sectors finding themselves in different lanes. Some will gradually get up to speed, others may be stuck on the entrance ramp and a few could accelerate so quickly that they catch the attention of their governing central bank.

All eyes – still – on the Fed

Having learned important lessons from the GFC, central banks acted quickly to stabilize financial markets as the pandemic spread. Their initial focus was maintaining market liquidity. The inability to accurately price securities of businesses with little earnings visibility and investors’ unwillingness to buy anything but the “safest” assets threatened to aggravate the crisis. The fastest to act was the Fed. Including the initial ramp-up in the early days of the GFC, it took the Fed six years and three rounds of quantitative easing (QE) to increase its balance sheet from $900 billion to roughly $4.5 trillion. In 2020, total assets held by the U.S. central bank rose by $3 trillion in just 14 weeks.

Unlike during the GFC, this time the Fed pledged to backstop corporate credits. While the facility was aimed at investment-grade issuers and “fallen angels,” its commitment to act provided a lifeline to riskier credits as rapidly narrowing investment-grade spreads sent investors into higher-yielding securities. Maintaining liquidity, however, came at a cost and that cost was distortions in securities prices across the risk spectrum. As the global economy continues to stabilize and securities are once again expected to stand on the merits of their fundamentals, any curtailment of central bank support could result in the party ending for issuers of suspect quality.

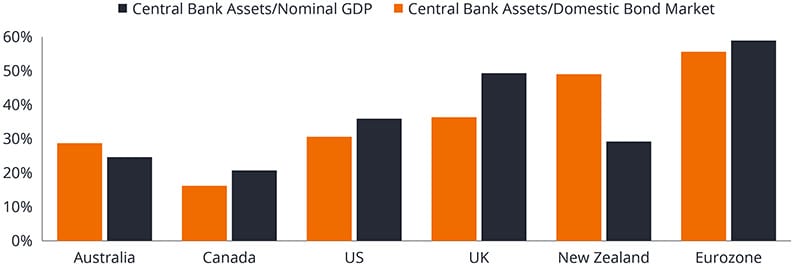

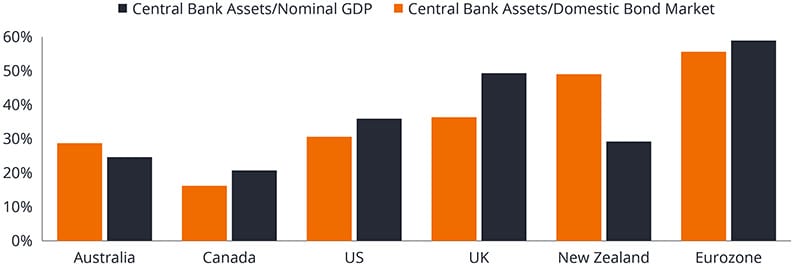

This process was replicated across major economies. Although other central banks were not as quick off the mark, they eventually created facilities to restore liquidity and buy their economies time until large-scale vaccinations could be deployed. By certain measures, some countries have “out-doved,” or been more accommodative than, the Fed. When compared to the size of their domestic bond market rather than their economy, at their maximum, the balance sheet expansions of several countries were on par with the U.S., or in the case of Australia, exceeded it.

Figure 1: Central bank assets relative to domestic bond markets and GDP

A central bank’s balance sheet relative to the domestic bond market rather than GDP is what moves the needle, and by this measure other countries were equally – or more – accommodative than the U.S.

After you, please

It’s the Fed, however, that’s still calling the shots. Chairman Jerome Powell has been firm in the Fed’s commitment to keep rates on hold until well into 2023 and in the bank’s assent to allow inflation to run above target, as long as it averages 2% over the long-term.

This places other central banks in a conundrum. No country, especially export-dependent ones, wants to tighten policy ahead of the Fed. Doing so would invite growth-sapping currency appreciation. Unfortunately for several countries, that tipping point may be approaching. Australia, for example, has already added back all the jobs lost in the pandemic and its GDP is forecast to grow by 4.5% this year and a still robust 3.1% in 2022. In Canada, of the nearly 3 million jobs lost in the first two months of the pandemic, over 80% of them have returned. In the U.S., only 63% of the initial 22 million lost positions have come back. The upshot is the Bank of Canada has already been forced to taper its balance sheet while the Fed keeps expanding its by $120 billion monthly.

The strength of the Fed’s resolve may rest on one word: Transitory. Year-over-year headline consumer price inflation is expected to register higher than 3% in each of the next three quarters given low base effects, the release of pent-up demand for items like travel and lingering supply chain disruptions. The Fed believes this surge will be ephemeral, with price gains falling back to 2.1% in 2022. Should they be right, they can be patient. If the bump in prices leads to persistent, rising inflation expectations – which they sometimes do – the Fed may find itself at risk of falling behind the curve and creating the conditions for yields on longer-dated Treasuries to sell off.

