May 2020

The long-term opportunity in structured securities

Jason Brooks

Jason Brooks

Securitised Products Analyst Will Palamet

Will Palamet

Securitised Products Analyst Nick Childs, CFA

Nick Childs, CFA

Portfolio Manager | Securitised Products Analyst John Kerschner, CFA

John Kerschner, CFA

Head of US Securitised Products | Portfolio Manager

Key takeaways

- Many structured securities have lagged corporate bonds in their recovery from the lows of March as the latter received more explicit support from the Federal Reserve (Fed). But the ability to earn higher income for credit similarly rated to the U.S. government is, in our view, compelling.

- Given the large opportunity set in the securitized market, we believe that in-depth research can reveal mispriced securities with an attractive risk/reward outlook.

- We broadly favor higher-quality, seasoned and shorter-duration exposures as we maintain our view that these characteristics offer investors attractive risk-adjusted returns in uncertain, volatile and low-yielding times.

Please see glossary of terms beneath article

Why have many structured securities broadly lagged corporate bonds in their recovery from the lows of March? The primary cause, in our view, was the Federal Reserve’s (Fed) explicit support for corporate bonds. In contrast to its direct support to both the investment-grade and high-yield corporate bond markets, in terms of structured securities, the Fed is only buying Agency mortgage-backed securities (MBS), albeit in historic amounts. To the rest of the securitized market, the Fed offered only a variant on the Term Asset-Backed Securities Loan Facility (TALF) and limited it to AAA rated commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS). The effect, predictably, has prolonged the illiquidity of the securitized market generally, delaying its recovery. But this unusual situation could create a unique opportunity for investors with in-depth fundamental research capabilities – and patience.

What will spark the securitized market to rise?

2020 is not 2008. While the downturn in 2008 was caused primarily by excess leverage in the financial sector generally and structured securities specifically, the 2020 crisis has been the result of a sudden, swift, economic shutdown with no more cause attributable to the securitized market than the investment-grade corporate bond market. In fact, many of the fundamental variables were stronger for securitized sectors in early 2020 – consumer leverage was relatively low compared to corporate leverage and aggregate asset qualities (which underly the securities) were relatively high.

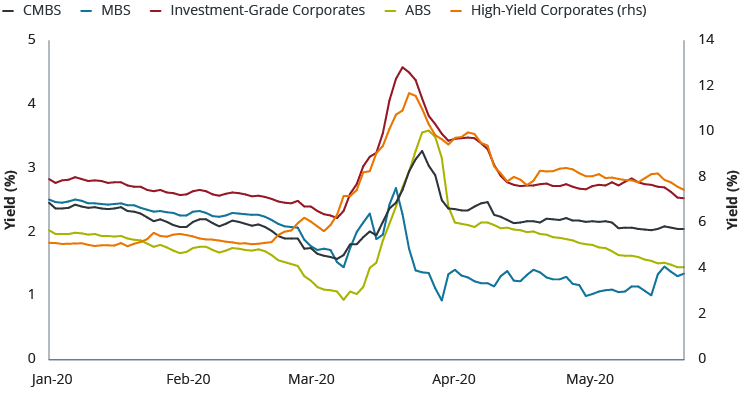

We do not know the breadth or depth of the current recession and (outside of Agency MBS) expect caution and lower liquidity to prevail across the securitized market until the economic outlook is clearer. However, current yields broadly reflect this, remaining well above their pre-crisis levels while U.S. government bond yields are at historic lows (and remarkably close to zero). The additional income available for structured securities that carry the same AAA rating as the government, or better, may warrant a closer look.

YEAR-TO-DATE YIELDS FOR CORPORATE AND STRUCTURED SECURITIES

Source: Bloomberg, as of 30 April 2020. CMBS: Bloomberg Barclays U.S. Commercial Mortgage Backed Securities Index. MBS: Bloomberg Barclays U.S. MBS Index. Investment-Grade Corporates: Bloomberg Barclays U.S. Corporate Bond Index. ABS: Bloomberg Barclays U.S. Aggregate Asset Backed Securities Index. High-Yield Corporates: Bloomberg Barclays U.S. Corporate High Yield Bond Index.

