However, taking a closer look at UK returns shows a large discrepancy of performance of companies within the market. The FTSE 100, representing the largest 100 companies in the UK market, has returned +1.6% over the period, while medium and smaller companies have suffered a similar fate as overseas indices, with the FTSE 250 and FTSE Small Cap indices falling 17.3% and 13.0%, respectively.1 Dissecting the FTSE 100 further shows the performance of the UK market is even more skewed; the top 20 largest companies in the UK market, are up 12.4% on a weighted basis for the year to end of August. For the same period, the other 80 stocks in the FTSE 100 are down 19.3%.1 This has been a very unusual period for the UK market where performance has been so dominated by such few large companies. Looking at those companies, however, one can understand why. High commodity prices has led to the outperformance of BP, Shell, Glencore and Rio Tinto, rising interest rates has supported HSBC, defensive positioning has driven shares in the likes of British American Tobacco, AstraZeneca, National Grid and Vodafone while more stock specific reasons have aided Compass Group and the London Stock Exchange.

So although at the headline level the UK market appears to have been relatively resilient this year, looking beneath the surface shows that the vast majority of UK stocks have suffered the same fate as overseas equities and have been weak, reflecting investors’ concerns over recessionary risks etc. Given this underlying weakness, the question becomes whether now is a good time to invest and what to buy?

Unsurprisingly the sectors that have come under the most pressure this year are cyclical in nature and are most exposed to slowing economic growth. Consumer discretionary (-18.9%), industrials (-18.4%) and financial services (-20.5%) have all performed poorly and are where valuations are now starting to look attractive.1 This creates a quandary – although valuations appear attractive, is it too early to start buying cyclicals when the outlook is so uncertain and current earnings forecasts, which those valuations are based on, may prove too optimistic. To buy cyclicals here an investor needs to believe that either the earnings forecasts are correct and the valuation is indeed attractive or that the valuation is so depressed it already discounts a too bearish expectation for earnings.

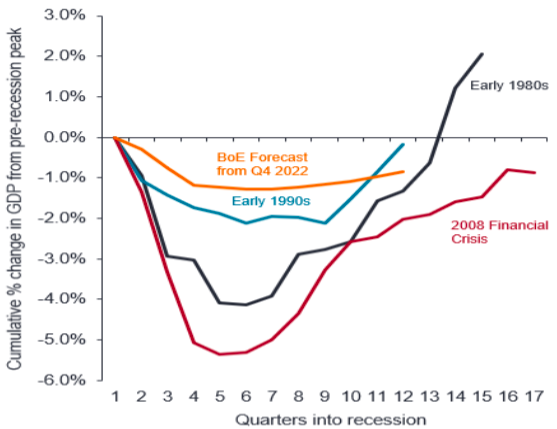

The Bank of England, in its August monetary policy report, is now projecting the UK enters recession from the fourth quarter of this year. While this may sound alarming one needs to put their forecasts into context. The chart below shows their projections verses previous recessions, highlighting any potential recession could be less severe than experienced in the past. While consumers’ discretionary spending is under significant pressure currently, generally, corporate balance sheets are robust, banks have strong capital positions and labour markets are tight, which would all support a less severe recession, something that is mirrored in other developed market economies. This therefore helps to judge what the correct level of earnings a cyclical company can generate in a more difficult trading environment.

Source: The Bank of England, Monetary Policy Report – August 2022

Two good quality, albeit cyclical businesses, we currently like are PageGroup and Vesuvius where we believe a recession is already discounted in the valuation. PageGroup is a specialist recruitment consultancy. The company provides mostly permanent recruitment service for executives, qualified professionals, and clerical professionals across a broad range of industries and geographies. Currently, the consensus of analysts covering the company forecast its net fees (effectively a recruiter’s gross profit) to grow by 1.3% in 2023. This feels particularly optimistic given the current economic outlook. If we assume net fees fall by 25% in 2023 (They fell 28% during the pandemic) and apply the same average Enterprise Value (EV) / Net Fee multiple (a valuation metric used to value recruitment companies) of 1.6x the company traded at during the Global Financial Crisis this would approx. yield the current share price.2 While there are risks to this analysis; the fall in net fees could be more severe than our assumption and the market could ascribe a lower multiple to the business than during a previous recession, we believe our assumptions are on the conservative side and hence we have concluded a too bearish outcome is currently being discounted in the current share price.

The UK market has been resilient so far this year despite a worsening economic outlook but within the market there has been a significant divergence in performance between the largest 20 companies and the rest of the market. This has created a buying opportunity in certain cyclicals despite the negative economic background but only in those companies where the valuation is already discounting a too bearish outcome for revenues and earnings.

1Source: Bloomberg as at 31/08/2022

2Source: HSBC Research Note: “Recession priced in, churning out profit”, 03/08/2022

3Source: Factset as at 26/08/2022

Cyclical stocks – Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Inflation – The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Monetary policy – The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Valuation metrics – Metrics used to gauge a company’s performance, financial health, and expectations for future earnings eg, price to earnings (P/E) ratio and return on equity (ROE).

![]()