How long will the AI wave last?

Following two years of back-to-back double-digit returns,1 investors continue to ask whether investment in generative artificial intelligence (gen AI) is now over. While we are no longer in the early stages of the Gen AI ‘fourth wave’ of technology, we believe that investors are still underestimating both the length and magnitude of investment required, as well as the long-term disruption and benefits it will bring.

Computing waves are lengthy

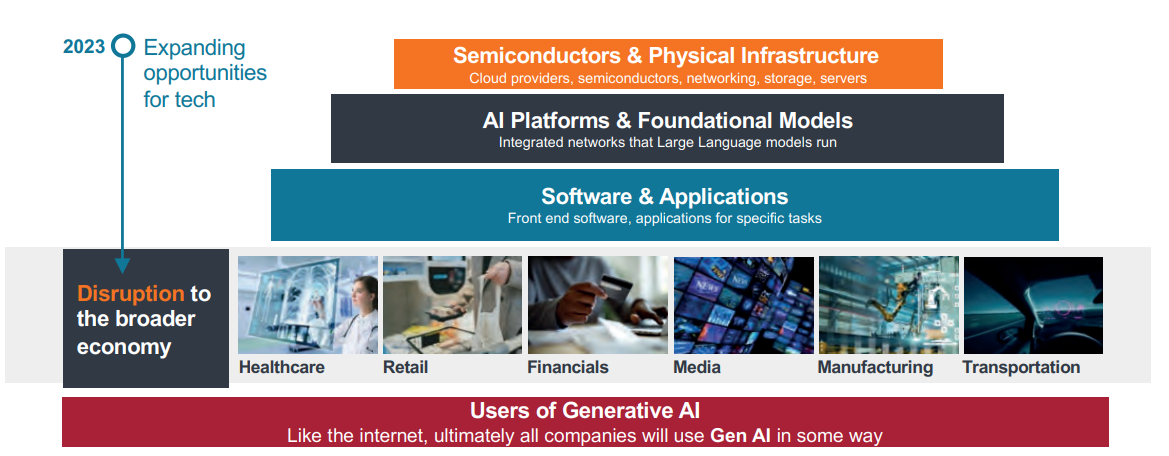

Firstly, it is important to clarify the difference between a compute wave and a theme (like cybersecurity, electric vehicles, or clean technology). A computing wave requires broad investment across the full stack of technology – from silicon building blocks, to user interfaces and applications. The PC internet era required an initial shift from the analogue world to digital, driving prices of computing down, which democratised access and connected homes. The mobile cloud wave that internet infrastructure was built upon, was catalysed by the launch of the iPhone in 2007. It is notable that a key mobile application like Uber did not have its initial public offering (IPO) until 2019.

The parallel here is that infrastructure has to be built and scale achieved before the most exciting and useful new applications are fully developed and adopted. The pace of capital expenditure investment in AI data centres has been unprecedented and the demand for accelerated computing from the likes of NVIDIA, the tech hardware and software company, has grown at an unparalleled pace. However, this Gen AI wave is still in the early stages of being embraced by consumers and businesses and the full range of its potential has yet to be realised. Our experience shows this to be consistent with the pattern of previous tech waves.

Gen AI spans resource and productivity optimisation; shifts in payments and financial systems; transportation being reimagined by autonomous capabilities; healthcare diagnostics, surgery and drug discovery; humanoid robots, and the more familiar upgraded PC and mobile devices. We know there is much yet to come as AI copilots and autonomous agents become commonplace across the economy. For investors, patience is required to benefit from this pervasive and transformative wave.

Figure 1: Why AI is a wave, not a theme

It requires investment in all tech layers, leading to broad disruption and innovation

Volatility is to be expected, not feared

Investors should not expect the pace of development and adoption of Gen AI to be linear. Indeed, past waves have typically run for more than six years and delivered outsized returns – but all have also involved elevated volatility and frequent market declines.2

A changing political regime in the US will bring additional volatility as taxes, tariffs and regulations are reconsidered. Technology and artificial intelligence are a national priority for many countries and central to a broader deglobalisation and reindustrialisation strategy being undertaken. While this is expected to increase volatility it will also serve as a tailwind to demand in infrastructure and in areas like autonomous driving.

As this AI wave matures, we believe that active management will be more important than ever. Interest rates are unlikely to be returning to zero, so valuation discipline will be an important feature of determining returns. Typically, periods of technology inflection are notable for changes in market leadership, therefore relying on indices heavily weighted to the winners of the last wave may prove challenging.

