September 2020

Portfolio protection in a world of radical uncertainty

-

Mark Richardson, DPhil

Mark Richardson, DPhil

Portfolio Manager

Key takeaways

- Left-tail events occur substantially more frequently than one might expect. We believe that we should be looking to hedge risk for our clients over all timeframes. The question is how to achieve this, while minimizing costs.

- It is possible to identify certain core characteristics of past crises to help build an approximate map of what a credible diversified protection strategy might look like.

- The power of a well-constructed protection strategy lies in the judicious combination of different protective prongs, allocating to each of them in such a way that acknowledges the existence of radical uncertainty.

Tail-risks are by their nature difficult, or even impossible, to anticipate. Were that not the case, the obvious remedy would simply be to de-risk ahead of the expected event that by assumption you know with a high degree of confidence is coming. Though some risk events are potentially foreseeable in advance (market risk around scheduled elections, for instance) the most significant ones, in terms of their impact on portfolios, tend to be those that for all practical purposes are unforeseeable. The COVID-19 crash in early 2020 may well become a literal textbook example of this.

We begin from the assertion that the world is rife with radical uncertainty[1]. Indeed, we see that the quantity of unforeseeable risk is sufficiently large that not hedging is simply not a viable option. Our main goal in constructing a ‘protection’ strategy is with reference to this set of unforeseeable risks. A recognition of this fact suggests that any reasonable risk mitigation programme thus requires some sort of protective capacity to be in play at all times. The key question then becomes how to do this.

No two crises are exactly alike or play out in the same way. Nevertheless, it is possible to identify certain core characteristics shared by many past stress events in order to build an approximate map of what a credible diversified protection strategy might look like. This framework has led us to the view that a sensible way to go about implementing real-world protection involves assembling a suite of strategies tuned for systematic resilience against both short-term sharp sell-offs and more protracted longer-term risk-off environments.

There are three key tools within our diversified alternatives toolset available for deployment in a protection strategy: ‘Long Volatility’, ‘Trend’ and ‘Discretionary Macro’. The first two are fully systematic and ‘always on’, whereas the third is (as the name suggests) discretionary and operates by identifying ex-ante visible macro catalysts, looking for opportunities to buy under-priced convexity.

Long Volatility is deployed by establishing a position in equity index put options. Such trades are generally expensive to run and the key is finding a way to minimise the carry without damaging the payoff potential in a crisis. Option convexity of this sort performed exceptionally well in risk events past such as Black Monday in October 1987 and the 2008 Global Financial Crisis (GFC). They may be characteristically well suited to benefit from the appearance of market ‘gaps’, such as in October ‘87 and, much more recently, the series of extremely volatile days observed in March 2020.

‘Trend’ strategies work by establishing time-series momentum exposures across asset classes, implemented via global futures. Defensive variants of such strategies tend towards having relatively short-dated signal windows, resulting in a higher level of reactivity to abrupt trend reversals. Trend can generally be expected to perform well as a hedge during periods of sustained drawdown, such as in the GFC.

Discretionary Macro trading relies upon insight into global macroeconomic events and trends, and their specific implications for risk assets (typically equities, bonds, currencies and commodities). Once a catalyst or theme has been identified, the task is to identify a likely expression vehicle and purchase convexity on that asset for a price below perception of what the fair value is. To give a concrete example: a Sterling put purchased several months ahead of the Brexit referendum could have been obtained at very low cost on account of the general perception at the time that the probability of Brexit occurring was very low. But in order to make this trade one would have first required a view that the market was incorrectly pricing the risk.

With respect to March 2020, the sell-off was characterised by extreme levels of realised volatility, entailing multiple days of super-normal equity downside moves. Long Volatility is set up to capture these effects in the form of Gamma (the capture of realised volatility) and Vega (the capture of surging option prices).

In general, the power of a well-constructed protection strategy lies in the judicious combination of different protective prongs, allocating to each of them in such a way that acknowledges the existence of radical uncertainty. As discussed above, this typically involves making an allocation to each component. The trick is to do so in such a way that reflects the current ‘pricing’ of each of the components. For example, in the several years prior to 2020, option prices had been compressed to very low levels by a variety of factors (the existence of the short-volatility complex, for instance). This made it much more attractive to attach a substantial weighting to Long Volatility on account of the low ex-ante cost.

