After being unloved for some time, ASEAN countries look to be making a comeback. In this article, we explore some of the reasons why ASEAN markets might be better placed to deal with some of the challenges dominating the current market environment.

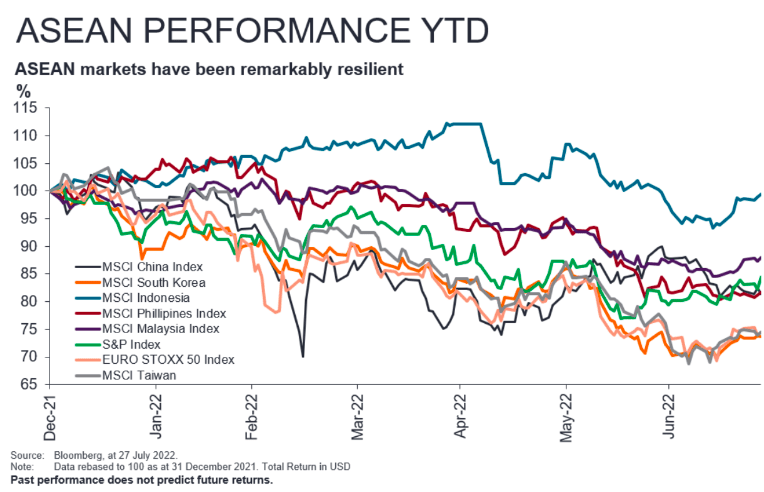

During 2020/21 – which now feels like a long time ago given the events in 2022 -we saw North Asian countries such as China, Taiwan and South Korea perform strongly. This was primarily due to the rally in tech stocks as people adapted to working from home and as demand for tech goods and services rose. In addition, these countries quickly implemented Covid-19 restrictions and vaccine programmes – meaning the socio-economic impact of the pandemic was mitigated (to an extent),and normal-ish life resumed.

Meanwhile, their ASEAN counterparts struggled as governments struggled to contain the virus leading to severe economic disruptions and slower growth. These countries also consist of contact-intensive sectors that were severely impacted by lockdown restrictions, e.g., manufacturing, agriculture, and tourism. This divergence in performance created a North/South divide – which we discussed in our previous article.

Though uncertainty remains and investors continue to sift through a laundry list of concerns-ASEAN countries, in our view, look better positioned to deal with some of the challenges. It’s important to mention here that though we have added to our exposure to Indonesia, we have modest weighting to ASEAN with zero exposure to Malaysia, the Philippines, and the one stock in Thailand. However, the regional dynamics at play cannot be ignored because they could potentially shift the opportunity set for investors.

Long-awaited post-Covid recovery

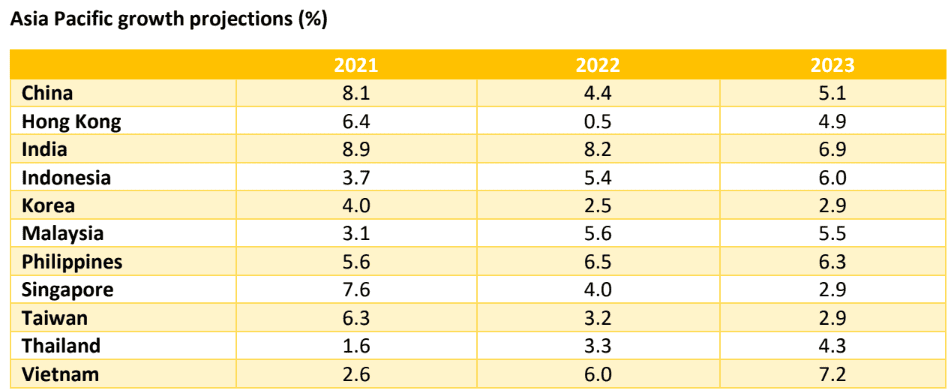

The first is the region’s growth outlook compared to other parts of the world. After struggling in 2020/21, the growth prospects for ASEAN countries have improved as economic reopening,and the relaxation of social distancing measures have provided a tailwind for domestic demand and services. In addition, governments in these countries have also relaxed international border restrictions,and quarantine-free travel is now allowed for fully vaccinated visitors in most countries.

As a result, mobility indicators have picked up. For example,in Thailand -a country heavily dependent on tourism -it’s estimated that tourist arrivals will reach 32% of pre-covid levels in 2022 and 65% of pre-covid levels in 2023.4 Due to this combination of factors, we’ve seen growth projections for countries like Indonesia, Philippines, Vietnam,Thailand,and Malaysia upwardly revised as investors tap into the long-awaited post-Covid-19 recovery following anaemic growth in 2020/21 (see chart below).

