This article is part of the latest Trends and Opportunities report, which outlines key themes for the next stage of this market cycle and their nuanced implications across global asset classes.

Even during a slowdown, credit remains attractive since high current yields and interest rate sensitivity can counterbalance – or possibly exceed – potential losses from spread widening.

2022 Recap

- As the Federal Reserve (Fed) dramatically raised rates last year, investment-grade (IG) credit sold off more than high-yield (non-IG) credit due to its greater sensitivity to interest rate volatility.

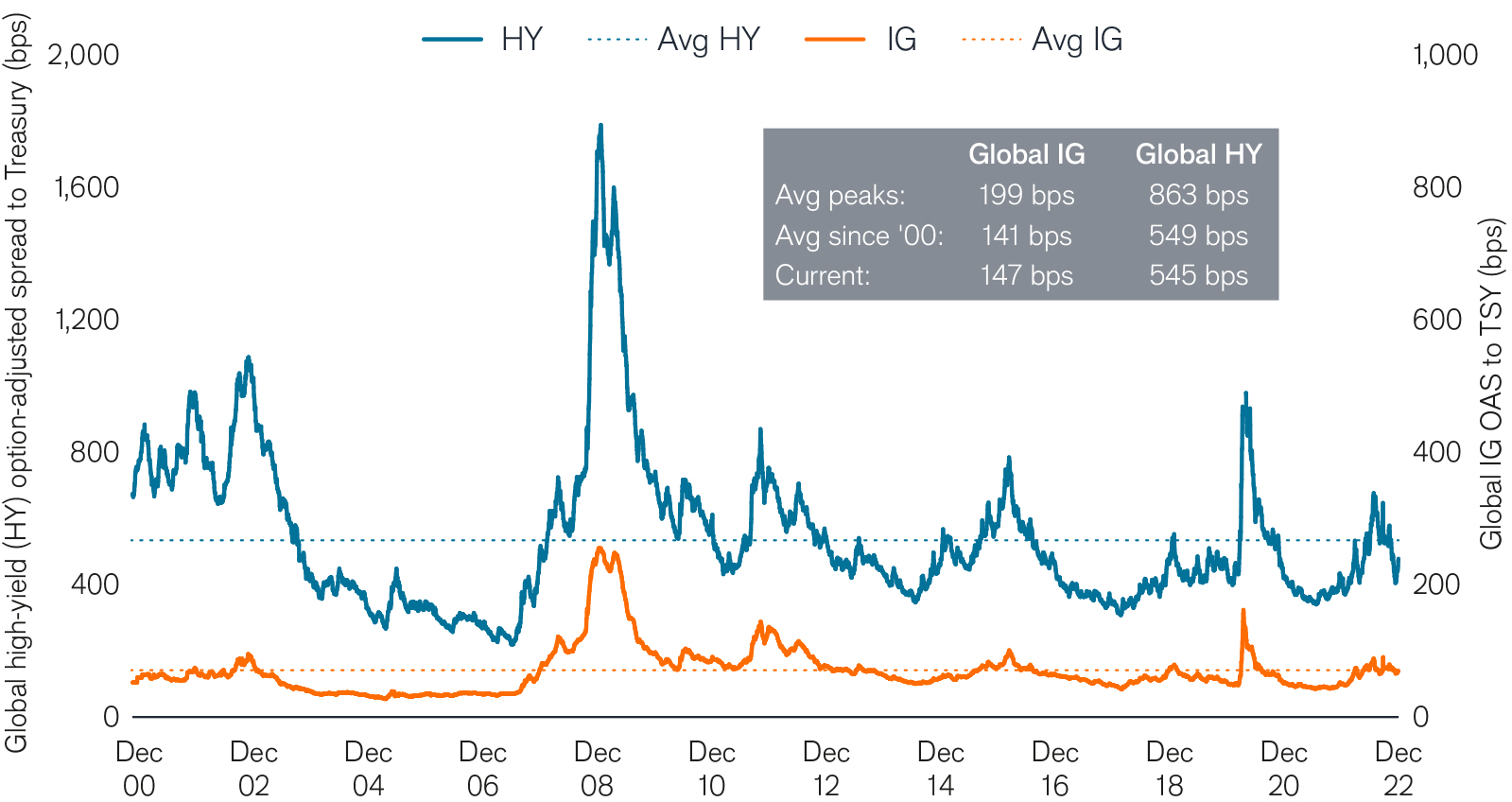

- While the Fed’s efforts to combat inflation dominated headlines in 2022, the labor market has remained surprisingly resilient, with companies’ earnings yet to show significant strain at the start of the new year. Credit spreads have therefore not yet widened to the levels typically seen during a recession.

