“Lagged beta” implies some private investments and their public counterparts might not be as different as they first seem. At times, much of the perceived private vs. public performance differential might be explained simply by differences in timing, liquidity, and accounting.

With public REITs currently showing a historically large performance differential compared to private real estate (i.e., net asset value, or NAV, discount), it’s crucial for any private real estate investor to understand the reason behind this differential and what seem to be clear-cut implications for forward-looking performance expectations.

Similar assets, different price timing: The driver of lagged beta

As discussed by the Janus Henderson Global Property Equities team in their excellent article, Private vs. listed property pricing disconnect signals opportunities, under the section, “Same assets, different prices”:

We believe what we are witnessing is a real time, very extreme, example of private valuation lag. Listed [public] REITs are traded daily, as such they tend to ‘price in’ new information like higher interest rates and recession risk in a matter of days or weeks. In contrast, there is no third-party market for private real estate funds, and the managers of these funds instead rely on appraisals and desktop analysis to report a valuation to their investors on a monthly or quarterly basis.

Among their points is that many pricing discrepancies between public REITs and private real estate are not due to a difference in fund composition, but instead simply due to the private real estate markets’ slow pricing processes unfolding over the course of quarters or years compared to the daily pricing of public REITs.

To externally verify this sentiment, consider this study by Alexander D. Beath, Ph.D. & Chris Flynn, CFA, “Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States, 1998 – 2019”:

Exhibit 1: Public REITs vs private real estate have a 0.84 correlation after adjusting for reporting lag

Annual returns for public REITs and private real estate, 1998-2018 (adjusted for private real estate’s reporting lag)

Alexander D. Beath, Ph.D. & Chris Flynn, CFA, “Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States, 1998-2018” (October 2019).

