The risk-reward ratio, or rather one’s perception of it, is the cornerstone of any investment decision. An investment with a high degree of associated risk requires a high expected return for it to be attractive (or indeed, viable) to investors. The greater the risk, the greater the reward.

This is clearly demonstrated when comparing fixed income investments, such as bonds, to equities. If an investor purchased a 10-year government bond with the aim of holding it until maturity, they would have clarity on their expected returns throughout the investment lifecycle. Whereas, the outcome for an equity held for the same period is much less predictable.

Equities, by their nature, can be more sensitive to economic shifts and market movements. However, although there is much that can go “wrong”, there is further potential to outperform.

This reward-for-risk dynamic is captured in the yield gap, a ratio that divides equities’ dividend yield by the yield of long-term government bonds. The higher the yield gap, the better relative value equities are deemed to be. In recent months the yield gap has been narrowing and has now become negligible, meaning bonds and equities are experiencing similar expected return dynamics, with the former having a reduced risk exposure. In short, bonds appear to have a superior risk-return profile.

Mind the gap

As the yield gap has gradually compressed this year, it’s understandable that many investors have sought refuge in fixed income assets.

However, the yield gap has historically been tricky to interpret, particularly when it has narrowed. For instance, in the early 1980s, a yield gap crunch preceded a decade-long run of equity market outperformance. Investors who responded to the crunch by rotating towards fixed income were left rueing missed opportunities.

Notably, the yield gap has often widened in an inflationary environment – with bonds yielding much more than equities. In the high inflation context of the 1970s, equities outpaced bonds. Further, if inflation is to remain high for a long period, as many analysts expect, the real yields of long-duration government bonds are likely to be unattractive or even negative. Together, the lesson of this history is that there is no unerringly normal relationship between bonds and equities.

Cash is king

With this in mind, investors should not necessarily take equities ‘off the table’ in a high inflation, high interest rate environment. Such decisions depend entirely on the individual circumstances of each investor.

Indeed, income-paying equities have historically offered a degree of inflation protection, through dividend growth, that narrows the risk/reward gap to some degree.

These are the focus of The City of London Investment Trust (CTY), managed by Job Curtis with support from David Smith, which has increased its dividend every year since 1966 regardless of market conditions or volatility. In doing so, the Trust – which invests mainly in UK equities with a bias towards large, multinational companies – has provided investors with the comfort of a consistent dividend.

Over the 10 years to 30 June 2023, the Trust’s dividend has grown by 40.6%, outpacing the cumulative effect of inflation, as measured by the Consumer Price Index (CPI) of 33.5%.

The CTY structure reinforces the potentially defensive role of equity income. The fund’s dividends can be bolstered by its internal revenue reserves, smoothing pay-outs across short-term challenges. Moreover, Job has guided CTY to its record-setting annual dividend increases over 32 years of management, through the highs and lows of multiple cycles.

While the narrowing of the yield gap may deter some investors from allocating to anything related to the equity market, the potential protective capabilities of dividend growth should not be discounted wholesale.

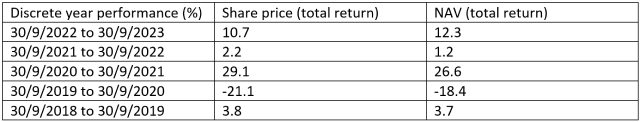

Past performance does not predict future returns

Bond

A debt security issued by a company or a government, used as a way of raising money. The investor buying the bond is effectively lending money to the issuer of the bond. Bonds offer a return to investors in the form of fixed periodic payments (a ‘coupon’), and the eventual return at maturity of the original amount invested – the par value. Because of their fixed periodic interest payments, they are also often called fixed income instruments.

Bond yield

The level of income on a security expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. There is an inverse relationship between bond yields and bond prices. Lower bond yields mean higher bond prices, and vice versa.

Consumer price index (CPI)

A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate inflation. ‘Headline’ CPI inflation is a calculation of total inflation in an economy, and includes items such as food and energy, where prices tend to be more volatile. ‘Core’ CPI inflation is a measure of inflation that excludes transitory/volatile items such as food and energy.

Dividend

A variable discretionary payment made by a company to its shareholders.

Downside risk

An estimation of how much a security or portfolio may lose if the market moves against it.

Economic cycle

The fluctuation of the economy between expansion (growth) and contraction (recession), commonly measured in terms of gross domestic product (GDP). It is influenced by many factors, including household, government and business spending, trade, technology and central bank policy. The economic cycle consists of four recognised stages. ‘Early cycle’ is when the economy transitions from recession to recovery; ‘mid-cycle’ is the subsequent period of positive (but more moderate) growth. In the ‘late cycle’, growth slows as the economy reaches its full potential, wages start to rise and inflation begins to pick up, leading to lower demand, falling corporate earnings and eventually the fourth stage – recession.

Equity

A security representing ownership, typically listed on a stock exchange. ‘Equities’ as an asset class means investments in shares, as opposed to, for instance, bonds. To have ‘equity’ in a company means to hold shares in that company and therefore have part ownership.

Inflation

The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures. The opposite of deflation.

Nominal/real yield

The nominal yield on a bond is the coupon, essentially the interest rate that the bond issuer promises to pay the holder. The real yield is the nominal yield minus the rate of inflation.

Risk/risk taking

The acceptance of greater risk in exchange for potentially higher returns. This can apply to both individual investors and companies. An assessment of investors’ attitude to risk forms a fundamental part of identifying a suitable investment strategy for their objectives. For investment trusts: Risk taking is the key measure used to assess risk is volatility of returns, using historic net asset value (NAV) performance of the Company over 1 and 3 years. In this instance volatility measures how much a company’s NAV fluctuates over time in relation to the UK Equity market. The higher a volatility figure, the more the NAV has fluctuated (both up and down) over time. Please note that risk categorisations are indicative and based principally on historic data and should not be solely relied upon when making investment decisions.

Volatility

The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Yield

The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price. For investment trusts: Calculated by dividing the current financial year’s dividends per share (this will include prospective dividends) by the current price per share, then multiplying by 100 to arrive at a percentage figure.

Disclaimers:

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc