Flexible Multi-Sector Strategies for a Low-Yield World

Key Takeaways

- Accommodative monetary policies around the globe have created a challenging environment for traditional core and core plus fixed income strategies.

- In response, many plan sponsors are shifting assets from duration-laden core fixed income strategies to credit-laden, higher-yielding private debt strategies.

- In an effort to improve the overall fixed income structure, we advocate for complementing traditional core or core plus strategies with more flexible, “multi-sector” strategies.

The extended period of accommodative monetary policy from major central banks has fostered a low-yield environment where most institutional investors find the yields on their traditional core and core plus strategies aren’t keeping pace with their spending needs. In response, plan sponsors are seeking a more optimal mix of fixed income strategies. With accommodative monetary policy likely to remain in place for longer than many had expected and the end of the credit cycle drawing near, we advocate for an option that has the potential to both increase the yield of an overall fixed income structure and maintain the risk-reducing benefits of the asset class. In what follows, we advocate for more flexible, “multi-sector” fixed income strategies that can act as a complement to traditional core and core plus mandates.

With the yield on the Bloomberg Barclays U.S. Aggregate Bond Index (the Agg) cut in half since December 31, 1999, institutional investors have been continually searching for higher-yielding fixed income strategies. Their behavior is entirely rational since the yield on the Agg as of March 31, 2019, at 2.9% is less than half the required rate of return of most institutional investors. Even for an asset intended to reduce equity risk, the current yields on most core and core plus portfolios are too low, leading many plan sponsors to seek alternative solutions including rethinking appropriate benchmarks, increasing single-sector satellite mandates and shifting assets from duration-laden core fixed income strategies to credit-laden, higher-yielding private debt strategies. In a low interest rate and low default environment, taking on greater credit risk has been a winning strategy. But what about when the tide turns, and credit and illiquidity risks spike?

Investors still value the risk-hedging qualities of core fixed income portfolios. What is lacking from them is the appropriate level of yield that, in our opinion, should be roughly double the current yield of the Agg. Therefore, we believe higher tracking error/more flexible fixed income strategies that maintain traditional intermediate duration exposure should play a more prominent role in many institutional fixed income structures, especially in an environment where interest rates are expected to remain low for longer.

The Failings of the Agg

Investors have historically favored the Agg as a benchmark for U.S. core fixed income mandates. Managing tightly to the index was a workable solution when the yield was relatively high and duration not too long. Today, however, with duration steadily extending and yield declining, the Agg is looking less and less like an intermediate core fixed income benchmark. Given the duration of almost six years and the yield of about 3.0% (as shown in Exhibits 1 and 2), a 100 basis point rise in interest rates would roughly result in a 3.0% loss for the Agg.

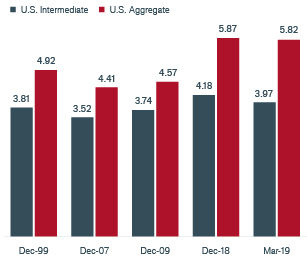

Exhibit 1: Duration on the Agg versus the Intermediate Index

Divergence Between the Two Indices is Increasing

Source: Barclays Live.

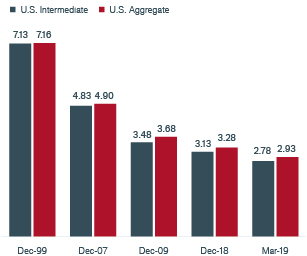

Exhibit 2: Yield on the Agg versus the Intermediate Index

Yield Cut in Half from December 1999 to March 2019

Source: Barclays Live.

Not surprisingly, some plan sponsors and institutional consultants have considered shifting to alternative benchmarks. A shift to the Bloomberg Barclays U.S. Intermediate Bond Index (the Intermediate Index), for example, would limit loss to about 1.0% in the aforementioned scenario, due to the shorter duration of about four years.

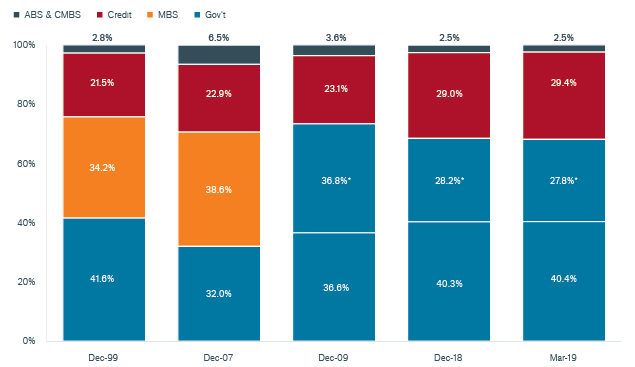

When compared to the Intermediate Index, the yield is no longer commensurate with the additional risk of the Agg, which is currently dominated by U.S. Treasuries or government-related securities, as shown in Exhibit 3. However, from today’s starting points, even the Intermediate Index fails to generate enough yield to meet the required rate of return for most institutional investors. We believe this has significant implications for both plan sponsors and managers of core fixed income portfolios.