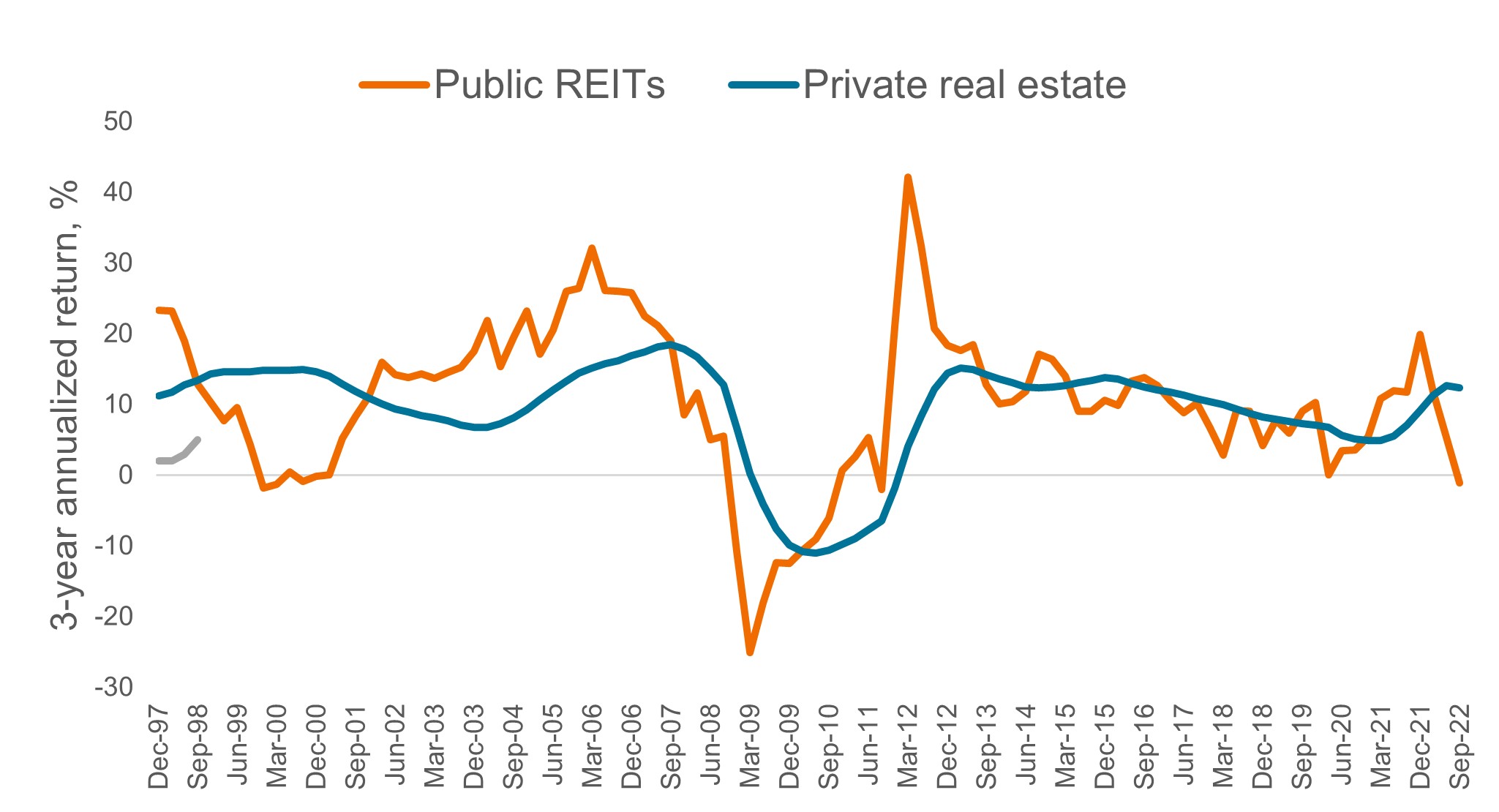

Our own analysis of public vs. private real estate index data is another illustration of how public REITs and private real estate are two seemingly different universes that converge after adjusting for timing. First, to show a general comparison of public vs. private real estate indices, below is the rolling 3-year annualized return for public and private real estate since 1995. This is broadly representative of the performance differential between public and private estate returns, as experienced by medium-term investors (Exhibit 2).

Exhibit 2: Over time, public vs. private real estate indices diverge

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, Private REITs: NCREIF Fund ODCE, January 1, 1995-September 30, 2022.

