This article is part of the latest Trends and Opportunities report, which outlines key themes for the next stage of this market cycle and their nuanced implications across global asset classes.

Short-duration fixed income is a strategically crucial bedrock exposure for portfolios with a potential compelling entry point

2022 Recap

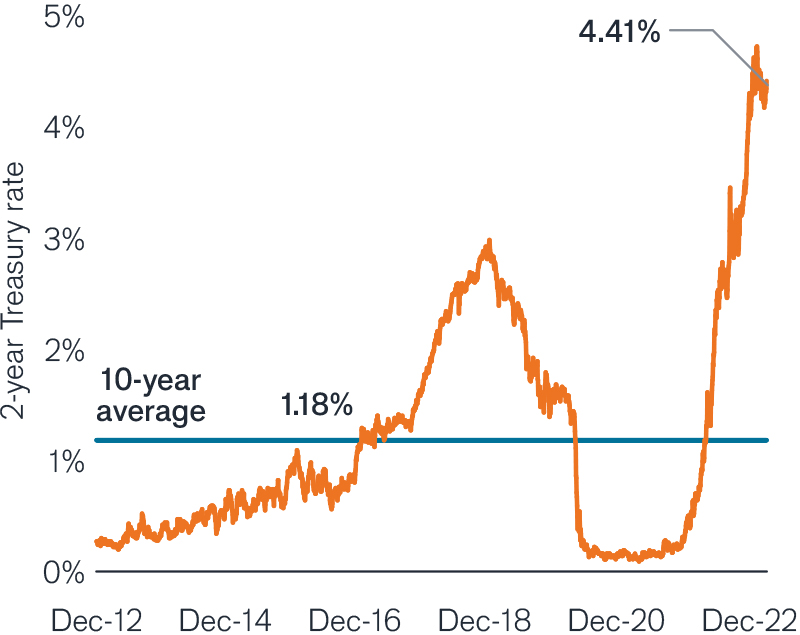

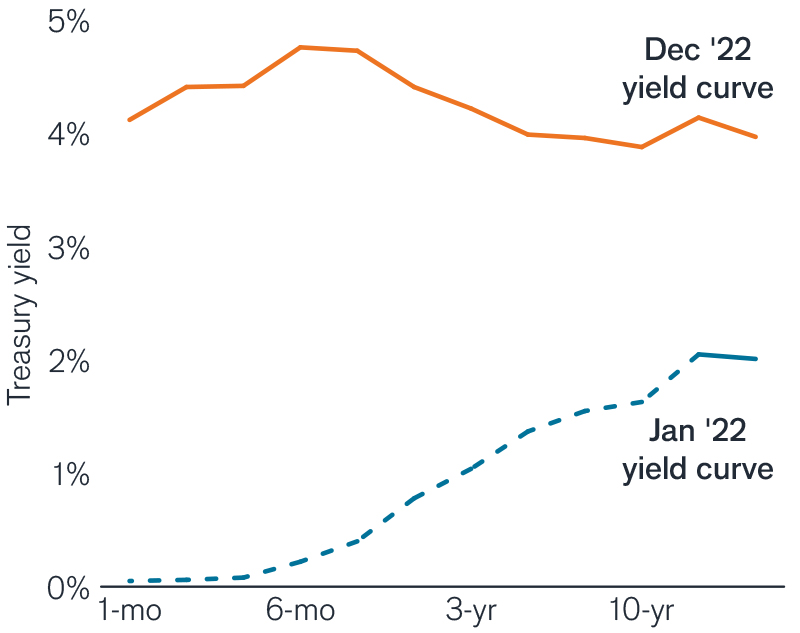

- To tame the highest rates of inflation in modern history, the Federal Reserve (Fed) hiked rates a staggering 425 basis points (bps) in 2022, sending yields on short-dated assets to

levels not seen since 2007. - Since short-dated yields are more sensitive to Fed policy, this massive repricing resulted in a deeply inverted yield curve.

- Despite this rapid rise in yields, shorter-duration Treasuries, which have less interest rate sensitivity than intermediate-duration Treasuries, were down just 3.82% vs.12.6%, respectively, as at 31 December 2022.

Seismic shift in bedrock fixed income

Source: Bloomberg, Janus Henderson Investors, as at 31 December 2022.

Outlook

- It remains uncertain how far the Fed will raise rates and when/if they will pivot. We therefore still foresee elevated interest rate volatility in the first half of the year.

- As rates could remain higher throughout the year as the economy slows, we think investors may benefit from limiting interest rate sensitivity while also increasing the credit quality in their portfolios.

- Maintaining a high-quality ballast on the short end of the curve might finally provide compelling yields and mitigate downside risk ahead of an uncertain economic environment, while also limiting duration risk if we end up in a rate regime that is higher for longer.

