In an era where the Federal Reserve (Fed) prioritizes forward guidance, one could presume that at least some of their policy-setting meetings would be non-events. That has not been the case of late. Indeed, today’s statement by the Federal Open Market Committee (FOMC) had the undivided attention of financial markets. The reason being the unique – and likely unanticipated – situation of a still-resilient U.S. economy despite nearly a year of the upper boundary of the Fed’s benchmark lending rate sitting at a restrictive 5.50%.

With no rate cuts baked into this meeting or July’s, investors’ eyes were on changes to the Fed’s quarterly update to their Summary of Economic Projections and the accompanying “dot plot” survey that conveys Fed members’ anticipated rate path. This meeting took on elevated importance given the increasingly mixed signals emanating from key economic indicators. Coincidentally, Wednesday’s consumer price index (CPI) report for May showed a second month of cooling inflation after the first quarter’s upside surprises.

We believe the mixed data validates the Fed’s wait-and-see approach. Chairman Jay Powell understands the imperative of maintaining the central bank’s credibility and has been quick to reiterate what conditions must be met for policy to loosen: Either gaining greater confidence that inflation is moving sustainably toward its 2.0% target or seeing the labor market unexpectedly weaken. Thus far, neither has occurred.

From a markets perspective, we again caution investors against reading too much into an individual policy statement or – in the case of last Friday’s employment report and today’s CPI data – a single economic release. Reacting to policymakers’ reactions to lagging economic data is likely a fool’s errand and a recipe for near-term market volatility.

Instead, we believe investors can take some comfort in a scenario evolving in a manner we would expect, with restrictive conditions eventually transitioning to easing, but without sending the economy into recession. This would be favorable to shorter-dated bonds in anticipation of rate cuts and higher-quality riskier assets – i.e., investment-grade credits and stocks – that would benefit from an extended cycle. Valuations matter as well, and investors should recognize what’s priced in across asset classes. A goldilocks scenario is welcome, but in the end, we should remember how that fairy tale ends.

