Biotech as a sector is at an inflection point, driven by a surge in medical breakthroughs and an ageing and increasingly affluent global population. Many family offices recognise that rapid scientific and technological advances have never been more relevant to society’s progress and increasingly are looking to invest in the ‘second golden age’ of biomedical innovation.

1. The risk of remaining long only

Where family office investors can often come unstuck when investing in biotech, is by holding on to one stock for too long or by mispricing the scientific and commercial opportunities of underlying therapeutics. In this high-risk, high-reward sector, it’s critical to be actively engaged and know when to add and lessen risk appropriately.

Between 2019 and 2021, the entire world saw biotechnology at its best, witnessing the rapid creation and production of highly efficacious COVID-19 vaccines in 10 months instead of the industry average of about 10 years.

The likes of AstraZeneca, Moderna and Pfizer saw hundreds-of-billions-of dollars in combined sales for fighting the pandemic in 2020 and 2021. Their subsequent share prices matched their outsized sales performance.

However 2023 was a year where the COVID party turned into the COVID hangover, with sales of COVID-19 products, from treatments to vaccines to diagnostics, falling precipitously. Total revenues at Pfizer, for example, declined from $100 billion in 2022 to about $60 billion in 2023.

This had a major impact on returns. If you took a long position in Pfizer in 2019 and held through the pandemic until today, you would have lost 27% on your shares.

