Should investors be concerned about an AI “bubble”?

Hype often accompanies the emergence of a transformational technology, and with hype comes considerable noise. But in our view, the hype around AI is more than justified: We believe it has the potential to be the greatest productivity enhancer since the Industrial Revolution.

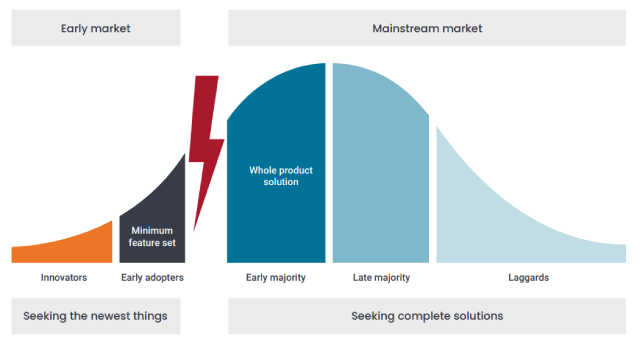

Open AI released ChatGPT less than two years ago. And while its arrival may have seemed like a lightning strike, the concept of and predecessor technologies for AI were decades in the making. Investors who are focused on early adopters may worry that we’re in an AI bubble, but we believe the lion’s share of the technology’s commercial and investment ramifications have yet to play out.

To fully grasp the degree to which this revolutionary – as opposed to evolutionary – force could affect the global economy, consider what is already being hypothesized by analysts, economists, and policymakers. Just as automation has done for manufacturing over the past several decades, AI stands to raise productivity in the services sector. And by boosting productivity, many experts believe AI could influence economic growth, wages, the level of inflation, and even interest rates.

Within financial markets, companies’ ability to effectively leverage AI will factor into their stock price, and AI’s macro effects will be considerations for bond investors. The bottom line is, very few pockets of the global economy are immune to the rollout of AI.

How is the AI theme changing the investment opportunity set?

While the efficiencies reaped by AI will reverberate across the global economy, gaining optimal investment exposure to this powerful theme is not simple. As with other innovative breakthroughs, there will be leaders and laggards, with the latter camp at risk of being disintermediated for failing to comprehend the magnitude of AI’s disruptive potential.

The progression

While investors are focused on early AI adopters, we believe the lion’s share of the technology’s commercial and investment ramifications have yet to play out.

Source: Janus Henderson Investors

Although time will tell which companies got it right, in the meantime, investors face an environment where valuations can appear high – accurately or otherwise – for companies associated with the AI theme. While we believe the potential for attractive compounded earnings growth justifies many of these valuations, other companies will get it wrong and wind up on the wrong side of the AI divide.

We think the key to successfully investing in AI is case-by-case fundamental analysis. Our focus is on identifying the long-term winners and losers so we’re able to determine whether a business can grow into some of these elevated valuations at which they are currently trading.

Do elevated valuations mean it’s too late to gain exposure to AI?

Investors concerned about being late to the AI party may be reassured by knowing that the earnings potential of technological breakthroughs is typically overestimated in the near term while considerably underestimated over longer horizons.

This is likely the case with AI. While the innovators and early adopters have already been identified, investors – and often companies themselves – are still unsure of the full impact AI will have on various sectors, business models, and functions.

A unique feature of AI is the breadth of players across industries and value chains to which it can provide lasting benefits – and in turn, long-term investment opportunities. Unlike other recent technological advancements, AI has the potential to impact every facet of an enterprise – from front office to back office and even product development. Its reach will be felt across industries and even extend to government applications. We expect AI to provide an earnings tailwind as companies deploy it with the aim of streamlining costs, generating revenue, and developing new products.

What role can the Global Technology and Innovation Fund play in an investor’s portfolio?

Technology is dramatically impacting every sector of the economy, and this growth equities Fund seeks to invest in companies around the globe that are driving that innovation or benefiting from technological advancements. We invest in companies with a culture of innovation that we believe to be resilient, and we also seek smaller positions in companies that have optionality – that is, large potential upside under a specific scenario.

Our team of tech analysts is embedded deeply within the sector, approaching research as an industry participant. In this complex and rapidly growing sector, it is critical to have experienced investors working to evaluate the impact of disruptive technologies and actively aiming to identify both winners and losers.

Through this approach, the Fund seeks long-term growth of capital and aims to provide investors strong, risk-adjusted returns over time.