Multiple tailwinds place residential real estate in a favourable position

Alongside a growing economy, US apartment landlords are benefiting from demographic tailwinds, as the largest age cohort today also happens to be in the prime rental age of 25-34 (see chart 1). With home ownership unattainable for many given mortgage rates over 6%,1 homeownership rates have continued to decline. Alongside this we have seen an (overdue?) pickup in the ‘unbundling’ of younger adults from their parental homes. Together, these factors have amplified rental demand, reflected in occupancy levels exceeding 95% in recent quarters,2 a level typically associated with market rental growth.

Chart 1: Continuing apartment demand supported by demographics – prime rental age is the largest US age cohort

Source: US Census Bureau, national population by characteristics, latest data at 2023.

Locations such as Seattle and San Francisco, which had languished post-pandemic, are also now witnessing a recovery, supported by newly-elected politicians focusing on re-establishing the vibrancy of central business districts, and return to work mandates by major tech employers such as Amazon, Microsoft, and Salesforce.

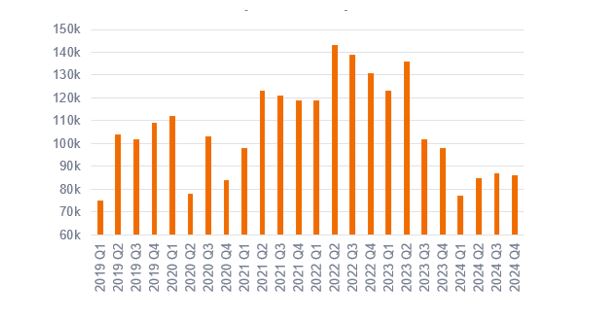

The headwind for landlords in recent years has been the high levels of new inventory hitting markets. This is a consequence of the record construction spree triggered by low borrowing costs and buoyant demand in 2021 and 2022, notably in Sunbelt cities like Nashville, Austin, and Charlotte. Rent growth here is weak, and at times has been negative. However, with construction starts trending down (chart 2), expectations are for an inflection point in these markets next year, setting the stage for a resumption of broad-based growth across the apartments sector.

Chart 2: Supply for multifamily units is trending downwards

Quarterly multifamily development starts (units)

Source: US Census Bureau and US. Department of Housing and Urban Development, Survey of Construction. New privately-owned housing units started, data to Q4 2024.

Senior housing: boomers leading the pack

Senior housing landlords have been amongst the best performers in the real estate investment trust (REIT) market in recent years. Market leader Welltower has seen an almost 150% shareholder return since the start of 2023,3 far outperforming even the en-vogue data centre landlords!

Demand is experiencing remarkable growth, driven by the anticipated 5% annual increase in the 80+ demographic through 2030.4 With occupancy rates and rental growth on the rise, senior housing REITs have leveraged operational efficiencies and data insights to offer superior services to residents and improved margins to shareholders. The pandemic spurred a retreat of private capital from this asset class, which has allowed listed REITs like Welltower and Ventas to acquire, at scale, properties at attractive yields in the 7-8% range,5 enabling a powerful blend of internal and external growth.

Student accommodation – supply constrained with resilient demand

At the other end of the demographic spectrum, student housing continues to see demand for purpose-built accommodation far outstripping available supply, which has enabled some landlords to consistently see rental growth rates ahead of inflation. In the current academic year, UK-focused REIT Unite reported rental growth of more than 8% from the prior year.6 With a shrinking supply of private rental housing, constraints on new development and recession resilient demand, we expect the sector to continue to deliver.

Living sector offers defensive growth at a discount today

As we look ahead, the residential sector, supported by traditional apartment landlords alongside alternative sub-sectors, presents a compelling investment case as supply pressures ease and could be set for another period of outperformance.