Exhibit 3: Sector Allocations of the Agg

Post 2008, U.S. Government and Related Sectors Dominate

Source: Barclays Live.

Outdated Guidelines

Despite the shifting composition of the Agg, its rising duration risk and declining yield, the management of core fixed income portfolios has not adapted accordingly. Traditional core fixed income managers have been reticent to deviate from the long-standing benchmark, and plan sponsors have not adjusted their investment guidelines.

Consider the following typical investment guidelines for core plus fixed income strategies:

- The portfolio duration may deviate no more than plus/minus 25% from the benchmark.

- The portfolio may invest no more than 20% in non-investment-grade securities.

- The portfolio may invest no more than 30% in out-of-the benchmark securities.

Given the duration of 5.8 years for the Agg as of March 31, 2019, the aforementioned duration constraint produces a duration range between 4.4 and 7.3 years. In practice, most core fixed income managers are unlikely to swing from 4.4 years to 7.3 years in duration positioning – that represents too big a move.

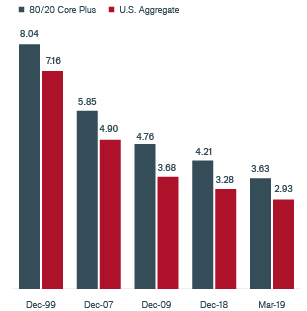

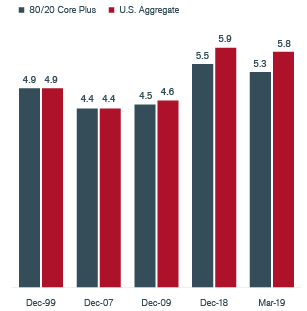

While helpful, a maximum 20% allocation in non-investment-grade securities will not meaningfully increase the yield on a core plus portfolio. The simulations shown in Exhibits 4 and 5 demonstrate the impact on a core fixed income portfolio when 20% of the portfolio – the maximum typically allowed – was allocated to the high-yield sector. As of March 31, 2019, when compared to the Agg, the yield increased from 2.9% to 3.6% and the duration decreased from 5.8 years to 5.3 years. This was both positive and meaningful on a relative basis, but the absolute level of yield still remained low, particularly when compared to pre-crisis levels. Further, if 20% of the portfolio was allocated to non-investment-grade securities, the portfolio manager is limited in how much to allocate to other non-benchmark securities such as emerging market debt.

Exhibit 4: Yield on a Stylized Core Plus Portfolio with a 20% Allocation to High Yield

The Absolute Level of Yield Remained Low

Source: Barclays Live. Stylized core plus portfolio with 80% Bloomberg Barclays U.S. Aggregate Index and 20% Bloomberg Barclays U.S. Corporate High Yield Index.

Exhibit 5: Duration of a Stylized Core Plus Portfolio with a 20% Allocation to High Yield

Duration was Marginally Shortened

Source: Barclays Live. Stylized core plus portfolio with 80% Bloomberg Barclays U.S. Aggregate Index and 20% Bloomberg Barclays U.S. Corporate High Yield Index.

Layer these constraints with tight spread levels, and not only is a core plus manager’s ability to generate adequate yield hampered, but so too is the ability to offset interest rate volatility with spread volatility. Managers are placed in a difficult position to try to outperform the Agg through duration management, which is inherently challenging, or to reach to areas of the market not traditionally considered appropriate for core and core plus portfolios.

A Risky Trade-Off

With core fixed income duration at all-time highs and yields not commensurate with that level of risk, many plan sponsors have turned to private debt strategies, or sought to increase allocations to higher-yielding, single-sector satellite investments. While this can generate higher yield, it can also increase correlations to equities at a time when credit spreads are tight and well below long-term averages. Low interest rates have extended the economic and credit cycles and fostered a low default environment, resulting in generally higher returns for many of these credit-focused strategies. However, single-sector strategies often retain significant drawdown risk, which will present challenges for investors when the cycle turns, and credit risk spikes while liquidity dries up.

Multi-Sector: A Flexible Complement to Core Plus

To adapt to the changes that have taken place in the fixed income markets and seek to generate a more appropriate level of income – ideally double the current yield on the Agg – while still maintaining the potential to mitigate drawdown risk, plan sponsors may want to consider one or both of the following paths:

- Allocate to dynamic, higher-active-risk “multi-sector” strategies; or

- Relax the investment guidelines for existing core plus mandates to be more aligned with multi-sector strategies

Multi-sector strategies offer the ability to add value from two major investment decisions: 1) sector allocation and 2) security selection. In making these decisions, they aim to benefit from having access to a broader opportunity set and greater flexibility versus core plus strategies.

Given the challenges inherent in redefining investment guidelines and the low likelihood that core plus managers would take full advantage of any newly acquired flexibility, we recommend that plan sponsors consider supplementing existing core plus mandates with more dynamic, higher-active-risk, multi-sector strategies. Pairing a multi-sector strategy with the duration of a core plus strategy provides a path for plan sponsors to potentially generate sufficient yield from the overall fixed income structure while still maintaining the diversification benefits of core fixed income.

