When we established our Multi-Asset Credit (MAC) strategy more than 10 years ago, we had very clear views around the style of portfolio we were intending to deliver for clients. The strategy was based on constructing a portfolio that had the following key characteristics:

- Low interest rate exposure to ensure that at least 70% of the portfolio was invested in floating rate assets, thus minimising sensitivity to changes in government bond yields

- Diversification away from traditional fixed income assets, with the inclusion of two well-known asset classes, namely secured loans and asset-backed securities (ABS)

- Defensive senior and secured bias – seeking to minimise downside risk and losses derived from defaults by investing in assets that sit at the top of an issuers debt stack and additionally benefit from being secured.

Combine these criteria with the level of returns we wanted to deliver for our investors, and it was clear that secured loans should form a key component of the strategy. Our allocation to this asset class has varied between 39% and 53% since inception in 2012.

Whilst there are other types of floating rate assets available, namely Asset Backed Securities (ABS) and Floating Rate Notes (FRNs). ABS are primarily used as a risk dampener or investment grade (IG) credit alternative, but ultimately are not expected to deliver the overall strategy return being targeted. FRNs have a place in the portfolio, but the overall FRN market is modest in Europe and tiny in the US. So whilst these instruments have a place in the portfolio, the mainstay of our floating rate exposure in this strategy will always be secured loans.

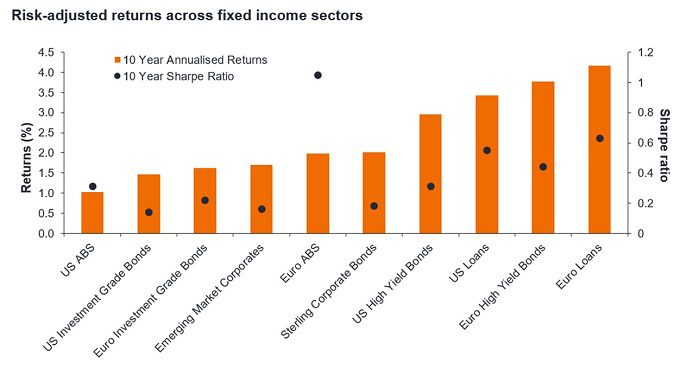

The syndicated secured loans market in the US totals approximately US$1,400bn, whilst in Europe it is close to €400 bn. Long-term returns from loans in the US and Europe stack up very well versus other fixed income asset classes (Exhibit 1), highlighting the significant contribution this asset class has made to our MAC strategy.

Exhibit 1: Loans have offered attractive risk-adjusted returns

Source: Janus Henderson, Bloomberg, Barclays, ICE BofA, Credit Suisse, Credit Suisse, 30 April 2013 to 30 April 2023. Past performance does not predict future returns.

Are loans not illiquid?

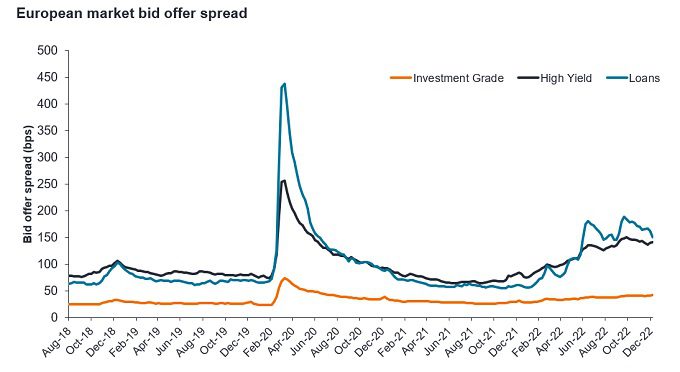

Many observers suggest loans are less liquid than, say, high yield bonds. Whilst this is true for small loan issues, typically found in the private credit market, this is definitely not the case for the broadly syndicated larger loans that we invest in for MAC. Comparing bid/offer spreads in the syndicated loan market with those of the high yield market, objectively a good proxy for market liquidity, shows a very similar trend across these two asset classes, both in the US and Europe (Exhibit 2).

Exhibit 2: Loans liquidity has remained on par with conventional bonds

Source: Janus Henderson, MSCI, IHS Markit, as at 11 January 2023. Past performance does not predict future performance.

The perceived illiquidity comes from the fact loans are not traded via an exchange and thus the settlement process is somewhat extended. As our analysis shows, however, this does not mean that there is a lack of buyers offering a fair price for these assets. A consequence of this delayed settlement process is that any fund with a sizeable allocation to loans will need a structure that accounts for the delay in receiving cash from the sale of loans when funding redemptions. We have chosen to address this by applying a short notice period for dealing in our MAC strategies.