2. Implementing an active approach

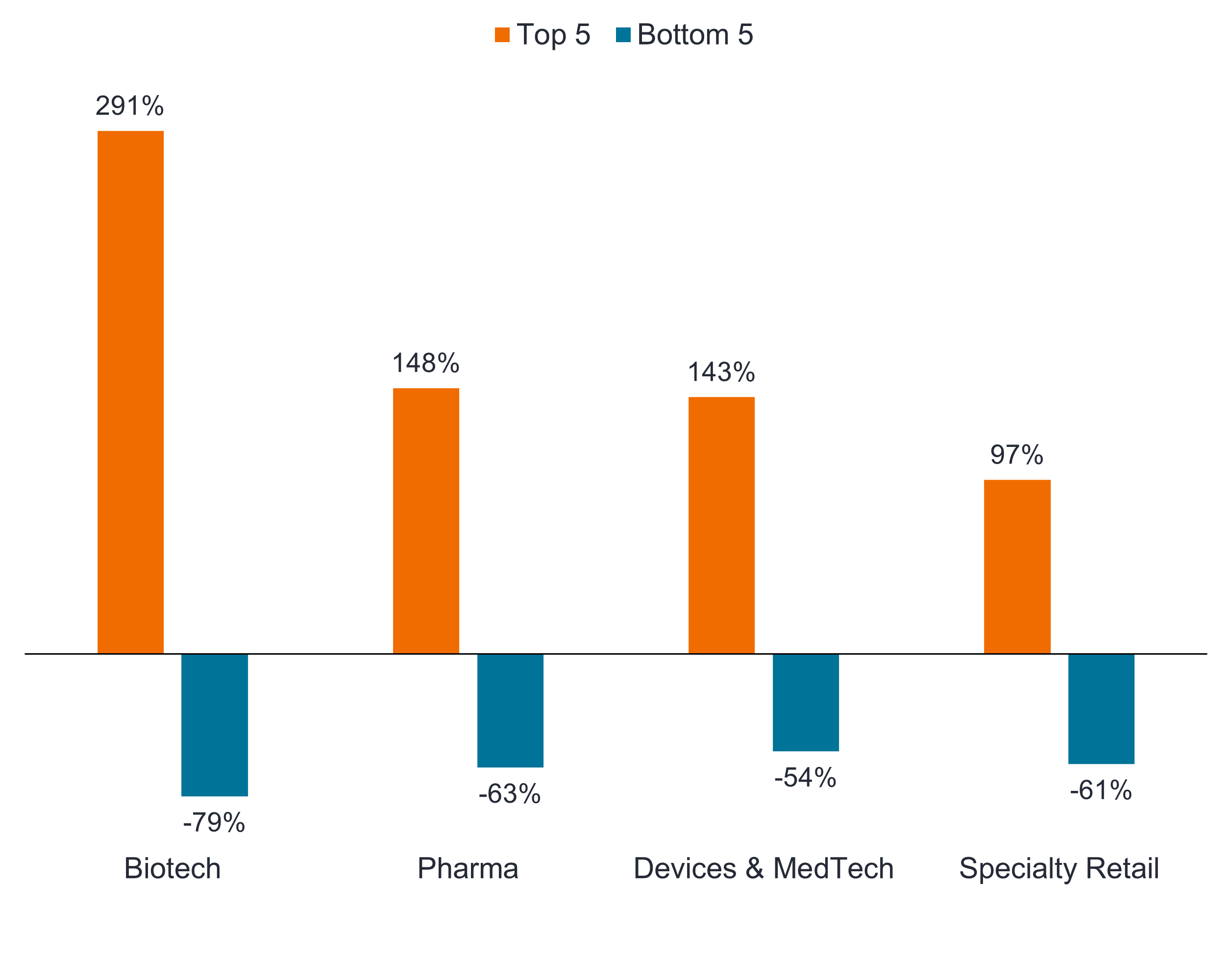

To achieve returns in biotech you need to understand both the science and commercial opportunities of new products and have the ability to navigate through short-term noise and disparate stock performance (see chart below).

Chart 1: 10-year average return of top/bottom five stocks

Source: Wilshire 5000 Index, 2014-2023. Based on analysis of 10-year period. The Wilshire 5000 is a market capitalization-weighted index that seeks to represent the broad U.S. equity market.

Source: Wilshire 5000 Index, 2014-2023. Based on analysis of 10-year period. The Wilshire 5000 is a market capitalization-weighted index that seeks to represent the broad U.S. equity market.

Picking which biotech companies will be the top five winners over a decade is no easy feat. The sweet spot for family office investors is implementing an active approach to investing in small- and mid-cap biotech.

In 2023, small- and mid-cap biotech and medical device companies were weighed down by rising interest rates and market distortions created by COVID-19. In turn, 2024 began and remains with many small- and mid-cap company valuations looking attractive relative to the broader market and long-term industry averages. These same companies are now prime acquisition targets of larger biopharmaceutical firms, as low valuations and promising drug pipelines are appealing. With 22 biotech mergers and acquisitions valued at US$1 billion or more in 2023, there is an expectation this M&A will continue throughout 2024.

3. Cutting through the biotech noise

Deep industry expertise is required to navigate the biotech industry adeptly. The healthcare and biotech investment teams at Janus Henderson Investors (including professionals with biomedical Ph.D.’s and M.D.s) track small, medium and large biotechnology companies, studying medical treatments that address high unmet medical needs, shifts in government policy, industry trends and other risk measures to identify both near- and long-term opportunities and to know which levers to pull to balance high-risk positions.

Such opportunities came in 2022, when the US passed the Inflation Reduction Act (IRA). The legislation caused panic in markets because, for the first time, price negotiations were allowed for select drugs sold to the elderly. Wall Street consensus was this would negatively impact the biopharmaceutical companies’ bottom lines. However, deeper market knowledge would have considered positives for the industry, including a 13-year grace period for biologics (around the time most drugs lose patent protection anyway) and out-of-pocket spending caps on drugs, making it easier for seniors to afford their medications. The net result: Overall, the law is forecast to cost the global biopharma industry less than US$200 billion in total revenue over 10 years, or under 2% of sales.1