Source: IMF World Economic Outlook Database, April 2022

Source: IMF World Economic Outlook Database, April 2022

Note: Real GDP growth

The inflation/stagflation conundrum

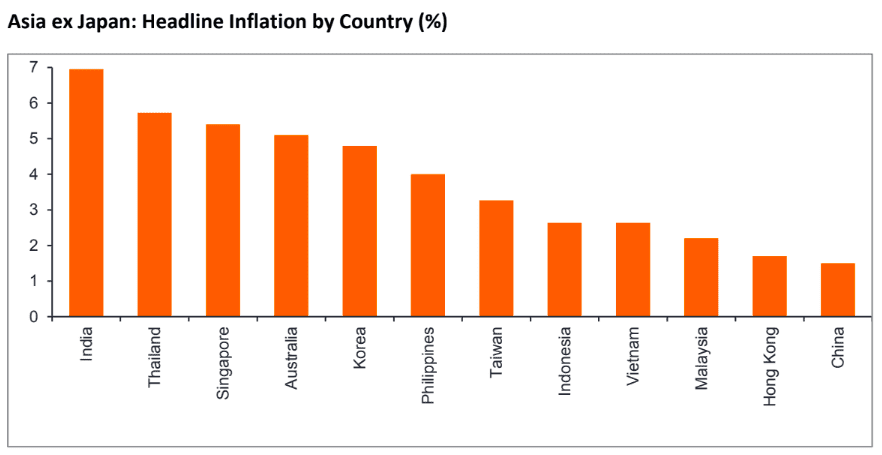

The second is low inflation and the reduced risk of stagflation, which many market commentators have discussed. Inflation across the Asia Pacific region has generally been lower than in other Developed markets: a more gradual reopening has led to fewer demand shocks compared to the West. Therefore, countries and businesses in the region have not experienced the massive surge in demand and big switch from services to goods experienced elsewhere that has found capacity insufficient.

It’s also crucial to look at the underlying drivers of inflation and their impact. For example,house price and wage inflation -high in other parts of the world -haven’t been much of a factor in ASEAN countries. In addition, rising food, fuel, and commodity prices, which have severely impacted some economies, have been beneficial to commodity-exporting countries such as Indonesia, Malaysia,and Thailand.

Source: Trading economics, data as at March2022. Vietnam and SouthKorea, at April 2022.

Though inflation will likely go up given the strength in commodity prices, it will be from a much lower base relative to developed markets. In addition, governments in ASEAN countries have put measures in place to mitigate the impact of rising global commodity prices. For example, Indonesia has price ceilings on retail packaged and bulk sales of cooking oil, whilst the Philippines has targeted discounts and subsidies for farmers,fishers and public utility vehicle drivers. Meanwhile, Taiwan and Thailand both have temporary cuts to fuel prices to offset increases in retail diesel prices -a move that could soften the shock of inflation.

Another hot topic is stagflation. This is particularly acute in Europe,where we are seeing slowing growth as the cost-of-living crisis intensifies, whilst inflation continues to grind higher. In Asia, however, the risk of stagflation appears much lower. Six of the biggest ASEAN economies are growing at a rate faster than inflation, with growth underpinned by the benefits of economic reopening.

Supply chain disruptions

The third is supply chain disruptions. ASEAN countries have also been relatively insulated from some of the supply chain disruptions that have been a headwind to other markets. Though supply chain issues may originate in Asia, the ramifications of global shortages have been felt downstream and away from Asia. Therefore, companies in the region haven’t experienced the same logistics and transportation issues that some companies in developed markets are grappling with. Freight costs, for example, have been much more pronounced between Asia to the US and Asia to Europe than Asia to Asia or US/Europe to Asia.

Countries like Indonesia, India and the Philippines are also less exposed to the spill over risks from the global slowdown in demand from China/Europe as their exports to these regions represent a small proportion of their GDP.If anything, these supply chain disruptions might benefit some ASEAN countries as companies look to diversify their supply away from China. While the pandemic was a wake-up call for many companies, rising wages and tariffs (US-China trade war) have long been catalysts of this great migration.

1Source: Bloomberg, as at 25th July 2022

2Source: Bloomberg as at 03/08/22

3Source: Bloomberg as at 22/06/22 – performance is noted from their respective pandemic highs

4Source: CEIC, Haver, Morgan Stanley Research, as at 10th May 2022