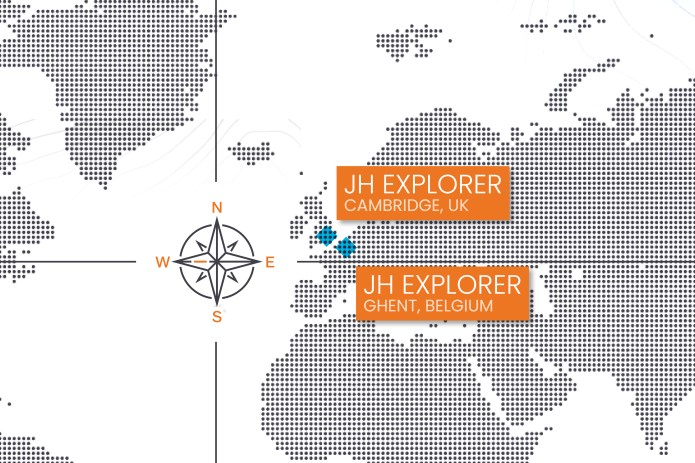

| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

I am a huge fan of bacteria. My appreciation for these tiny organisms started with their essential role in making beer and it deepened when I started making sourdough bread during the COVID lockdown. On site visits to Cambridge, UK and Ghent, Belgium earlier this year, I came across some other contributions bacteria are making to humanity. COVID was a reminder of the threat posed by tiny creatures but my travels have shown that these tiny creatures can also play a role in facilitating the energy transition and the journey to achieve net zero.

At their carbon recycling bio-refinery located on the same site as ArcelorMittal’s steel factory in Ghent, Belgium, a small company called LanzaTech (Nasdaq: LNZA) showed me how bacteria can be used to break down waste emissions – carbon dioxide and carbon monoxide to make ethanol and other industrial chemicals. In addition to the facility at ArcelorMittal’s Ghent steel factory, LanzaTech has commercial-scale facilities at five other locations globally, utilising a diverse range of feedstocks.

At steel and mining group ArcellorMittal’s Ghent factory

During my visit, ArcelorMittal’s Chief Technology Officer stated that LanzaTech’s approach is a novel technology that abates carbon emissions whilst making money by producing a product (ethanol) that can be readily marketed. His words ring in my ears, “Without carbon pricing this process is economical,” ie. this makes sense to implement even without a penalty being imposed for produced carbon. This facility is a part of ArcelorMittal’s plan to reduce its European Scope 1 and 2 emissions by 35% by 2030. For an investment of EUR200m ArcelorMittal expects to reduce its carbon emissions by 125,000 tons per annum (tpa) and produce 80m litres of ethanol, making this a potential win-win for both company and the environment.

Mixing microbes with emissions to produce the chemicals needed for the transition to net zero

The LanzaTech process uses “off gasses” (a mix of carbon dioxide, carbon monoxide, hydrogen and nitrogen), which are pressurised, concentrated and fermented using specialised bacteria in a bio-reactor, to produce ethanol in a continuous process. A co-product output from the process is protein that is currently used in a bio-digester to produce biogas, but can also be used as animal feed (as is done already in China).

The visit to Europe’s first commercial carbon bio-refinery left me with three conclusions 1) this is happening, the facility is very real and surprisingly large; 2) the economics are quite compelling; and 3) using bacteria to make ethanol from carbon emissions is the tip of the iceberg – other chemical building blocks are likely to follow e.g. production of acetone, isopropanol and mono-ethylene-glycol. These chemicals are used to make a range of products such as textiles, shoe soles, packaging, cleaning products, fragrances, sustainable aviation fuel, detergents and surfactants. Making use of industrial off-gasses, offers a net zero pathway for hard to decarbonise industries such as steel, ferro alloys and cement.

I turned to the teeming small creatures that can be held between the thumb and forefinger: the little things that compose the foundation of our ecosystems, the little things, as I like to say, who run the world.”

E.O. Wilson, biologist, naturalist, ecologist, and entomologist known for developing the field of sociobiology

From ancient bacteria to graphite today

I also learnt how fossilised bacteria facilitate the production of car batteries on a visit to Talga Group’s R&D facility in Cambridge, UK.

Talga is an emerging graphite producer with ambitions to be an advanced materials company. Graphite is used to make battery anodes, an essential component of electric vehicles and energy storage. Organisation for Economic Co-operation and Development (OECD) countries are worried about their reliance on China to process and produce around 90% of the world’s graphite. As the European Union looks to establish local supply chains, it will need natural graphite deposits such as Talga’s in Vittangi, Northern Sweden.