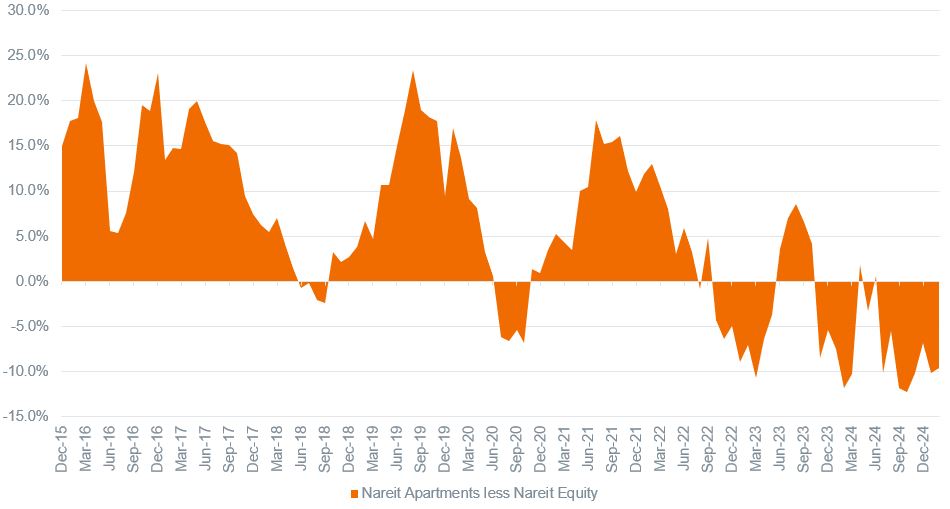

Chart 3: Apartment REITs have outperformed broader REITs more than 70% of the time over the past ten years

Rolling 3-year annualised Apartment REITs outperformance versus Equity REITs

Source: Bloomberg, Janus Henderson Investors analysis, 3-year total returns (monthly) Nareit Equity Apartments Index less Nareit Equity Index 10 years to 28 February 2025. Past performance does not predict future returns.

We also take comfort from the fact that US residential REITs are currently trading at a double-digit discount to net asset value (NAV) and multiples have de-rated from their historical premiums.7 This is despite the fact that balance sheets are stronger than ever, and operating platforms are driving strong efficiencies and growth potential. As a result, we believe residential REITs look well positioned for a multi-year run of earnings and dividend per share growth and the potential for a re-rating, as evidence of the next cycle surfaces through accelerating rent growth.

1 MortgageNewsDaily.com; typical 30-year mortgage term, as at 28 March 2025.

2 As reported by various residential REITs, Q4 2024 occupancy levels.

3 Financecharts.com, Welltower REIT, 30 December 2022 to 28 February 2025. Past performance does not predict future returns.

4 Organisation for Economic Co-operation and Development, 2025-2030 estimates.

5 Welltower Q4 2024 earnings report.

6 Unite Group.com as at 25 February 2025; financial results 2024.

7 SNL Real Estate as at 31 January 2025. Past performance does not predict future returns.

Featured image at beginning of the article: Welltower’s senior housing asset on 56th Street, Manhattan. Image credit: Welltower Inc., published and reproduced with permission.

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

FTSE Nareit All Equity REITs Index tracks the performance of the U.S. real estate investment trust (REIT) market.

Balance sheet: an indicator of a company’s financial strength. The balance sheet is a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

De-rating: occurs when investors are willing to pay a lower price for (REIT) shares, usually in anticipation of lower future earnings.

Discount to NAV: net asset value (NAV) measures the underlying value of the REIT’s holdings by taking the market value and subtracting any debts, such as mortgage liabilities. When a REIT’s market price is lower than its NAV, it is said to be trading at a discount.

Dividend per share: the total dividend a company/REIT pays out over a 12-month period, divided by the total number of outstanding shares.

Multifamily: residential real estate that allows for more than one households to live in a single property, and are often rented out rather than being owner-occupied, with some sharing communal spaces and utilities.

Multiples: are used to compare the value of similar assets. In real estate a common multiple is the cap rate, used for income-producing properties such as apartments, offices, or retail, which reflects the return on investment and the risk of the property.

NAV: Net Asset Value measures the underlying value of the REIT’s holdings by taking the market value and subtracting any debts, such as mortgage liabilities.

Property multiples de-rated from historical premium: refers to valuations that are now cheaper compared to the higher prices that investors were willing to pay in the past.

Property yield: the annual return on the capital investment usually expressed as a percentage of the capital value.

Re-rating: occurs when investors are willing to pay a higher price for (REIT) shares, usually in anticipation of higher future earnings.