The wake-up call

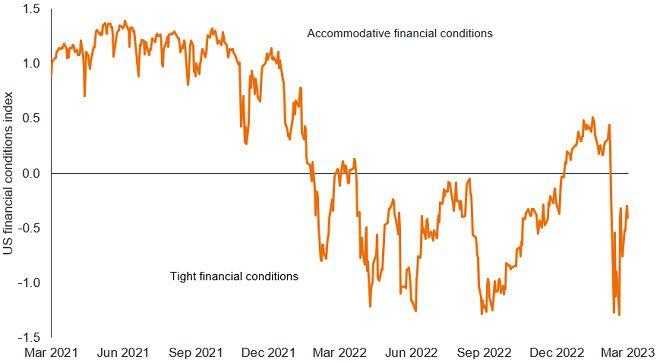

A key requisite for central bank policy success was to tighten financial conditions to slow the economy and thus dampen inflation. The market strength earlier in the year was unhelpful to their cause as higher values for risk assets such as equities and tighter credit spreads were offsetting some of the tightening from higher interest rates. The banking crisis in March was a rude awakening for markets, although in shifting behaviour it may have granted central bankers their wish.

Figure 1: Bank crisis restored tightness to financial conditions

Source: Bloomberg, Bloomberg US Financial Conditions Index, 31 March 2021 to 31 March 2023. The index is a Z-score that indicates the number of standard deviations by which current financial conditions deviate from normal (pre-crisis) levels. It tracks stress in money, bond and equity markets to assess availability and cost of credit.

It was widely expected that central banks would need to break things to restore price stability. Bank collapses in March threw an obstacle into the mix by reigniting concerns around financial stability – the Global Financial Crisis (GFC) casts a long shadow – but what impact might the recent banking stress have on credit and rates?

*The Fixed Income Investment Strategy Group (ISG) brings together investment professionals from across the global fixed income platform and other Janus Henderson teams, providing a forum for debate around the fixed income asset class and key drivers of the market. The ISG Insight seeks to provide a summary of recent debate within the group.