July 2022 US Growth Equities

Revisiting U.S. Growth in a Challenging Environment – Test 2

Portfolio Managers Doug Rao and Brian Demain discuss the changing market environment for growth equities ‒ from the Russia/Ukraine conflict to repercussions developing from the COVID policy response.

KEY TAKEAWAYS

- Market volatility has spiked as investors weigh the effects of the Russia/Ukraine conflict, rising inflation and other long-term effects of the powerful fiscal and monetary pandemic response.

- Inflation ‒ from goods, wages and commodities ‒ and the potential for higher interest rates will affect growth equity earnings and the multiples that investors are willing to pay for them.

- As the market environment evolves, we remain focused on durable investment themes, but also companies with the ability to outgrow the headwinds of inflation and higher rates.

KEY TAKEAWAYS

- Market volatility has spiked as investors weigh the effects of the Russia/Ukraine conflict, rising inflation and other long-term effects of the powerful fiscal and monetary pandemic response.

- Inflation ‒ from goods, wages and commodities ‒ and the potential for higher interest rates will affect growth equity earnings and the multiples that investors are willing to pay for them.

- As the market environment evolves, we remain focused on durable investment themes, but also companies with the ability to outgrow the headwinds of inflation and higher rates.

Recent volatility has clearly signaled that investors are sorting through the potential for protracted military action in Ukraine and the economic implications of the West’s sanctions on Russia. While the conflict in Ukraine has become front and center for markets, investors are also faced with the long-term impacts of the monetary and fiscal response to the pandemic. The prospect of persistent inflation is certainly one of the most central concerns. We think it is helpful to break inflation into two components ‒ goods inflation and wage inflation ‒ to better understand the underlying dynamics.