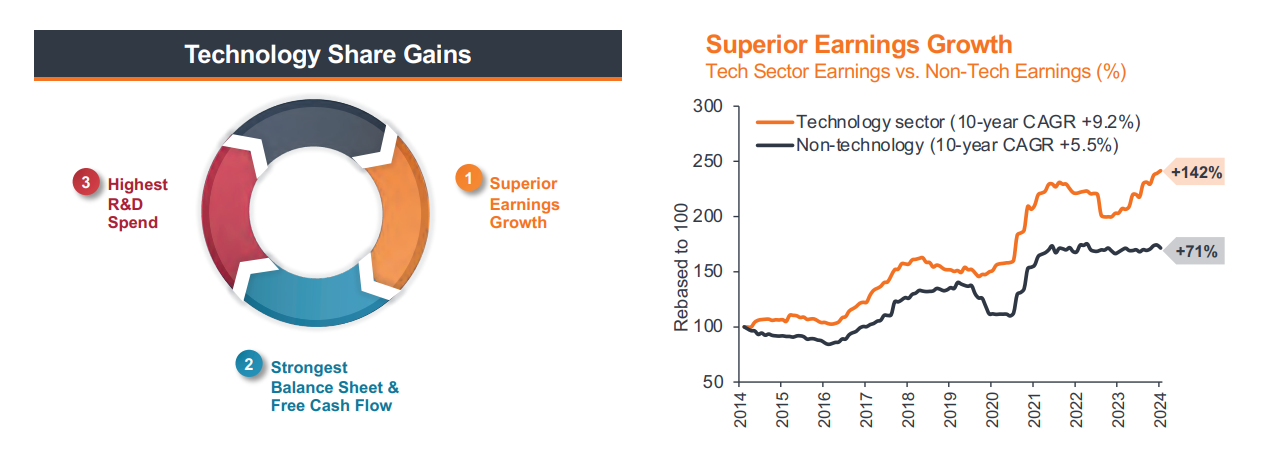

Going back ten years, seven of the largest 10 technology companies outperformed the broader MSCI All World Index, while only four outperformed the tech index itself. Technology remains a ‘winners take most’ market; higher growth is not guaranteed by shifting down in company size. Companies with a large user base and large platforms are able to more quickly scale new products, with significant resources to do so. Company size preference alone has therefore not been a reliable strategy for stock selection in the technology sector – nor has a narrow thematic bias.

Gen AI is giving the tech ‘vampire’ superpowers

The build-out of infrastructure and applications for Gen AI is expected to take years to play out. It is important to note that with each wave of technology not only has more investment been required to realise its potential, but more disruption across the broader economy has ensued. As the Gen AI wave matures, disruption across many other sectors will accelerate – just as it has in the past. The technology sector continues to leverage its balance sheet strength advantage to invest heavily in future research and development, supporting its capability to generate attractive returns for investors.

We continue to be excited by the outlook for technology equities. As Gen AI matures, it essentially gives the ‘vampire’ (technology) superpowers to use its FAANGs to suck more share from the wider economy. We believe that investors will be well served to remain focused on the companies and sectors that are driving, rather than experiencing, disruption.

1Source: Janus Henderson Investors, Bloomberg. Tech sector = S&P 500 Information Technology Index, total returns in USD terms for 2023 and 2024.

2Source: Janus Henderson Investors, Bloomberg, as at 31 December 2023. Tech sector = S&P 500 Information Technology Index, total returns in USD terms. PC wave 1994-2000; mobile internet wave 2009 to 2015.

Figure 2: AI is enabling accelerated technology share gains

Source: Janus Henderson Investors, Bernstein, as at 31 October 2024. Rebased to 100 at 31 October 2014. Tech sector earnings chart compares earnings in Technology defined as MSCI ACWI Information Technology + Communication Services (ex Telecoms) Index and Non-technology defined as MSCI ACWI ex (Information Technology + Communication Services ex Telecoms) Index. Based on trailing earnings. Prior to December 2018, the custom index of MSCI ACWI IT & Communication Services includes companies that were originally in the Technology sector and companies that are currently in the Communication Services sector. Past performance does not predict future returns.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

AI copilot: an intelligent virtual assistant that leverages large language models (LLMs) to facilitate natural, human-like conversational interactions, supporting users in a wide variety of tasks.

Balance sheet strength: refers to a company being in a strong financial position. The balance sheet is a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

FAANG: was an acronym coined in 2013 for Facebook, Amazon, Apple, Netflix, and Google as these major tech stocks’ performance had a substantial effect on the overall global equities market.

Generative AI: refers to deep-learning models that train on large volumes of raw data to generate ‘new content’ including text, images, audio and video.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.