What does the economic recovery mean for equities in 2021?

-

Matt Peron

Matt Peron

Director of Research | Portfolio Manager

Market GPS |

Market GPS |

What does the economic recovery mean for equities in 2021?

-

Matt Peron

Matt Peron

Director of Research | Portfolio Manager

Where do equity markets go from here? Director of Equity Research Matt Peron looks at the components typically required to support resilient equities markets and assesses the current backdrop. He explores the importance of corporate earnings, the impact of low interest rates and flags the scenarios to watch for that could derail an otherwise positive outlook for 2021.

Key takeaways

- Recent upward revisions in earnings estimates reflect improving economic data, and we expect the trend to continue into 2021.

- Leading companies have the opportunity to emerge from the crisis in an even stronger position as they seek acquisition targets and capitalize on competitor missteps.

- In addition to the unknown duration of the pandemic, it is important to watch for potential changes in the regulatory environment and a possible inflationary surprise.

Over the past few years, every upward move in equities has been met by doubters. The argument was that valuations were expensive. If they weren’t, it was due to the disproportionate index weights of mega-cap tech and Internet companies. In 2019, soaring markets ignored the trade war, and in 2020, the mid-year recovery failed to grasp the magnitude of the pandemic and instead benefited from a torrent of stimulus.

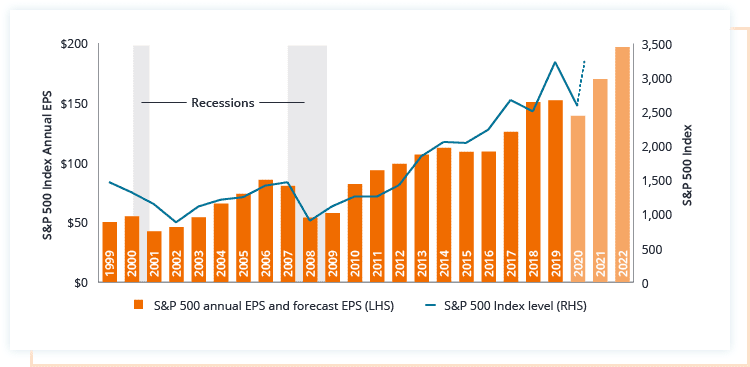

While it is necessary to assess what role such factors play in the trajectory of equities, we believe that the driving force behind a resilient stock market remains a favorable earnings backdrop (as supported by Exhibit 1). Moving into 2021, we see this key component to be in place. We also have confidence it has longevity thanks to a better-than-expected economic rebound since the lockdowns of the first half of 2020 and the ability of companies to rapidly adapt to meet changing business conditions.

Exhibit 1: Equity markets typically take their lead from earnings levels

Stock prices typically follow earnings, and the recent upward revision of future year earnings estimates – with 2021 earnings expected to eclipse those of 2019 – was reflected in the rally in the second half of 2020.

Source: Bloomberg, as of 10 November 2020. 2020-2022 earnings per share (EPS) are estimates; S&P 500 Index level is year-end except for 2020, which indicates 31 March level (solid line), followed by late-year recovery through 10 November (dashed line).

An unmistakable – and welcome – V-shaped recovery

While it may appear somewhat inappropriate to discuss our positive outlook for equities in the midst of a COVID-19 pandemic that has caused untold human suffering, we should note that the products and services of several sectors have been integral in helping businesses and households navigate this uncertain period. With cases rising at the time of writing in Europe and the U.S., we expect remote working and e-commerce solutions to stay in demand over the coming months. More recently, innovative pharmaceutical and biotechnology companies have come to the fore as the race toward a vaccine and other therapies continues. The value these sectors are adding to the economy is reflected in them generating some of the highest market returns so far in 2020. They have recently been joined by materials, which has benefited from fiscal expansion in China. Conversely, travel and energy could remain challenged given the decline in overall economic activity in the absence of a widely available vaccine (which, despite progress, likely remains a long way off), and banks face headwinds in the form of perennially low interest rates weighing on margins.