Goods Inflation

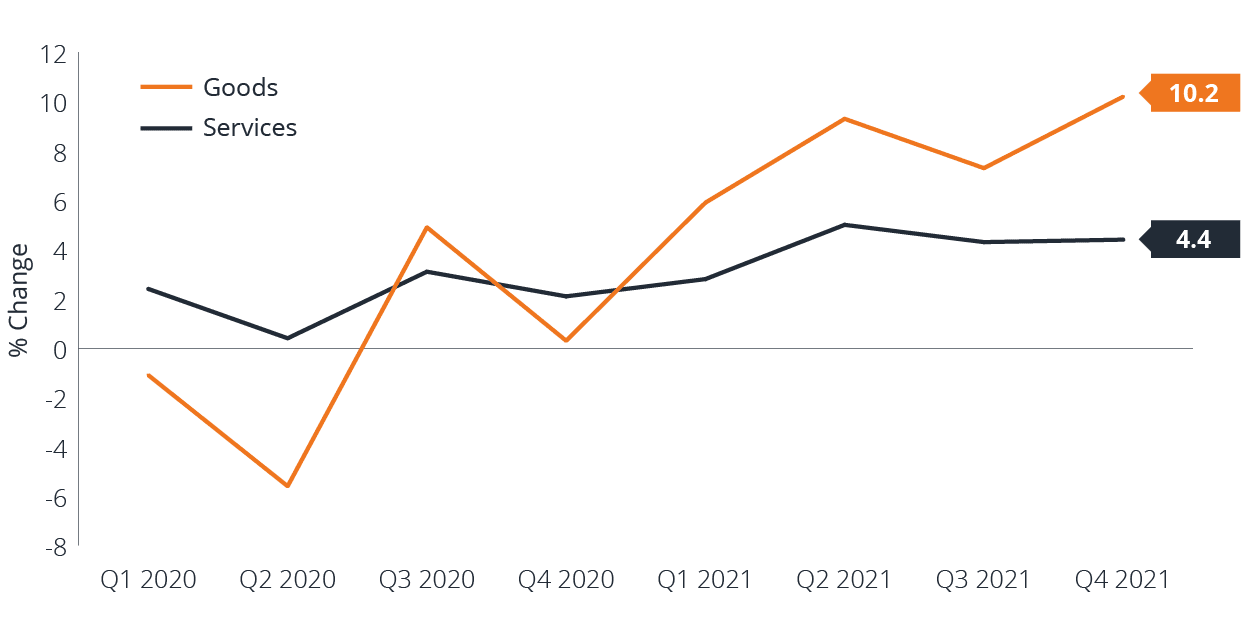

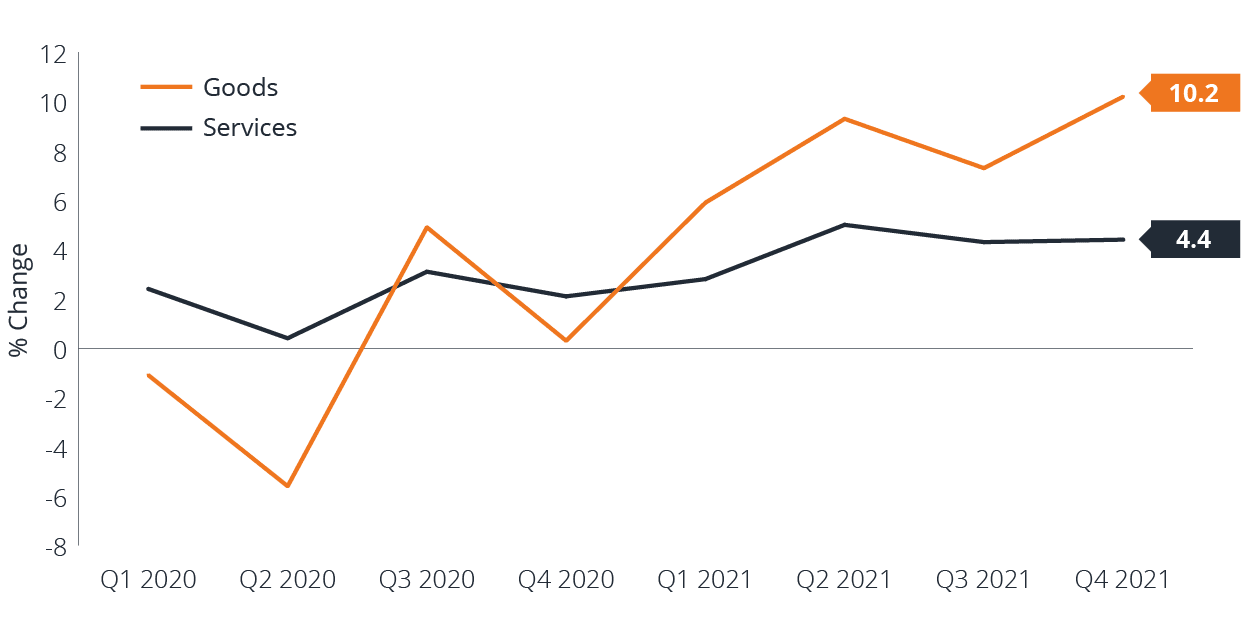

At the onset of COVID, central banks and governments flooded markets with monetary and fiscal stimulus, and, as a result, consumer spending skyrocketed. More precisely, spending on goods (as opposed to services) rose sharply, as travel restrictions and health concerns prevented consumers from accessing the physical economy. Prior to the pandemic, goods purchases were roughly 31% of total Personal Consumption Expenditures (PCE) in the U.S. but have climbed and now remain at over 35%. This demand increase combined with snarled supply chains has driven up goods prices, resulting in the elevated inflation numbers that we have seen in recent months (Exhibit 1).

Exhibit 1: U.S. Personal Consumption Expenditures (PCE) Inflation

Source: U.S. Bureau of Economic Analysis, as of 7 March 2022, % Change from Preceding Period in Prices, Seasonally Adjusted at Annual Rates.

Source: U.S. Bureau of Economic Analysis, as of 7 March 2022, % Change from Preceding Period in Prices, Seasonally Adjusted at Annual Rates.

Russia’s military action in Ukraine has since created a massive spike in commodities prices as countries reconsider their reliance on Russian raw materials and the conflict chokes off supply. Oil and natural gas prices have been some of the most visible areas, but Russia is also a major supplier of metals such as nickel, steel and aluminum. Russia and Ukraine are leading exporters of grains such as wheat and corn, and fertilizer materials such as potash and phosphates. A crimp on these supplies has the potential to significantly affect food security and crop yields ‒ and, thus, prices ‒ in coming years.

The ultimate impact and duration of the conflict remain unknown, but significant spikes in commodities prices ‒ particularly crude oil ‒ could trigger a recession. While the effects of inflation and added disruption to supply chains will spread through the U.S. economy in various ways, the resulting higher prices act as a tax on consumers, hindering their ability to spend on other goods and services and grow the economy. As markets dip, consumers could be further impacted by the wealth effect as the value of their assets decline.

