If Europe wasn’t hated in the investment world before, it certainly is now. After six months of war in Ukraine with no signs of ceasefire, a pending recession, and a deepening energy crisis, the sentiment is understandable. But where some see doom, we see opportunity. As active investors, we seek value where the market is in retreat. This has been the case for oil and gas for a while now, and Russian President Vladimir Putin’s actions (not least using the Nord Stream 1 pipeline as a bargaining chip against Europe) have served to exacerbate matters.

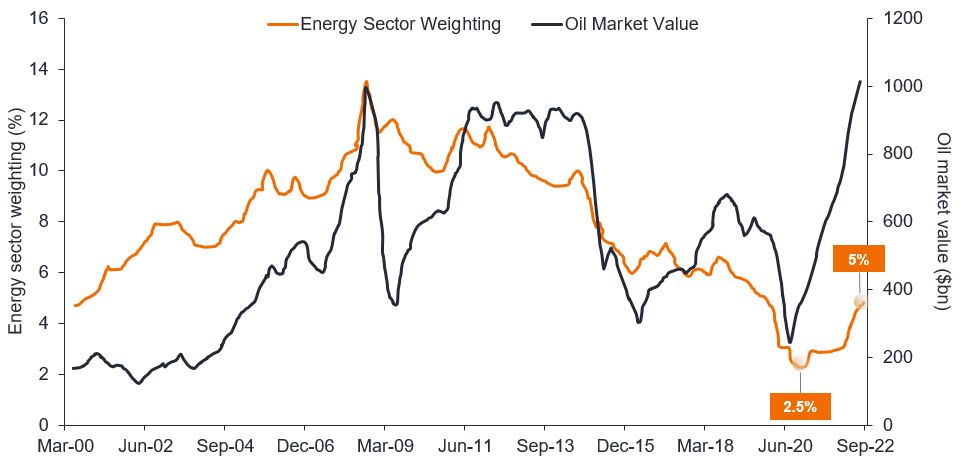

There is currently a large disparity between the fundamentals of many oil majors and their valuations, and oil remains the best-performing sector since the start of the year. Despite this, the sector sits at a consensual underweight in many portfolios and its representation in global indices is far lower today than its market value suggests it should be – Figure 1. While fears of deep recession have sporadically hit the oil price, as was the case most recently in the second week of September, our view is that prices will remain higher for longer.1

Figure 1: Energy sector positioning remains low

Source: Alliance Bernstein, Janus Henderson Investors, as at 24 August 2022.

Recently we have seen other investors gravitate towards this view, especially – and not without irony – those branded as sustainability fund managers. In August, Citywire reported a number of sustainable funds with an increasing exposure to big oil. This is particularly interesting as the rigid/purist approaches we have seen to fossil fuels by many of these funds has in part caused the huge misallocations of capital and dislocations we currently find in the sector.

So, what evidence is there to support a ‘higher for longer’ oil price? Simple supply and demand economics suggests that if supply remains restricted and demand remains robust, prices will remain high.

Supply is constrained

From the ground up

In addition to the lack of gas supply from Russia, Putin’s current weapon of choice against Europe, supply is waning from the ground up. Organisation of the Petroleum Exporting Countries (OPEC) member countries produce around 40% of the world’s crude oil.2 OPEC is currently working at close to capacity, and its recent decision to cut crude supply to prop up prices will intensify these supply constraints.

Elsewhere, US shale growth is not increasing. Shale is typically short-cycle, meaning that ramping up production can be quickly achieved by taking oil from drilled-but-uncompleted wells. However, the number of shale wells awaiting completion has fallen sharply since highs in 2020. As a result, the latent potential of shale has shrunk. Combined with shortages in oilfield equipment and labour, the ability for shale to make up for any loss of supply has waned.3

Big oil remains disciplined on oil extraction

After years of pressure from all angles, oil majors are now committed to reducing oil production and transitioning to alternative fuel types to meet climate pledges. As a result, oil extraction is slowly but surely reducing. With many oil majors remaining determined to reach their sustainability goals, it does not appear that these commitments will be compromised any time soon.

Decades-long underinvestment in energy

In 2020, around 40% of the European Union’s (EU’s) gas was imported from Russia, with Germany and Italy particularly reliant on those supplies, having imported 65% and 43%, respectively4 – a damning reflection on the past two decades of underinvestment in energy on the continent. Fortunately, we have noted a paradigm shift in Europe towards greater localisation of supply chains and tangible investment into energy, infrastructure, and defence since the invasion of Ukraine.

The European Commission’s REPowerEU initiative targets an approximate doubling of the renewable incremental capacity by 2030 and to increase the deployment rate of renewables by 20%.5,6 While this may be a good step forwards, it will take time to achieve. In the near-term investment in oil and gas production is essential.