Where illiquidity caused a security to be marked lower than the economic outlook may have warranted, we expect it will gradually reprice as the fundamental data becomes clearer and risks can be better priced; uncertainty requires an additional premium, as insurance against the worst case happening. Like corporate credit, we expect there will be defaults and permanent credit impairment. But the opportunity set is very large in the securitized market, and we believe that in-depth research can reveal mispriced securities with an attractive risk/reward outlook.

Opportunities in MBS

Forbearance requests in MBS have risen sharply, but approximately 40% of those requesting a reduction or postponement in payments are still paying their full mortgage. Regardless, both the interest and the principal on Agency MBS is guaranteed to investors by the Agencies, so the risk of capital impairment on Agency MBS is equivalent to the risk that the U.S. government chooses to relinquish their backing of the Agencies. And, as forbearance and/or delinquency prohibits refinancing, the risk of prepayments that would normally accompany such a swift drop in U.S. Treasury yields has greatly diminished – a positive for holders of Agency MBS.

At the security level, the current climate should lead to significant dispersion in the pre-payment characteristics of different offerings, creating opportunities. How will borrowers cure their forbearance? When? As different bonds are more or less sensitive to the possible outcomes, relative-value opportunities abound and are likely to persist as the impact of the recession evolves. As active managers specializing in security-by-security analysis, we see this as an opportunity to add value. Individual credit-risk-transfer (CRT) securities, for example, have different terms, with some having explicit language protecting investors from forbearance while others may have language protecting investors from hurricanes. While we would hope that hurricanes will not be added to the list of struggles the American homeowner faces, close analysis of individual securities can reveal critical differences in the risks, and those differences deserve significantly different pricing.

Opportunities in CMBS

Index-eligible super senior AAA CMBS, if issued prior to March 23, are TALF eligible and thus relatively more liquid and higher priced at the date of writing. We think the non-TALF eligible securities, particularly those collateralized by a single asset or sponsored by a single borrower, are more interesting. In our view, CMBS securities collateralized by higher-quality, marquee, real estate holdings or with significant institutional sponsorship – large insurance companies with deep pockets that will be less reluctant to write off an asset – deserve to be priced based on these characteristics. Yields currently available in many sectors and securities appear attractive, insofar as they carry a premium for illiquidity and – in today’s market – simply the fact that they are not TALF eligible, and thus take a little more work to price accurately.

Data relevant to CMBS so far is showing to be stronger in many aspects than the market anticipated. For example, rent collection among certain property types such as multifamily, industrial and office, have been higher than expected, with the apartment sector a beneficiary of the various stimulus packages and economic impact payments. In general, we think securities with lower retail or hotel exposure and higher exposure to more stable real estate subsectors offer more attractive risk/reward, particularly those with relatively low leverage and a high percentage of institutional or well-capitalized sponsors.

Opportunities in ABS

Newly issued AAA rated ABS are eligible for the TALF program, effectively putting a floor on the assets’ prices, and current spreads largely reflect that support. Like the other securitized markets, the most interesting opportunities remain highly sector and security specific.

Liquidity in aircraft-related ABS remains poor as few investors are willing to speculate on how the aviation sector will perform in the coming months. But some of the more esoteric industries, such as cell towers or litigation financing, have held up remarkably well. The largest ABS sector, Auto ABS, also has performed better than expected. The sudden shutdown closed many of the resale outlets, causing used car prices to fall sharply. But used car prices have rebounded as some liquidity has returned. And, looking ahead, near-zero government rates should help demand for new cars, as could the reluctance of consumers to take public transit or taxis in the interest of social distancing.

The subprime auto market is particularly interesting to us given the prevalent assumption that subprime means greater risk. On the contrary, there is a rating spectrum for both prime and subprime autos, so it is possible that an investment-grade rated prime auto bond is riskier than a AAA rated subprime auto bond. After the volatility in March, prime auto securities were the first to recover. But, in our view, subprime auto may perform equally well or even better in the months ahead, because people rely on their vehicles to get to work, to gather essentials, etc. Indeed, a number of subprime issuers are seeing collections better than they were pre-crisis.

