Here, we find out why the team at Henderson Smaller Companies Investment Trust think smaller companies should be part of any drawdown portfolio.

Smaller companies are seen as a vital tool in the journey to building wealth – nascent, volatile, and razor-focused on growth – their share price rises can at times can shoot the lights out. However, conventional wisdom is that they have little room to pay dividends or income. This means in the decumulation phases – when investors are seeking income – small caps are often excluded from investors’ portfolios. Neil Hermon, Portfolio Manager of Henderson Smaller Companies Investment Trust (HSL), thinks this view needs challenging and believes that the combination of capital growth and growing income found in higher quality smaller companies should be considered for any portfolio.

Building wealth

When looking at how wealth is built over a lifetime, there tends to be two distinct phases: an accumulation phase, where we try our hardest to grow our pot of assets, and a decumulation phase, where we draw on those assets in retirement and look for ways to generate income.

In the accumulation phase, investment objectives tend to have a growth bias. At this stage, riskier assets are considered appropriate as we strive for higher returns while time is on hand to help ride out potentially large asset price swings. As such, smaller companies are often part of any accumulators’ portfolio. The assumption is that small-caps early in their business lives, brimming with project and product ideas, and will therefore invest any spare cash into growth, which, if successful, should translate into strong share price returns. Therefore, paying dividends is not perceived as a top priority.

As we move into the decumulation phase, conventional wisdom is to de-risk our portfolios and tilt strategies towards income producing assets such as bonds and larger companies. Within equities, the assumption is that large-caps are entrenched in their markets with a range of established products and reliable cashflows, so can pay strong and reliable dividends.

While much of this thesis is sound, the UK small and mid-cap team working on HSL believe generalising small-caps as volatile businesses disinterested in dividends is a misconception. High quality firms can generate strong returns from their projects, while also growing their dividends in lockstep with a disciplined approach to their finances.

The importance of income

The small-cap space encompasses a broad spectrum of companies, from fledgling businesses with promising products and tantalising capital upside but little to show for it today, through to more established businesses with a track record of strong earnings and stable dividend growth. In finding quality businesses that will deliver over the long term, the team at HSL seek the latter.

Furthermore, they look for four defining characteristics as a signal of quality under the banner of 4Ms. By this, we mean they seek strong management teams and well-defined business models that competitors have difficulties replicating. In addition, the money the business generates is vital, with the team looking for strong balance sheets and growth powered by steady and reliable earnings as opposed to a diet of debt. Finally, they look for momentum in earnings that will exceed analyst expectations year over year.

The discipline of dividends is a key element in assessing the financials. It shows management is focused on what’s important: that if cash isn’t being used or is in excess, it is returned to shareholders, signalling confidence that funding for any new projects will come from the earnings they are sure to receive over the upcoming period. It also ensures cash isn’t wasted on vanity projects or those with paltry returns. By investing in these types of businesses, the team feel confident that they are able to deliver on the Trust’s primary objective of capital growth in addition to providing a stable and consistent income stream to investors.

FHSL in a drawdown portfolio

With each passing generation, we live longer. As a result, a retirement portfolio may need to last 25-30 years and the risk is that we run out of income before our time comes. Therefore, any drawdown portfolio should retain an element of growth – particularly given the rather worrying current inflationary environment.

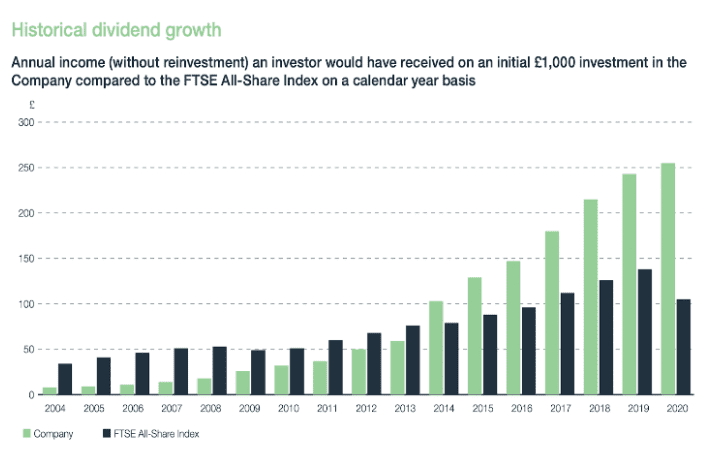

Of course, retirees’ main focus will be on income generating assets, and large-cap equity funds are likely to offer a higher yield today. According to LINK, as at the end of the first quarter this year, over the next 12 months the FTSE-100 will yield 3.8% versus the FTSE-250’s 2.4%.ii Though the starting yield for HSL is lower than the FTSE All Share, the growth bias of the Trust means that in the medium to longer term, the income potential is greater i.e. investors get the best of both worlds – capital growth and higher income in the future.

HSL’s strong dividend track record serves the point. If you had invested £1000 back in 2004, in real terms by 2020, you would be receiving a little over £250 in annual income – far higher than if you had stuck with the FTSE-100.

Source: Henderson Smaller Companies Trust, Annual Report 2021

Source: Henderson Smaller Companies Trust, Annual Report 2021 What is more, there are some risks apparent in the larger dividend stocks of the FTSE-100: payments are concentrated in the hands of very few companies. According to LINK, in the first quarter of this year, 48% of all UK dividends was paid by just five companies. The next ten companies accounted for a further 31% – meaning just 15 companies paid 79% of the entire UK dividend bill.ii As a result, large-cap UK income funds will hold many of the same stocks, and if there’s an issue in one of the big payers, the yield an investor receives could be severely affected. Bar Covid related cuts, BP’s dividend cut following the Macondo oil spill is a good example here. This can be contrasted with HSL’s diversified list of over 100 companies, which reduces the potential impact on income in the event a company needs to cut its dividend.

Treading cautiously

Small cap stocks

Of course, the outlook for markets presently involves some trepidation. Uncomfortably high inflation spurred by pandemic-related supply chain logjams and higher commodity prices stoked by the war in Ukraine are causing central bankers to raise interest faster than expected This has raised concerns about slowing global growth and potential recession in some economies. In such an environment, small-caps and other equities are likely to feel some short-term pain as stock market volatility rises.

Nonetheless, this environment creates an opportunity for skilled stock pickers to initiate positions or add to existing holdings in which they have a high conviction. Furthermore, supply-side cost pressures are likely to ease over the course of the year and the long-term story for domestically focused UK stocks looks encouraging as the economy recovers from the Covid-induced slump and businesses adjust to the new normal.

As such, the merits of investing in carefully selected small-caps should be considered by any investor in both the accumulation and decumulation phases of building a retirement pot. An investment trust such as HSL is useful to any drawdown portfolio by seizing upon two important objectives: the capital growth required to continue growing our wealth throughout the increasingly lengthy lives we lead, and a consistent and strongly growing income stream that’s all too important in the day-to-day funding of our golden years.

ii Source: LinkGroup UK Dividend Monitor – Q1 2022

Volatile – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.