Janus Henderson’s annual Investor Survey reveals that investors are grappling with a host of uncertainties, with the upcoming presidential election, inflation, and concerns about a possible recession weighing on their minds.

The survey – conducted from April to May 2024 – found that higher interest rates and market volatility have caused more than a third of investors to shift assets out of equities in the past year, and 32% are planning to do so in the next 12 months. Meanwhile, nearly 80% of investors are worried about how the election will impact their finances, and 62% plan to reduce portfolio risk until the election is decided. (Read our colleague Ben Rizzuto’s article for more on investors’ election concerns.)

These types of decisions – made in reaction to short-term concerns – can jeopardize an investor’s long-range goals. That’s why it’s critical for advisors to help investors maintain perspective and keep them on track with their long-term financial plan.

Seeking safety – at a cost

Nearly half of investors cited “feel safer in cash and/or fixed income” as their reason for shifting or planning to shift out of equities. These investors may not feel like they are sacrificing much to be in a risk-off stance, now that savings accounts, money markets, and certificates of deposit are paying relatively attractive yields with negligible risk. But while cash is useful for short-term liquidity needs, investors should be aware of two notable pitfalls associated with using cash as a long-term investing strategy.

First, as the Federal Reserve (Fed) cuts rates, cash yields will drop in unison, and investors sitting in cash will have failed to lock in higher yields for any meaningful period.

Second, cash rates do not benefit from falling yields like many other risk assets. For example, fixed-rate bonds experience price appreciation when yields fall, while the present value of a company’s future earnings increases as rates come down, raising the value of its stock, all else equal.