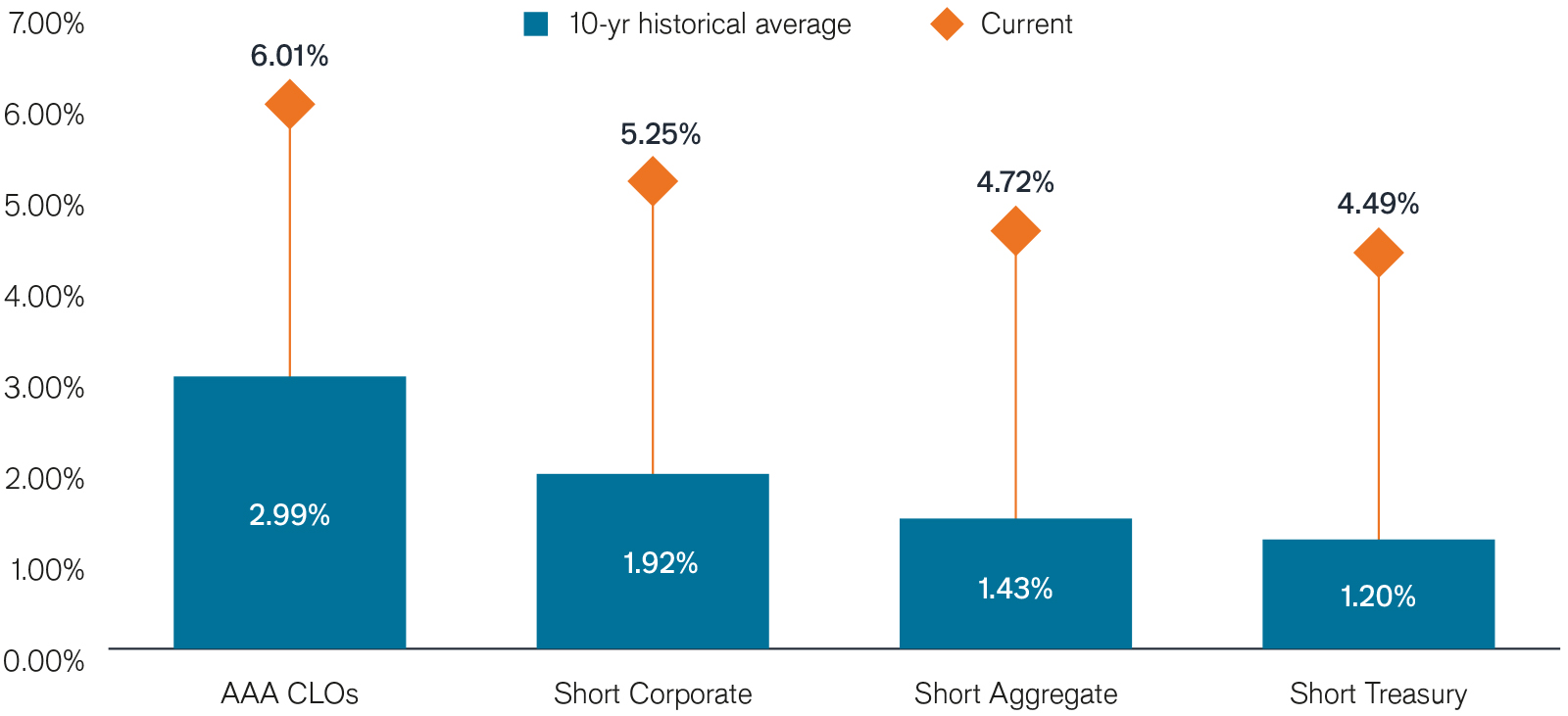

Yields soar past historical levels

Source: Bloomberg, as at 31 December 2022. Indices represented are JPM AAA CLO Index, Bloomberg U.S. Corp 1-3yr TR USD, Bloomberg U.S. Aggregate 1-3yr TR USD, Bloomberg U.S. 1-3 Treasury TR USD.

PCS Perspective

- In our view, short-duration fixed income is a strategically crucial bedrock exposure for portfolios, with a potentially compelling entry point.

- It’s important to keep in mind that short-term fixed income encompasses more than Treasuries; Collateralized Loan Obligations (CLOs), corporates, and global sovereigns

all bring their own curves, risks, opportunities, and sources of diversification. - A diversified approach to a short-term allocation that utilizes securitized assets, corporate spreads, and/or seeks to navigate global monetary cycle divergences might

help prepare a portfolio to keep up with the possibility of stubbornly high inflation. - In an environment where the outlook for both markets and the economy is murky, being nimble and flexible in a short-term allocation may help investors maintain stability during

rate volatility, while also potentially providing opportunities to capture capital appreciation in the case of a Fed pivot or market recovery.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg 1-3 Year U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market with maturities between 1-3 years.

Bloomberg 1-3 Year U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

Bloomberg 1-3 Year U.S. Treasury Index measures U.S. Treasury securities with maturities between 1-3 years.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

J.P. Morgan CLO AAA Index is designed to track the AAA-rated components of the USD-denominated, broadly syndicated CLO market.

Yield cushion, defined as a security’s yield divided by duration, is a common approach that looks at bond yields as a cushion protecting bond investors from the potential negative effects of duration risk. The yield cushion potentially helps mitigate losses from falling bond prices if yields were to rise.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.