Key Takeaways

- The Federal Reserve’s forward guidance on interest rates and balance sheet tapering stand to put downward pressure on bond prices, and investors may soon face a day of reckoning on their fixed income allocations.

- Rather than lowering return expectations, investors can take steps to proactively adjust interest rate, credit and geographical exposure to navigate future market challenges.

- Central to a strategy seeking to deliver positive returns is a bond portfolio that incorporates securities which are able to generate income and have sufficient yield cushions to counteract rising rates.

Introduction

For decades, investors have allocated funds to core fixed income with the expectation of capital preservation, portfolio diversification and predictable income streams. In the years following the Global Financial Crisis, monetary policy and economic conditions have chipped away at these attributes. As central banks became the marginal buyers of government debt and mortgages, yields on these securities fell short of what fixed income investors had come to expect. Now the bedrock of capital preservation has also come into question as the Federal Reserve’s (Fed) forward guidance on interest rates and balance sheet tapering program stand to put downward pressure on bond prices. Investors now face a reckoning as to what they will expect going forward from their fixed income allocations. While rising interest rate environments weighing on bond prices is not unprecedented, for the past three-plus decades they have been cyclical in nature. The headwinds presently facing the bond market have the potential to be secular, and investors must plan for that eventuality accordingly.

Rather than resigning themselves to lowered expectations, investors can undertake measures to increase the odds of capturing the risk and return characteristics they have come to expect from core fixed income. One step is to recognize the shortcomings of the benchmarks by which many core fixed income strategies are measured. We argue that the distortive effects of accommodative monetary policies are often acutely manifested in these benchmarks. Perhaps paradoxically, the odds of sustaining core-like performance can be increased by untethering oneself from widely used indices and adopting an absolute return approach for a portion of one’s fixed income allocation. Strategies unencumbered by geography or duration, in our view, can serve as a powerful complement to a broader core portfolio containing traditional benchmark-focused strategies.

It’s About Duration

One of the primary drivers of the multi-decade secular bull market for bonds was the steady waning of interest rate risk. Former Fed Chairman Paul Volcker famously “broke the back” of inflation. Later, his successor, Alan Greenspan, spoke of “the great moderation” in reference to the disinflationary effects of a globalizing economy. In the post-crisis era, persistently tepid economic growth kept a lid on inflation, and Fed asset purchases almost guaranteed that yields on U.S. Treasuries would hover near historic lows.

Exhibit 1: Annualized Total Returns of Major Fixed Income Indices

Yields across core fixed income universe lag their longer-term, pre-crisis averages.

Bloomberg Barclays indices shown represent investment grade, fixed-rate debt of the U.S. bond markets described by their names.

One component of the Fed’s extraordinary policy was 2011’s “Operation Twist,” which sought to lower interest rates on longer-dated Treasuries. This not only compressed yields on longer-term U.S. debt, but it also incentivized corporate borrowers to issue longer-tenor securities. As a result, the duration of the Bloomberg Barclays U.S. Aggregate Bond Index (Agg) climbed from 3.7 years at the end of 2008 to as high as 6.2 years in early 2018. Implicit in the term premium – the extra amount of return typically required by investors to compensate them for the additional risk of holding longer-dated securities – of bonds is that some interest rate risk – as measured by duration – is acceptable, as long as one is compensated for it. As seen in Exhibit 2, however, massive Fed asset purchases resulted in the yield-to-worst on the Agg dipping to as low as 1.6% in 2012, and its present reading of 3.6% is still well below the 1997 to 2007 average of 5.6%.

Exhibit 2: Mismatch of Risk and Return in Core Bonds

Core bond yields, represented by the Bloomberg Barclays U.S. Aggregate Bond Index, presently fail to reflect the elevated level of interest rate risk as measured by duration.

Source: Bloomberg Barclays, as of 11/30/2018.

