Investment Environment

September was a very weak month for the UK equity market as the FTSE All-Share Index fell 5.9%. UK government bond yields rose sharply (prices fell) while sterling fell relative to the US dollar and the euro following unexpected tax cuts announced by the new Chancellor of the Exchequer. This perceived domestic uncertainty had a greater impact on the share prices of small and medium-sized companies, which (on average) generate a greater portion of their earnings in the UK. For example, the FTSE 250 Index of medium-sized companies fell 9.7% while the FTSE Small Cap Index (ex Investment Trusts) fell 8.5% (all figures given are total return, in sterling terms).¹

Portfolio review

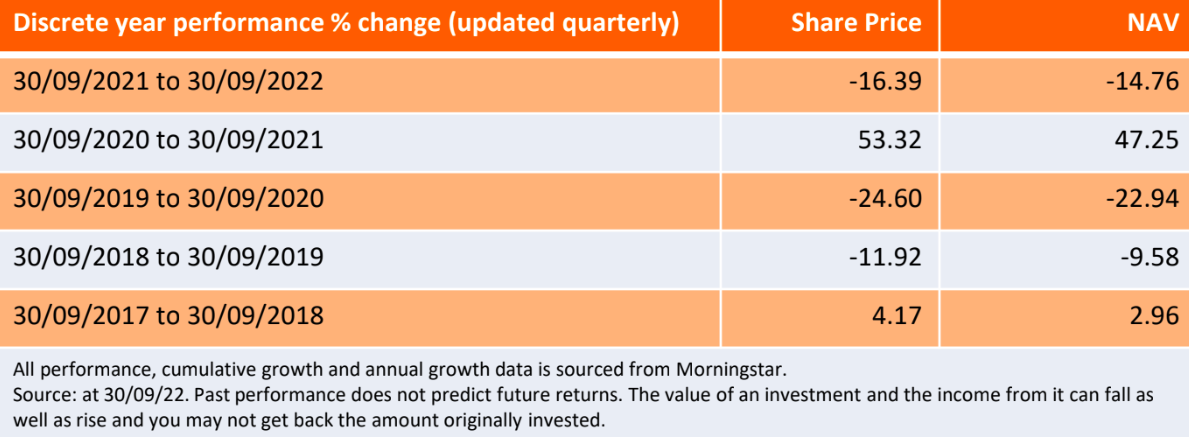

The Company fell 8.3% underperforming its FTSE All-Share Index benchmark which fell 5.9%. Over the same period, the company’s AIC UK Equity Income peer group fell 6.4%.¹

We have always had a multi-cap approach and in more typical circumstances less than half of the portfolio is invested in the FTSE 100 Index, with the remainder held predominantly in small and medium-sized UK companies. It is our view that this exposure to smaller companies provides the potential for both faster earnings growth -because companies are at an earlier stage of their lifecycle and therefore have a longer pathway of growth ahead of them -and greater diversification of income generation. However, this year (and September was no exception), small and medium-sized companies have significantly underperformed, and this has been a headwind to performance. At the sector level, industrials were the largest detractors from returns due to ongoing concerns about the impact a slowdown in the global economy would have on their earnings.

Our trading activity during September focused largely on making additions to existing positions following share price weakness. This included textile rental company Johnson Service Group, building materials company Marshalls, and free-to-air broadcaster STV. All of these companies have operations predominantly in the UK and the shares have de-rated to substantially lower than historic average valuations given the concerns about a slowdown in the domestic economy. These additions were funded by the sale of Centrica, which had performed well year-to-date based on the rise in energy prices. However, the outlook for long-term margins in its UK retail energy supply business remained unclear.

Manager Outlook

Sentiment towards UK equities has been poor for a number of years, as illustrated by net flow data, the widening valuation differential versus overseas peers, and sentiment indicators (such as fund manager surveys). This weak sentiment has, if anything, been exacerbated over the last month because of additional political uncertainty and therefore a greater ‘risk premium’ associated with UK assets. While it is frustrating to see much of the portfolio de-rate, the scale of the valuation falls we have seen could be viewed as an opportunity to add to positions at significantly below their long-run average valuations. In many cases the companies we are adding to are market leading businesses, with strong balance sheets and experienced management teams.

¹Source: Bloomberg as at 31 August 2022

Cyclical stocks – Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

De/Re-rating – When the market changes its view of a company sufficiently to make calculation ratios such as PE substantially higher or lower, this a re-rating or de-rating.

Dividend yield – The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Net capital outflow – Net capital outflow (NCO) is the net flow of funds being invested abroad by a country during a certain period of time (usually a year). A positive NCO means that the country invests outside more than the world invests in it. NCO is one oftwo major ways of characterizing the nature of a country’s financial and economic interaction with the other parts of the world (the otherbeing the balance of trade).

Valuation metrics – Metrics used to gauge a company’s performance, financial health, and expectations for future earnings eg, price to earnings (P/E) ratio and return on equity (ROE).