When we look ahead to the outlook for global equities in 2025, I think it’s going to be less dictated by what happens to interest rates. The default world view of markets until late 2024 had been an expectation for rates to fall in a synchronised way – excluding Japan, of course, which is on its own rate cycle.

With a Trump administration, which is likely to introduce some inflationary policies, those rate expectations are being reconsidered. Instead, it is probably more helpful to look for returns on a more bottom-up basis i.e. looking at the individual corporate characteristics of a company. That plays to our strengths, which is looking for free-cash-flow growth that is undervalued by the market.

We find that in a number of areas, such as defence. As the US pivots away from Europe and NATO and more to the Pacific, European governments are going to have to step up and pay more for their own defence. In aggregate, much more money is likely to be spent as countries rebuild their security.

Asia is likely to be a fascinating case of diverging fortunes, with “the haves” and “the have-nots.” I think China is going to face challenges as the US gets tougher around sanctions and trade deficits and trade imbalances. At the same time, I see India as very much in the ascendant. We are finding reasons for long-term growth that is likely to be sustained there for a long period of time, including a growing technology sector and upgrading of infrastructure.

Japan will be more of an idiosyncratic story. There is a lot of value there, but you have to be selective. You have to be able to find the value on a bottom-up basis, where the hidden value is often lower down in the balance sheet, capital structures becoming more efficient, and companies becoming a little more motivated around profitability.

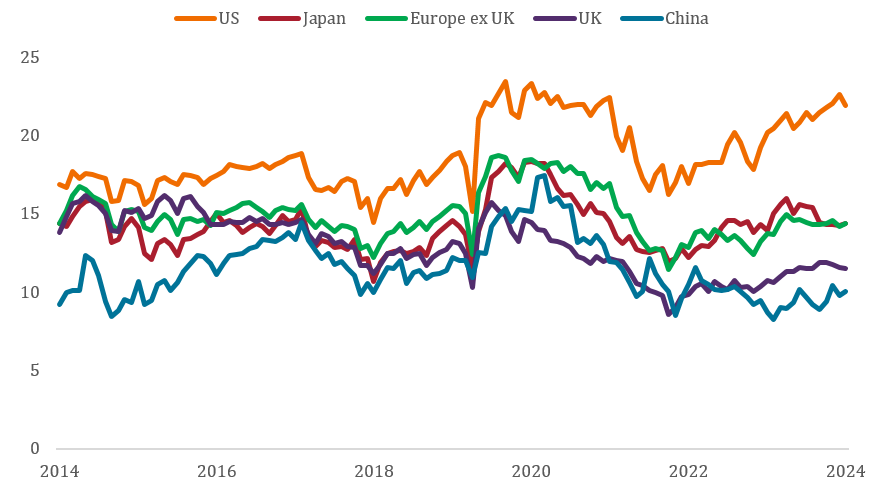

Opportunities also exist on the valuation side. In Europe, for example, you do have lower price-to-earnings (P/E) multiples, but you also have lower growth rates. We are by no means arguing for a closing of P/E multiples between Europe and the US to parity. I think that is unrealistic. That said, we find that there are some quite attractive, reasonably fast-growing companies in Europe and parts of Asia.

On the flipside, in the US, we also see pockets of stretched valuations. So, you could see, at the margin, the US get cheaper – or multiples compress – and some pockets of Europe and Asia where valuations increase.

The main risks are volatility around geopolitics. The appointments by President Trump point to a quite a hardline policy stance, particularly as it relates to foreign policy and trade. The one thing that we can predict, therefore, is that risk is back, and volatility is rising. We just have to make sure that the companies in which we are invested are resilient to that volatility and stay focused on free cash flow.

Price-to-earnings (P/E) ratio

Source: LSEG Datastream, MSCI indices for respective country or region, P/E ratios, 31 December 2014 to 31 December 2024. Earnings here are forward earnings, which are estimated earnings over the next 12 months. There is no guarantee that past trends will continue or forecasts will be realised.

Free cash flow (FCF) is cash that a company generates after allowing for day-to-day running expenses and capital expenditure. It can then use the cash to make purchases, pay dividends or reduce debt.

Idiosyncratic risks are factors that are specific to a particular company.

Price-to-Earnings (P/E) ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Volatility measures the rate and extent at which the price of a security or index, moves up and down. The higher the volatility the higher the risk of the investment