- Investment-grade spreads, however, have priced in more of a slowing growth environment, while high-yield spreads remain below their 10-year historic averages.

Pricing in investment-grade (IG) better reflects recession risk

Source: Bloomberg as at 31 December 2022. Investment-Grade (IG) credit and high yield (Non-IG) credit represented by Bloomberg Global Aggregate Corporate TR USD and Bloomberg Global High Yield TR USD, respectively. Avg peak spreads ex ‘08 and COVID.

Outlook

- In the face of a looming growth slowdown, IG and non-IG spreads remain relatively tight by historical standards, and thus are vulnerable to further widening.

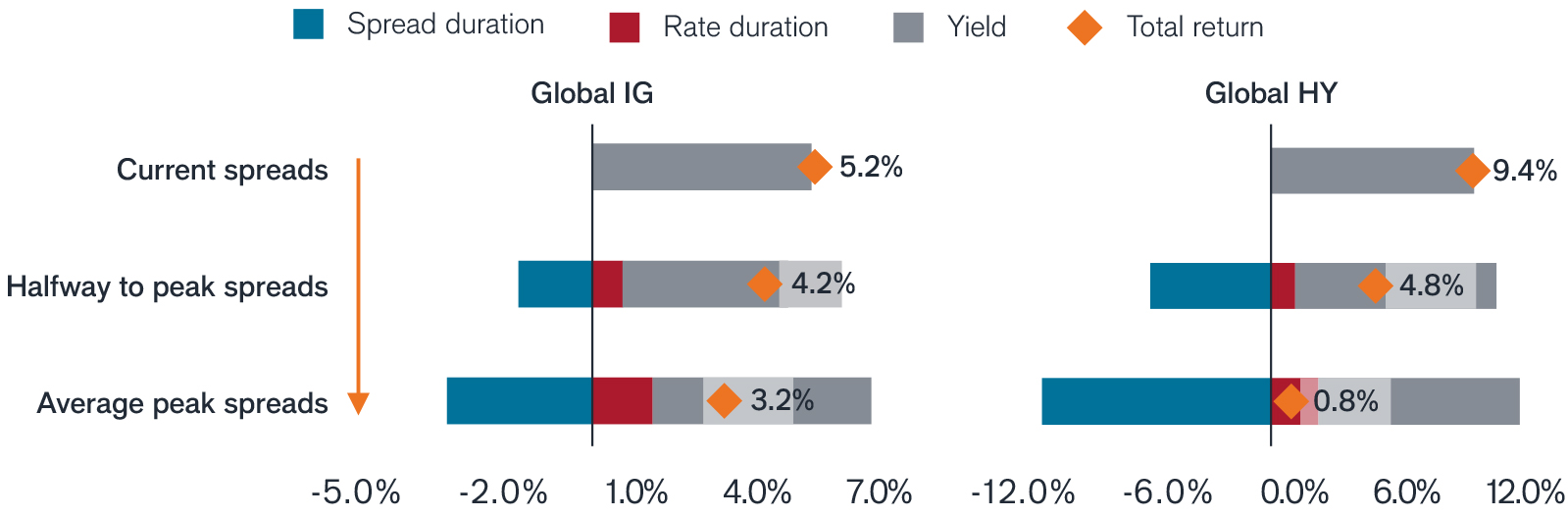

- Even during a slowdown, credit remains attractive since high current yields and interest rate sensitivity can counterbalance – or possibly exceed – potential losses from spread widening.

- Furthermore, an uncertain economic outlook should lead to a lighter supply of credit, as most companies have already locked in low-coupon, longer-duration bonds. These technical trends should be supportive for both investment-grade and high-yield credit.

A higher starting yield can help weather spread widening

Source: Janus Henderson, as at 31 December 2022, assuming 1-year holding period.

PCS Perspective

- The high-quality nature of IG credit translates to lower risk of significant earnings deterioration compared to non-IG. With spreads above historical averages and starting yields at over 5.0%, careful IG credit security selection may provide opportunities for defensive total return.

- Non-IG high-yield spread widening can generate larger losses than its IG counterparts. However, the higher starting level of carry – almost 9.5% as at 31 December 2022 – means non-IG spreads would have to widen to historical non-crisis peak levels (i.e., ex-COVID and Global Financial Crisis) before leading to negative total return.

- Active managers with the ability to identify strong fundamentals can help navigate volatility and default risk, potentially making an allocation to credit an attractive risk-adjusted opportunity in a year where the outlook for equities is uncertain.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg Global Aggregate Corporate Bond Index measures global investment grade, fixed-rate corporate bonds.

Bloomberg Global High Yield Index is a broad-based measure of the global high-yield fixed income markets.

Carry is the excess income earned from holding a higher yielding security relative to another.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.