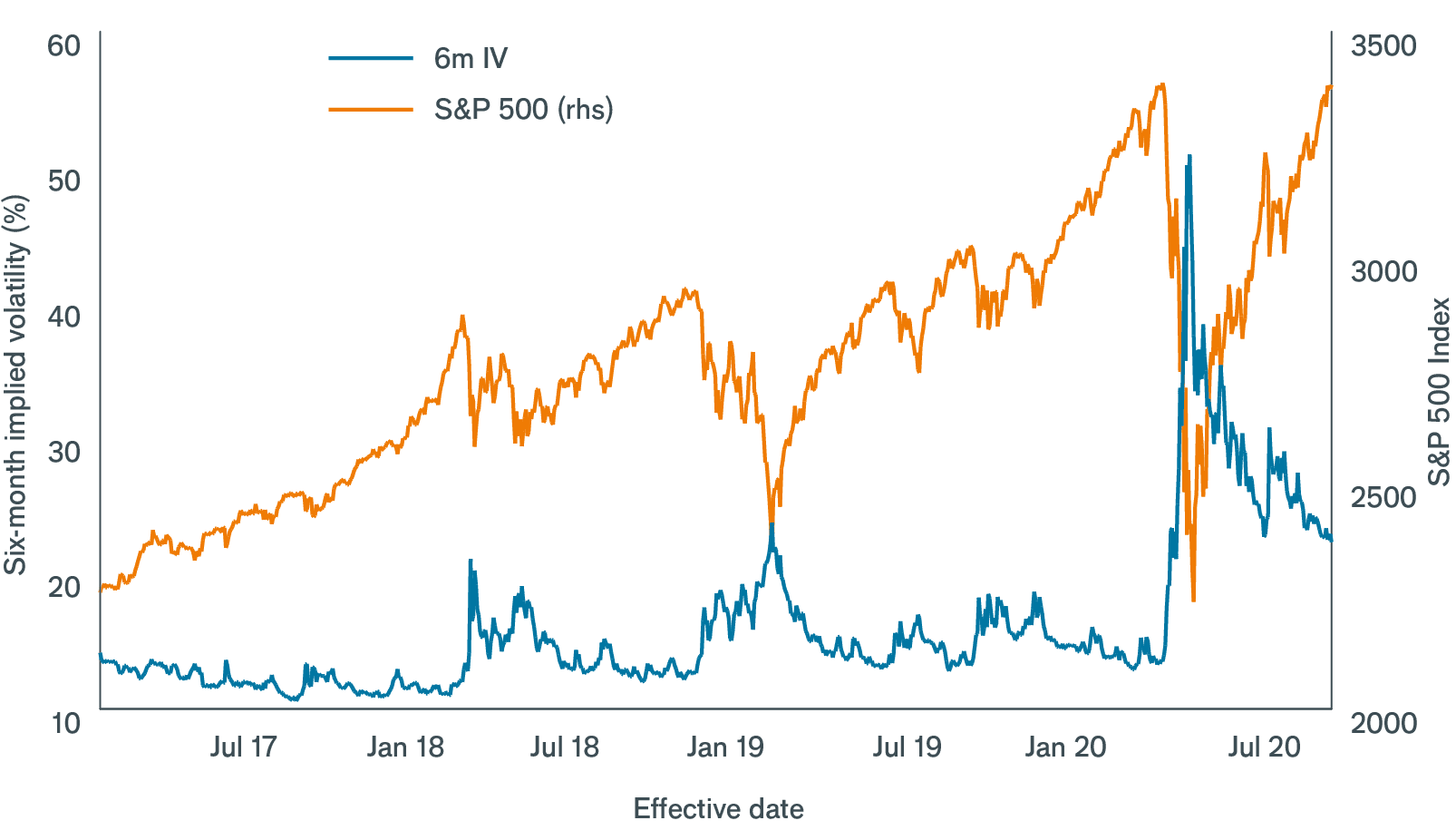

Following the events of 2020, although equity markets have recovered much of their lost ground, option prices – as measured by implied volatility – remain very high (see Exhibit 1). This suggests that in the short term, Long Volatility requires a lesser weighting within a protection strategy, and that other approaches need to move into focus.

EXHIBIT 1: OPTION PRICES REMAIN VERY HIGH

Source: Bloomberg, Janus Henderson Investors, 3 January 2017 to 17 August 2020 6mIV = 6 month implied volatility. Past performance is not a guide to future performance.

Aside from the potential to generate positive returns during periods of market stress, investors that implement protection strategies may also benefit from the second-order effect of being able to access opportunities in distressed environments by virtue of capital that has been returned to them from the protective strategy. This is important because such opportunities typically do not exist in abundance in normal times.

The positive features of a protection strategy may not always be visible on shorter timescales. Since the nature of tail events is that they are exceptional, the temptation remains for some risk-on investment vehicles to consider protection strategies unnecessary. In truth, however, left-tail events occur substantially more frequently than many expect. From a fiduciary perspective, we believe that we should be hedging risk for our clients over all timeframes. If we are going to do that, the question shifts to how to achieve this, while minimising costs.

[1] Mervyn King and John Kay, ‘Radical Uncertainty: Decision-Making Beyond the Numbers’. 2020.

ALTERNATIVEPERSPECTIVES Explore more

More Alternative Perspectives

PREVIOUS ARTICLE

Bond/equity correlation: how to hedge the free lunch

The relationship between equities and bonds is a central tenet of modern market behaviour. In this article, Portfolio Manager Natasha Sibley considers whether investors should continue to take this easy source of diversification for granted.

NEXT ARTICLE

A new tactical addition to portfolio protection

How can we mitigate some of the challenges associated with systematic ‘strategies that are ‘always on’? In this article, Portfolio Managers Andrew Kaleel and Maya Perone discuss the new Tail hedge strategy and how it can be used to address some of these challenges.