Tenor also matters. A lot of the more seasoned Auto ABS securities are, at this point in their life cycle, overcollateralized. As payments are made on the underlying loans, the principal and interest go toward reducing the ABS debt balance, improving credit enhancement or the debt balance as a percentage of the total collateral. At some point, even the recovery value of the underlying assets can exceed the amount owed.

Opportunities in whole business securitizations (WBS)

The bulk of WBS is in the fast-food sector, which has performed relatively well through the crisis. Roughly 75% of the quick-service restaurant sector was off-premises (e.g., delivery or carryout) or drive-through before the crisis, which compares favorably to the restaurant sector as a whole. Nevertheless, they generally offer a premium yield over comparable high-yield or investment-grade corporate bonds from the same issuer. And, corporate bond debt is generally unsecured, while WBS is typically secured by the entity’s income-producing assets and/or their intellectual property. Ultimately, we view the excess yield available in WBS as more than sufficient compensation for lower liquidity resulting from the market’s smaller size and unique properties. As security-selection specialists, we relish (no pun intended) the opportunity to fully understand the credit and thus more efficiently monetize the liquidity premium.

Looking ahead

In the current environment, patience is required for successful investment in structured securities. But we believe that the illiquidity relative to corporate bonds offers a sufficient premium, and we see opportunities in the wide range of sectors, structures and individual securities available. In times of crisis, many securities are marked well below “fair value” given the high degree of uncertainty. As such, price movement can often be skewed to the upside, reducing volatility. Put differently, we consider the crisis-to-date performance to imply securitized assets have more relative upside, and less relative downside, compared to corporate credit. The ability to earn higher income for credit similarly rated to the U.S. government (while also, in the case of Agency MBS or TALF-eligible securities, having its explicit support) is, in our view, compelling. Nevertheless, we continue to broadly favor higher-quality, seasoned and shorter-duration exposures as we believe these characteristics offer investors better risk-adjusted returns in uncertain, volatile and low-yielding times.

Term Asset-Backed Securities Loan Facility (TALF): Created by the Fed in November 2008 and reinstated in 2020 to boost consumer spending in order to help jump-start the economy. The program seeks to broadly enhance market conditions for primary ABS and secondary CMBS and support the credit needs of consumers and businesses.

Glossary

Duration: Duration is a measure of a bond price’s sensitivity to changes in interest rates.

Term Asset-Backed Securities Loan Facility (TALF): Created by the Fed in November 2008 and reinstated in 2020 to boost consumer spending in order to help jump-start the economy. The program seeks to broadly enhance market conditions for primary ABS and secondary CMBS and support the credit needs of consumers and businesses.

Credit Risk Transfer Securities (CRT): Pioneered by Freddie Mac in 2013, Credit Risk Transfer programs structure mortgage credit risk into securities and insurance offerings, allowing the transfer of mortgage credit risk exposure to investors.

Bloomberg Barclays U.S. Commercial Mortgage Backed Securities (CMBS) Index measures the investment-grade market of U.S. Agency and U.S. non-agency CMBS securities.

Bloomberg Barclays U.S. Mortgage Backed Securities (MBS) Index tracks the performance of U.S. fixed-rate agency mortgage backed pass-through securities.

Bloomberg Barclays U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

Bloomberg Barclays U.S. Aggregate Asset Backed Securities (ABS) Index measures the investment-grade market of U.S. ABS.

Bloomberg Barclays U.S. Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market.

Fixed Income Perspectives

More Fixed Income Perspectives

Previous Article

Are near-term debt levels a distraction?

Credit portfolio managers John Lloyd and Tim Winstone argue that markets are fixated with the near-term expansion in debt levels when a deeper look at credit fundamentals shows a more nuanced picture.

Next Article

A negative fed funds rate: not yet willing – or needing – to go “there”

Co-Head of Global Bonds Nick Maroutsos states that even without negative interest rates, bond portfolios must work harder to achieve desired results.