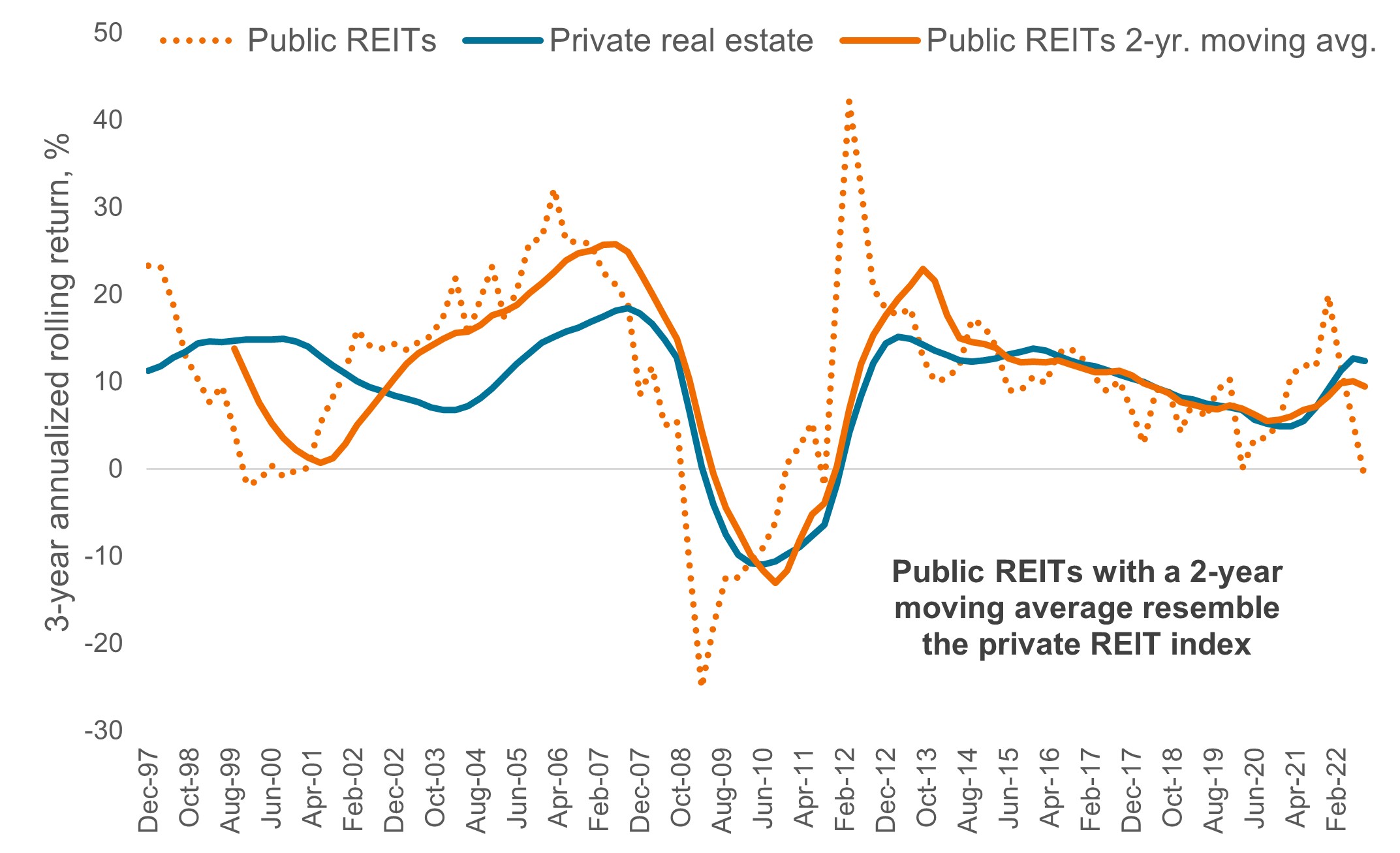

Next, a simple two-year moving average applied to the public index illustrates that much of the apparent divergence is accounted for by the aforementioned slow pricing processes of private real estate.

Exhibit 3: Adjusted for time, public vs. private real estate indices converge

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, Private real estate: NCREIF Fund ODCE, January 1, 1995-September 30, 2022.

