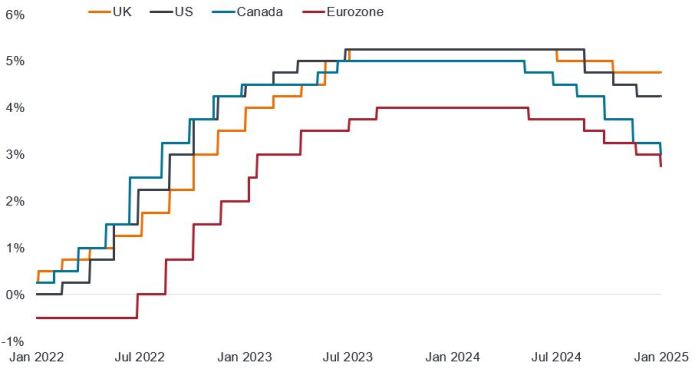

The final week of January has been a busy week for central bank decisions and communication albeit with no surprises. The US Federal Reserve opted to stand still while it assesses the prospect for inflation, while the Bank of Canada shaved another 25 basis points (bps) off its policy rate to 3%. The latter expected inflation to be around its 2% target over the next two years. It noted that business investment remains weak even as household activity perks up but conceded that the resilience of Canada’s economy could be tested if it faced significant tariffs.

Policy interest rates in major developed markets

Source: LSEG Datastream, UK = Bank of England Bank rate, US = Federal Reserve Fed Funds Target Rate (lower bound), Canada = Bank of Canada overnight policy rate, Eurozone = ECB deposit rate (January rate cut takes effect 5 February), 31 January 2022 to 30 January 2025

As regards the European Central Bank (ECB) there were no surprises as there was an element of autopilot to its decision to reduce interest rates. The cut of 25bp takes its key deposit rate down to 2.75% and a further cut in March to 2.5% feels relatively baked in. Once at this level there will likely be a raging debate between doves and hawks on the pace of further cuts. ECB President Lagarde mentioned in the December 2024 press conference that neutral was estimated to be 1.75% to 2.5%, so you can see why this debate will surface at those levels.

Lagarde expressed a high degree of confidence in the disinflation process. In her words “monetary policy remains restrictive”. Growth headwinds remain but they expect (or hope) for a pick-up driven by consumers seeing rising real wages (although that did not happen last year).

Putting it in context

The bigger picture issue for all central banks (excluding UK) in Q1 2025 will be the degree to which core inflation (which excludes volatile items such as food and energy) takes another leg down, driven by lagging/sticky services inflation. The reason that Q1 is so important for this is because services businesses disproportionately set prices in January for the full year. In the last two years, we have witnessed high services prices in this annual price setting on the back of 5%+ headline inflation the year before. As of this January, the US and Europe will see previous year prices running at approximately 2.5%.

A step down in the January pricing of services will be an important missing element in the final phases of disinflation, squeezing core inflation into the low-to-mid 2% from high 2% today. The base effects of high prices last year make a decline in year-on-year inflation rates an easier bar to meet. Progress on wages and rent inflation has already fallen into place so this is the final hurdle for most central banks.

UK as an outlier

The UK remains the outlier on all of these measures of progress: wages remain elevated with another 7% rise in the National Living wage in April 2025; a new inflation shock in the form of the recent tax rises on employers; and another round of regulated price increases (water, rail, private school fees). The starting point for core CPI (3.2% for the 12 months to December 2024) in the UK remains an international outlier before these new shocks hit.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Basis points: Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%, 100bps = 1%.

Doves: This describes policymakers who are inclined to loosen monetary policy, i.e. lean towards cutting interest rates to stimulate the economy. The opposite of hawks which describes policymakers who are more inclined to raise interest rates to curb inflation.

Disinflation: A fall in the rate of inflation.

Inflation: The rate at which prices of goods and services are rising in the economy. The Consumer Price Index is a measure of inflation that examines the price change of a basket of consumer goods and services over time. Core Inflation are price indices that exclude volatile items, typically food and energy.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary stimulus or loosening refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.