The increased pressure on consumers and the potential for recession will complicate the U.S. Federal Reserve’s (Fed) already difficult task of reining in inflation without disturbing the economic recovery. If the COVID situation continues to improve and supply chains can be repaired, we could see price moderation and higher services spending ‒ more in line with pre-pandemic norms. However, a prolonged Russia/Ukrainian conflict will continue to keep inflationary pressure on goods.

Wage Inflation

At the same time, we believe inflation from lower-income wages will be sustained. For the last several decades, globalization kept a lid on low-end wages in the U.S., as we imported inexpensive goods and jobs were moved offshore to lower-paying countries. However, more recently, the U.S. is retrenching away from globalization and is in the process of re-industrialization, which has likely accelerated as the West de-couples from Russia. This, along with sharply lower labor participation rates due to the pandemic, has led to rising wages. Higher pay could be generally positive for the U.S. economy, as consumer spending accounts for a majority of gross domestic product (GDP), and workers will have more money to spend. However, the secular repricing of low-end wages will create some headwinds on margins for companies in coming years.

Inflation and Higher Rates – Implications for Growth Companies

Over the next three to five years, we believe inflation and, similarly, interest rates, will matter for growth equity valuations. Since the Global Financial Crisis, we have enjoyed an extended period of both very low interest rates and inflation, during which historically low rates have incentivized investors to bid up growth valuations. This dynamic can change quickly as interest rates ‒ and, therefore, discount rates ‒ increase, particularly for high-growth companies with expected cash flows far out in the future.

Stock prices are a function of earnings, earnings growth and the multiples investors are willing to pay for that earnings and earnings growth. We fully expect that if rates rise, earnings multiples will contract, and so it will be increasingly important to identify companies that can outrun ‒ through their growth ‒ the multiple contraction that we expect to see. Companies with pricing power should also be better positioned to weather an inflationary environment than companies that are unable to raise prices as costs are increasing.