Steady as she goes

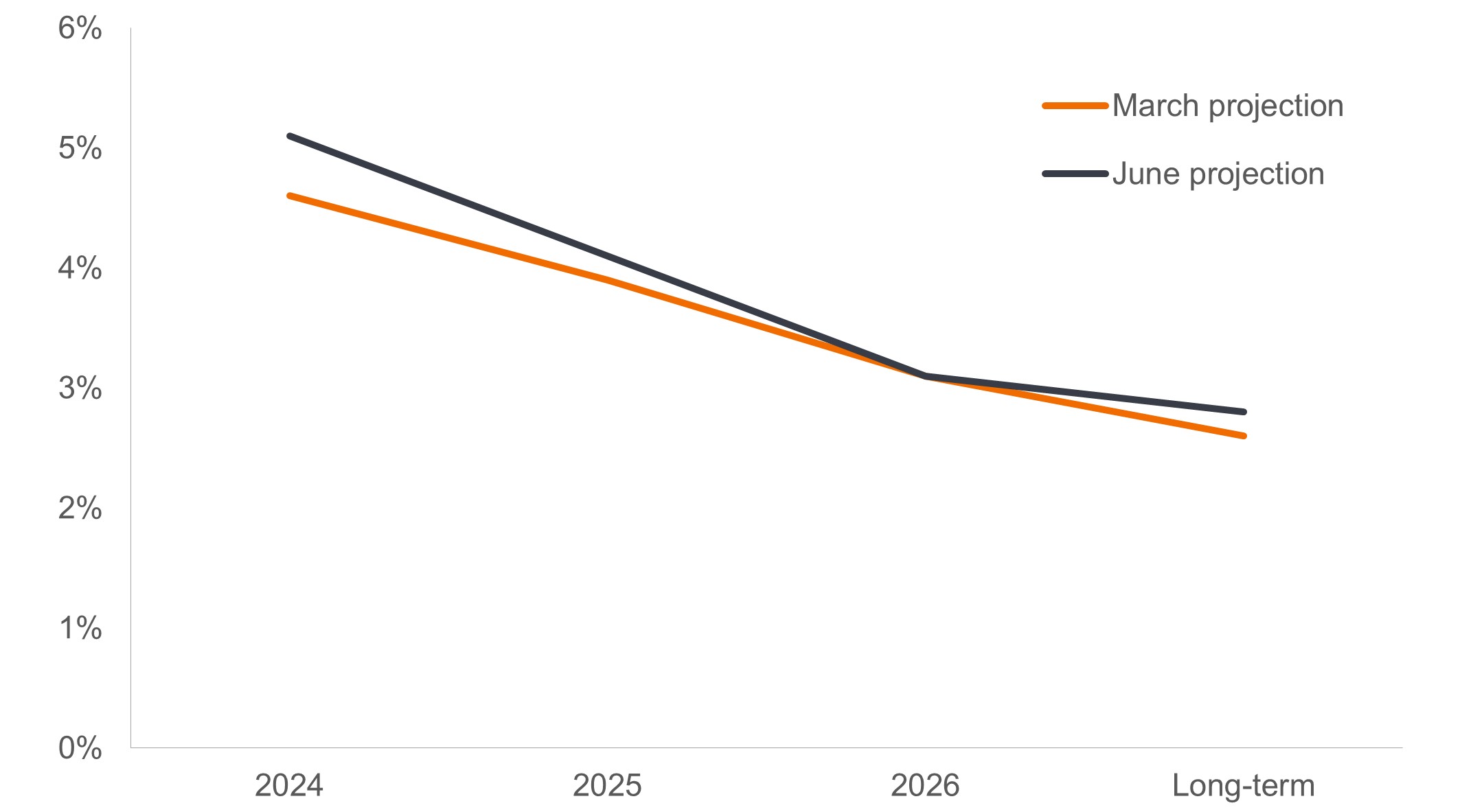

A highlight of today’s statement was how little the Fed’s economic projections were altered. Economic growth and the unemployment rate held steady for 2024 relative to the Fed’s prior statement while headline and core inflation were modestly raised by 20 basis points (bps), to 2.6% and 2.8%, respectively. Perhaps the most notable change was the Fed’s anticipated rates path, with voting members now expecting only one 25 bps decrease in 2024, down from three at the last meeting.

Fed’s projected path of year-end interest rates

While progress on inflation hasn’t been sufficient to cut rates perhaps more than once in 2024, “modest” further progress toward the 2.0% goal means that, over the midterm, the expected destination of policy rates has not changed.

Source: Bloomberg, Federal Reserve as of 12 June 2024.

On the surface this may seem hawkish, but we believe that a delay in cuts doesn’t necessarily equate to a shallower policy cycle – a point driven home by a larger amount of anticipated 2025 cuts partly compensating for fewer this year and the end-of-year 2026 federal funds rate remaining steady at 3.1%. The longer-term neutral rate did tick up to 2.8%, but the dispersion among respondents indicates less certainty with that expectation.

Inflation back on track?