Rates grow more complex

While economic reopening should allow the fundamental merits of corporate and government issuers to again attract investors’ attention, the future path of monetary policy is likely to remain a pivotal factor in financial markets. Although U.S. Treasury yields likely got ahead of economic reality earlier this year – a view validated by recent range-bound trading – the longer-term bias is toward higher rates. Key for investors is to identify regions capable of threading the needle between delivering welcome growth but not igniting a level of inflation that would either push yields uncomfortably higher or compel monetary authorities to deploy the blunt instrument of rate hikes sooner than expected.

When weighing these risks, we believe that the likelihood of elevated volatility in mid- to longer-dated government bonds has risen. Six months ago, emphasizing the front end of the yield curve would have condemned investors to meager returns. Given the year’s steepening between ultra-short dates and bonds with three- to five-year tenors, that’s no longer the case. Maturing securities once again have the potential to generate returns by rolling down the curve given their yields tend to fall as their prices converge toward par value at maturity.

This, however, is premised on the front end of the curve staying anchored. For that to occur, central banks must maintain a hyper-dovish stance. Countries where tightening labor markets are at risk of wage-driven inflation may not have that luxury. The U.S., on the other hand – with its labor market slack and central bank latching its credibility to a “no-hike” forward guidance – has emerged as a viable destination to harvest front-end carry. This should remain the case as long as the Fed’s thesis of 2021 inflation proving transient stays intact.

Figure 2: Two- and five-year bond yields and associated spreads

This is not to dismiss other regions’ prospects. Several countries, including Canada, Australia, Singapore and South Korea, offer shorter-dated yields close to – or higher than – those found in the U.S. And with foreign central banks reticent to tighten before the Fed, they could maintain this posture as long as inflation expectations stay contained. Should spiking prices provoke a policy response, however, these sovereign curves could quickly experience a “bear flattener,” eliminating the opportunity for near-term carry.

The right region, the right sector

The doubling-down on QE during the pandemic has only reinforced the view that central bank purchases are distorting sovereign debt markets. The presence of a more pronounced term premium in the investment-grade corporate credit curve bears this out and, in our view, better reflects the market’s expectation for economic growth. In our view, the combination of relatively higher yields and lower exposure to interest-rate volatility in a potentially inflationary environment makes the risk/reward profile of shorter-dated corporates among the most favorable in the fixed income space at present.

Furthermore, gradually diverging monetary policy and interest rate differentials should enable investors to identify attractive relative value trades as securities of similar credit quality – sometimes of the same issuer – trade at more favorable valuations in one market than another. These inconsistencies in pricing multiplied during the crisis as other jurisdictions did not match the Fed’s level of support for credit markets. With rates still low, expanding one’s investable universe to capitalize on these distortions increases the chances of generating excess returns without incurring commensurately higher credit risk.

Figure 3: Credit valuation as measured by spreads on credit default swaps

Similar to what’s occurring geographically, the pace at which different economic sectors emerge from the pandemic will impact their investment potential. For much of the past year we emphasized the risks facing industries broadly associated with travel. While many of our concerns still exist, the prospects for some sectors have improved. We do not believe that all of this optimism has been priced into the market.

These dislocations can be caused by either blanket categorizations of which “COVID bucket” companies fit into or an underappreciation of their financial position. Conversely, many undeserving issuers have benefited from market narratives when in reality they’ve survived the past year on the largesse of yield-hungry buyers riding the wave of narrowing credit spreads. We believe that identifying the worthy – but unloved – issuers and avoiding the free riders will be an important source of excess returns for credit investors as the global economy normalizes.

Stay nimble

For much of the post-GFC era, we’ve stated that bond portfolios must work harder to achieve a fixed income allocation’s historical objectives of capital preservation and generating attractive risk-adjusted income streams. We believe this still is the case. Yet in the nascent post-pandemic era, with both regions and sectors on disparate trajectories of recovery, the breadth of the levers one can pull has increased.

While pockets of growth across the economy present opportunity, the specter of inflation and monetary policy error – by tightening too quickly or not quickly enough – cannot be ignored. The most pressing goal for a bond investor over the next several quarters is to identify the mix of regions, sectors and securities that can generate returns less correlated to riskier assets and offer levels of volatility lower than those found in equities and even longer-duration bonds.

Sources: All data presented is sourced from Bloomberg, unless otherwise noted; as at 21 May 2021.

Featured Funds

VNLA

Short Duration Income ETF

JUCDX

Absolute Return Income Opportunities Fund

Glossary Expand

Read more on these topics

Fixed Income Credit Interest RatesView All Perspectives

Jason England

Portfolio Manager

Jason England

Portfolio Manager Daniel Siluk

Portfolio Manager

Daniel Siluk

Portfolio Manager Jason England

Portfolio Manager

Jason England

Portfolio Manager Daniel Siluk

Portfolio Manager

Daniel Siluk

Portfolio Manager