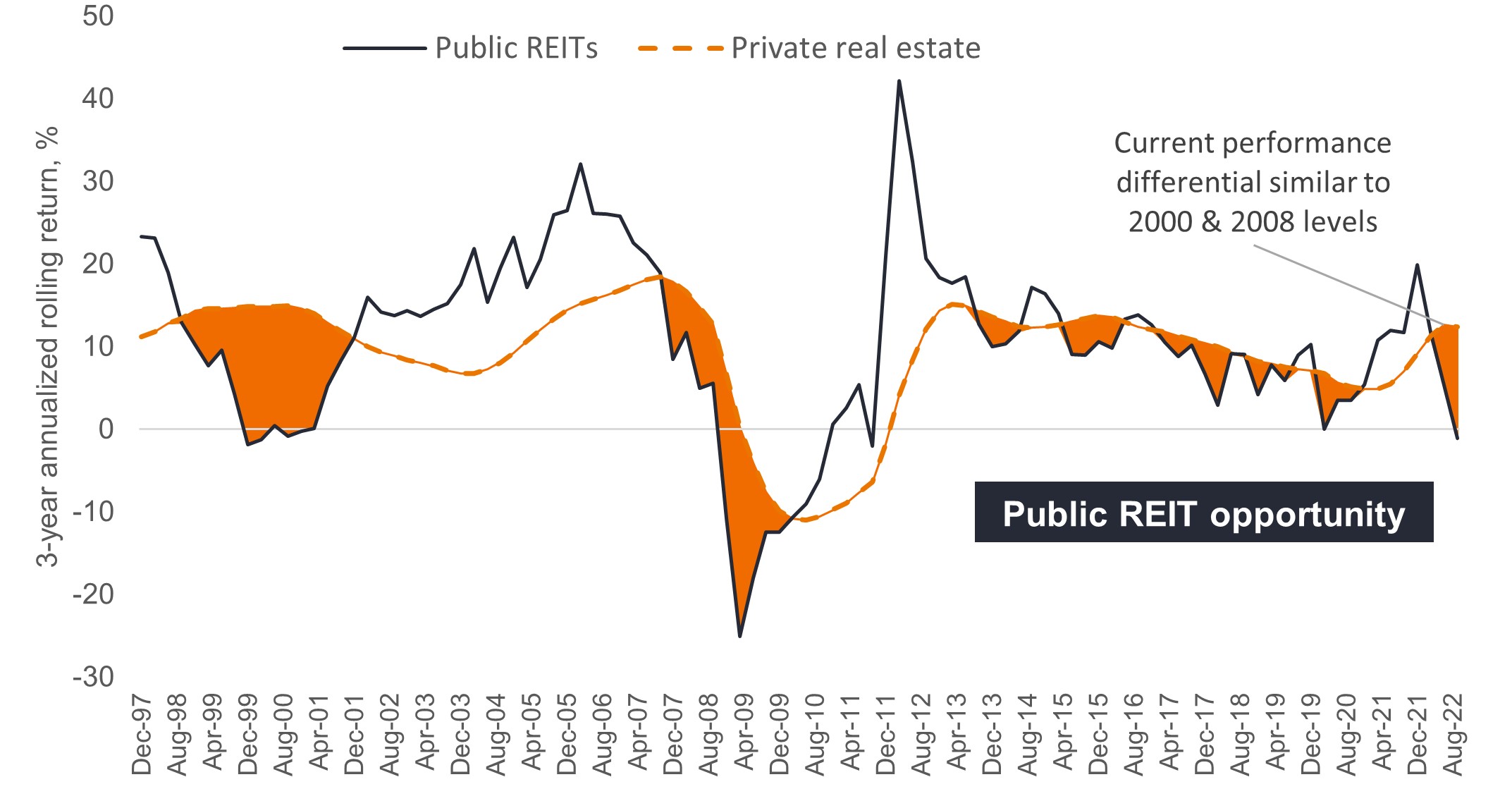

Most importantly, it doesn’t take an artificial moving average to make these time series converge; historically, the divergences between public and private real estate values have converged over time on their own (Exhibit 4).

Exhibit 4: A window of opportunity – until it slams shut

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, Private real estate: NCREIF Fund ODCE, January 1, 1995-September 30, 2022.

Similar assets, different prices = the opportunity

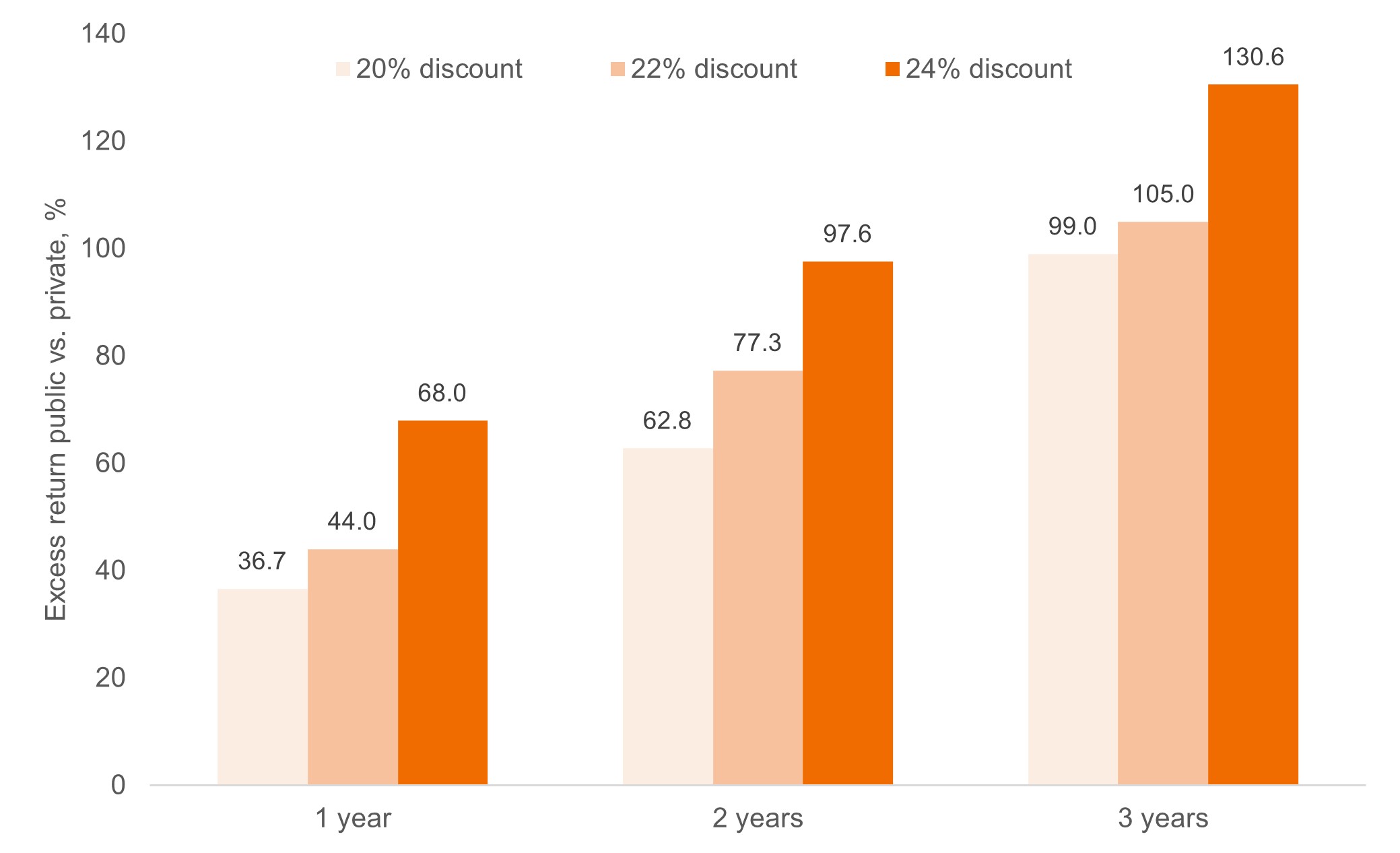

As of September 30, the end of Q3 2022, public REITs have an 28% discount to NAV.1 Here we make a slightly optimistic rounding of that discount, down to only 20%, and look at the historical outperformance of public REITs vs. private real estate in the subsequent one, two, and three-year periods.

