We all have our biases, and those biases or preferences may be on full display during election season.

There are few things – aside maybe from religious and/or sport team affiliations – as ingrained into our personal beings as our political identities. Whether we are Democrat, Republican, or Independent, our party affiliation is held as a badge of honor. The question nowadays is whether that fervor is voiced in polite company, in public, or strictly in the privacy of the voting booth.

[jh_content_filter spoke=”atpa, chpa-de, depa, uspa”]As we’ve discussed, political fervor is inherently emotional, and for many Americans, that emotion leads to concerns about our investment portfolios. Just as in the 2023 edition, our 2024 Investor Survey – conducted from April to May 2024 – reveals that the U.S. presidential election once again ranks as investors’ top concern. More importantly, financial advisors should be aware that election anxiety has led 62% of investors to plan on taking less risk with their investments until the election is decided.[/jh_content_filter][jh_content_filter spoke=”itpa”]As we’ve discussed, political fervor is inherently emotional, and for many Americans, that emotion leads to concerns about our investment portfolios. Just as in the 2023 edition, our 2024 Investor Survey – conducted from April to May 2024 – reveals that the U.S. presidential election once again ranks as investors’ top concern. More importantly, financial advisors should be aware that election anxiety has led 62% of investors to plan on taking less risk with their investments until the election is decided.[/jh_content_filter]

JHI

Historical data shows that this is not a good idea, since even though the markets have historically performed differently during election years compared to non-election years, the difference is not so great that investors should be making significant changes to their allocations.

Market returns during the U.S. presidential election years (1937-2024)

Considerable anxiety in advance of elections but little discernable impact on returns

| Average annual return of S&P 500® Index | |

| All years | 12.07% |

| Presidential election years | 10.13% |

| Average during other years | 12.72% |

This reaction to the upcoming election is a classic example of emotions pushing investors to make ill-timed investment decisions that could hurt the long-term trajectory of their financial plans. A key aspect of our job as financial professionals is to provide an emotional check for our clients, even when it comes to sensitive topics like politics. In fact, our survey found that 67% of investors who were either very or somewhat satisfied with their financial advisor appreciated that their advisor “keeps my emotions in check during periods of elevated market volatility.”1

Part of helping keep clients’ emotions in check is providing context and education around current and historical trends. But it may also involve helping clients recognize and understand the behavioral biases or heuristics they may be falling prey to. An emotional election season provides an environment ripe for behavioral bias – and those biases can be detrimental to an investor’s portfolio.

So, with that said, I’d like to discuss three of the main behavioral biases investors may experience over the next several months and how advisors can help.

Confirmation bias

The tendency for individuals to seek out information that supports their preexisting beliefs and avoids information that could contradict their already held beliefs.

This bias is especially prevalent in the algorithm-driven, social-media dominated environment we live in today. An investor who already holds a certain view on a political candidate may read a news story or social media post (delivered to them based on an algorithm that recognizes their preferences) that paints the candidate in a negative light, which may solidify the investor’s feelings. Those now more-solidified feelings may lead to emotionally fueled, ill-timed portfolio decisions should the candidate pull ahead in the polls or win the election.

Advisors can help investors balance out this bias by providing information from the opposite side of the spectrum, or by playing devil’s advocate when investors pull out their phones and say, “Did you see this story?!”

Recency bias

The tendency for financial decision-makers to overweight recent events and discount historical trends or averages.

Nothing is more recent than the last headline we saw. For example, consider the effect of a headline proclaiming: “This is the most important election of our lives!” That sentiment (which we seem to hear every time there’s an election), along with the suggestion that the candidate from the opposing party could win, turns up the heat and intensifies the emotions investors feel.

This is where historical data can be helpful. You could point to the fact that the markets tend to perform well over the long term, and that any election-related volatility is short lived. Or you could do a quick Google search and find political experts who said that the 2020 election (or maybe the 2016, or 1996, or even the 1964 election) were the most important elections of our lifetimes.

This historical data helps widen the perspective of an investor who may be too focused on the present – and on short-term market moves – due to recency bias.

Attachment bias

An emotional predisposition that causes an individual to act irrationally toward people or objects to which they have an emotional attachment.

This bias is at the heart of any political campaign. We are attached to the candidates from our chosen political party simply because they are fellow Democrats or Republicans.

Of course, if this attachment were to function as an investing strategy, investors would only invest during the administrations of their favored party.

Showing investors exactly how this might play out is a great way to help them overcome this bias.