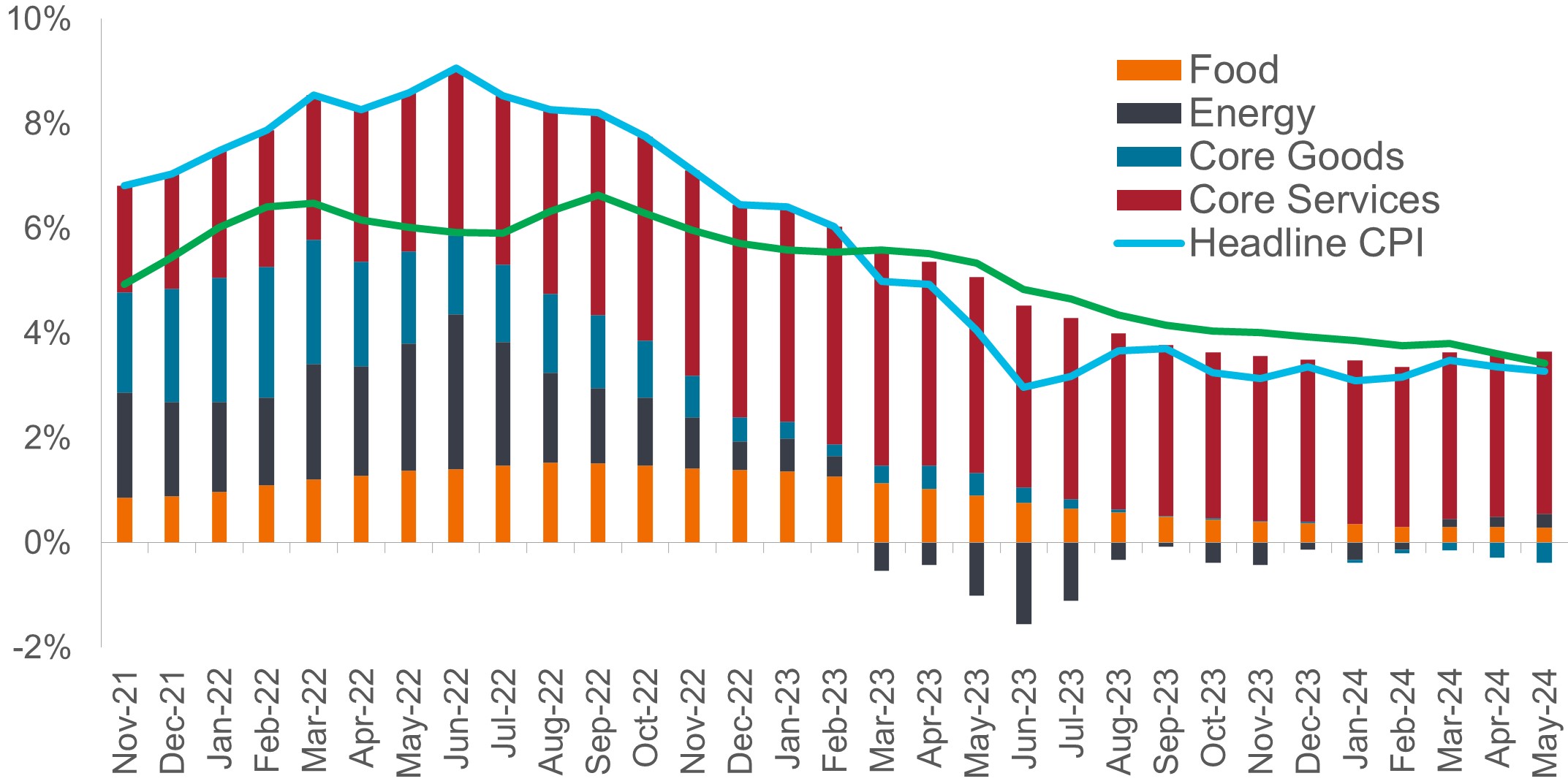

Much attention has centered on inflation, especially after its early-year uptick. Two months of moderating data likely means that – as had been hoped – the earlier upside surprises were due to seasonal factors. For May, headline CPI was flat month over month and fell from 3.4% to 3.3% year over year. Monthly and annual core inflation modestly fell. Still, after the March surprise, the April and May inflation data likely buy the Fed time to determine how and where the economy may be softening.

Components of U.S. consumer price index (year over year)

Goods disinflation may soon get an assist from slowing rents inflation, putting downward pressure on core services inflation.

Source: Bloomberg as of 12 June 2024.

Items that we believe may assuage Fed concerns include the easing of the three-month annualized pace of core inflation, falling food prices, and the stabilization of rents. Each of these factors may – for technical reasons – play a greater role in future disinflationary trends, which we expect to be realized over the second half of the year. In aggregate, these dovish developments will likely keep a rate cut on the table for 2024.

So when?

Having policy optionality may prove prescient, as beneath a putatively healthy employment market, we see some signs of softening and a few lingering questions, namely the mixed signals emanating from diverging employment data in the Bureau of Labor Statistic’s establishment and household survey. Similarly, while the Purchasing Managers’ Index for manufacturing is in contraction territory, its services sibling has strengthened of late.

Rather than scratching our heads at conflicting signals, we view them as the natural result of an economy that has changed its composition in recent years and is dealing with generationally high interest rates. The U.S. economy appears less rate sensitive than in cycles past, and hybrid work and the gig economy – not to mention technological efficiencies from sources such as artificial intelligence – may be impacting the labor market in ways not yet fully understood by economists.

Market positioning: Bullish, with an asterisk

Uncharted territory understandably leads to jittery markets. Today’s statement has not changed our view toward bonds and riskier assets. We are likely on the cusp of an easing cycle – but are not there yet. Moderating inflation and observable – but not alarming – slowing of the labor market means that a soft landing is still on the table. This, in our view, should be supportive of the riskier assets that are more dependent upon the extension of the economic cycle.

Periods of falling rates should lead to lower yields along the front end of the Treasuries curve. And while this should be a tailwind for fixed income as investors exit cash in favor of bonds, we need to recognize that some pockets of the market have already anticipated this. Again, valuations are important. Buying into risk solely on anticipation of a goldilocks scenario is not enough. With valuations rich in many market segments, any negative economic surprise would have immediate repercussions, especially in more speculative areas that seem to price in better – if not best – case scenarios.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

The FOMC dot plot is a chart that summarizes the FOMC’s outlook for the federal funds rate.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors, based on a survey of private sector companies.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

An inverted yield curve occurs when short-term yields are higher than long-term yields.

IMPORTANT INFORMATION

Bond prices generally move in the opposite direction of interest rates, thus bond prices may decline as interest rates rise, and vice versa.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Interest rate movements will affect a fund’s share price and yield.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.