It is impossible to contextualize this week’s Federal Reserve (Fed) decision without acknowledging the results of the U.S. election. Monetary policy and interest rates were already at an inflection point as Fed officials backed away from a restrictive stance and – along with market participants – attempted to decipher what a new rate regime would look like. As we will discuss later, that is where the ramifications of a second Trump administration are most likely to be felt.

Pulling back ever so slightly

The market correctly anticipated this week’s 25 basis-point (bps) reduction in the federal funds rate, and we believe prognosticators are spot on with expectations for another 25 bps cut in December. This pace is in line with the trajectory expressed by the Fed’s September internal survey and slightly above what forward-looking markets had then expected. Causing the Fed to revisit its earlier planned path are continued economic strength and a resilient labor market – while also taking into account noise associated with recent storms and a labor strike.

Easing inflation – and expectations for that to continue – gave the Fed leeway in cutting rates by 50 bps in September to address a labor market that was showing signs of softening at the margins. In contrast, some of the dovish wording from the Fed’s September statement was absent, replaced with the more cautionary “has made progress” and “somewhat elevated” qualifiers when addressing inflation. We interpret this as a nod not only to the welcome extension of the economic cycle but also the introduction of greater uncertainty for 2025 around the priorities of the incoming Trump administration.

Largely left unsaid, but a question investors cannot ignore, is how a shift in trade policy, regulation, and the approach toward fiscal deficits will impact economic growth, inflation expectations and, ultimately, the appropriate neutral rate of monetary policy.

With growth comes inflation?

By cutting rates 25 bps, the Fed has signaled that, for the time being, policy rates remain restrictive, and it has the latitude to reduce rates to support the late-cycle economy. Data bear this out, as an upper bound of 4.75% on the fed funds rate remains well above core inflation of 2.7% as measured by the Fed’s favored gauge.

Presuming November’s employment report will adjust for the dislocations caused by the hurricanes, steady jobs growth has provided the Fed cover to be even more circumspect in reducing rates until it gains greater clarity on how the economy may respond to Trump’s agenda.

The market has already calibrated its expectations, with the implied 10-year inflation projections embedded in Treasury markets rising to as high as 2.45% in the wake of the election, well above the September low of 2.03%. Similarly, futures markets have taken nearly 100 bps of cuts off the table by mid-2025 compared to what was expected only two months ago – a development that hints at inflation not yet being dead and buried.