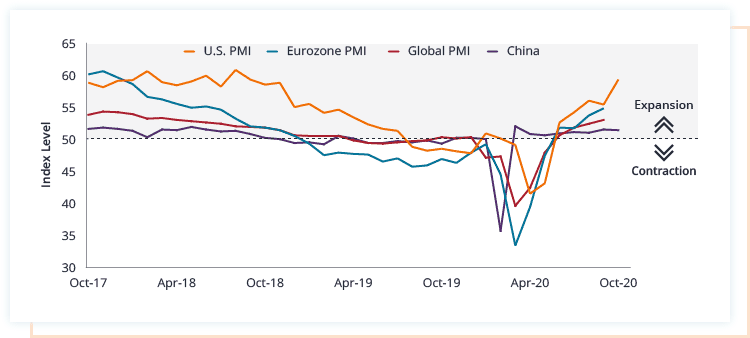

Yet, we believe 2020’s highfliers have the potential to be joined by other sectors as evidence builds that a “V-shaped” recovery is emerging. We are witnessing considerably improving data across the economy. Major global purchasing manager indices have returned to expansion territory, as seen in Exhibit 2. These leading indicators align with consensus expectations that after contracting by 3.9% in 2020, global economic output should rise by 5.2% next year and 3.6% in 2022.

Exhibit 2: Improving business confidence in a return to growth

The unprecedented collapse – and ensuing rebound – of business purchasing manager indices is indicative of other data that support the notion that the global economy is healing more rapidly than expected.

Source: Bloomberg, as of 10 November 2020.

Source: Bloomberg, as of 10 November 2020. Purchasing manager indices are based on monthly reports and surveys from the manufacturing and services sectors. They provide an indication of economic trends and levels of business confidence.

Regionally, major emerging markets and Asia ex Japan are on track to log positive economic growth this year, with U.S. growth being upwardly revised to -4.0%, still ahead of a struggling eurozone and UK. Yet, by 2021, all major regions are expected to return to positive growth.

Of the 21 million cumulative U.S. jobs lost at the depth of the pandemic’s lockdowns, 12 million have returned. The consumer sector, as measured by core retail sales, was quick to rebound in the first half and was followed by a resumption of business spending. We recognize that these monthly gains in the U.S. were off low comparables, and that businesses and households could again shut their wallets in the event of an uncontrolled viral breakout, but many countries have coalesced around the idea that certain economic activity remains essential and many companies have learned to adapt their business models to accommodate changes in client behavior.

Global economic growth expected to turn positive in 2021

Corporate dynamism at work

Improving economic conditions are already being reflected in corporate earnings and upwardly revised estimates for the coming quarters. With most companies in the S&P 500® Index having reported third quarter earnings at the time of writing, 82% beat consensus estimates by an aggregate 17% over what had been expected. Looking forward, although full-year 2020 earnings on the S&P 500 are expected to decline by nearly 9% compared to 2019, they are forecast to rise by 22% in 2021 and by another 15.7% in 2022. Notably leading the expected earnings gains for 2021 are industrials, consumer discretionary and materials – three sectors typically dependent upon broad economic growth.

Few business models are designed to withstand a 50% decline in revenues. Valuing companies in light of such tail-risk events is similarly challenging. Yet we find many companies in far better positions than we expected just a few months ago. Much of this resilience is attributable to the lessons learned in the wake of the Global Financial Crisis (GFC) and ensuing slow recovery. Companies streamlined processes, repaired balance sheets and industries pursued rationalization. It appears a similar playbook is being followed now, albeit on an accelerated pace and with more government assistance.

We believe that the driving force behind a resilient stock market remains a favorable earnings backdrop.”

Source: Bloomberg Consensus Estimates, as of 11 November 2020.

We have long recognized that the next crisis is potentially just around the corner. The strongest corporate management teams understand this as well. It is our belief that risk-aware and resilient companies often come out the other side of a crisis in an even stronger position. One method through which they accomplish this – that is receiving little attention – is consolidation. We expect companies with room on their balance sheets to seek businesses or business lines that are complementary to their core offerings and that allow them to improve their cost structure and pricing power.

We’ve recently seen such rationalization occur in the semiconductor industry as companies bulked up to combat overcapacity and weak pricing. Candidates likely to apply this approach in the wake of the pandemic include the energy sector and anything related to travel and tourism. Few sectors are immune to the upheaval wrought by COVID-19 and companies, in our view, would be well served to undertake “self-help” today rather than have adverse conditions dictate their fate tomorrow. Banks, for example, face acute pressure from the low interest rate environment. Unable to increase net interest margins, financial companies are seeking to boost profitability by jettisoning low-margin businesses and expanding potentially more lucrative ones, with wealth management an example of the latter.