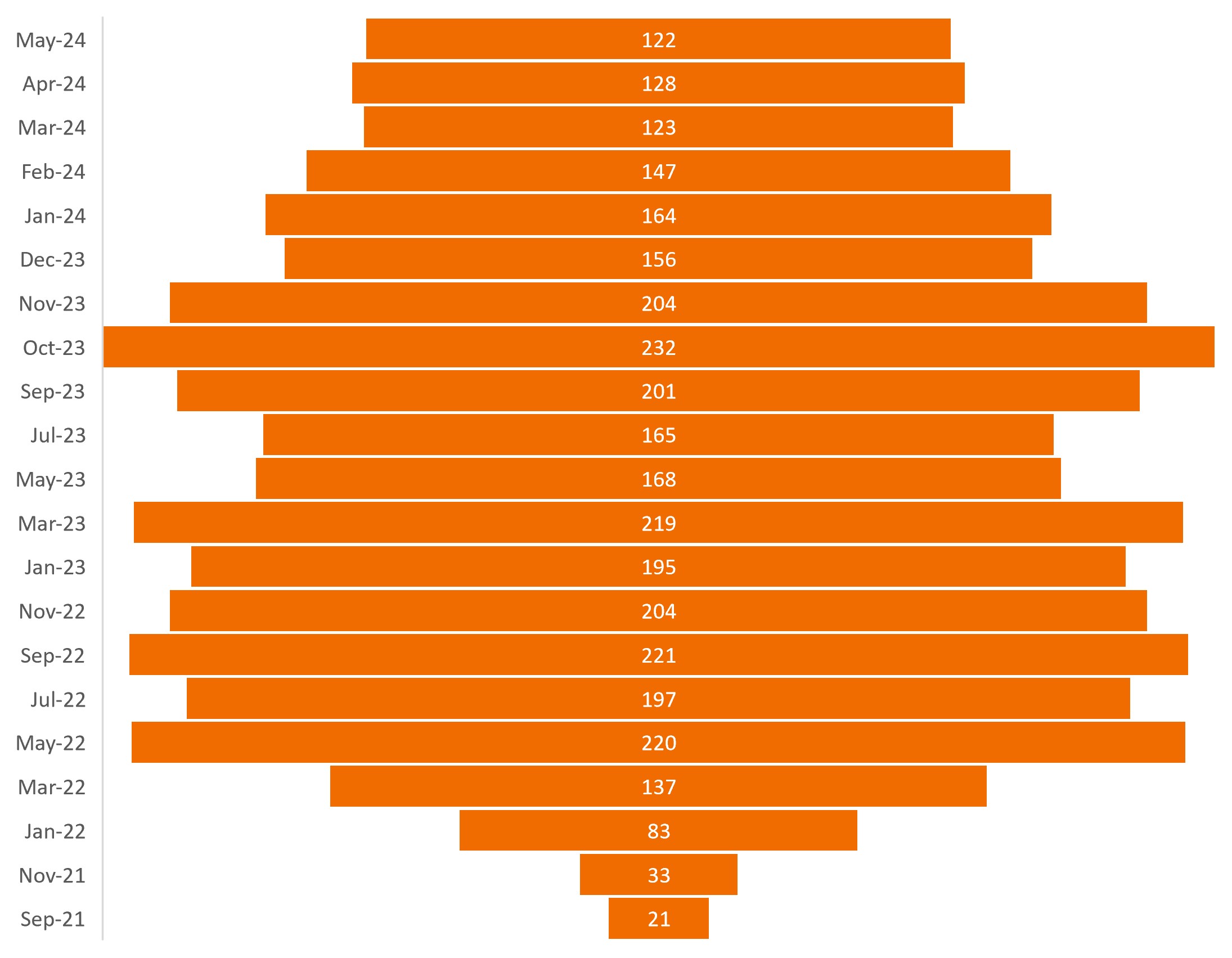

Chart 2: Biotech companies on sale

Number of life sciences companies worldwide with a negative enterprise value*

Source: CapitalIQ, Stifel, data as of 24 May 2024. * Enterprise value is the value of a firm equal to its equity value, plus net debt, plus any minority interest.

| It is easy for family office investors to get caught up in the story of smaller biotech firms that have the potential to change the world if their drugs or products come to market. It’s critical, however, to weigh company valuations against the probability of success. In some instances, a share price can runaway despite the fundamentals of the underlying asset not improving, and this is why you need to separate the noise from reality. These decisions will only become tougher for family offices and professional investors as more biotech companies enter the market and evolve. As the ageing global population needs further medical treatment, there will be innovative solutions and new ways of applying biomedicine. Family office investors should ensure they are well-equipped to explore the landscape. |

Get in touch

The Janus Henderson Team is on hand to assist you with working through any questions. Please contact us to arrange a consultation.

Ashleigh Lane

Institutional Sales Director

Ashleigh.lane@janushenderson.com

+61 (02) 8298 4071

1Congressional Budget Office Cost Estimate, as of 15 July 2022.