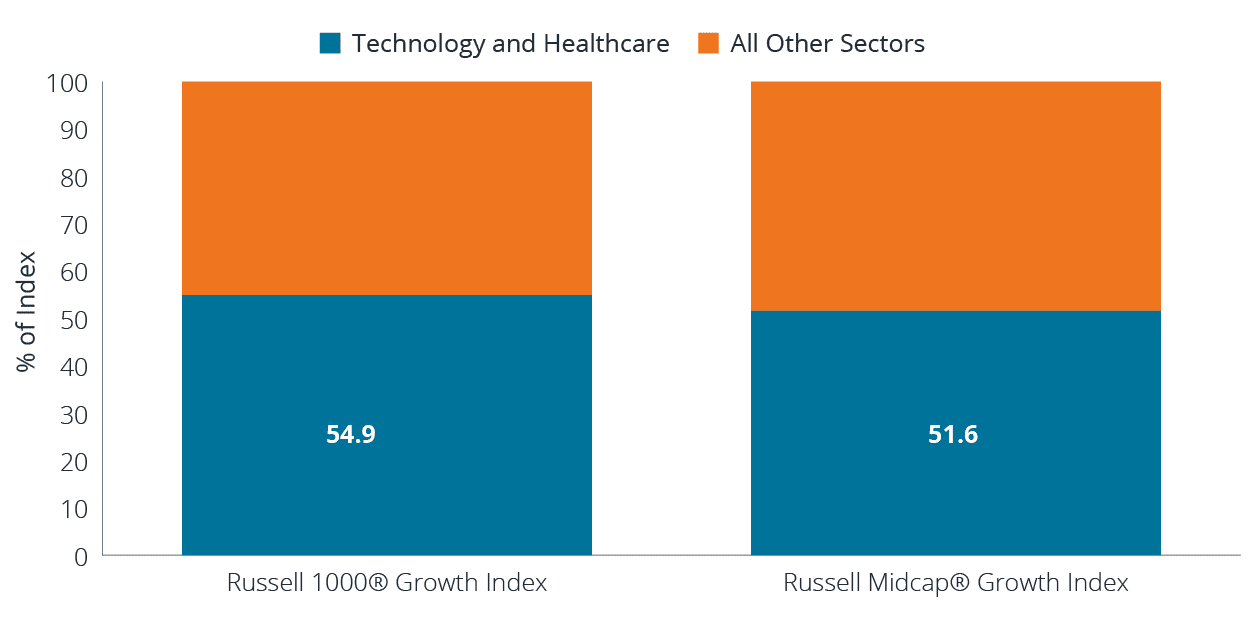

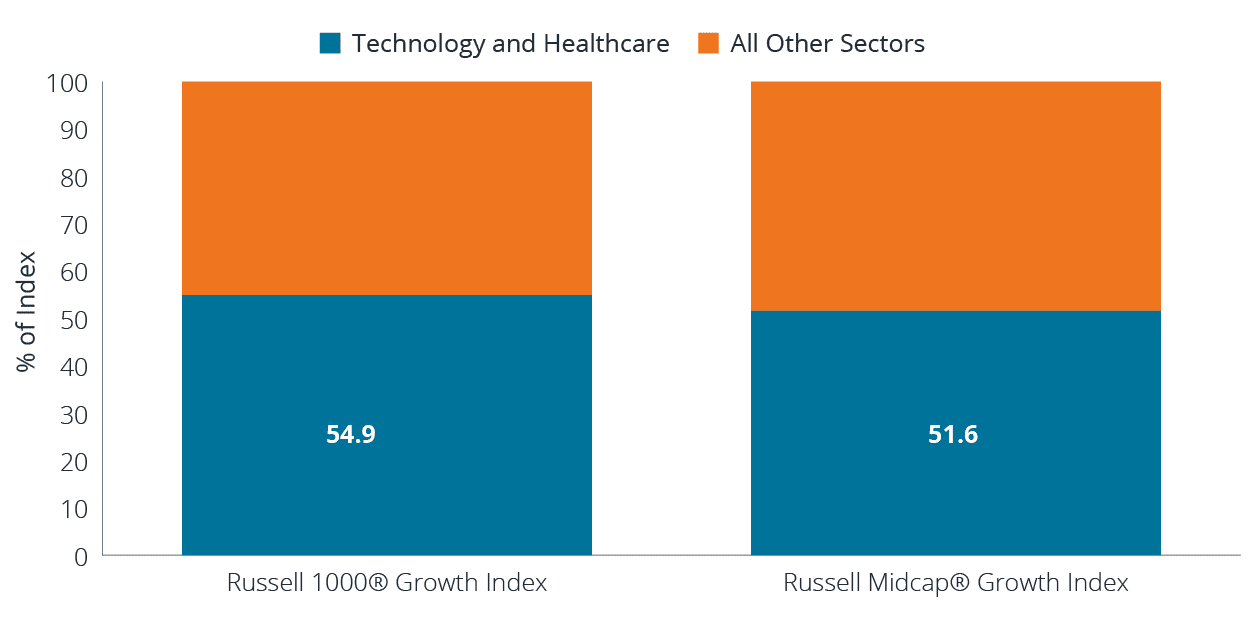

A large portion of the U.S. growth investing landscape is made up of information technology and health care stocks. In fact, over half of both the Russell 1000

® Growth and Russell Midcap

® Growth indices are in these sectors (Exhibit 2), in contrast with the last significant period of inflation ‒ the 1970s ‒ when the economy was much more goods-driven and industrial-focused.

Exhibit 2: U.S. Growth Index Sector Weightings

Source: FactSet, as of 31 January 2022.

Source: FactSet, as of 31 January 2022.

Select companies in these sectors have the ability to produce wide profit margins and operate with a lower level of labor intensity than other market segments. So, while inflation will certainly matter for these businesses’ earnings, these characteristics could help to make its impact less pronounced.

Investment Themes in a Changing Environment

One of the lessons we learned through the COVID crisis is that direct digital relationships with customers are extremely significant. Companies that have successfully forged these relationships have gained the ability to constantly communicate with their customers, but also to learn from them ‒ for instance, to better manage inventory, working capital and other business functions. The omnichannel approach is readily evident in the retail industry but has also been adopted in office work environments, telemedicine, online dating and other areas. From an investment standpoint, these digital relationships have added flexibility and resiliency, strengthening businesses across the economy.

Going forward, we see opportunity in other long-term themes. For one, we believe that there is still a long runway of growth for the large cloud platform providers, even as these businesses have already grown at an impressive rate. Semiconductors are providing building blocks for rising cloud server demand, but also key components in the shift to electric ‒ and, ultimately, autonomous ‒ vehicles. As manufacturers ramp up electric vehicle (EV) production, essential chips and components that weren’t present in internal combustion vehicles, but are in EVs, will be in high demand.