The charts below show that, at historically similar starting points, public REITs outperform private real estate by a stunningly wide margin. Further, this outperformance has been reliable: Public REITs outperformed private real estate 100% of the time over every two- and three-year period, and 86% of one-year periods.

Exhibit 5: Following a 20% or greater discount to NAV, public REITs usually outperform by a wide margin

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs TR USD, Private Real Estate: NCREIF Fund ODCE, January 1, 1990 – September 30, 2022, Discount to NAV data from Green Street Advisors.

Exhibit 6: With public REITs currently trading at a 28% discount, we see an even greater opportunity for outperformance

Source: Morningstar Direct, Morningstar returns for FTSE Nariet All Equity REITs and NCREIF Fund ODCE, January 1, 1990-September 30, 2022. Discount to NAV data from Green Street Advisors.

A conundrum for private real estate investors, with public REITs as a potential solution

The current dislocation in public REITs is so striking that even private real estate behemoths like Blackstone are optimistic on the opportunity:

“Market volatility is creating opportunities, including several public company situations.” Jonathan Gray, President/COO, Blackstone Q1 2022 Earnings Call

In our portfolio consultations, the illiquidity of private real estate, rather than viewed as a cost, is often cited by advisors as an end-client benefit because it discourages disruptive emotional investing behavior like market-timing. Therein lies the conundrum for private real estate investors: By historical standards, we established that private real estate is primed to underperform public real estate in the years ahead, but private real estate is not often sold based on short term market expectations.

A practical solution for private real estate investors could lie in blending an allocation to private and public REITs. Based on the prior analysis, it follows that a 50/50 blend of public REITs and private real estate outperformed private real estate by 50% total return over the following three years over every single three-year period since the start of 1990.

Liquid public REITs can potentially be funded by diversifying or rebalancing away from a portion of an existing illiquid private real estate allocation, or it might be more practical to fund liquid public REITs from the liquid core equity portfolio.

Further, regardless of short-term pricing disconnects between public and private real estate, in numerous studies using various indices, public REITs have been cited as providing superior long-term total returns compared to their private counterparts.

Exhibit 7: Annualized outperformance of public REITs vs. private real estate: Published research

| Public REITs | Private real estate | Public – private | |

| Beath/Flynn | 9.2% | 7.9% | +1.3% |

| Bollinger/Pagliari | 11.2% | 8.9% | +2.3% |

| Arnold/Ling/Narajo | 10.3% | 8.7% | +1.6% |

| Average | 10.2% | 8.5% | +1.7% |

NCREIF ODCE vs FTSE NAREIT All Equity REITs Index 1999 – 2021, Bloomberg. Alexander D. Beath, Ph.D. & Chris Flynn, CFA. “Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States, 1998 – 2019.” October 2021: Page 7, Bollinger, Mitchell A. and Joseph L. Pagliari, Jr. “Another Look at Private Real Estate Returns by Strategy.” The Journal of Portfolio Management Special Real Estate Issue 2019: 95-112. (2000 – 2017). Private RE return is average of value add and opportunistic composites. Thomas R Arnold, David C Ling, Andy Naranjo. “Private Equity Real Estate Fund Performance: A Comparison to REITs and Open-End Core Funds.” The Journal of Portfolio Management Special Real Estate Issue 2021, October 2021. Time period studied 2000-2014.

We’ve previously written about the merits of public REITs as a long-term strategic diversifier for a core equity portfolio. In our article, REITs: A Diversification Trilogy, we listed the three potential benefits of a REIT allocation:

- Survive and thrive during inflation

- Provide a diversified income source

- Diversify from U.S. tech and growth concentrations

It is worth keeping in mind that, while real estate funds offer various potential advantages, their use in an overall portfolio can be less straightforward to assess in terms of exposure and potential risk. This conundrum, coupled with the array of solutions available in the market, highlights the importance of thorough research and due diligence. Please reach out to our team for a dedicated consultation to ensure the use of real estate fund(s) is helping you to achieve your intended goals.

1 Source: Green Street Advisors.

IMPORTANT INFORMATION

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.