While electric vehicles are a relatively new phenomenon, the graphite that Talga will form into battery anodes began its story two billion years ago when the earth’s atmosphere had very little oxygen and high amounts of carbon dioxide. The only life on our planet were ancient single-celled organisms known as cyanobacteria, which fed off carbon dioxide and produced oxygen, fundamentally changing the chemistry of the atmosphere in the Great Oxygenation Event, setting the stage for the evolution of multi-cellular modern life. The oxygen they produced also poisoned themselves, leading to a wipe-out of the cyanobacteria, which fell to the bottom of shallow seas forming a thick, carbon-rich layer of sediment that became the graphite that Talga will be mining and processing into battery anodes.

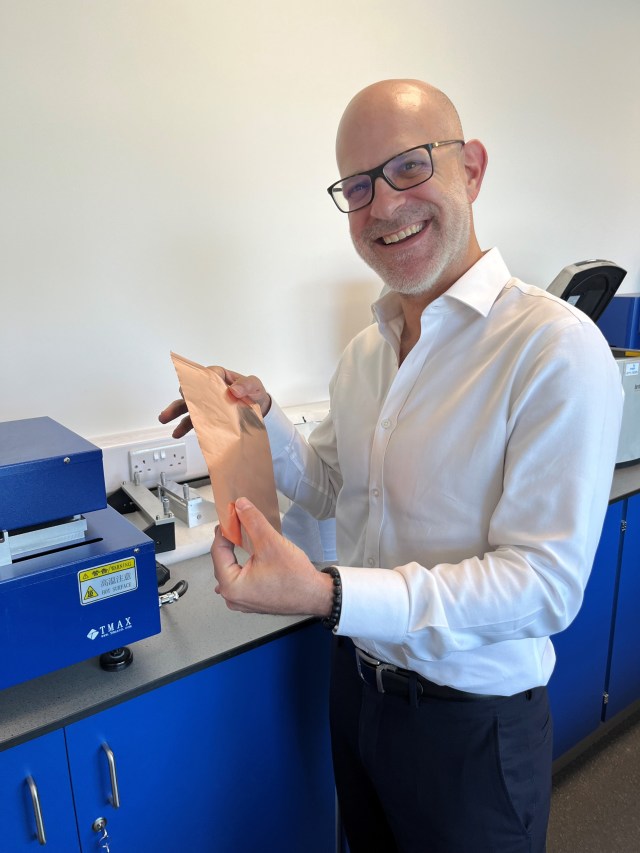

Battery anode material – copper coated with graphite

In Cambridge, I met a diverse group of PhD electrochemical and materials specialists. They were far more than academics playing around with anode chemistries and all of them had a sharp understanding of the commercial aspects of their work. Each technical innovation they test is considered in the context of how it could be applied in real-world continuous manufacturing, with respect for the cost limitations around optimising battery functionality. At this lab, staff are experimenting with various chemistries generating patents trademarks. The visit left me with the strong impression that Talga is really a battery anode company with a mine, rather than a mining and processing company. The company sees itself as a technology company that owns its own raw material resources rather than simply a resources company.

This, we think is a perfect example of how the resources sector is reinventing itself to be a contributor to a sustainable economy, creating exciting and significant opportunities for investors along the way.

Our ESG integration approach: Thoughtful, practical, research-driven and forward-looking

Bio-carbon refinery: a refinery that converts carbon emissions to energy and other beneficial by-products such as chemicals.

Carbon pricing: an approach that can help reduce carbon/greenhouse gas emissions by passing the cost of emitting on to emitters. A key aspect of carbon pricing is the “polluter pays” principle. By putting a price on carbon, society can hold emitters responsible for the serious costs of adding GHG emissions to the atmosphere.

Net zero: refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere. Net zero is reached when the amount of greenhouse gas added is no more than the amount taken away.

Scope 1 and 2 emissions: Scope 1 refers to all direct greenhouse gas (GHG) emissions eg. when a company operates its boilers and vehicles; Scope 2 refers to indirect GHG emissions from the consumption of purchased electricity, heat, or steam.

Vertical integration: when a business acquires other companies to increase control/reduce reliance on its supply and/or distribution chain, leading to a potential improvement in profitability.

IMPORTANT INFORMATION

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

There is no guarantee that past trends will continue, or forecasts will be realised.