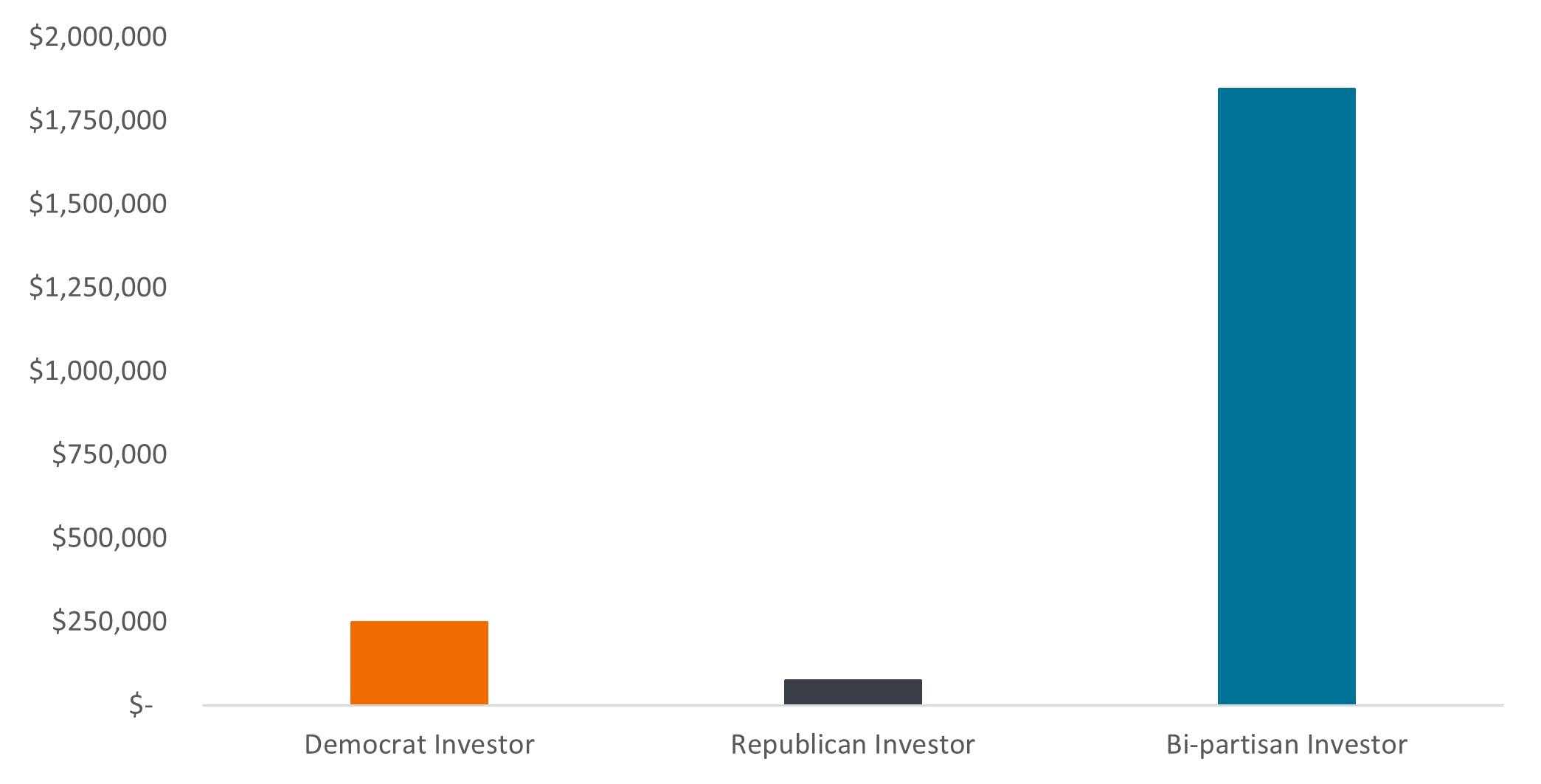

Below, you can see how an investor would have fared from 1977 to June 30, 2024, if they only invested in the S&P 500® Index during the administration of their preferred political party. We compare this experience to that of a bipartisan investor who simply invests in the S&P 500 throughout the period indicated, regardless of who is in office.

Results of partisan investing (1977 – June 30, 2024)

Assumes investors makes initial investment of $10,000 in S&P 500® Index only during Democrat/Republican administration and moves to cash (no return) during opposite party’s time in office. Past performance does not guarantee future results.

I have yet to find a better graphic on why bipartisan investing makes sense. (If only the chart could help engender greater bipartisanship in some of our legislative processes!)

The steadfastness of the bipartisan investor also reminds me of something I tell investors all year long:

“Our financial lives are not broken up into four-year terms. The financial goals we are investing for today have time horizons that may last 10, 20, 30, maybe even 40 years and could span several presidencies.”

Biases play a large role in our everyday lives. Money and emotion are two things that can exacerbate the negative effects of those biases, and election season inextricably links all three of them. For investors, it’s important to recognize these biases and behaviors to understand how they can influence decision-making. And advisors play a critical role in managing clients’ emotions so these common biases don’t lead to financial folly.

[jh_content_filter spoke=”atpa, chpa-de, depa, uspa”]If you’re interested in learning about other behavioral biases and how to combat them, feel free to reach out to me or your Janus Henderson contact to ask about our Mind & Money program. [/jh_content_filter]

1 Janus Henderson Investor Survey, September 2024.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.