May’s private nonfarm payrolls (NFP) came in significantly above expectations, rising 272,000 from April’s 175,000, with unemployment ticking up to 4.0%. While the jobs number may appear strong on the surface, there is some devil in the detail.

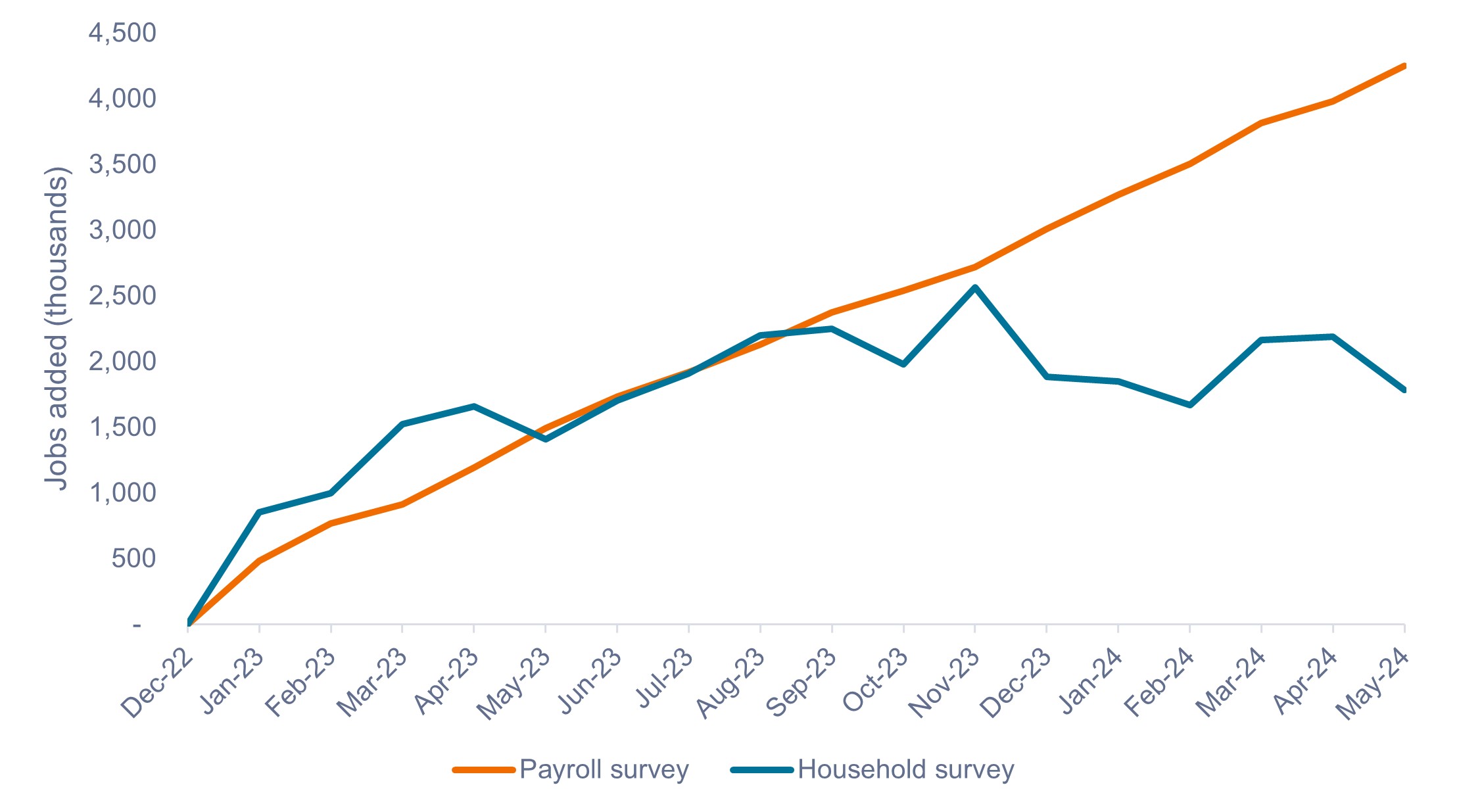

A significant dichotomy exists between the Bureau of Labor Statistics (BLS) NFP number (which is based on the payroll survey and counts the number of jobs) at +272,000 and the household survey number (which counts the number of people employed), which showed a loss of 408,000 jobs. The NFP number (payroll survey) drives the unemployment rate.