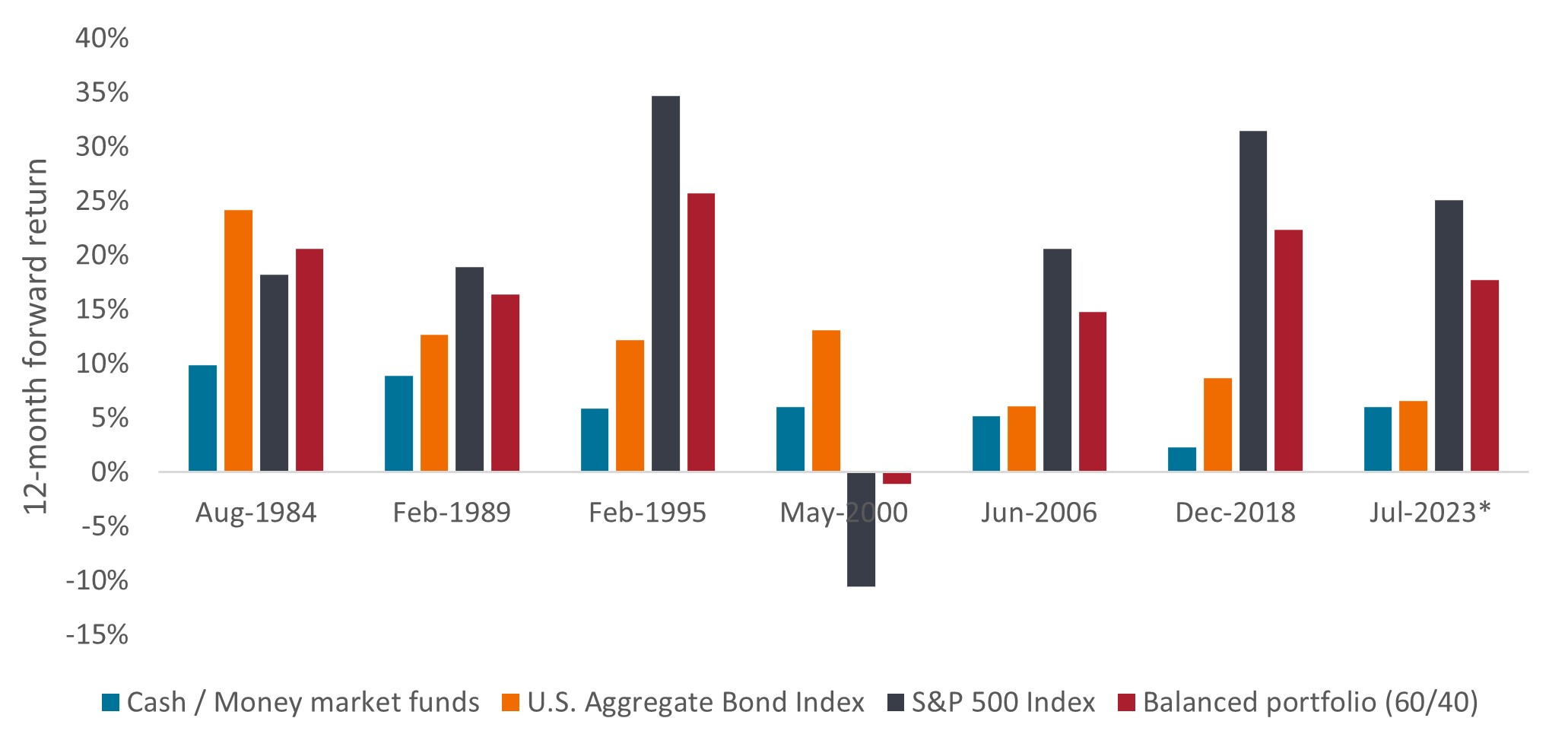

Historical market data can help demonstrate these concepts to clients. As shown in Exhibit 1, risk assets (stocks, bonds, and balanced portfolios) have largely outperformed cash in the 12-month period following the Fed’s last rate hike.

Exhibit 1: 12-month forward returns following the Fed’s final rate hike

Cash has lagged risk assets in six of the last seven cycles once the Fed stopped hiking.

Source: Bloomberg, Janus Henderson Investors, as of 31 August 2024. *July 2023 period shows returns for the 7-month period from 31 July 2023 to 29 February 2024. Balanced portfolio is a combination of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index and assumes annual rebalancing. Past performance does not predict future returns.

Source: Bloomberg, Janus Henderson Investors, as of 31 August 2024. *July 2023 period shows returns for the 7-month period from 31 July 2023 to 29 February 2024. Balanced portfolio is a combination of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index and assumes annual rebalancing. Past performance does not predict future returns.

For investors who may be hesitant to pivot to equities but are willing to incrementally take on risk, fixed income could be a logical destination along the risk spectrum. As is the case with money market strategies, bonds have also seen yields return to attractive levels. Unlike money markets, however, bonds have the potential to appreciate should developed markets continue to cut policy rates over the next several quarters.

Investors who don’t want to be caught with too little duration in that scenario, and who are worried about reinvestment risk with cash/money markets, may be well served by taking a barbell approach to duration in their fixed income portfolios. This can be accomplished by pairing their front-end allocation with longer-duration assets, such as Treasuries, mortgage-backed securities (MBS), or investment-grade bonds.

Time in the markets, not market timing

The 55% of investors who said they’re worried about a recession may be opting to park funds in cash as they wait for more economic certainty. Again, historical data can be used to demonstrate the problems associated with adopting this type of wait-and-see approach.

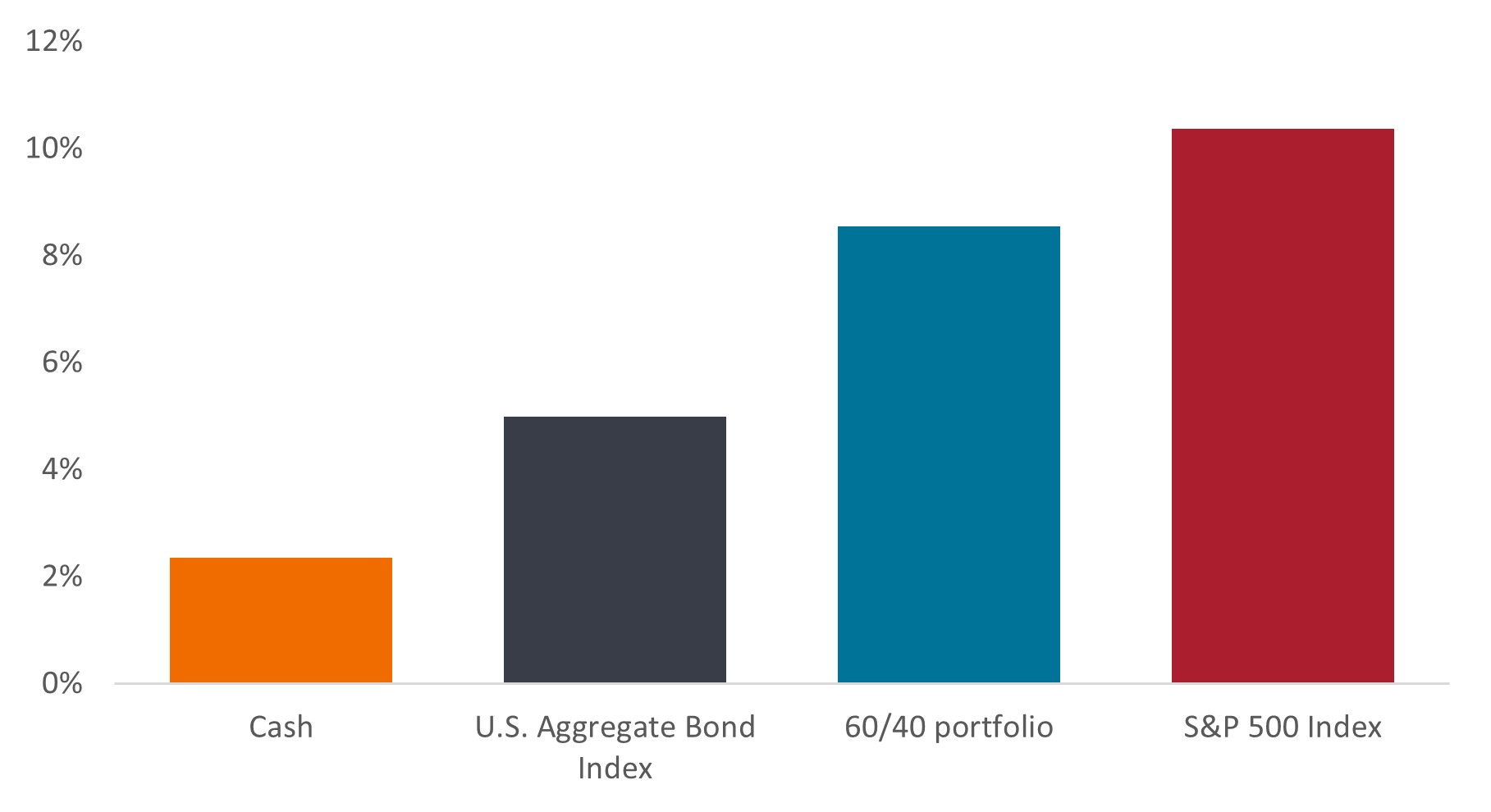

Exhibit 2 shows that risk assets have on average meaningfully outperformed cash over the long term, illustrating the opportunity cost of being out of the markets. Similarly, waiting to get back in may prove costly in the long run, because markets typically move too fast for investors to react in time. This is important because missing out on the first leg up in a market rally can be a significant driver of inferior long-term returns. Furthermore, cash and cash alternatives do not provide meaningful income when adjusted for inflation (which is not reflected in the chart below).

Exhibit 2: Average rolling 5-year return (1996 – 2023)

Source: Bloomberg, as of 31 December 2023. Average of 5-year annualized rolling returns based on calendar year returns. 60/40 balanced portfolio is a combination of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index and assumes annual rebalancing. Past performance does not predict future returns.

Source: Bloomberg, as of 31 December 2023. Average of 5-year annualized rolling returns based on calendar year returns. 60/40 balanced portfolio is a combination of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index and assumes annual rebalancing. Past performance does not predict future returns.

Don’t let FOMO get in the way of diversification

While investors appear to be wary of equities on some fronts, they also see areas of opportunity. Investors expressed the most enthusiasm for technology, with 73% viewing the sector as a good investment opportunity over the next 12 months.

Given the media attention around the tech-dominated Magnificent 7, it’s not surprising that investors are drawn to these stocks. However, our survey indicates that excitement – often based on fear of missing out, or FOMO – is causing some investors to abandon a key tenet of long-term investing: diversification.

Investors were asked to choose between a portfolio comprised solely of Mag 7 stocks and a portfolio comprised of 493 large U.S. companies that excludes the Mag 7. Close to half (44%) chose the Mag 7-only portfolio instead of the more diversified option. (It’s worth noting that only 23% cited “diversification” as a reason for shifting/planning to shift out of equities.)

The excitement around the Mag 7 may revolve around the market’s biggest investment theme: Artificial Intelligence (AI). Our investment teams believe AI may be the biggest economic multiplier in history and greatest productivity enhancer since the Industrial Revolution – good reasons to seek exposure to the theme. However, FOMO is not a reason to abandon a disciplined, long-term investment strategy focused on diversified sources of risk and return.

Our survey found that another favored component of the market is healthcare. The common thread between tech and healthcare is innovation. Tech companies are generally considered the top innovators, but healthcare has been rapidly developing novel therapies for previously intractable diseases.

With that in mind, when working with clients experiencing FOMO around the Mag 7 or other trendy areas of the market, advisors can explain that healthcare and other industries may provide indirect exposure to AI while allowing for greater diversification. Furthermore, because of the volatility associated with these sectors, a long-term, disciplined investment approach is warranted.

Embrace education

It’s natural for investors to experience anxiety and fear in the face of uncertainty. But those emotions become problematic when they influence portfolio allocation decisions.

Loss aversion and FOMO can lure investors into a market-timing mindset or lead them to pile into the trendiest stocks instead of being diversified. A lack of knowledge or misunderstanding can make investors more vulnerable to these traps. In our view, the best remedy is education and thoughtful, professional advice.

Our survey revealed promising news on that front: 88% of investors said they are very or somewhat interested in building knowledge of investments. Clearly, there is a large window of opportunity for advisors to educate clients and help keep them focused on their long-term goals while easing their anxiety around short-term events.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.