Since the announcement of the Pfizer vaccine’s efficacy against COVID-19 on 9 November, alongside the wider equity markets, we have seen a significant rotation to ‘value’ within the real estate investment trust (REIT) market. Specifically, while the overall US REIT sector has gained 14% since that day, ‘value’ REITs are up on average 52%, while ‘growth’ REITs have been declined by 7%.1 The rotation away from ‘growth’ real estate sectors that have directly benefited from COVID (industrial/logistics, cell towers, data centres, single-family rental housing, storage), towards ‘value’ sectors that have been negatively impacted by COVID (shopping centres, regional malls, hotels, office, coastal apartments) has been strong, and has happened in a very short space of time.

Identifying ‘quality compounders’

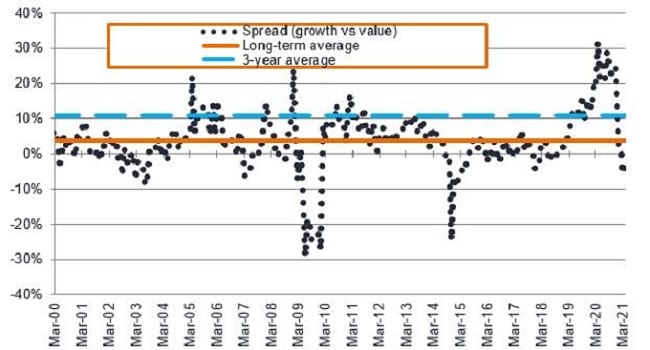

A recovery trade in the hardest hit real estate sectors was both expected and justified. Better‑than‑hoped vaccine announcements signalled the beginning of a return to normality and ongoing government stimulus cushioned the pandemic’s impact on the consumer. A focus on ‘cheap, but not broken’ names (stocks severely punished by the market but which could still offer a reasonable path to sustainable growth) has been beneficial, albeit some structurally impaired sectors, such as retail, have rallied the hardest. While the current trading momentum shows few signs of abating, we believe the performance differentials between value and growth real estate sectors have become stretched based on the underlying value of property assets; ie, fundamentals.

Growth versus value – so much has changed in a year

REITs in ‘growth’ sectors offer highly visible long-term compounding return potential, driven by permanent and powerful secular tailwinds such as e-commerce, mobile data, cloud computing, 5G and changing demographics. The growth prospects of many real estate companies exposed to these trends have improved, and look to continue to improve as a result of the pandemic. However, in the aftermath of recent underperformance of the wider REITs sector, these companies have seen their previously high valuation premium disappear.

Source: Evercore ISI Research, as at 1 March 2021. Past performance is not a guide to future performance. Note: Net asset value (NAV) per share represents the estimated private market value of REIT-owned properties. ‘Growth’ includes Industrial, Single Family Rentals, Manufactured Housing, Storage, Life Science Office sectors. ‘Value’ includes Shopping Centres, Malls, Traditional Office, Healthcare, Coastal Apartments, Student Accommodation.

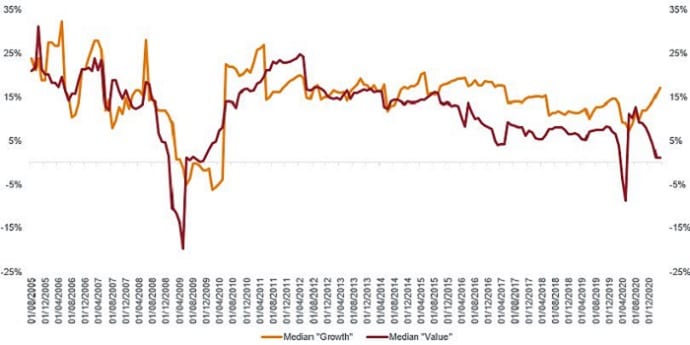

Figure 2 shows two-year forward earnings growth expectations for growth versus value companies. Here we can see that the valuation moves of late are at odds with current market consensus expectations, with estimates for the ‘value’ sectors having come down sharply, while estimates for the ‘growth’ sectors have increased.

Source: Janus Henderson Investors, Evercore ISI Research company classifications. Data based on 2-year forward market consensus FFO per share estimates to 31 March 2021. Funds From Operations (FFO) is used by REITs to define the cash flow from their operations; ie, a measure of operating performance. The FFO per share ratio is typically used to evaluate a REIT in lieu of earnings per share (EPS) used to evaluate general equities.

Growth opportunities abound

We believe that the market is attaching a more positive outlook to certain property types, which rely more on hope and continued economic recovery momentum, rather than fundamentals. Equally, the market appears to be underestimating the long-term growth potential of best‑in‑class REITs that have the ability to grow, create significant shareholder value and potentially offer superior property returns in the coming years.

In summary, we believe this level of valuation divergence between ‘value’ and ‘growth’ has created a compelling opportunity; a rare chance to buy some of the highest quality publicly traded real estate companies, operating in sectors that look to be on the right side of change, at attractive valuations.