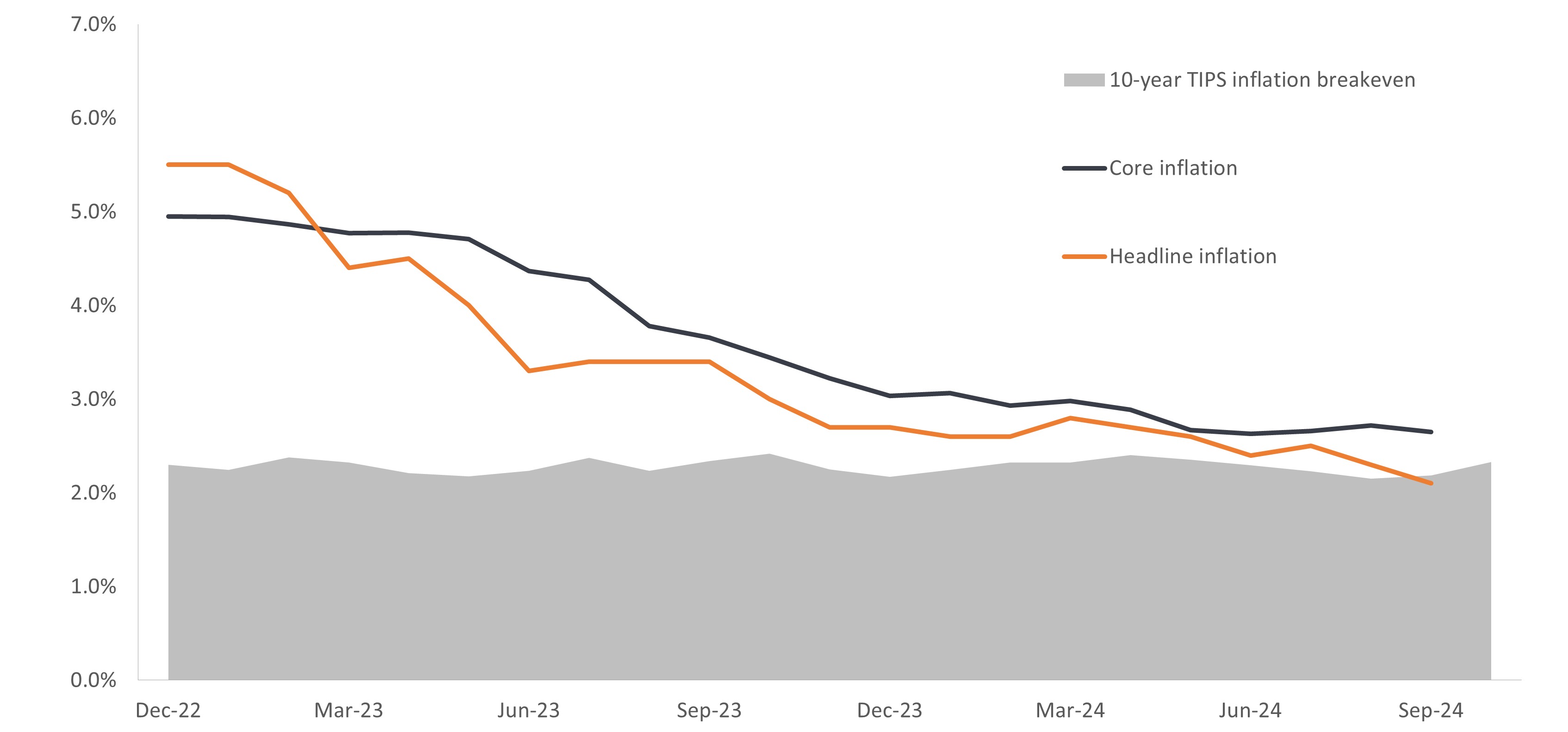

Exhibit 1: U.S. Inflation

While inflation has progressed toward the Fed’s 2.0% objective, the implied 10-year inflation average as measured by Treasury Inflation Protected Securities (TIPS) has nudged higher as the market positioned itself for a pro-growth “Trump Trade.”

Source: Bloomberg, as of 7 November 2024.

Not blurring the policy lines

Given rhetoric by Trump throughout his previous administration and during the campaign, questions have simmered about the sanctity of Fed independence. We believe protections are in place to ensure the Fed can pursue its statutory goals, unencumbered by the administration’s priorities. Still, Trump may leave his impression on the central bank by nominating and retaining members. We can expect jawboning around this topic to continue, but as was the case in his previous administration, such episodes would, in our view, largely be theatrics.

More germane to investors is economic policy, namely the administration’s approach to trade, industrial policy, and deficit spending. The first two have implications for price stability insofar as they could impede the free flow of goods and price discovery. To be seen is the degree to which talk of across-the-board tariffs are merely negotiating tactics.

With respect to deficits, the U.S. government has a well-earned reputation of being fiscally profligate. Increased productivity, however, could lead to economic growth sufficient to put potentially unsustainable deficits on a more manageable path. And as long as economic growth remains higher than the cost of capital, the market may prove surprisingly tolerant of persistent deficits. Yet there is a level that could ultimately be a red line for investors, and once that’s been crossed, a fierce market reaction would be hard to control.