Demand is alive

How much can depth curb demand?

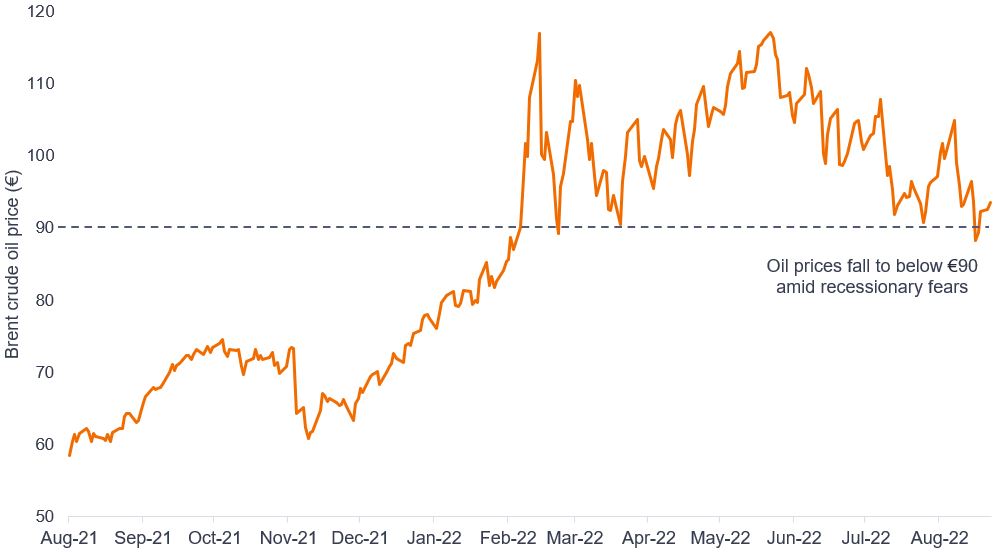

The market fears that a deep recession could significantly curb demand for oil and gas as businesses struggle to stay afloat and individuals rein in spending habits. These fears were reflected in the oil price in June, and again in September amid renewed fears which saw prices drop to below levels seen prior to Russia’s invasion of Ukraine – Figure 2.

Figure 2: Recessionary fears drive oil prices temporarily lower

Source: Bloomberg, Janus Henderson Investors, Brent Crude Oil prices denominated in euros, as at 13 September 2022.

While we expect that a recession will see demand fall, we do not agree with the extreme scenarios which suggest that demand for oil will entirely dry up. After all, energy is still essential even in the deepest of recessions for the production of food, the running of hospitals, and the heating of homes.

Oil and gas is part of the solution

We place significant value on the oil and gas industry over the medium- and long-term as Europe transitions to a green economy. It is unreasonable to withhold investment from oil and gas companies which are vital in the day-to-day running of our societies, and which are central to making long-term changes. As active investors we focus on where a company is going, not where it has come from. An orderly transition to net-zero carbon will rely on the largest, most-polluting companies to set realistic strategies and targets and we prefer to work with these companies to achieve these goals.

What does this mean for investors?

At the time of writing, European equities are trying to price what a winter of gas rationing and further elevated gas prices means for the various industries and households that are located on the continent. There is no doubt that the rest of the year will be volatile, but we believe that opportunities will present themselves to add to existing positions or enter new names where the valuation and fundamentals disconnect – this is certainly the case for many oil and gas names.

[jh_content_filter spoke=”apac-social, arpa, auii, aupi, axii, bepa, brpa, clpa, cnpi-en, copa, deii, dkii, dkpa, dkpi, fiii, fipa, hkpi-en, iepa, iepi, lupa, lupi, media, mxpa, nlii, noii, nopa, nopi, pepa, ptpa, seii, sepa, sepi, sgpi, social, ukii, ukpa, ukpi, uopa, usii, uspa, uspi, uypa, zapa”]

[/jh_content_filter]

1 Bloomberg, Brent Crude Oil prices, as at 13 September 2022.

2 US Energy Information Administration, as at 7 September 2022.

3 Reuters, ‘U.S shale shortages to limit efforts to replace banned Russian oil’, March 2022.

4 Eurostat, DUKES, Jefferies Estimates, 2020.

5 European Commission, REPowerEU initiative, Janus Henderson Investors, 8 March 2022.

6 Ember Climate Insights, ‘Shocked into action’, June 2022.

Net zero refers to greenhouse gas production being balanced by removal from the atmosphere.

IMPORTANT INFORMATION

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Increased portfolio turnover may result in higher expenses and potentially higher net taxable gains or losses.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation, and exploration projects.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.