Current opportunities in loans

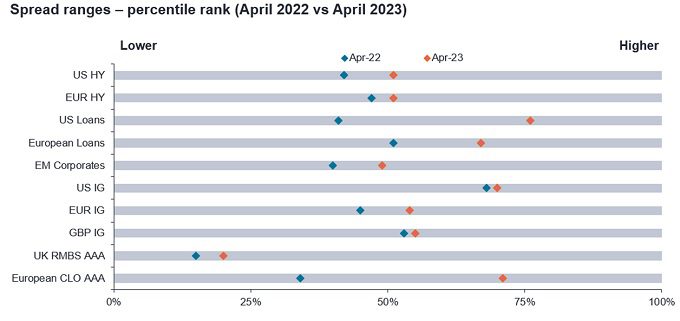

Secured loans remain as relevant today to MAC as they did when we first launched the strategy. In our view, risk-adjusted returns on loans continue to look attractive. The spreads available on loans also look compelling when compared to other fixed income asset classes, and relative to where they were in April 2022 (Exhibit 3).

Exhibit 3: Loans continue to offer attractive spreads

Source: Bloomberg, Credit Suisse, JP Morgan, Janus Henderson Investors Analysis, comparing spread ranges between different fixed income asset classes between 30 April 2022 and 30 April 2023. HY= high yield; EM= emerging markets; IG= investment grade; RMBS= residential mortgage-backed securities; CLO= collateralised loan obligation. Past performance does not predict future performance.

Data shows the amount of time that as a percentile that spread have been tighter/wider than current levels. For CLOs and UK RMBS this is based on monthly data from 2006 to date; EM Credit from end 2003. All other asset types based on monthly data over the prior 20-year period.

Indices used: Credit Suisse Western European Leveraged Loan Index, Credit Suisse Leveraged Loan Index, JP Morgan UK RMBS AAA 5y GBP, ICE BofAML US High Yield Index, ICE BofAML European Currency Non-Financial High Yield 2% Constrained, ICE BofAML US Emerging Markets Liquid Corporate Plus Index, ICE BofAML Sterling Corporate Index, ICE BofAML US Corporate Index, ICE BofAML Euro Corporate Index. CLOs based on Citi Velocity European 1.0 AAA CLOs up to March 2013 then European 2.0 AAA CLOs thereafter.

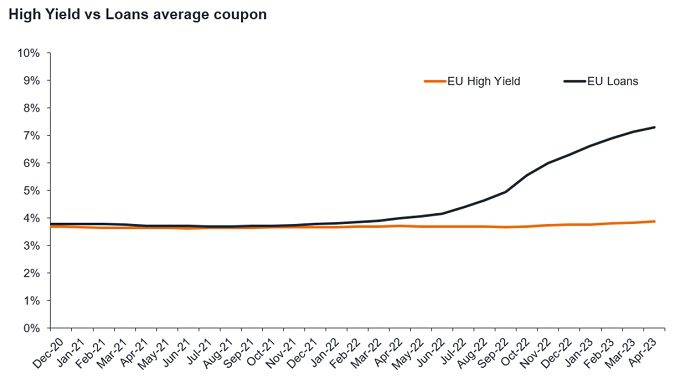

Loans were one of the best performing fixed income asset classes in 2022 and this outperformance has continued into 2023*. Loan yields continue to benefit from rising rates (Exhibit 4) and in our view now offer a very attractive running yield (income) for investors, which could help to cushion returns given the current uncertain economic outlook.

Exhibit 4: Cash interest receipts rising in loans

Source: Bloomberg, ICE BAML, Credit Suisse, 31 December 2020 to 30 April 2023. Past performance does not predict future returns.

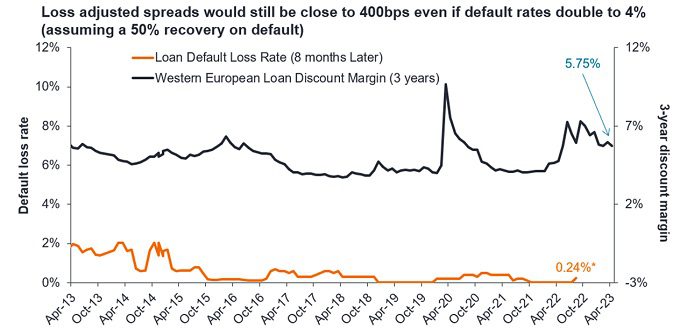

Loan spreads also offer a significant cushion against any rise in default rates and associated losses. Default rates have so far remained very low (under 2% for the 12 months to the end of Feb 2023); but given rising inflation and higher debt servicing costs, we would anticipate this picking up through 2024. However, we feel that investors are being compensated for this risk (Exhibit 5).

Exhibit 5: Current loans yields offer preservation against rising defaults

Source: Credit Suisse, Janus Henderson Investors Analysis, 30 April 2013 to 30 April 2023.

Summary

Loans have played a key role in helping to drive the performance of the MAC strategy since inception, and recent volatility has underscored their diversification potential. We believe that this diversification more than outweighs any concerns around their perceived illiquidity and the extended settlement cycle, which ultimately drives the dealing frequency on MAC. Rising interest rates have materially enhanced the yield delivered by the asset class, making them as relevant as ever to the strategy.

*As at end April 2023. Past performance does not predict future returns.