Location, location, location: considerations for a ‘listed’ approach to commercial real estate

-

Tim Gibson

Tim Gibson

Co-Head of Global Property Equities | Portfolio Manager -

Greg Kuhl, CFA

Greg Kuhl, CFA

Portfolio Manager -

Guy Barnard, CFA

Guy Barnard, CFA

Co-Head of Global Property Equities | Portfolio Manager

Location, location, location: considerations for a ‘listed’ approach to commercial real estate

-

Tim Gibson

Tim Gibson

Co-Head of Global Property Equities | Portfolio Manager -

Greg Kuhl, CFA

Greg Kuhl, CFA

Portfolio Manager -

Guy Barnard, CFA

Guy Barnard, CFA

Co-Head of Global Property Equities | Portfolio Manager

Investing in listed companies is an increasingly popular route to gaining exposure to commercial real estate. Portfolio managers Guy Barnard, Tim Gibson and Greg Kuhl explore the key considerations.

Key Takeaways

- The wide dispersions in stock and sector performance within listed real estate create opportunities. An active approach to selecting concentrated groups of companies to suit target outcomes is key within this diverse opportunity set.

- Specialist valuation techniques and expertise on the trends reshaping the real estate landscape are important lenses through which to view opportunities.

- As with many asset classes, environmental, social and governance (ESG) factors are key to future performance. This is particularly the case within listed real estate where integration within portfolios requires expert judgement and subjectivity.

“There are three criteria that matter in property: location, location, location.” While the true origins of this well-known phrase may be uncertain (first seen in print in a 1926 Chicago Tribune real estate advertisement)1, its veracity has proved timeless. It is well accepted that physical location is a primary determinant of real estate investing.

Beyond “location” and certain other factors, there are also key considerations around allocating capital within real estate. Capital can be deployed into private market real estate via direct ownership of buildings or through various types of private-equity real estate vehicles. Investors can also choose listed real estate equities (landlord companies quoted on a stock exchange that derive income from the ownership, trading, and development of income-producing real estate assets). Within listed real estate allocations, whether to take a passive (buying an index of listed real estate companies) or active (investing in a more selective portfolio) approach is another important decision. As more and more investors consider the listed real estate option, it is timely to explore key considerations within this relatively young and growing asset class.

Asset class considerations

It is important to look at the many parts that make up the whole. The listed real estate asset class is comprised of hundreds of companies owning thousands of physical assets across dozens of property types around the world. Each of these variables comes with its own set of supply and demand characteristics, some of which are much more favourable to landlords than others. Listed real estate companies are vehicles with significant scale and their management teams can opportunistically raise and deploy capital as they see fit. They often specialise in a single property type and employ highly experienced senior management teams with relevant expertise in private real estate and public equities.

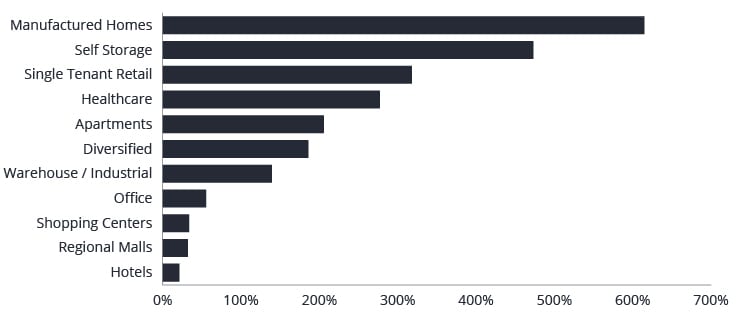

Commercial real estate is categorised between the “core” property sectors of retail, office, multifamily, and industrial, and “non-core” real estate. “Non-core” has seen significant growth in the last 20 years (see Figure 1) and broadens the range of property types available for investment significantly. Examples include single-tenant retail buildings, experiential real estate assets, cell phone towers, data centres, single-family rental homes, self-storage, laboratory space, manufactured home communities, and health care real estate.

Figure 1: Listed US real estate: an evolving asset class (% of index)

“Non-core” properties have outperformed “core” over the long term,2 although past performance is not a guide to future performance. The operational intensity and granular nature (i.e. fewer, extremely high-value single properties) of many non-core property types mean portfolios can take years, if not decades, to assemble and require a significant depth of expertise to manage. These types of businesses are very difficult to replicate and are uniquely suited to the long-term investment horizon and continuous access to capital afforded by public equity markets.

Key themes

This is an asset class that provides interesting and evolving risks and opportunities. We believe there are currently three considerations that should be top of mind when analysing the opportunity set.

1. Active or passive?

It is possible to invest in listed real estate passively by buying an appropriate index. Or to invest in an actively managed portfolio of listed real estate companies. We believe the latter approach is more appropriate with, in our view, a specialised asset class requiring specific knowledge and a high degree of selectivity.