In seeking to meet return objectives in the post-crisis era, some investors increased allocations to high-yield corporate credit and emerging market (EM) debt. More recently, some investors have attempted to generate income by taking on more esoteric exposure, including selling volatility – a strategy aimed to benefit from subdued market swings in bonds as well as other asset classes. The latter strategy had the effect of suppressing volatility across a range of asset classes, thus creating a level of complacency as investors deduced that the historical risk profiles of high-yield credit, EM debt and stocks were not to be feared.

Mind the Inflection Point

Bond investors now face three interrelated potential threats: 1) policy normalization reducing the role of the Fed as the marginal buyer of fixed income securities, 2) fiscal stimulus and a tight labor market increasing inflationary pressures, and 3) higher interest rates drawing investors back to traditional sources of income, resulting in a reversion to historical risk profiles in the asset classes in which volatility was being sold. Each of these factors on its own could lead to a higher probability of capital loss across the fixed income universe; their convergence would likely amplify the risks facing investors.

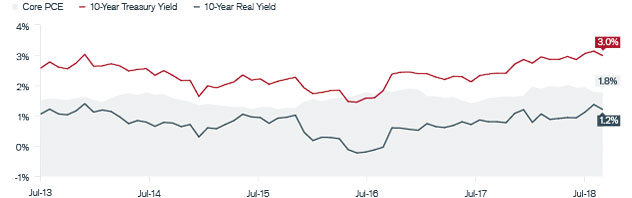

Exhibit 3: 10-year U.S. Treasury Nominal & Real Yields

Although they have emerged from the negative territory of 2016, real yields on the 10-year note still hover near 1%.

Real Yield measured as Yield reduced by Inflation.

Core PCE (Personal Consumption Expenditure Price Index, ex Food and Energy) is a gauge of core inflation.

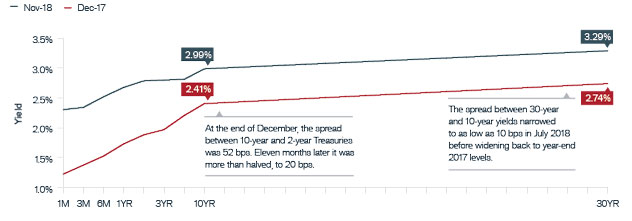

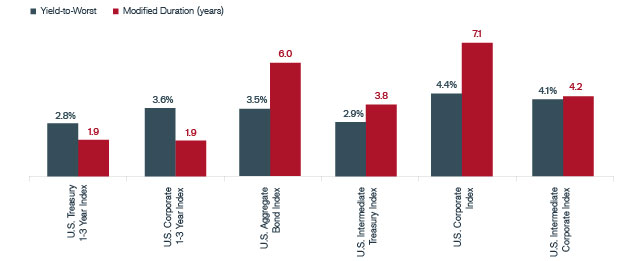

Bond investors who have stuck with strategies based on traditional core benchmarks may be at risk of capital loss. The culprit is the high level of interest rate risk embedded in the Agg. Extended duration – what investors are implicitly exposed to when closely tracking the Agg – does not appear to pay at present. This reality has been magnified by this year’s flattening of the U.S. yield curve. There is little payoff in maintaining duration similar to core benchmarks when the yield on 2-year Treasuries provides 93% of the yield of 10-year Treasuries, as has recently been the case. Put differently, given end-of-November yield levels, it would take a 146 basis point (bps) uptick in interest rates to wipe out the returns of the Bloomberg Barclays U.S. Treasury 1-3 Year Index. A much smaller 75 bps move is all that would be required to negate the yield of the U.S. Intermediate Treasury Index. For the broader Agg, a 59 bps rise in rates would drop returns to zero.

Exhibit 4: Flattening U.S. Treasuries Yield Curve in 2018

Source: Bloomberg, as of 11/30/2018.

Taking Control

Dealing with a post-accommodative world is no longer theoretical. The Fed has raised the federal funds rate eight times during this tightening cycle and has penciled in at least three more increases by the end of 2019. While having slightly more dovish expectations, the futures market is currently pricing in at least two more hikes over the same period. Given this backdrop, in order to increase the odds that a fixed income allocation delivers on its key tenet of capital preservation, investors should consider taking steps to minimize duration risk. One option is lowering one’s reliance on duration-laden benchmarks and incorporating an absolute return strategy into one’s broad fixed income structure.

While a wide-ranging category, what absolute return strategies largely have in common is their focus on generating positive returns – often measured against cash – rather than measuring performance relative to a specific benchmark. In fixed income, that means crafting an investment strategy that incorporates securities not included in established benchmarks such as the Agg. In the current environment, a primary appeal of an absolute return fixed income strategy is minimizing what one cannot control – interest rate risk that is often dictated by monetary policy and economic conditions – and maximizing the factors that one can.

Benchmark-constrained strategies may allow the latitude to deviate from an index’s duration by roughly one year in either direction. That band may be adequate in a world where duration is four years. At six years, however, it is unlikely to sufficiently lower one’s interest rate exposure. For example, investors with an acute focus on capital preservation may want to increase their allocation to shorter-dated securities given the current mismatch between duration and yield in many fixed income market segments. Given the characteristics presently exhibited in the bond market, by allocating toward shorter-dated securities, investors would harvest nearly all of the yield of longer-tenored bonds without taking on their materially higher duration risk.

Exhibit 5: Yield-to-Worst & Duration of Core Bond Market Segments

Duration-laden bonds presently offer de minimis incremental returns for additional level of risk incurred.

Bloomberg Barclays indices shown represent investment grade, fixed-rate debt of the U.S. bond markets described by their names

Going Global

Investors positioning themselves around the confines of the Agg limit themselves to U.S. securities. Given that the Fed is at the forefront of policy normalization, U.S. markets are the most vulnerable to rate increases. In contrast, a global strategy could enable investors to more effectively access securities that meet their preferred risk/return profile from a wider opportunity set, regardless of geography. Individual countries are at different stages of credit and monetary cycles. Advanced economies that maintain accommodative monetary policy relative to their peers and foreign investment-grade companies operating in favorable business environments may offer investors the potential for attractive risk-adjusted returns without nudging them lower in the capital structure or increasing exposure to emerging markets.

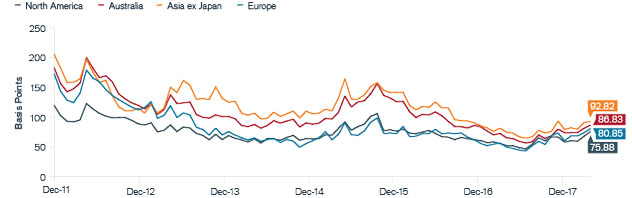

Exhibit 6: Investment-Grade Corporate CDS Spreads by Region

Credit spreads in many international developed markets tend to be wider than those of North America.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality, such as the difference between investment grade bonds and Treasuries.

Regions shown represented by Markit credit default swap (CDS) indices reflecting liquid, primarily investment grade entities in each region that trade in the CDS market.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Given the current abatement in global economic growth, trade-dependent Asia Pacific nations are likely to keep their policy rates on hold for the foreseeable future to support their domestic economies. Developed market sovereigns in this region not only have yields higher than those of European and Japanese counterparts – and in some cases, comparable to those of the U.S. – they are at a lower risk of rising interest rates cutting into returns.

The Pivotal Role of Credit

Another variable that merits greater attention from investors is credit quality within a portfolio. This is especially relevant given the outsized sway that interest rates presently play in determining these securities’ prices. With credit spreads tight by historical standards, bond prices may lack sufficient spread cushion to absorb a pronounced upward move in interest rates. Prudent security selection can help compensate for this. By identifying credits that have visible earnings streams, robust balance sheets and operate in industries with secular tailwinds, a manager may increase their chances of preserving capital while also generating a sufficient level of income. Identifying credits that justify their spreads takes on greater importance within investment-grade credits, as these securities tend to have higher correlations with Treasuries. Similar to sovereigns, the universe of investment-grade corporates outside the U.S. provides ample opportunity for selective managers to identify what they consider sound issuers domiciled in countries with favorable interest rate regimes.