Investment implications: The yield curve

Investors need to interpret this week’s political and policy developments through multiple lenses. The first is near term and is driven by contemporaneous data. The so-called Trump Trade has already resulted in higher bond yields across the curve. The shorter-dated maturities more closely tethered to policy rates may remain within their new – slightly more elevated – range as the Fed keeps a closer eye on inflation. As the longer end of the curve is largely dictated by economic and inflation expectations, we expect volatility to continue as investors seek more direction on the administration’s agenda. This section of the curve has also likely reset in a higher range.

Exhibit 2: U.S. Treasuries Curve

Not only has the inversion of the U.S. Treasuries yield curve ceased, but yields on all maturities have reset to a higher range as the market anticipates a new rate regime and possibly more inflation-driven risk on longer-dated tenors.

Source: Bloomberg, as of 7 November 2024.

Only in September did the yield on the 10-year Treasury climb above that of the 2-year note. Still, at roughly 12 bps, the spread between these two maturities is a fraction of its long-term average of roughly 100 bps. This lack of term premium, coupled with economic and policy uncertainty, makes capturing this incremental yield a dubious proposition in light of what we expect to be a still-volatile market.

Investment implications: Global opportunity set

A new U.S. economic regime would not occur in a vacuum. Already European central banks are leaning into rate cuts to support sputtering economies. More growth-friendly U.S. policy would only exacerbate this differential. The accompanying higher U.S. rate regime – potentially due to both higher levels of real economic growth and inflation – would be a drag on both advanced and emerging market currencies as investment flows shifted toward the U.S. The opportunities and risks presented by this divergence reinforces the need to have a global mindset when allocating capital within bond markets over the mid-term.

An economic plan prioritizing growth should be a boon to riskier assets. While equities may be the main beneficiaries, there will be winners in the bond market as well. High-yield borrowers should feel less compelled to deleverage as their ability to generate revenue improves. We are slightly more neutral on investment-grade issuance, given current valuations and their greater sensitivity to interest rate volatility.

Securitized credit has the potential to outperform as economic strength could raise the value of their underlying assets. And as policy and growth diverges across jurisdictions, investors have the potential to unearth opportunities in regions with falling rates and where credit valuations appear more attractive.

Learning its lesson

In conclusion, we believe the path of U.S. monetary policy will be both data dependent and (government) policy independent. Implicit in this, however, is that the latter will ultimately guide the former. Chairman Jay Powell and any eventual successor will have to weigh when and how current conditions will be impacted by the administration’s priorities. Should full-throated, pro-growth, and potentially inflationary (in the form of punitive tariffs) initiatives be championed, the Fed is likely to become more accepting of a higher terminal rate for this cycle, with the aim of avoiding its post-pandemic miscalculation.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Core inflation is a measure of inflation that excludes volatile price components like food and energy.

High yield: A bond with a lower credit rating than an investment grade bond, also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Late cycle: a stage of the economic cycle where growth slows as the economy reaches its full potential, wages start to rise and inflation begins to pick up, leading to lower demand, falling corporate earnings and eventually recession.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Stimulus or dovish policy refers to a central bank increasing the supply of money and lowering borrowing costs.

Neutral rate/terminal rate: Economists refer to the neutral rate as the terminal interest rate where prices are stable and full employment is achieved. In other words, it is a natural interest rate that is neither accommodative nor restrictive, and as such is regarded as an equilibrium rate.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Treasuries/U.S. Treasury securities: Debt obligations issued by the US government. With government bonds, the investor is a creditor of the government. Treasury Bills and US Government Bonds are guaranteed by the full faith and credit of the United States government. They are generally considered to be free of credit risk and typically carry lower yields than other securities.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities, commonly used as an indicator of investors’ expectations about a country’s economic direction.

Important information

Fixed income securities are subject to interest rate, inflation, credit and default risk. As interest rates rise, bond prices usually fall, and vice versa. High-yield bonds, or “junk” bonds, involve a greater risk of default and price volatility. Foreign (ex U.S.) securities, including sovereign debt, are subject to currency fluctuations, political and economic uncertainty and increased volatility and lower liquidity, all of which are magnified in emerging markets.