Kicking off a new year typically means looking forward to a fresh start, new hope, new habits, and new beginnings. With 2024 being an election year, however, many of us are instead feeling a sense of unease. And whether they’re Republican, Democrat, or independent, many investors are concerned about how to prepare their portfolio for the upcoming election results – whatever they might be.

The 24-hour news cycle and social media and have led to increased polarization and a heightened sense of urgency around our elections. Mixing these ingredients with one’s finances makes for a situation where emotions run high, and uncertainty rules the day. For advisors and investors, this can lead to difficult conversations, poor decisions, and short-term tunnel vision – none of which serves our long-term financial goals.

In fact, we found that anxiety around the 2024 U.S. presidential election affected 78% of participants in our latest Investor Survey. More specifically, of the roughly 1,000 mass affluent and high-net-worth investors who took part in the survey, 49% said they are very concerned and 29% are somewhat concerned about how the election will play out.

In this year’s survey results, the election eclipsed investors’ concerns about inflation, risk of recession, and rising interest rates. These worries can push us to focus on the short term and get sucked into the emotional eye of the political storm. So, how can we calm ourselves and refocus on our long-term objectives? One effective strategy is to look at past results to gain a better understanding of how election years, the president, and changes in who controls Congress have historically affected financial markets.

Market returns during election years

Even though many of us feel significant anxiety about the markets and our assets as elections approach, the average return of the S&P 500® Index between 1937 and 2022 shows that election-year returns have on average historically been positive and accretive to our portfolios. More specifically, the average return from 1937 to 2022 of the S&P 500 was 11.9%. In non-election years, it was 12.5%, and in election years, it was 9.9%.

So, while election-year returns have historically been somewhat lower than non-election-year returns, they are still additive. And as we know, trying to time the market to try to make up for this difference would likely do more harm than good.

Market returns during the presidential years (1937-2022)

Considerable anxiety in advance of elections but little discernible impact on returns.

Source: Janus Henderson Investors, as of September 2023. Market performance based on S&P 500® Index for the period 1937-2022.

Party politics: Democrats, Republicans, and the market

Some of you may be thinking, “That’s all fine and good, but the political party of the president must influence the market. And what about Congress?” Republicans are said to be more fiscally responsible, which should lead to less government spending and lower taxes. This, combined with Republican’s pro-business sentiment, should lead to increased growth, lower debt-to-GDP ratios, a stronger economy, and a stock market that goes up more than down.

Democrats, on the other hand, are said to favor social programs, government spending, and higher taxes on corporations and the wealthy. As such, the idea of unified vs. divided government and its effect on the market may be top of mind.

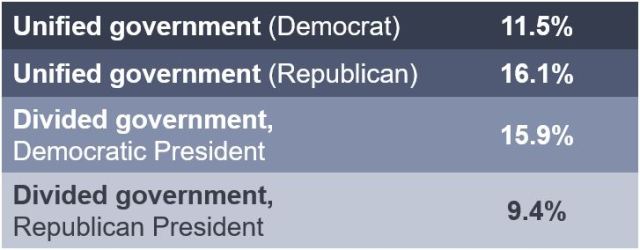

While these stereotypes exist for Republicans and Democrats, it’s important to remember they are just that: stereotypes. But what does history tell us? Let’s look at past results, remembering that we currently have a divided government, Democratic president scenario.

Market performance based on party control (calendar year following elections)

A house divided seems to stand just fine.

Source: Janus Henderson Investors, as of September 2023. Market performance based on S&P 500 Index for the period 1937-2022. Unified government indicates that the party of the incumbent president also controls both houses of Congress. Divided government indicates that the party of the incumbent president does not control both houses of Congress.

Just as with the historical market returns in election and non-election years, there are differences in how markets have performed based on party control. Over the long term, however, the markets have done well regardless of who is president and which party controls Congress.

One noteworthy wrinkle is that if the same party retains control of the Oval Office, the market return has historically been 11.8%, while in election years when the presidency changes parties, the market has averaged a 7.8% gain.

One explanation may be the markets and business cycles presidents inherit. Knight Kiplinger may have summed it up best in a 2009 article:

“Most presidents of the past 60 years — including Truman, Ford, Carter, Reagan and both Bushes – have been inaugurated amid varying degrees of economic stress … a tricky transition from war to peace, high inflation and interest rates or post-bubble recessions, usually accompanied by low confidence among consumers and businesses.”1

Vote for long-term planning!

While elections seem to have become more contentious, and the emotions associated with those feelings can make us feel anxious, it’s important to remember that our financial lives are not broken up into four-year terms. The financial goals we are investing for today have time horizons that may last 10, 20, 30, maybe even 40 years and could span several presidencies. Luckily, the historical data we covered here shows us that, over the long term, financial markets don’t necessarily care who the president is or who controls Congress.

Lastly, while we all have our own party affiliations, we shouldn’t let our political leanings or the partisan fervor that inevitably exists during an election year dictate how we plan.

So, make sure you get out and vote during the upcoming election. But when it comes to your finances, I would urge everyone to continue being a long-term “independent” investor.

1 “Obama Not First President To Inherit Bad Economy.” Kiplinger.com, January 18, 2009.

IMPORTANT INFORMATION

Active and passive investments may both lose value when valuations fall and market and economic conditions change.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.