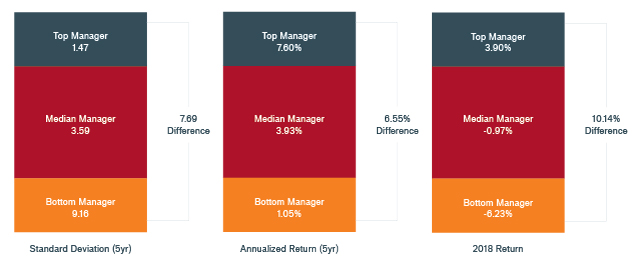

Approaches Vary, Dispersion Is Wide

Due to the inherent flexibility associated with multi-sector strategies, there are neither commonly accepted standards nor common names that define this fixed income category. Managers’ active risk taking varies significantly from each other, resulting in the wide performance dispersion shown in Exhibit 6.

Exhibit 6: Returns and Standard Deviations in the U.S. Multi-Sector Fixed Income Universe

There is Wide Performance Dispersion Among Managers

Source: eVestment, as of 3/31/19.

Broadly speaking, there are two types of multi-sector strategies. The first defines the underlying sectors more narrowly and can often invest only in targeted spread sectors such as high yield, emerging markets and bank loans. These strategies often establish either fixed or equal portfolio weights across sectors. The second defines the underlying sectors more broadly to include all major and minor segments of the fixed income universe, including traditional core sectors. These strategies take a more dynamic approach, seeking to balance interest rate risk and credit risk, as well as risk across different spread sectors.

In our opinion, strategies with a narrower view limit both portfolio diversification and the potential to add value through active sector allocation. They tend to apply a generalist approach to specialist spread sectors – primarily high yield, emerging market debt and bank loans – and rarely venture too far from neutral sector allocations. Conversely, managers who take a broader view may count on the breadth of sectors for greater portfolio diversification as well as active sector allocation as an added source of potential return. The ability to dynamically allocate risk across interest rates and credit spreads may also reduce the likelihood of large drawdowns in times of market stress.

Incorporating a More Flexible Approach May Strengthen the Core

In our judgment, multi-sector strategies can benefit from investing in all major and minor investment-grade and high-yield sectors of the U.S. fixed income market, including Treasuries, agency mortgage-backed securities, corporate bonds, bank loans, asset-backed securities, commercial mortgage-backed securities, emerging market debt, convertible bonds and structured credit. By design, multi-sector strategies should demand greater flexibility to allocate across the fixed income universe and seek higher allowable allocations to plus sectors. For example, investments in non-benchmark or non-investment-grade sectors should be allowed to go as high as 60% to 70% of the portfolio. However, ongoing relative value and correlation analyses among fixed income sectors is a critical component of a multi-sector strategy’s ability to determine the appropriate balance between core and plus sectors. This approach can help multi-sector managers capitalize on the most attractive yield opportunities – whether in spread product or rates – while seeking to reduce the risk of loss.

Duration exposure is often essential to mitigating the volatility of the plus sector allocation, but not the nearly six years of the Agg. Due to the lower yield per year of duration of the Agg versus the Intermediate Index (50 basis points versus 70 basis points per one year of duration), a duration of three to five years, more in line with the Intermediate Index, may be an appropriate target for multi-sector strategies.

Given the sector allocation flexibility and duration range outlined above, multi-sector strategies should target and exhibit higher active risk when benchmarked against the Agg. However, we believe that targeting total portfolio volatility roughly in line with the Agg (historically 3% to 5%) is key to preserving the risk-reducing qualities required of core fixed income strategies.

Working within these guidelines, multi-sector managers should offer the potential to generate attractive risk-adjusted returns. In an environment where carry as opposed to capital appreciation is anticipated to drive portfolio return, the yield of a multi-sector strategy is expected to generate a more predictable return stream.

Conclusion

Diminished term and risk premia are unfortunate byproducts of the accommodative monetary policies prevailing from major central banks around the globe, policies that appear likely to remain in place for longer than many had expected. This landscape has severely challenged the Agg, extending duration and compressing yield. As a result, many traditional core and core plus fixed income strategies – often benchmarked to the Agg – are no longer providing plan sponsors with sufficient income to meet their spending needs. In our opinion, to counter these effects, managers must be given greater latitude to deviate (but not completely detach) from the Agg.

To improve existing fixed income structures, we advocate for complementing traditional core or core plus strategies with the freedom and flexibility of multi-sector strategies. While an equal-weight pairing between core plus and multi-sector mandates warrants consideration, we recommend a stepwise approach, building the allocation to multi-sector strategies over time and in line with a plans’ overall risk tolerance. This approach allows plan sponsors to get comfortable with the strategy and its ability to complement core and core plus strategies. However, it is critical to incorporate a strategy that dynamically allocates across all fixed income sectors in a risk-controlled manner, seeking to increase yield without jeopardizing the risk-hedging quality of core fixed income.