January 2022 Specialty Equities

TEST2 Migration: Health care’s innovation shifts into high gear

January 2022 Specialty Equities

TEST2 Migration: Health care’s innovation shifts into high gear

Portfolio Manager Andy Acker explores the unprecedented number of medical breakthroughs occurring in health care and what it means for the sector.

Key Takeaways

- Biopharma companies developed vaccines for COVID-19 in record time. But as the pandemic’s end comes into sight, we believe health care’s achievements are only getting started.

- An ever-improving understanding of the biology of disease, advanced analytics and capital investment are leading to a surge of new drug approvals and boosting revenues.

- This momentum could accelerate as the sector increasingly targets unmet medical needs in areas such as cancer, autoimmune disease and diabetes, and attracts investor capital.

For much of the past year, efforts by biopharma companies to rein in the COVID-19 pandemic have dominated the news coming out of the health care sector. The industry’s response – developing vaccines and treatments for the novel coronavirus in less than a year – is one for the record books.

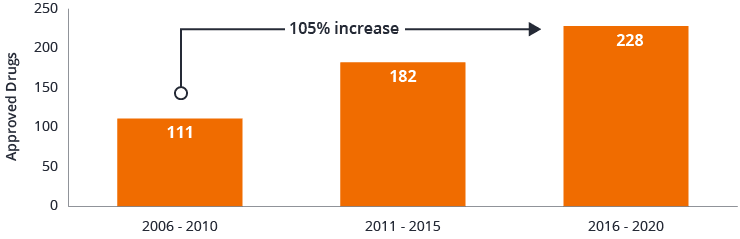

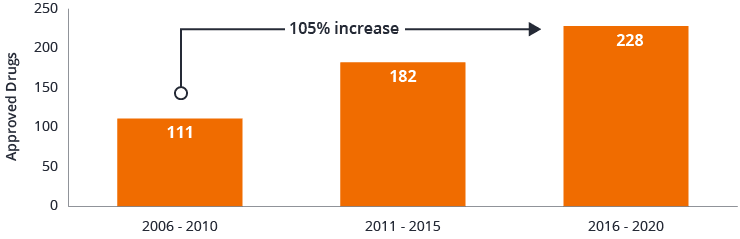

But as the end of the pandemic comes into sight, we believe health care’s achievements are only getting started. Last year, the U.S. Food and Drug Administration (FDA) approved 52 novel drugs, excluding medicines for COVID-19. That sum is not far from the 2018 record of 59 and occurred despite lockdown measures that closed labs and slowed drug-manufacturing site inspections

1 At the same time, some of the first COVID-19 vaccines to be granted emergency use authorization were based on advance drug modalities that previously had never moved beyond the research lab.

Figure 1: FDA novel drug approvals

Source: U.S. Food and Drug Administration, data as of 31 December 2020.

Source: U.S. Food and Drug Administration, data as of 31 December 2020.

In short, while the COVID-19 pandemic brought some parts of the global economy to a standstill, health care’s innovation engine was shifting into high gear. Looking ahead, we believe this momentum – rooted in accelerating innovation and supported by financial markets – could fuel growth in the sector for years to come.

Health care innovation ramps up

Even large-cap pharmaceutical companies have been ramping up their investments in novel therapeutics. Flush with cash but facing patent expirations, big pharma has been rapidly buying innovation through the acquisition of small- and mid-size biotechs, as highlighted in Figure 2. In December, for example, AstraZeneca announced it would spend US$39 billion to purchase Alexion Pharmaceuticals, a longtime biotech stalwart that will help AstraZeneca expand into the treatment of rare diseases.

Figure 2: Deal boom – mergers and acquisitions in biotech

Consider the case of spinal muscular atrophy (SMA). SMA is a hereditary neuromuscular disease that impairs an infant’s ability to sit, walk and breathe, often leading to death within the first two years of life. In late 2016, the FDA approved the first SMA therapy, Spinraza, an antisense-based drug that helps the body produce a protein critical for the functioning of motor neurons that is lacking in SMA patients. Then in 2019, regulators approved a gene therapy for SMA, Zolgensma, and in 2020, an oral small-molecule medicine, Evrysdi. Thus, within a matter of years, a genetic condition which previously had no available treatment gained three new medicines, each with a different mode of action.

Advances and breakthroughs

Advances are being made across a multitude of disease categories, with cancer screening among the most exciting. Early detection of cancer can drastically improve survival rates for patients. Blood-based tests in clinical trials aim to look for fragments of DNA and RNA released by tumors into the bloodstream, even before cancer symptoms are present. Preliminary data have been promising – so much so that two multibillion-dollar acquisitions of companies at the forefront of this science were announced in 2020.

The area of autoimmune disease also saw positive news. Myasthenia gravis is a condition in which a buildup of certain antibodies leads to attacks on nerves and muscles. In 2020, a drug candidate showed efficacy in targeting the neonatal Fc receptor responsible for regulating those antibodies. If confirmed by later-stage studies, this drug could pave the way to a broad class of promising new therapies for multiple autoimmune diseases.

