October 2020

Is now the time for defensive value?

-

Justin Tugman, CFA

Justin Tugman, CFA

Portfolio Manager

Key takeaways

- Growth stocks have experienced an historically long run of outperformance versus their value counterparts, a trend that has continued despite an economic environment disrupted by the COVID-19 pandemic.

- Several factors lead us to believe that a leadership change may be forthcoming.

- For investors concerned with ongoing market volatility and lofty stock valuations, a more defensive approach, with a focus on seeking to mitigate downside risk, may be a prudent strategy.

Growth stocks, which have seen a long-running advantage over their value counterparts, have somewhat unexpectedly continued to outperform during the difficult economic environment brought on by the COVID-19 pandemic. This is evidenced by the Russell 3000® Growth Index outperforming the Russell 3000® Value Index by over 31% this year (through 8 September 2020). Among other factors, a tremendous amount of monetary and fiscal stimulus has been supportive for growth stocks and has likely enticed investors to take on greater risk. This resilience in a difficult environment (in which one may typically expect companies with more defensive attributes to be in demand) and the long-running outperformance posted by growth stocks may cause investors to question: “Why follow a value-based approach now?” The answer will likely come down to an investor’s views on current stock valuations and the potential for continued market volatility in the future. If these raise concerns, a strategy incorporating defensive value stocks may well be timely.

Value and Growth – alternating historical leadership

We are currently in the longest period of growth outperformance against value since the 1970s. The Russell 3000 Growth Index has beaten the Russell 3000 Value Index by 227% since 6 June 2007 (through 8 September 2020). Although the current outperformance has been particularly persistent, value and growth investing tend to be cyclical. Despite the recent long run of growth leadership, a value-oriented strategy has recurrently outperformed over extended periods. Following the late ‘90s tech bubble, for instance, the market experienced a phase of value outperformance lasting over seven years, during which the Russell 3000 Value Index outperformed the Russell 3000 Growth Index by 133% (March 2000 through June 2007).

Mean reversion is a powerful market mechanism that is trending in value’s favor as growth has experienced an extended leadership run. Many investors today perceive value to be perpetually out of favor and, thus, expect the future to resemble the recent past. While growth could certainly continue to outperform, we think that it may be timely for certain investors to begin moving to value and away from growth.

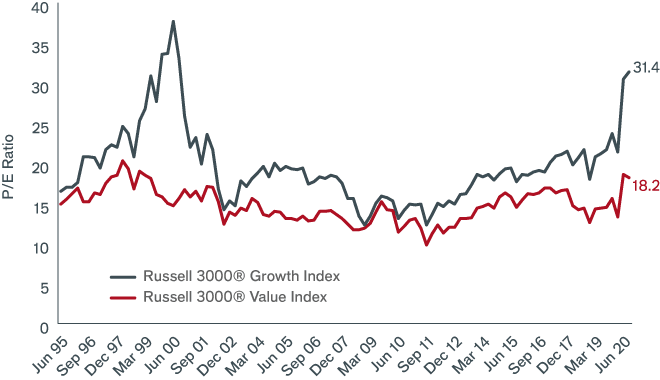

Extreme relative valuations

In addition to extended outperformance, the difference (or ‘spread’) between the valuation of growth and value stocks on a relative basis has expanded to near all-time highs, approaching levels, again, last seen during the late ‘90s tech bubble, as shown in the chart below. While the market appears willing to pay a substantial premium for growth, long-term value investors, such as ourselves, have to examine whether the cost of these stocks is justified. In many cases, in order to rationalize current valuations, overvalued stocks would have to grow at tremendous rates over an extended period of time, which, to us seems unlikely. While this trend could continue, history indicates that the spreads between valuations typically compress.

SPREAD BETWEEN GROWTH AND VALUE REACHES EXTREME LEVELS

[caption id=”attachment_320804″ align=”alignnone” width=”660″]

Source: Bloomberg. Price to Earnings (P/E) ratio, blended 12 months, 6/30/95 – 9/8/20, quarterly data. P/E ratio is used to value a company’s shares. It is calculated by dividing the current share price by its earnings per share. In general, a high P/E ratio indicates that investors expect strong earnings growth in the future.[/caption]

Why consider defensive value now?

Being conscious of valuation by not overpaying for an asset can provide a cushion of support for an investor. However, value investing does not come without risks, which is why we believe a defensive-value strategy focused on finding high-quality stocks (as opposed to buying anything that appears cheap) is particularly important. The first cornerstone of a defensive-value approach is that the company must be out of favor and attractively priced relative to the market or relative to its competitors: it must be a good value. Second, and more importantly, the stock must have defensive-quality characteristics such as a strong balance sheet, durable competitive advantage and a strong management team. As opposed to other value-based strategies, a defensive-value approach puts a significant premium on investing in businesses that, while potentially challenged in the near term, have strong long-term prospects. We term these companies “survivors” as this defense-first approach may help them weather difficult economic environments.

Generally speaking, during periods of heightened risk, a defensive investment strategy affords investors the opportunity to stay invested in the market while partly mitigating downside risk. We believe it is essential to stick to a disciplined investment process that, at its core, selectively identifies companies with defensive attributes and attractive upside potential. Given the valuation levels and performance gaps we currently see in the market, this approach may be timely.

The Russell 3000® Growth Index measures the performance of the growth sector of the broad US equity market. The Russell 3000® Value Index measures the performance of US equity stocks in the value sector of the market.

EQUITYPERSPECTIVES Back to main

Related products

Small Cap Value Fund (JNPSX)Mid Cap Value Fund (JNMCX)

Small-Mid Cap Value Fund (JSVDX)

Small Cap Value Fund (JSCOX)

Mid Cap Value Fund (JMVAX)

Small-Mid Cap Value Fund (JVSIX)

More Equity Perspectives

PREVIOUS ARTICLE

Is it time for the European Renaissance?

John Bennett, Director of European Equities, explains the potential turning point in markets that could propel European equities to compete with the long-running and seemingly invincible US bull market.

NEXT ARTICLE

Looking past election volatility

Director of Research Matt Peron says that while the 2020 U.S. presidential race could create volatility for stocks, such pullbacks are often based on fear, not long-term fundamentals.