Listed real estate offers a large universe of investments from which active managers can select focused groups of companies to suit certain target outcomes. This selectivity is, in our view, essential given the disparate nature of the asset class and the importance of valuation analysis. Listed real estate companies own tangible assets that can be valued using either traditional equity valuation tools (earnings multiples, discounted cash flows, dividend growth models), or private market valuation techniques (observation of comparable sales, Internal Rate of Return forecasts). This dual approach can provide active real estate managers with an important insight into intrinsic value. Skilled managers can use this informed perspective in conjunction with the daily liquidity of stocks to take advantage of potential mispricing in the market. This is particularly important given the wide dispersions in stock and sector performance that exist (see Figure 2).

Figure 2: Not all property types are created equal

15-year cumulative total return by US real estate property type

2. A shifting landscape

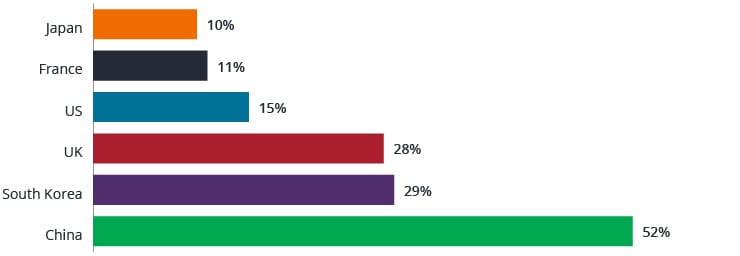

What has worked in the past (property types that are heavily represented in indices) may not be what works in the future. An example of an ongoing trend with disruption potential is demographics; this is leading to a shift in preferred housing options for baby boomers and millennials. Another is the digitisation of nearly everything; this is leading to a growing percentage of commerce occurring online, driving exponential growth in data traffic and consumption, and having an impact on where people choose to live and work (see Figure 3).

Figure 3: Growth in eCommerce: a key trend impacting real estate

Ecommerce sales penetration (2021 estimates): plenty of headroom for developed countries

These trends may mean that some of the core property types, notably office and retail, are facing more challenges than ever, while other types of property like warehouses, cell phone towers, and owners of specialty housing are benefiting from tailwinds. It is also important to consider less mainstream asset types that may not yet be included in benchmark indices. Applying an approach that allows the identification of, and access to, these new and growing property types is key to real estate investing.

“We believe that benchmark investing is akin to driving using the rearview mirror. There are dynamic trends reshaping how we live our lives and it is important to shape listed real estate portfolios around a vision of the future.”

3. ESG can’t be automated

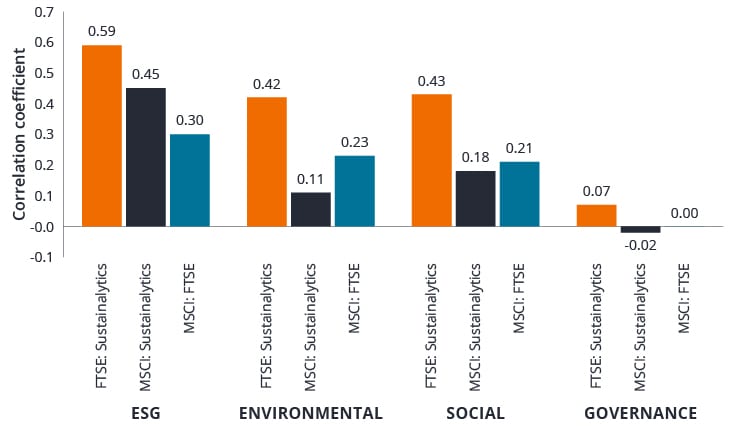

Effective integration of environmental, social and governance (ESG) factors into real estate portfolio construction requires judgement and subjectivity. There are many third-party providers attempting to quantitatively score real estate companies on ESG metrics. The near complete lack of agreement across these providers around which metrics to measure and whether a particular company is “good” or “bad” on a particular ESG pillar is a challenge (see Figure 4). In our view, this is another key supporting argument for taking an active approach where selectivity can be applied.

Figure 4: ESG scoring data can vary widely

Pairwise correlation between ESG rating services’ ranking of individual companies

ESG analysis is unlikely to ever be as clear cut as analysing a balance sheet given significant challenges in the comparison of companies operating in disparate industries. Within the real estate sector, a meaningful comparison of ESG principles across listed companies requires a depth of knowledge regarding the company’s property portfolio, its capital allocation, its management team’s incentives, and the oversight of its board of directors. The selection of specific real estate ESG criteria also needs to consider the vast operational differences that exist between various property types and markets. Within a specialist sector such as real estate, every company has unique considerations to evaluate and there is no standard set of reporting metrics. All of this means portfolio construction that includes a rational consideration of ESG is likely to remain a challenge unless approached actively. In our view, if approached in the right way based on sound judgement, the integration of ESG into portfolio construction can lead to meaningfully better performance.

In summary, we believe that “location, location, location” remains a truism in real estate investing, stemming from the fact that location is often the only aspect of a property that cannot be changed. There are, however, meaningful ways to change one’s investment approach to the asset class and listed real estate is a fast-developing route to capturing the diverse and exciting opportunities available.

1 Source : The New York Times Magazine, ‘Location, Location, Location’, 26 June 2009.

2 Source: Bloomberg Real Estate Property Type Indices. Cumulative total returns from 31 March 2006 to 31 March 2021. Past performance is not a guide to future performance.