Investors are facing a difficult time again; the narrative from mid-2024 onwards was that inflation was crushed, and rates would fall. This was a ‘Goldilocks World’ where you could buy both a bond with a yield that we recognised from pre-Global Financial Crisis times, or equities of almost any nature because falling rates were perceived to benefit everything from property equities to emerging markets. The last few months have proved to be less simple. US economic growth is better than expected, but Donald Trump won the election on a platform that includes many measures that may be inflationary, and the Federal Reserve has signalled that there may be fewer interest rate cuts than expected.

Events last year conspired to make higher-yielding companies some of the biggest underperformers, and has left them trading on attractive valuations relative to history. These sectors include property, healthcare, consumer staples, and utilities to name a few. The underperformance of these sectors is partly due to higher yields, they tend to react in the short term to changes in interest rates, but in the long term they generally benefit from inflation via pricing and sales growth.

They have also been ‘crowded out’ by the increasing concentration of markets in the US mega cap (mostly tech) stocks, which now make up more than 35% of the capitalisation of the US market (and the US market is almost 74% of the MSCI World Index).1 As more money is invested in trackers and index funds more money flows to the larger stocks. The historical precedents for this type of market are not great. The equity market downturns following the 2000 dotcom bubble, the 2008/9 Global Financial Crisis and the more recent COVID pandemic all coincided with periods where the weight of the top 10 stocks in the index reached a peak.

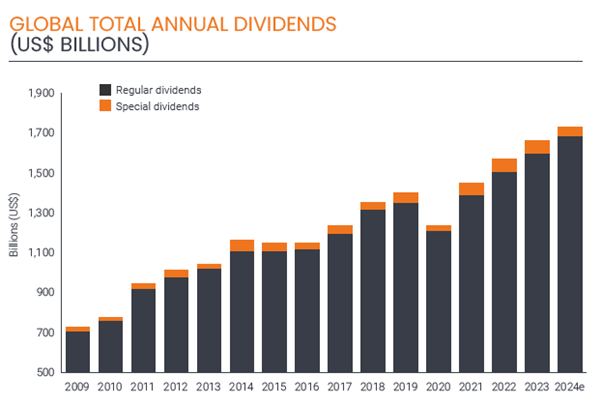

So these higher yielding sectors could offer some diversification from large tech, and they are not expensive. They started to outperform last year when interest rate expectations started to fall, so we do know investor interest in these sectors can be reignited. What might the future hold? It is hard to generalise but dividend growth from companies should continue, and this higher-yielding group should be no exception. The table below shows dividend payments of companies globally – as represented by the Janus Henderson Global Dividend Index. COVID was the only time regular dividends declined in a year. Whilst tariffs may be a threat for some industries, they should be far less disruptive than COVID was to society and businesses. Growth in dividends has actually picked up in a higher inflation environment despite higher debt costs because companies have been able to pass on higher prices.

It may be a tricky year, but higher-yielding stocks are providing an interesting entry point and a potential diversifier for investors in our view.

Source: Janus Henderson Global Dividend Index (JHGDI), Edition 44, November 2024. The JHGDI is a quarterly study that analyses dividends paid by the 1,200 largest firms globally. Dividends are the payments that companies make to shareholders; regular dividends are typically paid each year; special dividends are declared as one-off payments. Yield is the level of income on a security over a set period, typically expressed as a percentage rate. For equities, dividend yield is the total dividend payments per share over the past 12 months divided by the current share price, multiplied by 100 to arrive at a percentage figure.

1Source: MSCI USA Index, top 10 holdings as a percentage of the index; US country weight as a percentage of the MSCI World Index, as at 31 December 2024.