In a similar vein is the growth of biopharmaceuticals such as protein-based therapeutics, gene therapy and, famously, mRNA vaccines. Along with the progress of these technologies, costs in pharmaceutical production will likely increase dramatically, and the companies selling the various components used in their production will have powerful demand over the next 10 to 15 years.

Maintain Focus

During challenging times, it is important to question what is changing in the economy and with companies. Just as COVID has shaped markets in recent years, the military action in Ukraine has altered the global economic landscape and will have lasting impact. However, as markets shift, we continue to focus on companies well-placed for multi-year, secular growth in areas requiring a significant amount of investment. High-quality businesses that can capture a disproportionate share of those economics may be less exposed to external factors as more of their growth stems from capturing market share.

Featured Funds

JCAPX

Forty Fund

JMGRX

Enterprise Fund

JFRDX

Forty Fund

JANEX

Enterprise Fund

Read more on these topics

Growth Equities Interest Rates VolatilityView All Perspectives

Doug Rao

Portfolio Manager

Doug Rao

Portfolio Manager Brian Demain, CFA

Portfolio Manager

Brian Demain, CFA

Portfolio Manager Source: U.S. Bureau of Economic Analysis, as of 7 March 2022, % Change from Preceding Period in Prices, Seasonally Adjusted at Annual Rates.

Russia’s military action in Ukraine has since created a massive spike in commodities prices as countries reconsider their reliance on Russian raw materials and the conflict chokes off supply. Oil and natural gas prices have been some of the most visible areas, but Russia is also a major supplier of metals such as nickel, steel and aluminum. Russia and Ukraine are leading exporters of grains such as wheat and corn, and fertilizer materials such as potash and phosphates. A crimp on these supplies has the potential to significantly affect food security and crop yields ‒ and, thus, prices ‒ in coming years.

The ultimate impact and duration of the conflict remain unknown, but significant spikes in commodities prices ‒ particularly crude oil ‒ could trigger a recession. While the effects of inflation and added disruption to supply chains will spread through the U.S. economy in various ways, the resulting higher prices act as a tax on consumers, hindering their ability to spend on other goods and services and grow the economy. As markets dip, consumers could be further impacted by the wealth effect as the value of their assets decline.

The increased pressure on consumers and the potential for recession will complicate the U.S. Federal Reserve’s (Fed) already difficult task of reining in inflation without disturbing the economic recovery. If the COVID situation continues to improve and supply chains can be repaired, we could see price moderation and higher services spending ‒ more in line with pre-pandemic norms. However, a prolonged Russia/Ukrainian conflict will continue to keep inflationary pressure on goods.

Source: U.S. Bureau of Economic Analysis, as of 7 March 2022, % Change from Preceding Period in Prices, Seasonally Adjusted at Annual Rates.

Russia’s military action in Ukraine has since created a massive spike in commodities prices as countries reconsider their reliance on Russian raw materials and the conflict chokes off supply. Oil and natural gas prices have been some of the most visible areas, but Russia is also a major supplier of metals such as nickel, steel and aluminum. Russia and Ukraine are leading exporters of grains such as wheat and corn, and fertilizer materials such as potash and phosphates. A crimp on these supplies has the potential to significantly affect food security and crop yields ‒ and, thus, prices ‒ in coming years.

The ultimate impact and duration of the conflict remain unknown, but significant spikes in commodities prices ‒ particularly crude oil ‒ could trigger a recession. While the effects of inflation and added disruption to supply chains will spread through the U.S. economy in various ways, the resulting higher prices act as a tax on consumers, hindering their ability to spend on other goods and services and grow the economy. As markets dip, consumers could be further impacted by the wealth effect as the value of their assets decline.

The increased pressure on consumers and the potential for recession will complicate the U.S. Federal Reserve’s (Fed) already difficult task of reining in inflation without disturbing the economic recovery. If the COVID situation continues to improve and supply chains can be repaired, we could see price moderation and higher services spending ‒ more in line with pre-pandemic norms. However, a prolonged Russia/Ukrainian conflict will continue to keep inflationary pressure on goods.

Source: FactSet, as of 31 January 2022.

Select companies in these sectors have the ability to produce wide profit margins and operate with a lower level of labor intensity than other market segments. So, while inflation will certainly matter for these businesses’ earnings, these characteristics could help to make its impact less pronounced.

Source: FactSet, as of 31 January 2022.

Select companies in these sectors have the ability to produce wide profit margins and operate with a lower level of labor intensity than other market segments. So, while inflation will certainly matter for these businesses’ earnings, these characteristics could help to make its impact less pronounced.