Australia’s reliance on fossil fuels and our strong commodity export industry resulted in the decarbonisation agenda being on the back burner (excuse the pun) until recently. Previous inaction from government and corporates has now turned into a recognition of global targets (whilst acknowledging Australia’s starting point) and actions to match. Collective power is now in play to assist Australian companies to decarbonise.

After a slow start, the race has begun as Australian companies seek to reduce their carbon footprint and work towards a nationwide goal of reaching net zero emissions by 2050. While the result is important, the focus is also on how companies are going to get there. For some the pathway is orderly and achievable, while hard to abate sectors are challenged with reliance on new technologies and large capital expenditure. All companies are cajoled along by their stakeholders including shareholders, debt providers, others in their supply chain, government, and customers. Climate Action Plans and net zero commitments, including interim targets, are expected with each stakeholder able to hold companies to account. Non-compliance can lead to shareholders sacking boards, debt providers withholding capital, supply chain deals souring, penalties/higher taxing applied by governments (e.g. the introduction of the Australian Safeguard Mechanism) and loss of a customer base.

Setting firm, tangible, and credible carbon reduction targets and plans

The Science Based Target initiative (SBTi) was set up to drive ‘ambitious corporate climate action’ by helping companies to clearly define their path to reduce emissions in line with the Paris agreement goals. At time of writing, 5172 global companies have signed up to take action including 83 Australian firms. These include SBTi ‘targets’ which have been reviewed and validated and those ‘committed’ in which companies are working with SBTi to develop a pathway which needs to be submitted within 2 years. For approval, companies lay out their near-term targets (5-10 years) and outline the actions required for achievement. Long term targets are set (no later than 2050) and a company’s temperature alignment is determined, which shows the degree of temperature increase compared with pre-industrial levels. E.g., 1.5°C, well-below 2°C, and 2°C.

Many other Australian companies do have sustainability targets and frameworks in place but have decided against spending the money to get them registered with SBTi. Instead, companies such as Wesfarmers have said they would prefer to use those funds directly on decarbonising.

Examples of the decarbonisation efforts taking place in Australian companies include:

- Property developer Mirvac have already achieved net zero carbon and are working towards being net positive carbon, reducing their embodied carbon and building 5.5-star NABER rated energy efficient buildings.

- Coles and Woolworths are due to be fully powered by 100% renewable electricity by 2025, as they aggressively seek to reduce their Greenhouse Gas (GHG) emissions; Coles targeting 75% by 2030 and reaching net zero by 2050, while Woolworths seeks to be net positive carbon emissions by 2050.

- Banks such as Bank Australia are not lending to fossil fuel companies and are ambitiously committed to achieving net zero emissions across their operations, lending and investment portfolios by 2035. Similarly, Bendigo Bank has a 95% reduction target by 2040 for all financed emissions.

Government policy plays a significant role in promoting decarbonisation of companies

The Federal Government’s reform package to the Safeguard Mechanism, originally introduced by the Abbott Government in 2016, passed the Senate in Q2 2023 forcing the heavy emitters by law, to make cuts to their emissions and not just be offset. This law regulates the emissions of Australia’s 215 biggest polluting facilities, including fossil fuel companies, the big miners and chemical businesses which collectively contribute almost 30% of Australia’s total emissions. This is one of the action items required for Australia to achieve the government’s commitment of 43% reduction in carbon emissions by 2030 compared with 2005 levels.

While penalising companies that don’t comply to the near 5% cuts each year is a positive step forward, incentives and subsidies can assist with the acceleration. In addition to some State funded initiatives, the Federal Government has programs including:

- The Government’s Emissions Reduction Fund which provides business with Australian carbon credit units for adopting new technologies and practices that leads to storage or avoidance of carbon.

- Government grants available to assist companies with funding energy efficient projects.

- Tax incentives available to companies to improve energy performance.

- Funding programs have been set up for financing within the clean energy sector.