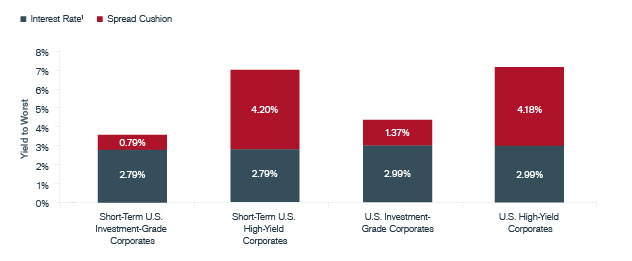

Exhibit 7: Interest-Rate Risk and Spread Cushion of U.S. Corporates

Spreads remain tight by historical standards, and while those of high-yield may look attractive relative to higher-quality issuers, they remain well below their longer-term, pre-crisis average.

Reflects yield-to-worst of the Bloomberg Barclays indices corresponding to each market segment shown. Spread cushion represents the difference between a risk asset’s yield to worst and its underlying risk-free benchmark. In certain cases, the spread cushion can enable investors to absorb potential losses due to an increase in the risk-free rate.

Within rising-rate environments such as in the U.S., investors can seek to identify securities that are less susceptible to higher interest rates. Again, the efficacy of this task stands to rise should investors be able to deviate from the strictures of a benchmark, in the form of securities included in – and weights assigned to segments of – a particular index. There is variation among industries with regard to how far along they are in the credit cycle. Some management teams have made balance sheet resilience a priority, while others have placed rewarding shareholders – often through increased leverage – at the fore. By expanding beyond the confines of the benchmark – in terms of credit quality of issuers and duration of securities – investors can construct a portfolio that aims to better meet their objectives while taking into account the challenges posed by the current market environment.

Limited Alternatives

While spreads in high-yield corporates may look enticing compared to investment-grade issuers, they remain near historic lows. That should merit caution given that the current credit cycle is showing signs of its age. Increasing the risk of drawdowns in high-yield corporates is the distinct possibility of these securities moving in tandem with stocks, a relationship that could be magnified during the later stages of a credit cycle. This risk was on display during October 2018’s equity market sell-off, which also saw spreads on high-yield credits materially widen. Consequently, investors who have sought to compensate for low yields in core bonds by increasing allocations to lower-quality issuers may need to rethink their strategy.

Looking Forward

The global economy has moved from a story of convergence to one of uncertainty. The benefits of fiscal stimulus in the U.S. may be negated by rising trade barriers. While the Fed has seemingly committed to additional rate increases and balance sheet reduction, European Central Bank President Mario Draghi has struck a more dovish tone, stating that eurozone rate hikes will be on hold through at least the summer of 2019. The yet-to-be determined final structure of Brexit casts a shadow over the UK economy.

If a breakout in growth and return of inflation results in an upward lurch in interest rates, absolute return strategies structured to avoid markets with the highest duration risk stand to give investors a greater chance of preserving capital and generating a moderate level of return. Should global growth slow or geopolitical risks increase, a globally diverse absolute return strategy could serve as a suitable complement to higher-duration core strategies by increasing diversification across tenors, regions, and – in some cases – sectors of the global fixed income universe.

The preponderance of signals suggests that interest rates in most regions are likely to move higher as central banks seek to normalize monetary policies. While not guaranteeing capital losses, a rising rate environment does create headwinds for many fixed income strategies. Income generation is likely to play a greater role in determining overall bond returns. Consequently, the ability to construct a bond portfolio incorporating securities able to consistently generate income and having sufficient yield cushions to counteract rising rates should be central to a strategy seeking to deliver positive returns. Incorporating an absolute return mindset into a broader fixed income structure stands to maximize this process while also taking steps in lessening exposure to the duration risk that is growing more prevalent in much of the world.

- U.S. Generic Govt 2 Year Yield used for short-term rate, U.S. Generic Govt 10 Year Yield used for long-term rate. Yield to Worst is the lowest potential yield an investor would earn – accounting for all provisions – short of a security defaulting. Modified Duration measures a bond’s sensitivity to interest rates, with a higher number, measured in years, being more sensitive.