More than a rates play

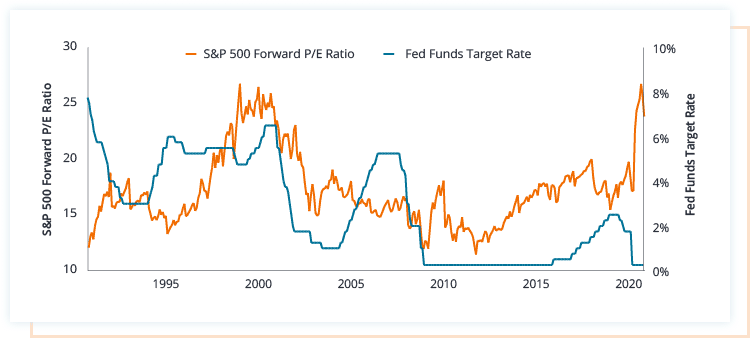

An explicit goal of low interest rate policies and central bank securities purchases is to push investors toward riskier assets. But there is more to buoyant equity prices than stocks being an alternative to paltry bond yields. Low rates benefit companies – and their stock prices – in myriad ways. Corporations have been eager to refinance at rock-bottom rates, with the aim of lowering their interest burden and thus potentially increasing profits. Similarly, low rates reduce the hurdle for capital projects to become profitable. This stands to spur the expenditure that should lead to higher productivity and profitability. Accordingly, and as illustrated in Exhibit 3, periods of low interest rates tend to coincide with higher stock valuations.

From a valuation perspective, low rates directly feed into the intrinsic value of a firm and, therefore, its stock price. By discounting the value of future cash flows at a lower cost of capital, their present value increases, making them more attractive to investors. This is particularly true for longer-duration assets like growth stocks leveraged to secular themes. In this context, today’s putatively lofty price-to-earnings (P/E) ratios appear less exuberant. Were the discount rate at 2%, 3% or 4% (the vestige of a bygone era), P/E ratios, especially outside of the technology and communications sectors, would be much closer to their historical levels.

Exhibit 3: Low interest rates typically correspond with higher valuations

A low interest rate environment typically corresponds with higher stock valuations, and when rates rise the price that an investor is willing to pay for a unit of earnings tends to compress.

Source: Bloomberg, as of 10 November 2020. Fed = U.S. Federal Reserve.

Source: Bloomberg, as of 10 November 2020. Fed = U.S. Federal Reserve. Forward P/E Ratio = A popular ratio used to value a company’s shares. It is calculated by dividing the current share price by its earnings per share. In general, a higher forward P/E ratio indicates that investors expect strong earnings growth in the future.

Risks: seen and unseen

While equities’ recovery, in our view, is grounded in favorable fundamentals, there are plenty of lurking risks that could turn things south in a hurry. After all, this time last year, few had heard of COVID-19. Among the risks that we believe should concern equities investors most is an uncontrollable resurgence of the virus. Even when a safe and effective vaccine is found, deploying it to a sufficient amount of the global population to dampen the virus’ spread could take longer than expected. In the interim, more damage from curtailed economic activity would be done.

In addition, as we had feared, the Trump administration and Congress were unable to reach an agreement on another round of U.S. stimulus prior to the election. While all parties agree that the economy needs more fiscal support, the lack of clarity about the ultimate size of the package and whether it proves sufficient in supporting vulnerable pockets of the economy may cast a shadow over corporate prospects.

A split government – with Democrats controlling the White House and Republicans the Senate – has been cheered on by investors. But this is a fragile scenario given the two outstanding Senate races in Georgia. The outcome of those, which should be known in early January, along with who President-elect Biden appoints to key Cabinet positions, will, in part, dictate how aggressive the new administration is with respect to tax and regulatory policy. Even with a change in administration, we expect the recent trend of deglobalization and a more cautious approach to the U.S.-China trade relationship to remain.

Even with a change in administration, we expect the recent trend of deglobalization and a more cautious approach to the U.S.-China trade relationship to remain.”

