Macro backdrop

After a sharp decline during June, UK equity markets rebounded in July with the FTSE All-Share Index returning 4.4%.¹ Within this, there was a reversal of the trend seen so far this year as small and medium-sized companies outperformed larger companies -the FTSE 250 Index rebounded strongly as it was up 8.3% and the microcap AIM Index rose 5.3%, while the FTSE 100 Index rose 3.7% (all figures are total return).1 While it is always difficult to pinpoint precisely what causes a market to turn, especially during the quieter summer months, this change in market direction came at a time when second quarter earnings releases from companies are proving broadly resilient, and when there was a growing expectation that we may be reaching the peak pace of interest rate rises -for example the US Federal Reserve (Fed), having raised interest rates 0.75% at the last two meetings, may now slow the pace to 0.5%.2

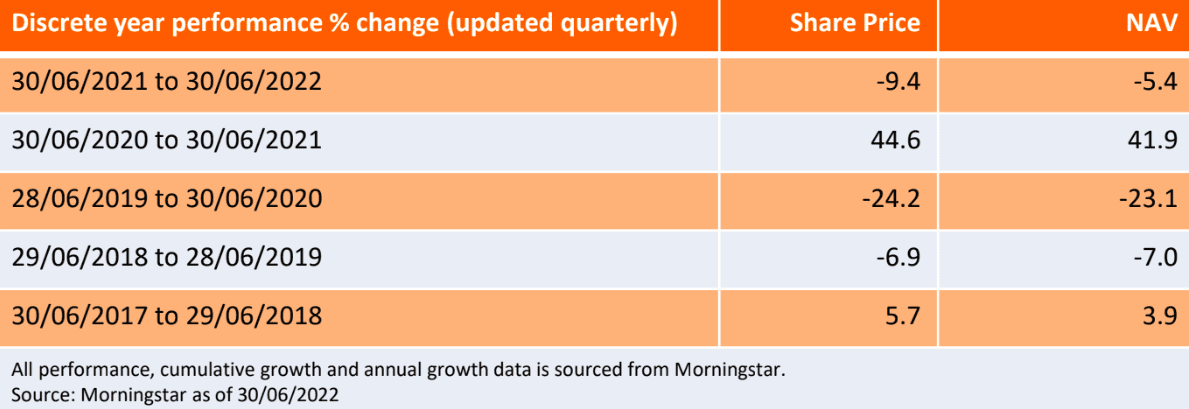

Fund performance and activity

In a rising market the Trust modestly underperformed, with its net asset value rising 4.1% relative to a 4.4% rise in its FTSE All-Share Index benchmark and a 5.2% rise in its AIC UK Equity Income peer group.1

The largest individual detractor from performance was motor insurer Direct Line, which lowered earnings expectations for the year as claims costs were higher than expected and higher prices will likely take time to recover these additional costs.3 While this is disappointing, we continue to think that Direct Line is a disciplined underwriter and it is now trading at a low valuation versus its history. Therefore, we added to the holding after the share price fall. Among the best performers during the month were industrial holdings Morgan Advanced Materials and brick manufacturer Ibstock. Both reported encouraging trading updates that have meant modest earnings upgrades.4

During the month, we added a new position in reinsurer Conduit. The shares have performed poorly and were trading at a lower valuation than historically because there have been some losses due to the war in Ukraine -for example, commercial buildings insurance where buildings have been destroyed. While this will likely impact earnings in the short-term, we retain our confidence in Conduit and in the meantime the shares are paying an above market average yield. We also added to existing positions in companies, including textile rental company Johnson Service Group, flooring distributor Headlam and Scottish housebuilder Springfield Properties. These additions were funded by a sale of the position in Euromoney Institutional Investor (which agreed to a takeover offer from private equity) and reductions in the positions in Centrica and BAE Systems following some good performance.

Outlook/strategy

The widespread assumption in the market is that the valuation compression we saw in the first half of the year is the prelude before widespread and material earnings declines as global economic growth slows. However, what we are hearing from companies so far, with the exception of discretionary ‘big ticket’ item spend, is that demand is remaining largely resilient. In our view, the likelihood looking ahead to the second half of the year is that there will likely be areas that remain resilient (for example there are pockets of consumers that built up substantial excess savings during the pandemic and therefore have the capability to continue spending), and there will also be areas of weakness that will likely to see earnings declines. We are adding to holdings where we think end demand could prove more resilient than expected, or where valuations have fallen such that we think considerable earnings declines are already ‘priced in’. In making these additions, we are seeking companies that are well managed by experienced teams and are market leaders (or one of the market leaders) in the product or service that they are providing.

1Source: Bloomberg as at 31 July 2022

2Source: Fed decision July 2022: Fed hikes interest rates by 0.75 percentage point (cnbc.com)

3Source: European markets close higher, continuing positive global trend; Direct Line down 10%

4Source: PowerPoint Presentation (morganadvancedmaterials.com)and Ibstock 1H PretaxProfit Rose, Expects to Beat 2022Earnings Views -MarketWatch

Dividend yield – The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Valuation metrics – Metrics used to gauge a company’s performance, financial health, and expectations for future earnings eg, price to earnings (P/E) ratio and return on equity (ROE).

NAV – The total value of a fund’s assets less its liabilities.