Over the past year, these two measures of employment have diverged by over 2 million jobs, as shown in Exhibit 1. Suffice to say, the household survey paints a picture of a weaker jobs market than the payroll survey. Therefore, we would expect downward revisions to the NFP numbers in the months ahead, with a corresponding rise in the unemployment rate.

Exhibit 1: Different surveys paint a different picture of U.S. employment

BLS payroll survey vs. household survey (Jan 2023 – May 2024)

Source: Bureau of Labor Statistics, as of 7 June 2024.

Source: Bureau of Labor Statistics, as of 7 June 2024.

Meanwhile, the path of central bank easing has started, although it has not been uniform. While the Federal Reserve (Fed) maintains its holding pattern, the Bank of Canada was the first of the G7 to cut rates on June 5, with the European Central Bank (ECB) following suit on June 6. This divergence in central bank policy is not unexpected, as guidance began to diverge earlier this year with less-sticky inflation globally compared to the U.S.

How to interpret the data release?

We believe the data suggest the economy is slowly slowing, with higher rates starting to filter through to businesses and consumers. With much of the recent data coming in softer than forecasted, the prospect for Fed rate cuts have increased.

Expectations for rate cuts in 2024 remain tempered from the seven that were priced into futures markets in January to just one or two at present. We believe the Fed does want to cut this year, but a cut is more likely to happen in September, or possibly even later.

Further, when the central bank does cut, we do not think it will kick off a consistent hiking cycle with a cut at each subsequent meeting. Rather, it is more likely the Fed will remain data dependent and revert to a less-frequent cadence, such as every other meeting.

In our view, this future cadence of rate cuts is perhaps more important than whether the Fed begins cutting in September or later.

What might the effect be on the yield curve?

An eventual easing cycle is unlikely to normalize the yield curve overnight. A deeply inverted yield curve may take quarters, if not years, to right itself. We think Fed cuts could bring yields on the front end of the yield curve (short-term maturities) down, while yields on longer-maturity bonds may remain elevated, with room to tick up modestly if U.S. inflation remains sticky.

It is important to remember that while investors got comfortable with zero-interest rate policy (ZIRP) over recent years, a yield of around 4% on 5-year and 10-year U.S. Treasuries is not far from fair value, in our view. We expect intermediate- and long-term yields could remain at similar levels while the front end of the curve adjusts downward on rate cuts.

How might investors respond?

With an inverted yield curve and the expectation that rates in the U.S. will remain elevated for longer, investors are being compensated attractively on the front end of the yield curve.

We believe this presents a unique opportunity to capture attractive yields from bonds with low interest-rate risk, such as in higher-yielding corporate and securitized fixed income, or in AAA collateralized loan obligations (CLO), which have exhibited very high credit quality and ultrashort duration due to their floating-rate coupons.

In our view, opportunity also exists for capital appreciation from longer-dated bonds, such as in agency mortgage-backed securities (MBS). MBS have historically outperformed when the yield curve normalizes or steepens.

We believe investors should remain aligned to their long-term goals by allocating across a well-diversified fixed income portfolio with a balance of interest rate and credit spread risk, while also looking to capture additional unique opportunities for higher income from short-duration bonds.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

IMPORTANT INFORMATION

Bond prices generally move in the opposite direction of interest rates, thus bond prices may decline as interest rates rise, and vice versa.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

The G7 (Group of Seven) is an intergovernmental political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Interest rate movements will affect a fund’s share price and yield.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.