Another potential risk that we don’t believe receives sufficient attention is rising inflation. While a rapid rise in prices is not our base-case scenario, the ingredients for an inflationary surprise are present. The level of liquidity provided by monetary stimulus is staggering. In the years immediately following the GFC, the level of the Federal Reserve’s (Fed) balance sheet relative to gross domestic product (GDP) peaked at just over 26%. This past June it was 40%. Should a vaccine be deemed viable and normal economic activity resumes while the Fed telegraphs that it is fine to let inflation run above its 2% target, prices could easily outrun efforts to rein them in.

We believe that with the volume of newly created money sitting on the sidelines, it would only take the velocity of money – the rate at which dollars circulate through the economy – to stop declining to potentially ignite an upward lurch in prices. Longer term, the government debt racked up during the pandemic could eventually weigh on the value of the dollar, thus leading to “imported inflation” in the form of more expensive foreign goods.

We are less concerned with corporate defaults. Due to years of low rates – and the wave of refinancing as benchmark rates slid toward 0% in the first half of 2020 – balance sheets largely appear steady and default rates are lower than levels registered during the GFC. While the Fed’s 2020 market intervention was aimed at stemming a liquidity crisis, questions remain about solvency. While not eliminated, these concerns have diminished thanks to the mid-year economic recovery and the Fed’s commitment to continue supporting the corporate sector, namely through buying bonds of different credit ratings.

Scenarios to consider

- By analyzing company fundamentals and monitoring macroeconomic data, we believe 2021 is shaping up to be amicable to stocks. Accordingly, equity market gains may become more dispersed as economic growth broadens, especially in the hard-hit consumer sector. The sector level themes powered by technological innovation should also contribute to equity returns given their adoption has been accelerated during the pandemic. Considering the nature of this downturn along with the global economy performing well prior to the pandemic, we may look back at equities’ 2020 nadir as the advent of a new bull market cycle, the last five of which has each lasted over five years.

- We are on the lookout for inflation. Should a larger-than-expected stimulus package be enacted and a vaccine rapidly distributed, we could see a rotation toward value stocks such as financials, which comprise roughly 14% of value stocks, and energy as well as other “price makers” that can pass along costs to customers. Under this scenario, certain consumer-exposed themes could suffer as households reallocate budgets.

- We cannot rule out additional lockdowns and subsequent economic pain. Nor is the coast clear for a business-friendly regulatory environment or a resumption of unfettered global trade. Should growth sputter, investors will likely seek growth where they can find it, and once again that is likely to be in the longer-duration sector level themes tied to technology, emerging market consumption and aging developed-market demographics.

In summary, as we move into 2021, our outlook for equities is positive, supported by strong earnings growth expectations and the more rapid recovery from the pandemic than feared. As noted, there are meaningful challenges to this outlook that require a close eye but for now we see fundamentals, forward-looking management teams and low interest rates as strong catalysts to helping equity markets overcome adversity.

GDP, employment data, corporate earnings results and estimates, Federal Reserve asset levels and value stock composition all sourced from Bloomberg, as of 10 November 2020.

Glossary

Bull market: A financial market in which the prices of securities are rising, especially over a long time. The opposite of a bear market.

Company fundamentals: Information that contributes to the valuation of a security, such as a company’s earnings or the evaluation of its management team, as well as wider economic factors.

Corporate defaults: The failure of a debtor (such as a bond issuer, and in this case a bond issuer in the corporate sector) to pay interest or to return an original amount loaned when due.

Credit rating: A score assigned to a borrower, based on their creditworthiness. It may apply to a government or company, or to one of their individual debts or financial obligations. An entity issuing investment-grade bonds would typically have a higher credit rating than one issuing high-yield bonds.

Earnings per share: The portion of a company’s profit attributable to each share in the company. It is one of the most popular ways for investors to assess a company’s profitability.

Fiscal expansion/fiscal stimulus/fiscal support: Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, which is typically set by a central bank. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt.

Gross domestic product: The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period, and is a broad measure of a country’s overall economic activity.

Liquidity: The ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as “liquid.”

Monetary stimulus/monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Purchasing manager indices: These are based on monthly reports and surveys from the manufacturing and services sectors. They provide an indication of economic trends and levels of business confidence.

Tail-risk events: These are considered events that have a small probability of occurring, but which could have a significant effect on performance were they to arise.

V-shaped recovery: Refers to the shape of a line chart based on data from financial markets or economic indicators. The V reflects a sharp move down and then a corresponding move upward in recovery.

Market GPS Home View All Outlooks