Finally, significant and exciting progress continues to be made in cell and gene therapies. As of early 2020, the FDA had received more than 900 investigational new drug applications for gene therapies in clinical studies.

7 Next-generation cell therapies are now being developed that will allow researchers to mass produce cancer-fighting immune cells, lowering the cost and time required to deliver these highly efficacious medicines.

Innovation leads to sales growth

The surge in medical innovation is having a commensurate impact on biopharma revenues. Last year, sales of biotech blockbuster drugs neared US$300 billion, about 50 times the amount from two decades ago as shown in Figure 3. Rising global demand for health care is helping drive the growth. At the same time, more drugs are now targeting patients with high, unmet medical needs. Tepezza, for example, was approved by the FDA in January 2020 as the first treatment for thyroid eye disease, a condition in which eye muscles and fatty tissue behind the eye become inflamed. With the potential to spare patients the need for multiple invasive surgeries, the drug was rapidly adopted. Last year, sales hit US$820 million, crushing consensus expectations of US$27 million and representing one of the best rare disease launches in history.

8 Even more remarkable, the explosive growth occurred during the pandemic, when regular medical care was often limited or delayed.

Figure 3: Blockbuster drug sales (US$ billions)

The next chapter: the internet of health care

As MiSight highlights, innovation is taking place throughout the health care sector. In medical devices, we are witnessing an unprecedented convergence of scientific and technological advances that could have life-changing potential for patients. In late 2019, pharmaceutical giant Eli Lilly announced it was partnering with Dexcom, a maker of continuous glucose monitors. CGMs are small sensors worn by diabetics that continuously measure blood sugar levels. Connected to an insulin pump, the CGM can automatically deliver insulin to patients when needed (no finger stick tests required). It also sends data to a wireless device, such as a smartphone. Eli Lilly and Dexcom’s partnership is intended to amass that data and, with the aid of machine learning, discover patterns across thousands of patients that could lead to better treatment plans for diabetics.

We expect this type of “connected” health care to gain momentum, particularly following COVID-19. The pandemic underscored the importance of managing comorbidities, as well as the need for remote care options. In the U.S., some 4 million people have been diagnosed with type 1 diabetes or type 2 intensive diabetes, with only about 40% of the former and 15% of the latter using CGMs. As shown in Figure 4, another 30 million people have non-intensive type 2 diabetes, of which roughly 1% use a CGM. As health care providers increasingly understand the potential long-term benefits of the technology, we believe reimbursement rates will improve and usage could soar.

Figure 4: Room to grow

Continuous glucose monitors (CGMs) have penetrated only a small percentage of the sizable diabetes market, creating opportunity for sales growth.

Balancing risk with opportunity

Enthusiasm for the rollout of COVID-19 vaccines and medical breakthroughs have sent stocks of some health care companies soaring, particularly those of preclinical or early-phase small-cap biotech firms. We believe caution is warranted in many cases where the science is still unproven and revenues are nonexistent. Industry research shows that 90% of drug candidates fail to move beyond clinical trials. Furthermore, in our experience, Wall Street analysts tend to under- or overestimate a new drug’s commercial potential 90% of the time. With that in mind, we believe investors need to be selective, balancing valuation with downside risks.

However, we also see a burgeoning opportunity set. Relative to the broad equity market, the health care sector trades at a discount, with a forward price-to-earnings (P/E) ratio of 16.3 compared to 22.9 for the S&P 500® Index

10. Stocks of profitable biotech companies are even cheaper, with an average forward P/E of 11.1.

11 In addition, in 2020, 100 companies were added to the Nasdaq Biotechnology Index, which requires firms to have a minimum market capitalization of US$200 million. In short, the industry is expanding rapidly and, in our view, could still have significant room to grow in the months and years ahead.

The Right Side

of Disruption

Learn More

Featured Funds

JNGLX

Global Life Sciences

JFNIX

Global Life Sciences

Glossary Expand

Read more on these topics

Global Perspectives Equities Health Care CoronavirusView All

Andy Acker, CFA

Global Life Sciences | Portfolio Manager

Andy Acker, CFA

Global Life Sciences | Portfolio Manager Andy Acker, CFA

Global Life Sciences | Portfolio Manager

Andy Acker, CFA

Global Life Sciences | Portfolio Manager Source: U.S. Food and Drug Administration, data as of 31 December 2020.

In short, while the COVID-19 pandemic brought some parts of the global economy to a standstill, health care’s innovation engine was shifting into high gear. Looking ahead, we believe this momentum – rooted in accelerating innovation and supported by financial markets – could fuel growth in the sector for years to come.

Source: U.S. Food and Drug Administration, data as of 31 December 2020.

In short, while the COVID-19 pandemic brought some parts of the global economy to a standstill, health care’s innovation engine was shifting into high gear. Looking ahead, we believe this momentum – rooted in accelerating innovation and supported by financial markets – could fuel growth in the sector for years to come.