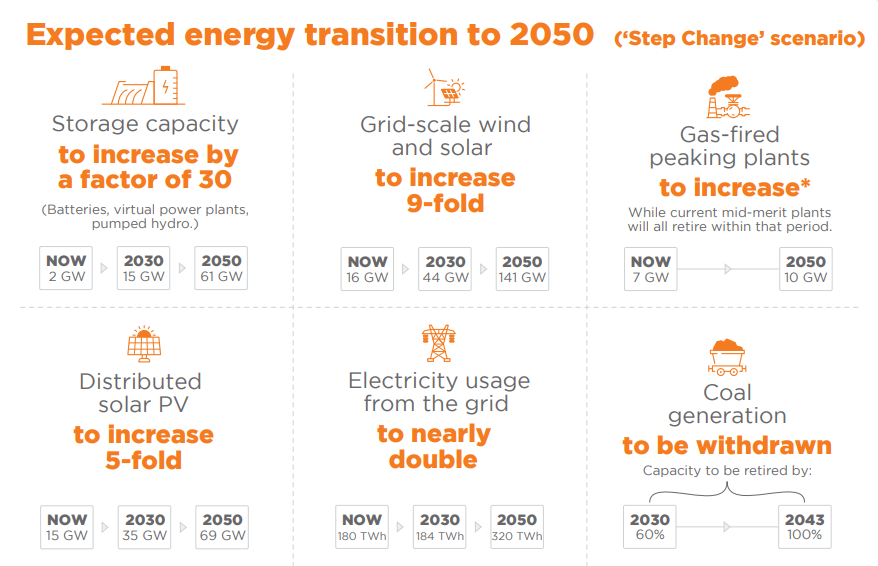

Source: Australian Energy Market Operator’s 2022 Integrated System Plan

*Degree of increase to be tiny compared to renewables and storage

Debt holders encouraging companies to decarbonise

While equity holders have voting rights, debt holders can withhold capital when they feel that a company doesn’t have a credible decarbonisation pathway in place. Failing to decarbonise represents a material ESG risk that can ultimately affect the credit profile of a company and the price of its shares and bonds. The first port of call for a debt investor is to engage with the company to better understand the business and how they plan to decarbonise.

For those that are laggards or need encouragement in certain areas, active stewardship is an option. Here debt investors talk to the company about areas they feel need improvement, which may include the setting of net zero targets including ambitious interim targets, having a credible action plan to achieve this, and being transparent in reporting their progress. Debt investors can be suggestive to achieve this outcome, or where noncompliance exists, seek to escalate to senior management and the board. The ultimate threat a debt investor has is to no longer offer funding.

Debt holders funding companies to decarbonise

Our newly launched Janus Henderson Sustainable Credit Fund seeks to invest in companies with robust sustainable practices with the potential to enhance outcomes for society’s wellbeing and protection of the planet. ‘Promote decarbonisation’ is one of the themes we are targeting. The types of issuers that we invest in are those that are committed to making the transition and have a robust and credible framework for achieving this. By offering funding to these companies, we are assisting in the reduction or removal of their carbon footprint – primarily GHG emissions, carbon dioxide (CO2) and methane (CH4) output into the atmosphere. Further, we seek out investment in newer climate technologies including solar, wind and hydro.

Debt instruments that are used to help companies decarbonise can be in the form of normal ‘vanilla’ bonds issued by companies that are considered “best in class” in terms of their decarbonisation strategy, with funding used for general capital expenditure on carbon reduction.

Alternatively, it could be in the form of a labelled bond. This includes:

- Green bonds where the capital raised from the bond is directly used to fund projects assisting the decarbonisation efforts of the firm.

- Sustainability bonds in which the funds are used to finance a pool of ‘green’ assets.

- Sustainability linked bonds (SLB’s) where the coupons paid to the investor are linked to the issuer’s achievement of certain climate related targets.

What does this mean for investors?

Collaborative efforts from varied stakeholders will greatly assist in the decarbonisation efforts of Australian companies. It is important that the right questions are asked, the focus remains on the material issues and non-compliance is acted upon. By supporting decarbonisation, we are addressing the issues of climate risk and creating more sustainable companies. Alleviating material ESG risks in the issuers we invest is likely to result in better risk adjusted returns for investors.

Australia has an opportunity to be a part of the global solution, with other countries looking to us to solve the hard to abate mining sectors and become a market leader. Advantageously, Australia is also abundant in minerals used in the transition such as Lithium (currently #1 supplier globally), Rare Earths, Nickel and Manganese and is known for the most (cost) efficient and advanced mining processes.

While decarbonisation is challenging and costly, Australia has more opportunities than risks which increasingly companies, society (consumer, investors) and governments are embracing.