March 2020

Liquidity in stressed markets is more expensive than you think

No bios have been selected to display.In this article, Investment Director Alistair Sayer consider the cost of trading when volatility spikes, and ask if liquid alternatives provide an alternative for investors to manage their portfolios during periods of uncertainty?

Key Takeaways

- Investors often need to sell what they can, rather than what they would like to, during periods of market uncertainty. This typically makes equities the commonly used shock absorber to meet spending requirements.

- The direct costs of trading stocks are indeed low relative to most other asset classes. But equity transactions during periods of stress are, on average, done at a steep price discount.

- Alternative investments typically are less sensitive to periods of equity market stress. However, they are often hindered by a general lack of liquidity, potentially undermining their value to investors. Liquid alternative strategies can potentially fill this gap.

According to conventional wisdom, individuals or institutions that sell stocks when volatility spikes are potentially uninformed and/or irrational. They are typically selling because they are overcome by fear, even though many believe the logical decision would be to stay the course and ride out the volatility. The implication is that sellers are potentially making poor and uninformed choices that could likely lead to worse returns.

We believe this is overly simplistic. Although behavioural biases surely play a role in investment decisions, people often transact not because they choose to, but because they need to. Even an investor with a well-structured and broadly diversified portfolio will periodically have mismatches between their inflows and their spending needs. For example, a pension plan needs to provide monthly benefits to plan members, while also potentially unexpectedly receiving capital calls from its private equity/venture capital partners. Investors typically also have other constraints, such as portfolio leverage, margin or volatility targets that force their hands, especially in stressed market conditions.

Sensible does not always equal practical

The real decision is very often what to sell, rather than whether to sell. Theoretically, an investor should consider liquidating a pro-rata slice of each holding to raise cash or avoid breaking a constraint. In practice, this is impractical. Many bonds are difficult to transact quickly, while most alternative investments, including real estate, private equity, venture capital, hedge funds, and so on, are illiquid – especially at short notice and in potentially small increments.

Consequently, investors often need to sell what they can, rather than what they would like to. This typically makes equities the commonly used shock absorber to meet spending requirements, change a portfolio profile, or hedge other risks. Stocks (accounting for dealing times) can be sold almost instantly and settle quickly: over US$300 billion of S&P 500 futures transact daily with an average bid-ask spread of <0.1%1.

The illusion of ‘nearly free’ trades

This creates the illusion that the liquidity cost of transacting in equities is nearly free. The direct costs of trading stocks – which include commissions, bid-ask spreads and other charges – are indeed low relative to most other asset classes. But equity transactions during periods of stress are, on average, done at a steep price discount. In other words, there is a large but invisible cost to selling stocks when market volatility is relatively high.

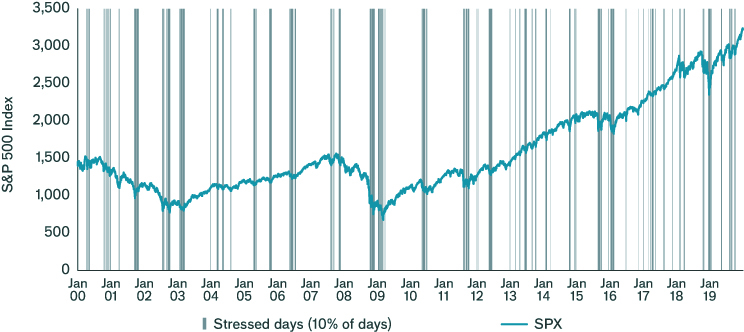

Source: Bloomberg, Janus Henderson Investors, shows the level of the S&P 500 Index, illustrated with the 10% of days annually in which market volatility (as measured by the VIX) was highest. From 3 January 2000 to 31 December 2019. Past performance is not a guide to future performance. The value of your investment may go down as well as up and you may not get back the amount originally invested.

We can illustrate this by ranking all days in each year based on the closing level of the Chicago Board Options Exchange (Cboe) Volatility Index (VIX). We label the 10% of days in a year with the highest VIX levels as ‘stressed’, while labelling the remaining 90% of days as ‘normal’. Exhibit 1 shows the last 20 years of the S&P 500 with the days labelled stressed highlighted in gray. The most stressed (volatile) days of each year are quite spread out and occur unpredictably.

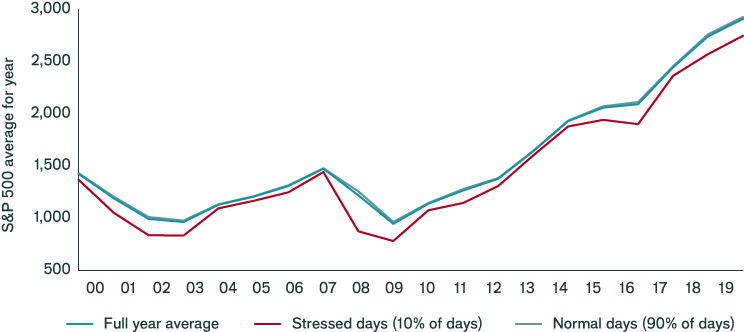

For each year, we calculate the average level of the S&P 500 for stressed days (10% of days), normal days (90% of days), as well as a full-year average (100% of days). Exhibit 2 compares the three averages. Notably, the stressed line is significantly below the full-year average, while the normal line is slightly above the full-year average.

Source: Bloomberg, Janus Henderson Investors, 3 January 2000 to 31 December 2019. Past performance is not a guide to future performance. The value of your investment may go down as well as up and you may not get back the amount originally invested.

The price discount on stressed days compared to the full-year S&P 500 average is about -8%, while the price premium for normal days is about +1%. Obviously, selling on high-volatility days is not always sub-optimal; prices can go down and volatility increase further, after all. But statistically, liquidating equities when volatility spikes is costly. Unfortunately, the need to sell in stressed markets often correlates with other negative events – i.e., worse economic conditions or other setbacks.

Are liquid alternative strategies a potential solution?

Other portfolio assets are unlikely to be completely correlated to equities and are therefore likely to hold up better during periods of equity market stress. Notably, alternative investments typically have a much lower beta to stocks. But investors are hindered by the general lack of liquidity in most alternatives and are often forced to sell liquid stock holdings at a discount instead.

Liquid alternative strategies can potentially fill this gap – giving investors real diversification from traditional asset classes, while providing the flexibility for investors to trade on their own terms, rather than as forced sellers. The liquid alternative sector has a host of different tools that can play an important role in portfolio construction, and potentially provide the opportunity for different investment behaviour. For example, adopting an explicit protection strategy into a portfolio can potentially enable investors to weather short-term market stresses, while positioning for potential longer-term opportunities.

1 Source: Bloomberg/CME, average of the previous 20 days, as at 20 February 2020

ALTERNATIVEPERSPECTIVES